FOR IMMEDIATE RELEASE

November 12, 2019

Contact: Cinamon Watson

303-949-7264

Lomax: “The property tax assessment rate for oil and natural gas production is 12 times higher than residential property and three times higher than commercial property.”

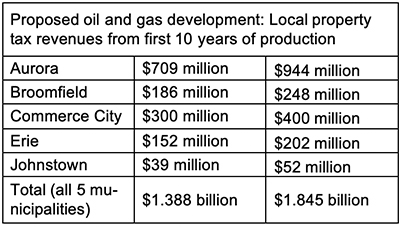

Denver, CO – Plans for oil and natural gas development in five municipalities along Colorado’s Front Range could generate $1.39 billion to $1.85 billion in new local property taxes for over the next 10 years, according to a new study from the Common Sense Policy Roundtable (CSPR).

Public schools would be the largest beneficiary, potentially receiving $822 million to $1.14 billion over 10 years – enough to raise teacher salaries in K-12 districts serving these communities by 31% to 42%. Municipal governments would potentially receive $194 million to $258 million over 10 years, which would be enough to repair roughly 600 to 800 lane miles of deteriorated local roads with brand new asphalt overlay. County governments, fire departments, parks and recreation agencies and other public services would also benefit from these new property tax revenues.

The study is called Local Revenue Impacts of Near-Term Oil and Gas Development in Colorado Municipalities: New Money for Schools, Roads and Public Services. Until now, most economic research on Colorado’s oil and gas sector has been statewide in nature, leaving a void of information at the local level. With Senate Bill 181 expanding the role of local governments in siting and regulating new energy production facilities, this study begins to fill that void, starting with property tax revenues that support a wide range of essential public services.

Using publicly available data – including sales volumes from recently completed wells in northern Colorado, development plans submitted to state and local officials, and mill levy rates – CSPR estimated property tax revenues across two different scenarios of near-term oil and gas development in five municipalities. Estimated revenues over 10 years are summarized below:

“Under state law, the property tax assessment rate for oil and natural gas production is 12 times higher than residential property and three times higher than commercial property,” said Simon Lomax, CSPR’s Energy Resources Fellow. “That higher tax rate is a major factor behind these revenue estimates.”

“This is not an exhaustive list of municipalities where future energy development may take place, and these revenue estimates are not intended predict future tax revenues down to the very last dollar and cent,” said Chris Brown, CSPR’s Director of Policy and Research. “Instead, we chose these communities to give policymakers and the public a better sense of how oil and gas development can grow a local government’s property tax base once energy production begins.”

Read the full study here.

###

Common Sense Policy Roundtable is a non-profit, free enterprise think tank dedicated to the protection and promotion of Colorado’s economy.