Still on a Collision Course with Government Rate-setting and Medical Provider Budget Cuts

About the Authors

Chris Brown is the Vice President of Policy & Research with Common Sense Institute where he leads the research efforts of CSI to provide insightful, accurate and actionable information on the implications of public policy issues throughout the state of Colorado.

Erik Gamm is a Research Analyst with Common Sense Institute where he supports the research efforts of CSI. Erik graduated from the University of Michigan in 2020 with a Bachelor of Arts in Economics.

About Common Sense Institute

Common Sense Institute is a non-partisan research organization dedicated to the protection and promotion of Colorado’s economy. CSI is at the forefront of important discussions concerning the future of free enterprise in Colorado and aims to have an impact on the issues that matter most to Coloradans.

CSI’s mission is to examine the fiscal impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI employs rigorous research techniques and dynamic modeling to evaluate the potential impact of these measures on the Colorado economy and individual opportunity.

Common Sense Institute was founded in 2010 originally as Common Sense Policy Roundtable. CSI’s founders were a concerned group of business and community leaders who observed that divisive partisanship was overwhelming policymaking and believed that sound economic analysis could help Coloradans make fact-based and common sense decisions.

Executive Summary

As of May 12, 2021 the authors of HB21-1232 have removed the so-called “public option” from the original bill, after frontline medical workers and other stakeholders warned such a measure would trigger budget cuts across the Colorado healthcare sector and undermine private health plans. These impacts were featured in our previous reports on public option proposals in Colorado including, “Third Time is No Charm” which modeled the potential financial and economic impacts of HB21-1232 as originally introduced.

The amended version of HB21-1232 relies on mandates on private insurance carriers to sell the Colorado option plan and reverts to similar, or even lower, government-set medical provider rates featured in the 2020 public option legislation. While there are important new details in the revised bill, its combined use of restrictive premium growth rate caps and low medical provider reimbursement rates will likely lead to a similar problem; government set prices that do not change the underlying cost of delivering care. As a result, it will force medical providers to cut spending in a way that negatively impacts access and quality, or it will force them to increase the cost shifting that already occurs in health care thereby increasing prices for commercial payers.

Caps on medical inflation are likely lower than projected annual cost increases

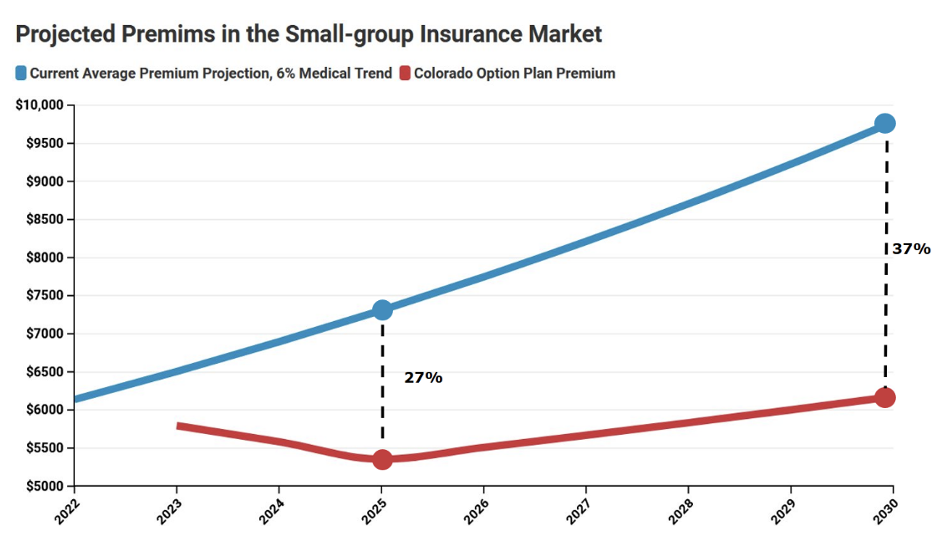

The amended version of HB21-1232 requires premiums for the Colorado option to be set 18% lower than the 2021 average in the individual and small-group insurance markets, with some allowance for medical inflation. However, the bill’s definition of medical inflation would currently impose a cap of 2.9%, which is much lower than forecasts and even lower than the 10-year historical average of individual market premium growth of 7.6%. Under a scenario where the cost of treating patients grows at 6% annually but the cap stays at 2.9%, the premium reduction target from the actual baseline is 27% lower in 2025 and 37% lower in 2030.

In effect, this means the real premium reduction target under HB21-1232 may be 1.5 to 2 times greater than is widely understood. Failure to comply would trigger an expansion of government price mandates from insurance premiums into medical rate setting, i.e., the state deciding how much hospitals should be reimbursed for treating patients. Regional cost pressures and market dynamics will vary the likelihood of prompting rate setting across countiesMedical provider reimbursement base rates are lower than any statewide average in the country

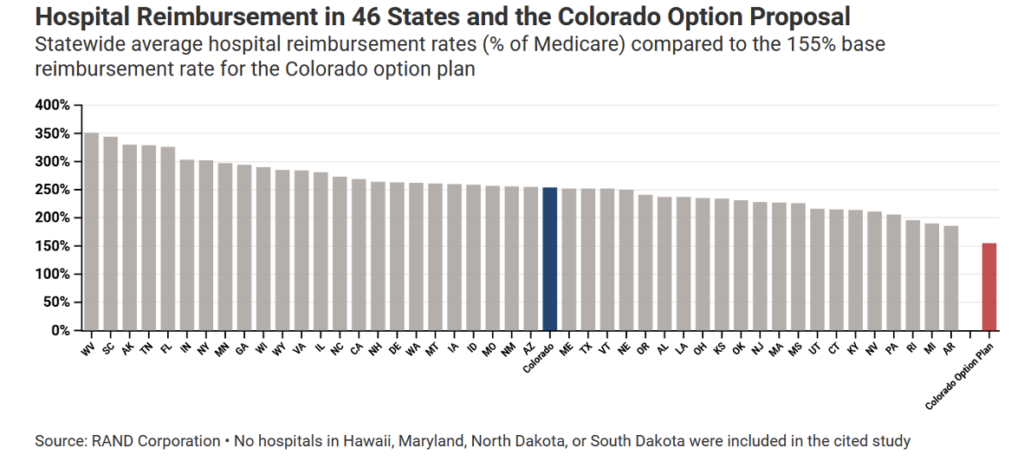

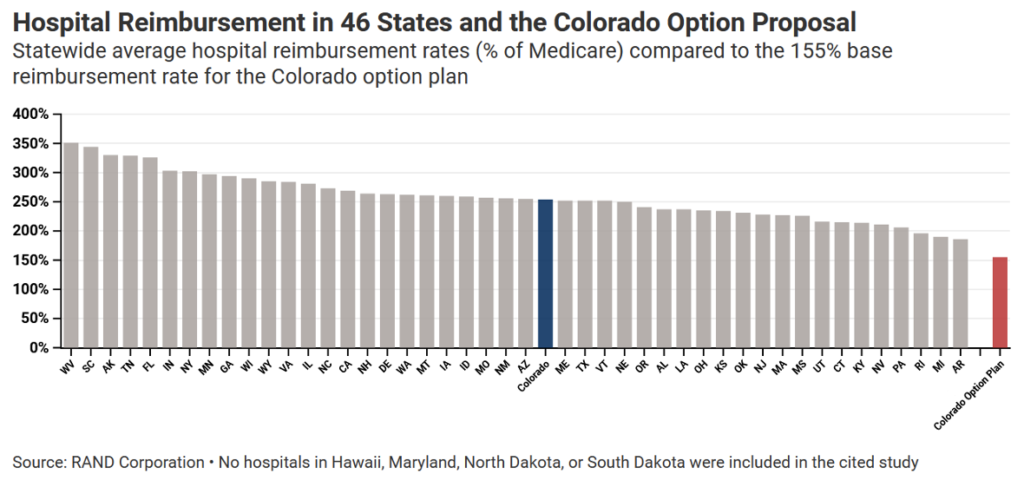

If rate-setting is triggered under HB21-1232, the Colorado option would offer a base reimbursement of 155% to 195% of Medicare rates to hospitals serving adult patients. In other states, however, private health plans on average pay 52 to 97 percentage points more – around 247% of Medicare – to overcome the fact that Medicare rates are set below the actual cost of treating patients. Based on research by authors at RAND Corporation, the 155% base rate specified in the Colorado option plan would be lower than all of the 46 states in the study. If the 195% maximum base rate for non-pediatric hospitals under HB21-1232 was applied across the board, the Colorado option would rank in the bottom three among state average private insurance payment rates for hospitals.

Earlier research into rate-setting suggests the amended version of HB21-1232 will have a major impact on hospital budgets across the state. In 2020, prior to the impacts of COVID-19, CSI analyzed a similar, if not higher set of reimbursement rates between 155% and 238% for hospitals under a state-controlled plan, using a model build by Guidehouse. Under this level of rate-setting, estimated revenue cuts to rural hospitals totaled $328 million in single year and cuts to urban hospitals totaled $828 million. Because HB21-1232 imposes more stringent rate-setting with a lower payment limit falling to 135% of Medicare for specific service lines, the budget cuts facing Colorado medical providers under HB 21-1232 would likely be even greater.

The Insurance Premium Growth Cap Is Much Lower Than the Projected Rate of Medical Cost Trends

The current version of HB21-1232, as amended and passed by the Colorado State House on May 10th 2020, includes an important detail that may appear minor but would have dramatic long-term impacts. The legislation caps the annual growth rate of the Colorado option plan premiums starting in 2025 at what the bill defines as “medical inflation.” Between the years of 2022 to 2024, the bill adjusts the 2021 premium rates using “medical inflation” in-order to calculate the required premium reduction levels.[i]

The following is how the current bill defines medical inflation:

“MEDICAL INFLATION” MEANS THE ANNUAL PERCENTAGE CHANGE IN THE MEDICAL CARE INDEX COMPONENT OF THE UNITED STATES DEPARTMENT OF LABOR’S BUREAU OF LABOR STATISTICS CONSUMER PRICE INDEX FOR MEDICAL CARE SERVICES AND MEDICAL CARE COMMODITIES, OR ITS APPLICABLE PREDECESSOR OR SUCCESSOR INDEX, BASED ON THE AVERAGE CHANGE IN THE MEDICAL CARE INDEX OVER THE PREVIOUS TEN YEARS.

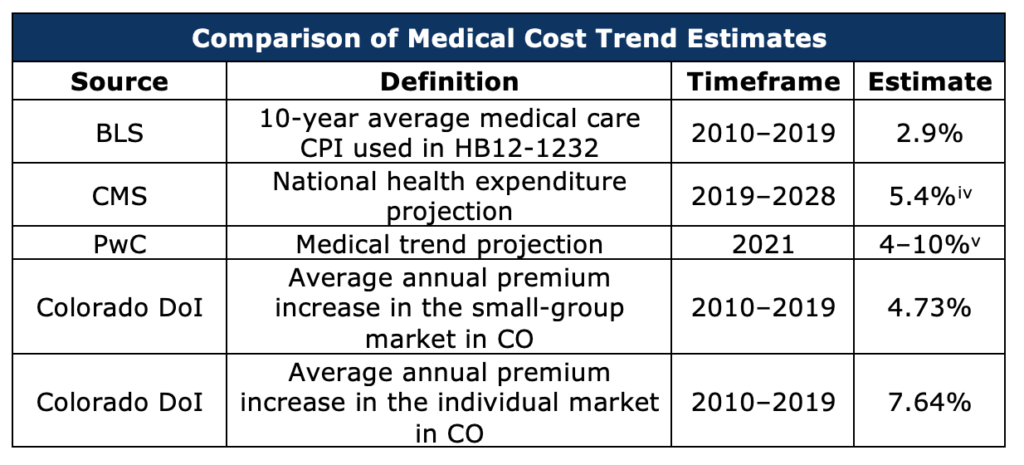

Based on this definition, the adjustment for medical inflation is actually a 10-year average of the national medical care consumer price index. It is not specific to Colorado, nor does it reflect actual cost pressures that arise in any single year. The current estimate for medical inflation as defined in HB21-1232 is 2.9%.[ii]

Allowing for premiums to grow at a rate of medical inflation is meant to address the medical cost trend, or simply “medical trend.” According to the Colorado Division of Insurance, medical trend is defined as “the projected increase in the costs of medical services assumed in setting premiums for health insurance plans.”[iii]

Components of Medical Cost Trends Include:

- Provider price changes

- Utilization of medical care

- Cost-shifting

- Technological innovation

- Pharmaceutical price changes

The challenges for carriers will arise when the allowable annual growth rate in premiums does not reflect actual medical trends. As the following table shows, external projections of medical trend, as well as the actual history of recent premium growth in Colorado, are much higher than the allowable growth rate. Therefore, over the long run, more and more carriers will face challenges hitting the required premium levels.

Below are three considerations of the medical cost trend which make this risk evident (see the above table for details):

- The annual medical cost trend over the next several years may be significantly different than the average medical CPI over the last ten years. PwC’s estimate of the 2021 medical cost trend is between 4% and 10%. The average annual growth in medical expenditures through 2028 projected by CMS is 5.4%.

- The annual growth in individual and small-group market premiums in Colorado have been significantly different from the growth in the medical care index over the same time. While that national medical care index has grown an average of 2.9% a year over the last decade, premiums in the individual market have grown by an average of 7.6% and the small group by an average of 4.7%.

- While these figures are representative of statewide or national averages, actual cost pressures will vary greatly across each of Colorado’s 64 counties.[vi]

Scenarios Related to Premium Growth under Different Cost Trends

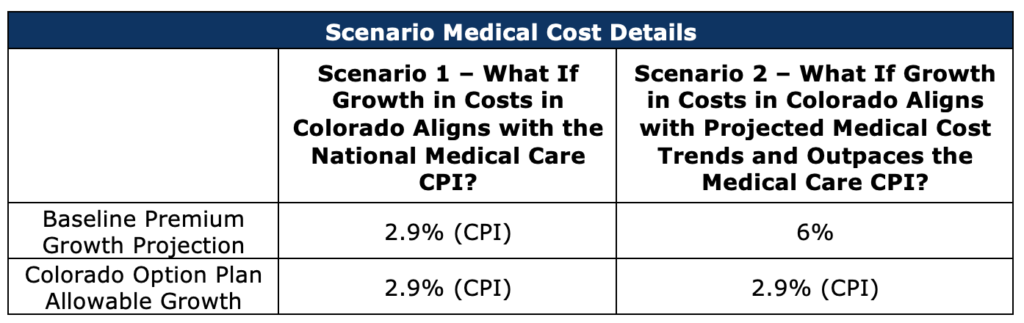

In previous drafts of HB21-1232, required premium reductions were defined against nominal 2021 levels until 2025, after which premiums would be allowed to grow at the rate of inflation plus 1% annually.[vii] The current draft would set reductions against medical trend–adjusted 2021 levels through 2025 and subsequently allow premiums to grow annually at that same adjusted rate. This means that, if inflation plus 1% exceeds the ten-year average medical trend in the long run, premiums would be more restricted subject to the rules in the current version of the bill than to the original bill as introduced.

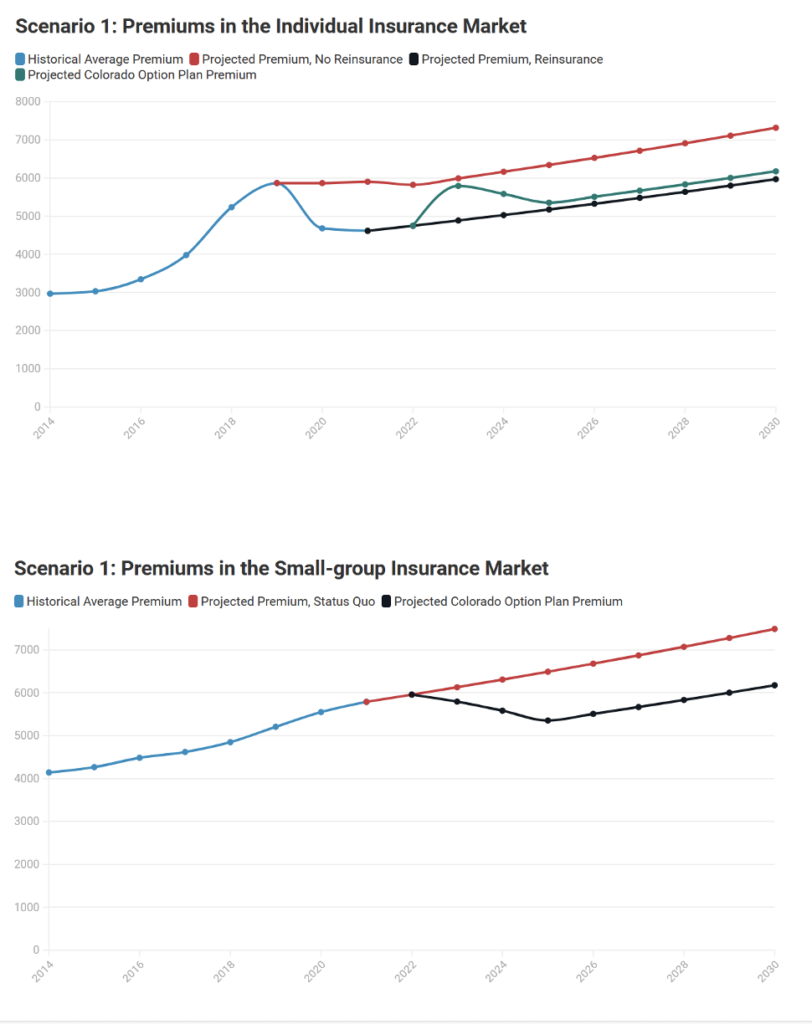

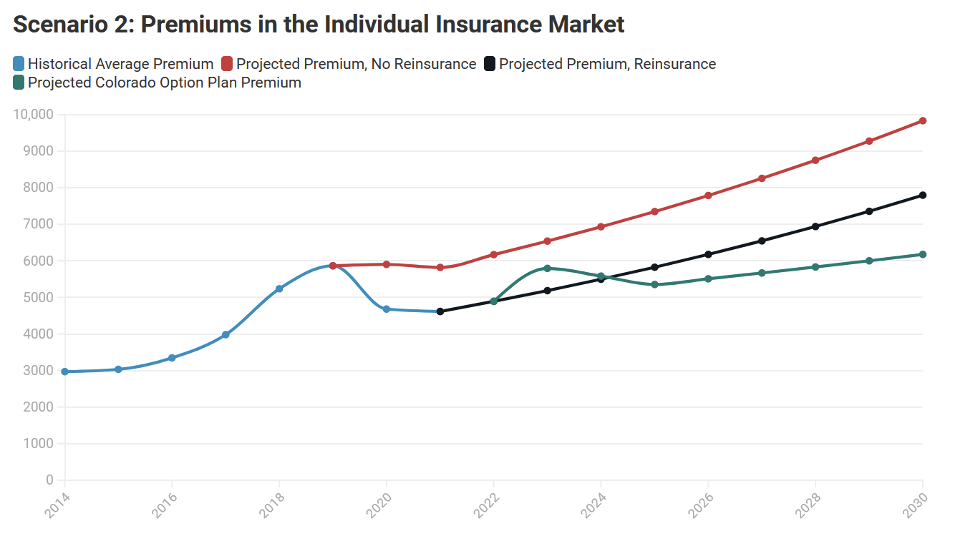

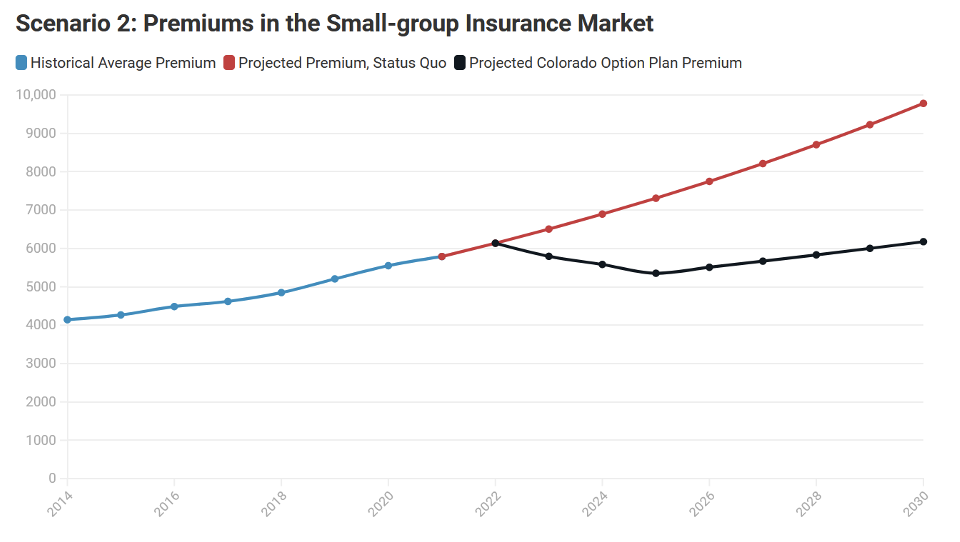

To illustrate this relationship between the actual medical trend and the bill’s allowable premium growth rates, the following 4 charts show projections from 2 different scenarios of premium growth in both the individual and small-group markets.

Scenario 1: Projected Actual Costs Align with the Allowable Premium Growth Specified in HB21-1232

In this scenario, the annual growth rate of actual medical cost trends is equal to the 10-year average medical care CPI. This could be interpreted as the premium growth cap in the bill accurately predicting the annual medical trend. While this is just a hypothetical example it serves as an important comparison point to scenario 2, where medical trends grow faster than the growth caps.

Scenario 1 Key Findings:

- In the individual market, the Colorado option plan is priced 18% below the baseline premium level in 2025 and 18% below it in 2030.

- If reinsurance remains effective, then for the duration of the projections, the average premium after reinsurance is applied is below the mandated premium cut in HB21-1232.

- This indicates less pressure on carriers to meet the demands of the bill and lower probability of having the state step in to set medical provider payment rates.

- In the small group market, the Colorado option plan is priced 18% below the baseline premium level in 2025 and 18% below it in 2030.

- Given the small group market does not have a reinsurance program, insurance carriers will have a more difficult time achieving these rates. However, given the rate of growth of costs is equivalent to the premium growth cap, the relative gap between the premium target and baseline does not grow over time.

- The provider revenue impact of the public option plan in the individual market is naught.

Scenario 2: Projected Actual Costs Are Significantly Higher Than the Allowable Premium Growth Specified in HB21-1232

In this scenario, the annual growth rate of actual medical cost trend is higher than the 10-year average medical care CPI, as estimated by actual projections. This could be interpreted as having the premium growth cap in the bill restricting growth in annual premiums despite the growth in underlying cost pressures across the health care industry.

Scenario 2 Key Findings:

- In the individual market, the Colorado option plan is priced 27% below the baseline premium level in 2025 and 37% below it in 2030.

- If reinsurance remains effective, then for the duration of the projections, the average premium after reinsurance is applied is above the mandated premium level in HB21-1232 starting in 2025.

- This indicates growing pressure on carriers to meet the demands of the bill and an increasing probability of having the state step in to set medical provider payment rates.

- In the small group market, the Colorado option plan is priced 27% below the baseline premium level in 2025 and 37% below it in 2030.

- The small group market does not have a reinsurance program, so insurance carriers will have a more difficult time achieving these rates.

- Given that the rate of cost growth is greater than the premium growth cap rate, the gap between the premium target and baseline grows over time

Restrictive Premium Growth Caps Will Inevitably Lead to State-set Reimbursement Payments with Base Rates that Would Be Lowest in the Nation

HB21-1232 currently grants authority to the Colorado Division of Insurance Commissioner to set medical provider reimbursement rates for the Colorado option plan sold by private carriers under two general conditions:

- Premiums do not hit the mandated reduced level

- Option plan networks do not meet adequacy requirements

As the current allowable growth rate in premiums is well below the projected annual growth in underlying medical costs, there is a seeming inevitability that more and more carriers and Colorado option plans will trigger the ability for the state to set provider reimbursement rates.

Several of our previous reports have detailed the impacts associated with reimbursement rate setting at similar levels proposed in the latest bill.

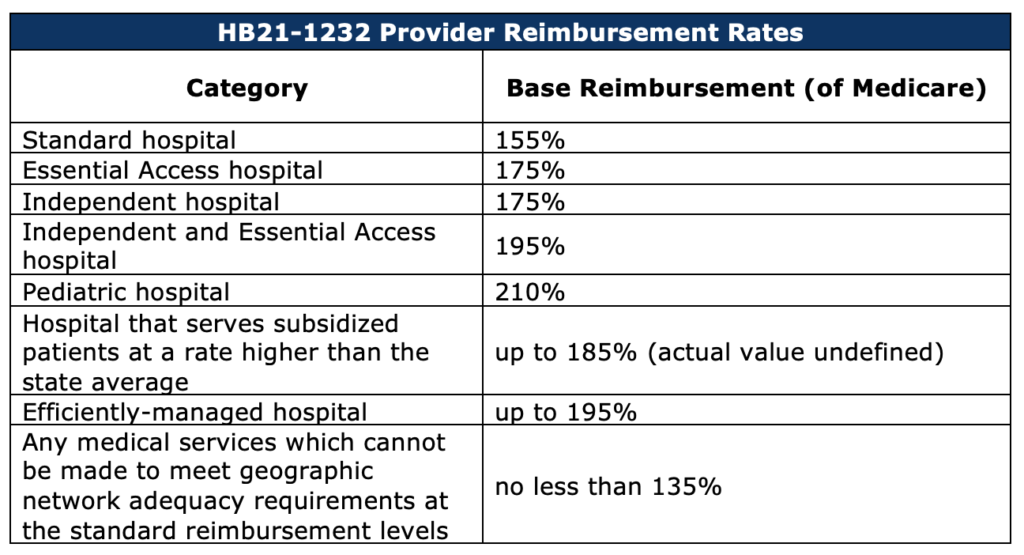

Another issue in the new bill is that of reimbursement levels for medical services provided by hospitals and other health care professionals. In the introduced draft of HB21-1232, provider reimbursement rates were left indeterminate; the most recent version, however, includes specific parameters for reimbursement and sets the mechanisms that would assign reimbursement rates to individual hospitals and medical services. The basic reimbursement rate for hospitals, as it was in the 2020 state option bill, would be 155% of Medicare; depending upon a hospital’s status, its performance, and the mix of services it provides, though, its basic reimbursement rate could be as high as 195% or as low as 135% (see the table below). In summary:

- HB21-1232’s hospital reimbursement schedule is similar to the one in last year’s public option bill but permits some rates to drop even lower.

- Other providers, like physicians, could have their reimbursement rates set as low as 135%.

- The basic hospital reimbursement rate, 155% of Medicare, is 97 percentage points lower than the latest national average reimbursement rate published by RAND.[viii] The lowest average rate, Arkansas’, is 186%.

- The highest a base reimbursement rate under this rate schedule, 210% of Medicare, applies to pediatric hospitals; this value is still lower than all but four states’ averages.

- Hospitals, especially rural hospitals, and ones that provide services which may fall short of their regions’ network adequacy requirements, would stand to lose hundreds of millions of dollars in revenue under the bill’s rates. Some could be subject to contraction or closure.

A base hospital reimbursement rate of 155% of Medicare would be lower than any state’s current average rate by 31 percentage points, and lower than Colorado’s current average rate by 99 percentage points. Even the highest reimbursement rate allowed by the bill, 210%, would only exceed four states’ averages. In Washington, the only state which has passed a public option proposal, the reimbursement rate for the public option plan is 160% of Medicare; so far, the state has failed to reach its premium reduction targets even at that level of reimbursement.

This means that Colorado hospitals, especially those which are already vulnerable, would stand to lose huge amounts of revenue as a result of this bill. According to CSI’s modeling, the 2020 state option bill, which prescribed a very similar reimbursement schedule, would have caused revenue losses between $500m and over $1b per year under a moderate enrollment scenario. Rural hospitals could be impacted worst of all.[ix] According to that same CSI study, “Rural hospitals would be disproportionately negatively impacted, and face reduction in revenue double what urban hospitals would face on a percentage basis. The modeling results of offering the Colorado option plan in both the individual and small group market…estimate a 3% reduction in revenue for urban hospitals and a 6.3% reduction for rural hospitals.”

[i] https://leg.colorado.gov/sites/default/files/documents/2021A/bills/2021a_1232_ren.pdf

[ii] https://fred.stlouisfed.org/series/CPIMEDSL

[iii] Colorado Division of Insurance 2019 Health Cost report. https://drive.google.com/drive/folders/0B_UoCf17OVmWfmdCd1g5bXJCZ2ZXZWdiWk1wbktpWUQwUTgwT2JiT3pMeWl1UU1zMEZOTG8

[iv] https://www.cms.gov/files/document/nhe-projections-2019-2028-forecast-summary.pdf

[v] https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html

[vi] https://drive.google.com/file/d/10z6SYTw5W31VbUuujpZYprMtv346LOIx/view

[vii] https://leg.colorado.gov/sites/default/files/documents/2021A/bills/2021a_1232_01.pdf

[viii] https://www.rand.org/pubs/research_reports/RR4394.html

[ix] https://commonsenseinstituteco.org/co-option-plan/