The Effects on Employment and Migration

Eric Fruits*

Economics International Corp.

April 2011

* With the assistance of Randall Pozdena, QuantEcon, Inc.

Executive Summary and Key Findings

Earlier this year, Colorado Senator Rollie Heath proposed three education-funding initiatives for the November 2011 ballot. The proposed measures would raise the individual and corporate income tax rate from 4.63 percent to 5 percent (an 8 percent increase) and increase the state sales tax rate from 2.9 percent to 3 percent (a 3 percent increase).

Earlier in the year, the Colorado Fiscal Policy Institute, a project of the Colorado Center on Law and Policy, filed six ballot measures with Colorado Legislative Council for voter consideration in November 2011. The measures would increase Colorado’s individual and corporate income tax rates. CFPI withdrew its measures in March 2011.

If passed, the measures constitute a potentially significant shift of resources from private hands to the public sector. Information from Colorado Legislative Council Staff suggests that the Heath Measures would increase state taxes by $536.1 million a year. A substantial portion of the Heath Measures’ increased taxes would be borne by Coloradans earning less than $100,000 a year. The CFPI Measures propose a massive increase in income taxes and a massive redistribution of tax burden to the top one percent of income earners. While CFPI has pitched the measures as “tax fairness” measures, in testimony before a state board, counsel for CFPI stated, “the purpose is to raise revenue” and the “we don’t need to get hung up on the fairness issue.”

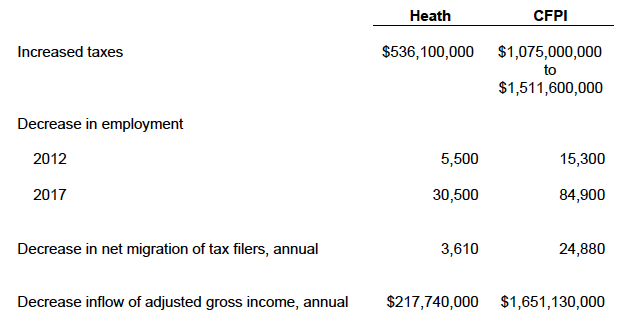

This report measures the likely effects of the Heath Measures and the CFPI Measures. It examines the effect of these policies on job growth in the state as well as the migration of taxpayers and their income. A large body of literature warns of the risks of raising tax rates on personal and corporate income. Research demonstrates that doing so slows economic growth, investment, formation of new firms, and numerous other processes necessary to jump-start a weakened economy. It also encourages out-migration of taxpayers. As shown in Table 1, the tax increases under the Heath Measures and the CFPI Measures would have a damaging impact on employment in Colorado and negatively impact net migration into the state.

Table 1:

Impacts of Proposed Tax Increases on Colorado Economy

- Both the Heath Measures and the CFPI Measures would slow Colorado’s recovery from the recent recession. The Heath Measures would reduce employment by 5,500 in the first full year. The negative impacts of the CFPI Measures would be nearly three times worse than the impacts of the Heath Measure.

- If the tax increases are permanent, then the impacts on growth would likewise be permanent. The reduction in growth rates over time indicate that the Heath Measures will reduce employment by 30,500 by 2017.

- The Heath Measures would substantially slow the migration of taxpayers to Colorado. The net result of the Heath Measures’ tax increases would be 3,610 fewer tax filers in the state than in the absence of the tax increases.

- The CFPI Measures would reverse past taxpayer migration trends and cause a net outflow of taxpayers and income from Colorado. The CFPI Measures would also cause a form of capital flight in which the incomes of those moving in to Colorado would be lower than the incomes of those moving out of Colorado.

About the Authors

Dr. Fruits is the primary author of this report, and performed the employment impact modeling. Dr. Pozdena contributed the migration modeling presented in this report. The report draws on previous joint work of the authors, especially Fruits and Pozdena (2009).

Eric Fruits, Ph.D. is President of Economics International Corp., a consulting firm specializing in economics, finance, and statistics. He is also an adjunct professor at Portland State University and the editor of a university publication. Dr. Fruits has been engaged by private and public sector clients, including state and local governments, to evaluate the economic and fiscal impacts of business activities and government policies. His economic analysis has been widely cited and has been published in The Economist, the Wall Street Journal, and USA Today. Dr. Fruits has been invited to provide analysis to the Oregon legislature regarding the state’s tax and spending policies. His testimony regarding the economics of Oregon public employee pension reforms was heard by a special session of the Oregon Supreme Court. His statistical analysis has been published in top-tier economics journals and his testimony regarding statistical analysis has been accepted by international criminal courts.

Contact information:

Eric Fruits, Ph.D.

Economics International Corp.

Tel: 503-928-6635

info@econinternational.com

Randall Pozdena, Ph.D. is President of QuantEcon, Inc.. He received his B.A. in Economics, with Honors, from Dartmouth College and his Ph.D. in economics from the University of California, Berkeley. Former positions held by the author include assistant professor of economics and finance, senior economist at the Stanford Research Institute (SRI International) and research vice president of the Federal Reserve Bank of San Francisco. He also served on numerous public, non-profit, and private boards and investment committees. He is a member of the CFA Institute and the Portland Society of Financial Analysts. He has authored over 50 referred articles and books, and has been cited in the Wall Street Journal, USA Today, and numerous other national and regional publications.

Contact information:

Randall J. Pozdena, Ph.D.

QuantEcon, Inc.

Tel: 503-368-4604

pozdena@quantecon.com

Tax Policy and the Colorado Economy:

The Effects on Employment and Migration

Eric Fruits

Economics International Corp.

April 2011

1 Introduction

Earlier this year, Colorado Senator Rollie Heath proposed three versions of an education funding initiative to be on the ballot in November 2011, he calls “Our Kids Can’t Wait” (hereafter, “Heath Measures”). Two versions would raise temporarily the individual and corporate income tax rate from 4.63 percent to 5 percent (an 8 percent increase) and increase the state sales tax rate from 2.9 percent to 3 percent (a 3 percent increase). The second version would make the tax increase permanent. The Denver Post reports that Senator Heath claim that his initiative would raise approximately $1.63 billion over three years; estimates from Colorado Legislative Council staff estimate revenues of $536.1 million year. Each of the Heath Measures specifies that the revenues from the tax increases must be earmarked for pre-K–12 education exclusively. Even so, Senator Heath has acknowledged that the money may not necessarily be applied toward education (Goodland, 2011).

In February 2011, the Colorado Fiscal Policy Institute, a project of the Colorado Center on Law and Policy, filed six ballot measures with Colorado Legislative Council for voter consideration in November 2011 (hereafter, “CFPI Measures”). A little more than a month after introduction, the measures have been withdrawn.

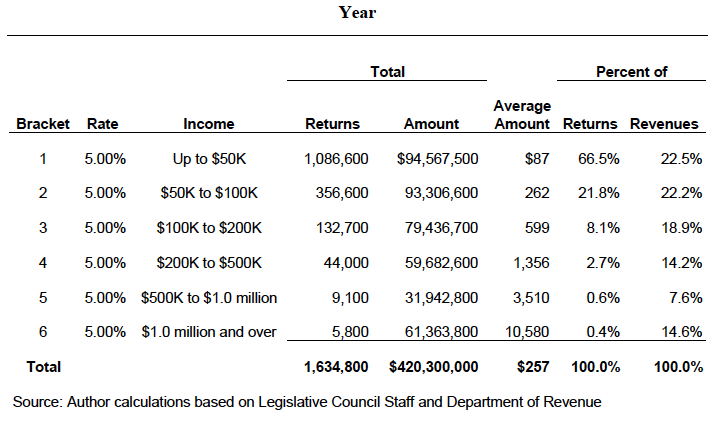

Table 2 identifies the brackets, the projected increase in tax revenues from each bracket, and the change in the amount of taxes paid by the average filer in each bracket under the Heath Measures. Compared with the CFPI Measures, the Heath Measures are much more regressive. While every taxpayer would see the same 8 percent increase in his or her individual income tax burden, nearly 45 percent of the total tax revenues from the Heath Measures would come from those earning less than $100,000 a year. Under the CFPI Measures, those in the top one percent would generate approximately two-thirds of the additional tax revenues. In contrast, under the Heath Measures, this group would account for less than one-quarter of the additional tax revenues.

Table 2:

Summary of Individual Income Taxes Under Health Measures, 2012–13 Fiscal Year

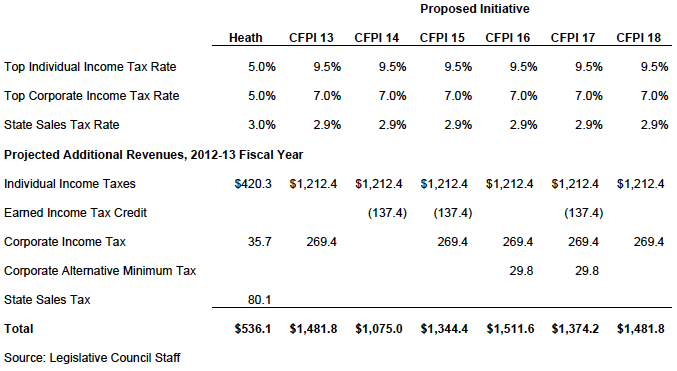

Each of the CFPI measures would have introduced a graduated individual income tax. All but one of the measures would have increased the corporate income tax rate. Two measures would have introduced an alternative minimum corporate tax. Three measures would have established a permanent and refundable state Earned Income Tax Credit equal to 20 percent of the federal EITC. A summary of the tax rates and projected revenues under the Heath Measures and the CFPI Measures is provided in Table 3.

Table 3:

Summary and Comparison of Health Measures and CFPI Measures

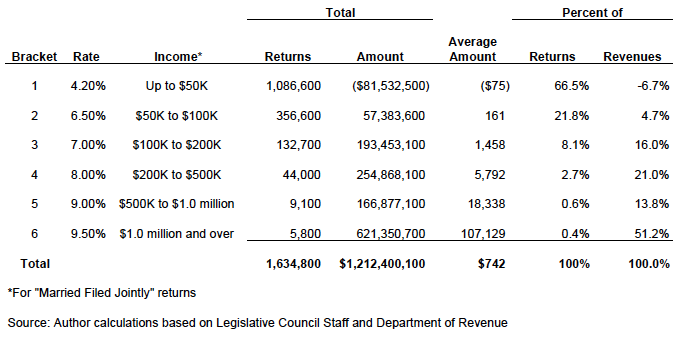

For individuals, the CFPI Measures would have replaced the current flat rate of 4.63 percent with six brackets ranging from 4.2 percent to 9.5 percent. Table 4 identifies the brackets, the projected change in tax revenues from each bracket, and the change in the amount of taxes that would have been paid by the average filer in each bracket. The table shows that approximately two-thirds of Colorado filers would have seen a decrease in their individual income tax assessment. The other third would have seen increased income tax levies. Those in the top one percent of income in the state would have accounted for two-thirds of the additional tax revenues raised by the CFPI Measures. Those in the top one percent are projected to have paid an additional $53,000 a year in Colorado state income taxes.

Table 4:

Summary of Individual Income Taxes Under CFPI Measures 13–18

2 The Questionable Rationale of the Proposed Tax Increases

The Colorado economy has just suffered a deep recession. The state’s unemployment rate has been hovering around a 9 percent—the highest rate since the Bureau of Labor Statistics has kept state-level records. The brunt of the recession has been borne by the private sector. Since employment peaked in 2008, Colorado has lost almost 189,000 private-sector jobs, a 9.4 percent drop in employment. Over the same period, government employment in the state has declined by less than one-quarter of one percent.

The lessons of other recessions suggest that raising taxes under these conditions endangers an economic recovery in that future growth is impaired by the elevation of marginal tax rates. The prospect of raising taxes selectively on private sector incomes—already disproportionately impaired by the deep recession—invites the question: Why would Colorado attempt to increase personal and corporate tax rates at such a vulnerable time?

A political-economic explanation is that the influence of pro-spending, special interest groups in Colorado put their own interests ahead of the state as a whole. This problem is not unique to Colorado. The Pew Center identified the 10 states with the gravest fiscal problems—with Colorado just missing the top 10 list (Vock et al., 2009). All but one of those states (and Colorado) also ranked in the top quartile of states with the highest ratio of lobbyists to legislators in 2006 (Center for Public Integrity, 2007).

A second explanation is that policy makers rely on casual and inadequate models of how the economy reacts to changes in tax policy. In the past and in other states, proponents of efforts to tax selectively the highest income households and the state’s corporations, for example, have relied on a policy prescription floated by the Center on Budget and Policy Priorities in an informal three page memorandum (Orszag and Stiglitz, 2001) written during the previous recession. It stated:

“The conclusion is that, if anything, tax increases on higher-income families are the least damaging mechanism for closing state fiscal deficits in the short run. Reductions in government spending on goods and services, or reductions in transfer payments to lower-income families, are likely to be more damaging to the economy in the short run than tax increases focused on higher-income families.”

A thorough review of Orszag and Stiglitz (2001) reveals, however, that even they recognize this advice is counterproductive to a prompt recovery:

“In any case, in terms of how counter-productive they are, there is no automatic preference for spending reductions rather than tax increases. It is worth emphasizing that any state spending reductions or tax increases are counterproductive at this time: they restrain the economy at a time when it is already slowing.”

It is important to note that Orszag and Stiglitz (2001) only looked at studies of consumption and saving by income level, and did not specifically measure the effect of taxes on economic recovery. Moreover, the memo does not address the relationship between saving and investment and the role investments play to fuel future prosperity. Thus they make a far-from-compelling case for further sacrificing private expenditures, saving and investment at a time when the economy is in recession.

A third explanation for attempting to increase taxes now is that policy makers have not been exposed to, or have chosen to ignore, the large body of literature that overwhelmingly warns of the risks of raising tax rates on personal and corporate income. The literature demonstrates that doing so slows economic growth, investment, formation of new firms, and numerous other processes necessary to jump-start a weakened economy. It also encourages outmigration of taxpayers. The following section demonstrates the volume of professional literature that predicts adverse economic consequences of increases in personal and corporate tax rates.

In addition to the adverse impacts on economic growth, it is unlikely that a steep rise in income tax rates would produce a similarly steep rise in government revenues. California enacted a wide range of tax increases in 2009 in hopes of balancing the state’s budget. However, revenues came up billions of dollars short of projections (Goldmacher, 2010). In 2010, Oregon passed two measures targeting corporations and upper income individuals for tax increases, retroactive to 2009. In the wake of the measures, Oregon’s employment in 2010 was approximately 2 percent lower (28,000 fewer employed) than it would have been if the measures had not passed (Fruits and Pozdena, 2009; Office of Economic Analysis, 2011). In addition, the state’s Legislative Revenue Office reports that revenues from the individual income tax increase will be one-third lower than originally projected (Esteve, 2010).

3 The Economic Effects of Taxation: A Literature Review

A large body of research summarized by Bartik (1991) and Wasylenko (1997), ties increased state and local personal and business income taxes to lower employment and lower economic output and other effects. For example, Wasylenko (1997) cites more than 70 such statistical tests, most of which demonstrate a negative relationship between higher or increasing taxes and economic and employment growth. More recent studies have used both US and international data to trace the effects of taxation on growth, and found similar effects.

- Myles (2009) reports that the “strongest empirical link” between taxation and growth is Plosser’s (1992) study that found a negative relationship between the share of income and profit taxes (relative to gross domestic product) and the growth rate of GDP.

- Padovano and Galli’s (2001) analysis of a cross-section time-series panel of 23 OECD (developed) economies for the period from the 1950s to the 1980s shows that high marginal tax rates and more progressive taxes are negatively correlated with long-run economic growth.

- Researchers at OECD (Johansson et al., 2008) find that, even after controlling for other potentially offsetting policies—such as employment protection legislation and unionization—that the combination of employment taxes and income taxes has a negative effect on the employment rate. The OECD calculates that a ten-percentage-points increase in the tax wedge (the difference between a worker’s wage rate and the amount they retain after taxes) in an average OECD country would decrease the employment rate by 3.7 percentage points (OECD, 2010).

- Prescott (2004) finds that higher income taxes reduce the number of hours worked among those that are employed.

- Using international data, Lee and Gordon (2005) find that corporate tax rates are significantly negatively correlated with average economic growth rates, even after controlling for various other determinants of economic growth, and other standard tax variables. Their statistical studies find that increases in corporate tax rates lead to lower future growth rates within countries. Specifically, they estimate that a cut in the corporate tax rate by 10 percentage points will raise the annual growth rate by one to two percentage points. By implication, a one-percentage point increase in the corporate tax rate will lower growth annually by 0.1 to 0.2 percentage points.

The international studies may be particularly important because the impact of US state taxes on state growth may be even greater than cross-country impacts. For example, Johansson et al. (2008) points out that in open economies, the design of one state’s tax system is influenced by the tax systems of other states, since governments are increasingly using their tax systems to improve their ability to compete in global markets. In addition, increasing globalization means that US businesses have investment opportunities outside of the US and its states.

- A large body of research based on US data developed since the syntheses of Bartik (1991) and Wasylenko (1997) also ties increased state and local personal and business income taxes to lower employment, lower economic output, and slower income growth. Moreover, there is significant evidence that households migrate to avoid the taxes.

- Mullen and Williams (1994) find that higher marginal tax rates impede state output growth (measured as gross state product).

- Yamarik (2000) finds that state tax policy explains state differentials in economic growth.

- Reed (2009) finds that an increase in US state tax revenues as a share of state personal income results in lower economic growth. He finds that the impacts of tax burden are both immediate and persistent. He calculates that a one percentage point increase in tax burden over a five-year period is associated with a contemporaneous decrease in state economic growth of 0.63 percentage points. In addition, it is estimated to lower growth by 0.73 percentage points over subsequent five-year periods.

- Gentry and Hubbard (2004), using data from the Panel Study of Income Dynamics, find that both higher tax rates and increased tax rate progressivity decrease the probability that a head of household will move to a better job during the coming year, slowing the potential for household income growth.

- Cebula (2009) finds that the existence of a state income tax influences migration patterns and that higher state income tax levels have resulted in reduced per capita income growth over time.

- Gius (2009) finds income taxes have an effect on migration for most races and age groups, and that individuals move from states with high income taxes to states with low income taxes. He asserts that these results corroborate the results obtained from the use of aggregate, state-level data.

- The Public Policy Institute of California (Kolko, 2009) finds that Californians of all incomes leave California for states without income taxes. Among highest income households, 36 percent more leave than arrive in California.

- Cox and McMahon (2009) find that 1.5 million New Yorkers left the state between 2000 and 2008 due to “high costs and taxes,” and that those that left were selectively higher income households.

- Studies from other countries with variable, internal regional tax rates support the hypothesis that US state-to-state migration would also be affected by tax policy. Liebig et al. (2006), for example, find that newly educated individuals, in particular, migrate in response to tax differences. A one-percentage point increase in the tax rate change effects a 2.8 percentage point increase in the net out migration rate.

3.1. Tax Increases, Government Spending and the Economy

Economics theory and literature is consistent about the effect of taxing private sector activity to divert resources to preserve the public sector.

- More than forty years ago, Baumol (1967) warned that imbalances in productivity growth between a “progressive” (such as manufacturing) sector and a “nonprogressive” (such as public services) sector lead to perpetual expenditure shifts into the non-progressive, lowproductivity- growth sectors. He argues that increasing expenditure levels in these sectors will cause the growth rate of overall output to decline.

- Mueller (2003) documents dozens of articles that empirically demonstrate that decisionmaking and operational efficiency are poorer in the public sector than in the private sector. Hence, the diversion of activity from the private sector to the public sector is inherently at high risk of being counter-productive.

Tax policies that concentrate the burden of budget instability on the private sector affect adversely the prospects of shortening the recession. The stimulation of long-run growth is crucial to the health of both the public and private sectors. Tax policies that discourage investment and spending in the short-run also tend to discourage businesses and high income tax payers from hiring.

- Evidence indicates that these deleterious impacts persist for a long period of time (Reed, 2008, 2009). Of the studies that have found a relationship between taxes and growth, overwhelming majorities have found that higher tax rates are associated with reduced growth.

- Barro (1996) concludes that most government spending does not enhance productivity. Indeed, the ratio of government consumption expenditure to economic output has a negative association with growth and investment.

- Barro (1991) argues that government consumption has no direct affect on private productivity. Instead he finds that increased government consumption lowers saving and growth through the distorting effects caused by taxation and government-expenditure programs.

The case for maintaining the size of the public sector in a recession is no clearer when tax revenues are diverted from the private sector to education or health spending, as opposed to infrastructure. Despite the superficial indications that such spending may preserve or enhance economic productivity, the evidence indicates the contrary. Indeed, theoretical and empirical evidence indicate that increasing taxes to increase transfer payments have a negative impact on economic growth. The CFPI Measure’s earned income tax credit is an example of such a transfer payment.

- Romans and Subrahmanyam (1979) argue that if tax revenues are used to fund transfer payments, then there is no flow or no perceived flow of benefits to resident firms and employed or employable individuals. Their empirical analysis finds that a more progressive personal tax structure and systems with a higher proportion of tax revenues flowing to transfer payments are negatively and significantly correlated with growth in state personal income.

