FOR IMMEDIATE RELEASE

August 17, 2023

Contact: Cinamon Watson

303-949-7264

Under Prop HH El Paso County Taxpayers Face Loss of $5,119 in TABOR Refunds

Denver, CO – This week, Common Sense Institute (CSI) released an analysis of Proposition HH, one of the most complicated ballot measures ever presented to voters.

“Coloradans are facing a historic property tax increase,” said Kelly Caufield, CSI Executive Director.

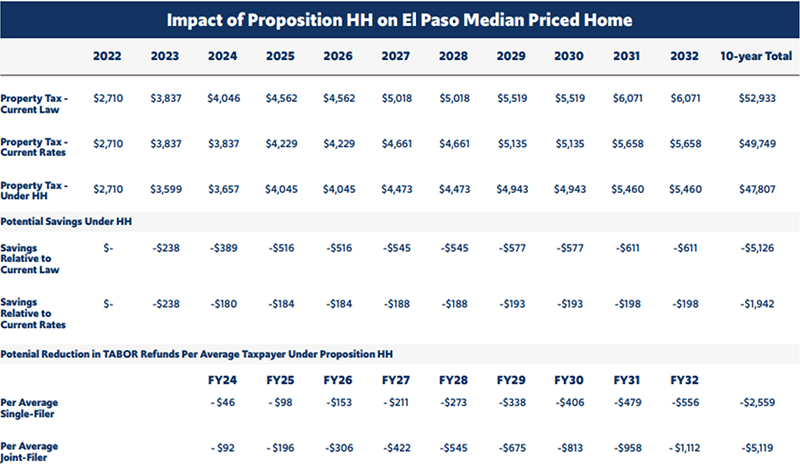

“Any gain in property tax reductions could be outweighed by long-term pain in state tax increases,” said study co-author Chris Brown, CSI Vice President of Policy & Research. Brown noted that under Prop HH, the average El Paso County homeowner would save $1,942 on their property tax bill relative to current rates over 10 years but could lose $5,119 in TABOR refunds.

“Any gain in property tax reductions could be outweighed by long-term pain in state tax increases,” said study co-author Chris Brown, CSI Vice President of Policy & Research. Brown noted that under Prop HH, El Paso County residents would save $1,942 on their property tax bill relative to current rates over 10 years but lose $5,119 in TABOR refunds.

Brown added, “If Prop HH passes, the state of Colorado will be able to collect and spend an additional $9 billion, funded by the significant increase in taxes Prop HH allows. If Prop HH were extended by the state legislature through 2040, which is allowed without voter approval, it could produce a $21 billion net tax increase, as property taxes are reduced by $21.49 billion while state taxes increase by $42.38 billion.”

Among the key findings of the study,

- Renters are the biggest losers. These joint filers will lose an estimated $5,119 in TABOR refunds over the next decade.

- The Bottom Line: When comparing the property tax increase to lost TABOR refunds, most taxpayers will pay more over the next 10 years if HH passes than if HH fails. Prop HH does not provide certainty or help to regulate the fluctuations in property taxes. A median priced home under current law would see a 42% tax increase from 2022 to 2023, and under Prop HH that same median average home still sees a large tax increase of 31%.

- Where does the funding go?

- Over 80% of additional money retained from Proposition HH would go to education with no accountability measures or spending guidelines.

- Up to 20% of the tax increase would go to reimburse local governments for lost property tax revenue, though it is likely much less than that will be needed as local government assessed value surpasses the backfill threshold.

- Up to $20 million annually for rental assistance.

- If not Prop HH Then What? Prop HH will be the only measure on property taxes voters see on the 2023 ballot, and the only policy, barring a special session, that could impact their 2023 taxes. However, there remain numerous other policy options that could be adopted by the legislature or voters that provide greater taxpayer certainty. A 4% property tax growth cap without an increase in the state spending limit, currently titled Initiative 50, is collecting signatures for the 2024 ballot.

###

Common Sense Institute is a non-partisan research organization dedicated to the protection and promotion of Colorado’s economy. CSI is at the forefront of important discussions concerning the future of free enterprise in Colorado and aims to have an impact on the issues that matter most to Coloradans. CSI’s mission is to examine the fiscal impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives.