![]() FULL REPORT: PDF | POWERPOINT

FULL REPORT: PDF | POWERPOINT

EL PASO COUNTY BUDGET: A SNAPSHOT OF EXPENDITURE AND HOW IT HAS CHANGED

- The El Paso County budget primarily encompasses services dedicated to residents across the entire county, such as the District Attorney’s Office, jail services, human services and public health. However, it also includes services focused primarily in unincorporated areas such as patrol, roads, parks and land use.

- Public safety represents 28% of the county’s total 2023 budget, totaling more than $132 million.

- Unrestricted General Fund public safety spending has grown from $61.3 million in 2013 to $89.2 million in 2023.

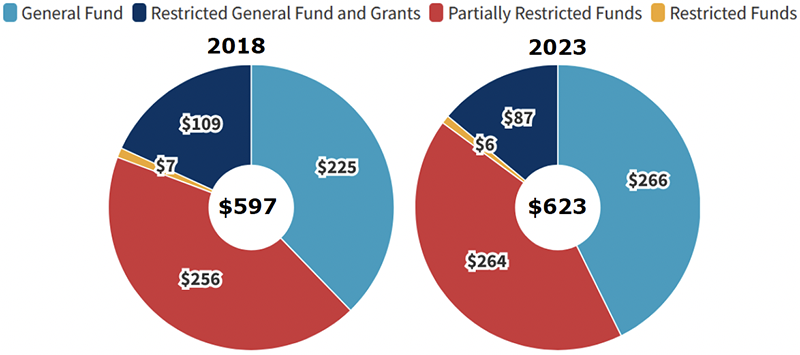

- Total spending per El Paso County resident, adjusted for inflation, has increased by 4% over the last 5 years from $597 to $623.

- Inflation adjusted spending per resident grew to $655 in 2021 and $726 in 2022 largely due to federal funding related to the COVID-19 pandemic.

About the Budget

The 2023 El Paso County Budget was adopted December 2022. The county’s fiscal year run concurrent with the calendar year. The first budget hearing for the 2024 budget is October 3rd, and the final budget hearing to adopt next year’s budget and certify the county’s mill levy is on December 5th.

The El Paso County budget funds general county expenses and 23 distinct governmental functions. These functions are:

- Sheriff’s Office

- District Attorney

- Information Technology

- Public Works

- Retirement

- Facilities/Facilities Management/Parking/ADA/Utilities

- Clerk and Recorder

- Community Services

- Financial Services

- Health Department Support

- County Assessor

- Planning and Community Development

- County Coroner

- Human Resources and Risk Management

- County Attorney

- Treasurer

- Board of County Commissioners

- Government Affairs

- Emergency Management

- Public Information Office

- Hazmat/ESA

- Economic Development

- County Surveyor

El Paso County 2024 Budget Timeline

10/3/23: Budget Hearing #1 – Preliminary budget hearing

10/19/23: Budget Hearing #2 – Critical Needs Hearing

10/24/23: Budget Hearing #3 – Critical Needs Hearing

11/14/23: Budget hearing #4 – BOCC Direction Hearing

12/5/23: Budget hearing #5 – Final budget hearing to adopt 2024 budget, certify county mill levy and authorize the Treasurer to Transfer between Funds

Some parts of this report display data from several functions combined into one item labeled “other.” These functions are the County Attorney, the Treasurer, the Board of County Commissioners, government affairs, emergency management, the Public Information Office, hazmat/ESA, economic development, and the County Surveyor. All report data comes from publicly available county budget reports.

2023-Budget-Book-Final.pdf (elpasoco.com)

El Paso County Budget Responsibilities

El Paso County is a statutory county, meaning it is a government service arm of the state.

El Paso County is a statutory county, meaning it is a government service arm of the state.

In 2021 there were 738,532 El Paso County residents. 28% of the county’s residents, or 204,881 people, lived on unincorporated land, outside of a municipal government boundary.

While the county provides some services exclusively to the those in unincorporated areas, it largely provides services that overlap multiple jurisdictions. The county’s mandated services include the following:

- Construction, maintenance and operation of the county jail and county courthouse

- District Attorney — Investigation and prosecution of crimes

- Certification of automobile titles; motor vehicle registrations; administration of all primary, general, and special elections in the County; records and maintenance of public documents

- Valuation of all real property and taxable business and residential property in the county

- Certification of all deaths and investigation into the causes of suspicious deaths that fall under the coroner’s jurisdiction

- Releases of Deeds of Trust and administration of foreclosures

- Design, construction, and maintenance of public highway systems in the county

- Administration of Human Services programs to include Child Support, Child and Adult Abuse/Neglect Prevention, and Food and Medical Assistance

In unincorporated areas the county serves as the primary law enforcement entity.

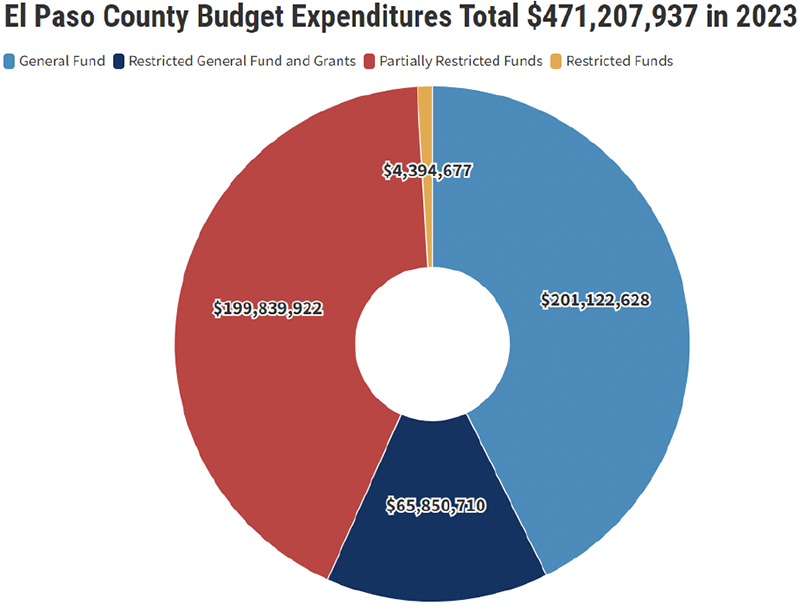

General Fund spending represents the primary fund source that the Board of County Commissioners deliberate over during the budgeting process.

The spending through Restricted Funds and Grants are determined based on federal, state and other compliancy requirements from public authorities outside of the County. Partially Restricted Funds are similar to Restricted Funds but are partially funded by local sales and use tax, property tax or specific ownership tax.

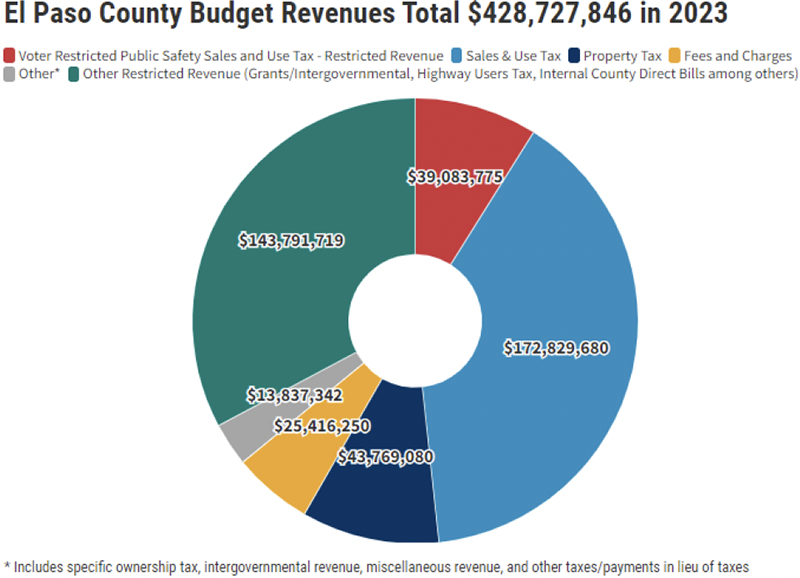

El Paso County’s single largest revenue source is its 1% sales and use tax, accounting for 39.4% of 2023 revenues.

The second largest revenue source is from property taxes, accounting for 10% of revenue. The county received approximately 12.2% of all property taxes in 2023. TABOR, a spending limitation in the state constitution, limits revenue growth to no more than 5.5% from the prior year. This has resulted in refunds to El Paso County taxpayers for several of the last few years.

The largest restricted revenue source is the Voter Restricted Public Safety Sales and Use Tax of 0.23%, which generated $39 million, or 8.9% of total revenue.

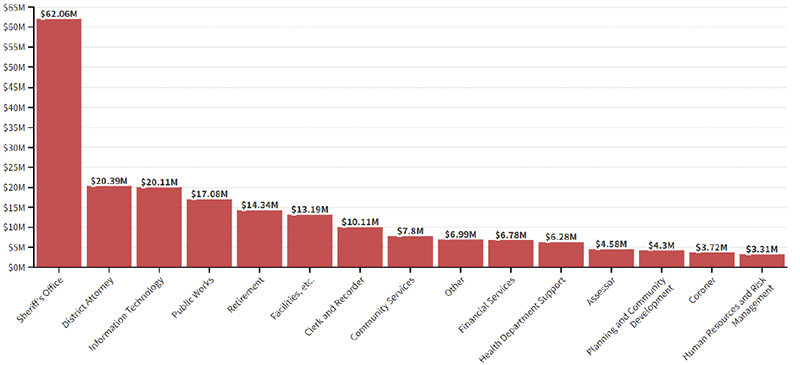

Unrestricted General Fund Expenditure Totals $201 million in 2023

While the Sheriff’s Office receives $62 million in the 2023 budget, all areas of public safety account for 44% of unrestricted General Fund spending or $89.2 million. The functions of public safety include the Sheriff’s Office along with the Coroner, District Attorney, Emergency Management & Hazmat/ESA, Justice Services. Unrestricted General Fund public safety spending increased by 9% in the 2023 budget or by $7.3 million.

There is an additional $42 million from restricted funds, including the voter approved public safety sales and use tax, that are allocated to public safety. Therefore 28% or $132.5 million of the 2023 El Paso County budget goes to public safety.

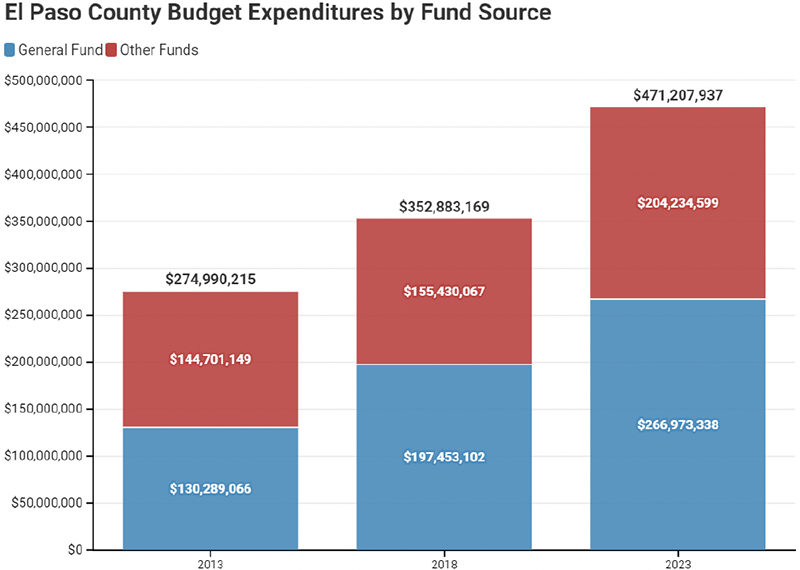

Budget Then and Now

- Total nominal spending by the El Paso County government has increased by 71% since 2013.

- Adjusted for population growth and inflation, the total budget has increased 8%

- Nominal spending from the county’s general fund has increased by 105% since 2013.

- Adjusted for population growth and inflation, the county’s General Fund budget has increased by 29%.

- The general fund’s share of the city’s budget has increased from 47% to 57%

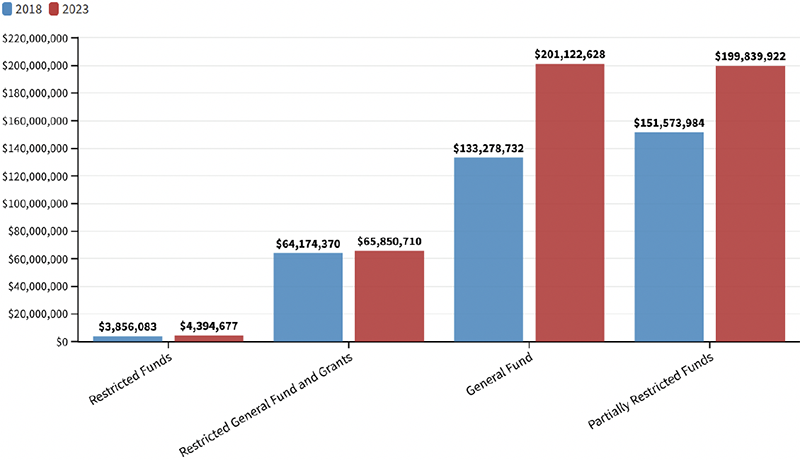

Total Expenditure by Fund Type in 2018 and 2023

Unrestricted General Fund spending has grown the fastest, and by the largest dollar amount over the last 5 years. Since 2018 unrestricted General Fund spending has grown 51%, and partially restricted funds have grown by 32%.

Total Government Expenditure per El Paso County Resident

Values are adjusted for population and inflation (2023 Dollars)

Between 2018 and 2023, the county’s population grew by 5%, adding 38,000 more people. Over that same period, inflation, as measured by the Denver consumer price index, rose 21%. Led by strong growth in unrestricted General Fund revenue growth, inflation adjusted expenditure per El Paso county resident grew from $597 to $623 or 4%.