- Bartik (1991, 1995) finds that to foster business growth, reducing business taxes is superior to increasing or maintaining the same levels of transfer payments.

- Helms (1985) finds that state and local tax increases significantly retard economic growth when the revenue is used to fund transfer payments.

- Heckman et al., (1998) note that increased government spending on education may increase the amount of education available. However, they also note that a progressive labor income tax discourages education, since the taxes saved while in school are more than offset in present value by the future taxes expected to be due on the resulting extra earnings. Thus, Heckman et al., (1998) conclude that the net effects of funding public education with tax increases are not clear-cut.

- More recently, Myles (2007) confirms that empirical evidence finds that a progressive income tax actually discourages education.

- Oliveira Martins et al. (2007) find that the impact of taxes on investment in higher education can be powerfully adverse. Their policy simulations show that a five percentage point increase in marginal tax rates leads to a 0.3 percentage point decrease in higher education graduation rates.

- Hartwig (2009) finds no evidence that additional spending on health care will aid capital formation or economic growth in the US or other OECD countries. On the contrary, further spending from current levels would lower the rate of economic growth.

Thus, the arguments for maintaining the size of the public sector in a recession—to preserve education, welfare and health care spending—most likely will slow the recovery from a recession. Though a seemingly well intentioned “safety net” policy, its results actually may be to prolong the affected individuals’ return to prosperity.

3.2. The Counter-Productivity of Selective Taxation

The authors of the CFPI Measures have called the measures a “Fair Tax Proposal.” In this way they imply that the current tax rates are “unfair,” specifically that the targets of the increased tax rates have not or are not contributing their “fair share” to the tax system. There is no economic evidence in favor of using tax policy to transfer income from one end of the distribution to the other. Indeed, While CFPI has pitched the measures as “tax fairness” measures, in testimony before a state board, counsel for CFPI stated that “the purpose is to raise revenue” and the “we don’t need to get hung up on the fairness issue.”

The targets of taxation under the CFPI Measures also happen to be the source of incomes for many other Coloradans. As a consequence, the burdens put on the targets of the measures will propagate to all income classes and enterprises. Research from the Federal Reserve confirms that higher income individuals tend to be business owners and managers, and invest at a rate far out of proportion to their share of total income (Bucks et al., 2009). Specifically, the research finds that households in the top 10 percent of incomes invest 14 times that of the median household, even though their income is only 4.3 times that of the median households. In this way, the CFPI Measures target the very class of individuals and businesses who fund, operate and develop businesses, jobs and new technologies.

Proponents of the measures may wish to advance the notion that the wealthy and corporations do not pay their “fair share” of taxes (see, for example, CFPI, 2008). This is a common, and particularly divisive, mischaracterization of reality. First, it ignores the fact that the targeted taxpayers pay Federal taxes as well as state taxes, and that they already contribute a share of total Federal revenue that is unmatched in the world. A study by the OECD found that the top 10 percent of US tax payers pay the largest percent of national taxes of any of the OECD countries. Specifically, this 10 percent pays over 45 percent of all income taxes, versus earning 33 percent of all income—a ratio of tax to income share of 1.35. This is almost 50 percent more progressive than Switzerland, at the opposite end of the scale, and more progressive than Sweden, Britain, and Netherlands. On the corporate tax side, only Japan has a higher corporate income tax rate than the US.

Many of us may be envious of, or put off by, the levels of income and the wealth that some enjoy. But we have to be careful to recognize that many others are encouraged by this evidence of the unlimited opportunity our economy offers, and recognize that middle- and lower class lives are better for their success. As Larry Gatlin, lead singer for The Gatlin Brothers (the famous country music group) humorously opined in the Wall Street Journal, “I am no economist, but I do know two things for sure: I never got a job from a poor man; and the more money people have in their pockets, the more jobs they create by spending that money.”

4 Projected Impacts on Colorado Job Growth

The literature reviewed above points the way to data and methods for measuring the effects of Colorado’s proposed tax increases. In this report, the likely economic impacts of the proposed tax policies are measured in two ways:

Using a database spanning 16 years for all 50 states, the effects of tax rate increases on job growth is measured empirically using regression analysis. This exercise finds that the proposed tax rate increases will perpetually impair the rate of job growth in Colorado. The effects of state tax policies are measured empirically using a panel of the 50 states pooled for the period 1994 through 2010. Thus the data and methodology employed for this study can be applied to any state considering a change in top marginal tax rates. In this report, the focus is on the effect of the increased tax rates on employment growth in Colorado.

4.1. Data and Methodology Used

The data used in this study consists of employment, tax, and regional economic and demographic characteristics of the states. The sources of the data are as follows:

- Employment information is from the US Bureau of Labor Statistics.

- Marginal tax rates and sales tax rates are from the Tax Foundation.

- Regional economic/demographic variables are from the US Bureau of Economic Analysis.

To measure tax rates, this study employs the top statutory marginal tax rate faced, respectively, by households and businesses. As Myles (2009) notes, economic theory dictates that the marginal tax rate is the most relevant variable to link taxes and growth. This is because the decision on whether or not to earn additional income depends on how much of that income can be retained. For this reason, he suggests that the link between growth and taxation should focus more on how the marginal rate of tax affects growth. Lee and Gordon (2005) indicate that the top statutory tax rate approximates the tax rate faced by potential entrepreneurs.

The study employs regression analysis, a widely used econometric technique. It measures the relationship between employment growth for a given state at a given point in time, and the statutory tax rates in place in the various states. Reed (2008) suggests that using lagged tax effects may provide a better explanation of the relationship between tax rates and growth than a model that does not include lagged effects. This is because the variables may interact over time in complex ways that are difficult to model or that the data are not well suited to relating to each other contemporaneously.

4.2. Results

The regressions provide the expected signs on the long run impacts of taxes on employment growth: Higher marginal tax rates are associated with reduced employment growth. While various specifications provide slightly different coefficient estimates, the regressions are robust across the specifications.

A one-percentage point increase in top individual income tax rate reduces annual employment growth by a little more than 0.1 percentage points. Corporate income tax rate increases have smaller impacts, but a wider potential range (given different model specifications). One reason for the smaller impacts is that corporations have a greater ability to shift income across space and time. Indeed, for almost every state, corporate income tax revenues have been steadily declining as a share of total tax revenues as businesses adopt strategies to reduce the impacts of tax policies.

If both individual and corporate income taxes were to increase to under one of the CFPI Measures, then Colorado’s annual job growth from their income tax rate increase features alone would decline by more than one-half of one percentage point per year. In the first year of the tax, employment would be 15,300 lower than employment under the current tax rates. By 2017, employment would be 84,900 lower. The employment impacts are much greater in 2017 because of the growth slowing impacts of the taxes increase over time. This is consistent with existing research, such as Barro (1996) who notes: “increases in growth rates by a few tenths of a percentage point matter a lot in the long run and are surely worth the trouble [to preserve].”

A one-percentage point increase in Colorado’s state sales tax rate would reduce employment growth by 0.01 to 0.02 percentage points. This reflects the well-documented observation that sales taxes are much less distortionary to employment than income-based taxes. An increase in state-level sales taxes, however, may trigger increases in local sales tax rates. Thus, the impacts of a state-level sales tax increase would likely have larger negative impacts than the impacts found in our model.

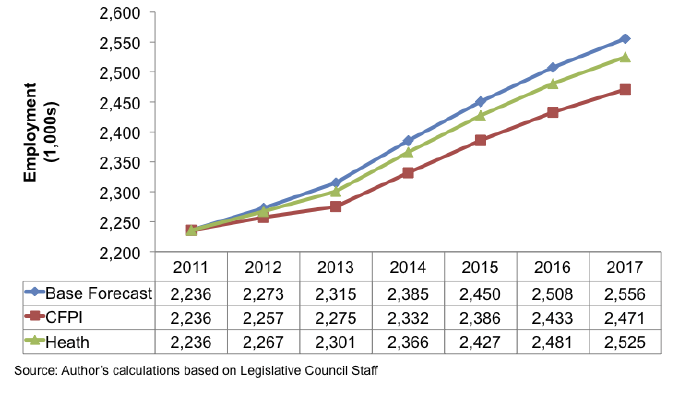

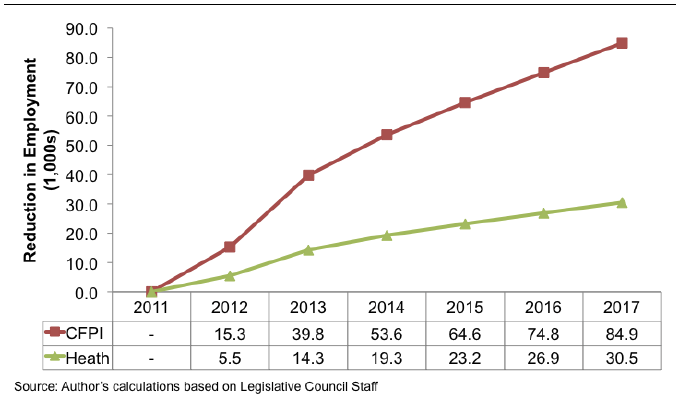

Figure 1 shows the employment forecast under the regression model, using the changes in top marginal rates over time specified in the legislation. For comparison, the figure shows the employment projections by the state economics office (which do not account for the impacts of the tax measures on employment) (Colorado Legislative Council, 2011). The figure shows that the tax increase will cause a slower recovery from the recession that will persist for years.

Figure 1:

Employment Impacts of Tax Measures

Figure 2:

Reduction in Employment Associated with Tax Measures

Figure 2 shows the impacts of the Heath Measures under the assumption that the tax rate increases do not expire. In the first year of the tax, employment would be 5,500 lower than with the current tax rates. By 2017, employment would be 30,500 lower. The employment impacts are much greater in 2017 because of the growth slowing impacts of the taxes increase over time. Because of the smaller increase in rates, the Heath Measures have a smaller negative impact on employment than the CFPI Measures. For example, the CFPI Measures would be associated with a reduction in employment of 84,900.

Last year CFPI claimed that the “Making Work Pay” tax cuts and credits “created” nearly 5,500 jobs (CFPI, 2010). This amounts to 7.7 jobs per $1 million in tax cuts. While the CFPI approach is flawed in many ways, the logic of the CFPI approach points to a “loss” of 4,100 jobs in the first full year the Heath Measure’s tax increases are in place. As a static model, the CFPI approach cannot model dynamic changes over time associated with changes in tax rates, and therefore understates the harmful effects of the tax increases on employment.

The employment impacts found here are likely smaller than the actual impacts of the CFPI Measures. This study only evaluates the impact of the increased top marginal tax rate increases. For example, it does not measure the impacts of the higher rates for joint filers earning between $50,000 and $1,000,000 a year. Also, it does not measure the impact of the alternative minimum tax for corporations under two of the CFPI Measures. The corporate alternative minimum tax represents approximately two percent of the total revenues the Colorado Legislative Council Staff projects, so it is unlikely to have a significant impact on Colorado employment. Nevertheless, it may be difficult to shift the perception among potential investors in the state that Colorado seeks selectively to burden its private sector generally, and its business and higher-income households specifically to support expanded state spending. In this regard, the trend in employment modeled here may be generous to the CFPI Measures.

5 Effects on the Migration of Colorado Taxpayers and Their Income

The notion that different taxing jurisdictions compete on the basis of fiscal policy, amongst other dimensions, was formalized as the “Tiebout Hypothesis” (Tiebout, 1956), also known as “voting with your feet.” The Tiebout Hypothesis has been the motivating logic behind many decades of migration analysis. Much of this research indicates that the location of households and businesses is influenced in no small way by the comparative tax policies of competing jurisdictions. This issue came to prominence with a series of Wall Street Journal editorials on “missing millionaires” in wake of tax income tax increases in Maryland and Oregon. Because so many taxpayers “go missing” after significant tax increases, state projections of tax revenues from higher tax rates often are overly optimistic.

The migration of taxpayers offers another perspective on the effects of the proposed increases in Colorado personal and corporate tax rates. Particularly in an economic downturn entrepreneurs or former owners of failed businesses may be especially prone to migrate. Indeed, many of the effects of taxation on employment growth may have migration of taxpayers or the locus of investment of income as the transmission mechanism for spatial job losses. Moreover, out-migration or reduced in-migration can influence the income distribution of those who comprise an economy and influence its future growth by virtue of this changing composition.

Although many characteristics of a state influence where households and businesses are located, many of these characteristics are unchanging (such as climate) or change only slowly over time (such as the composition of the work force, housing availability, social and political attitudes, educational and transportation infrastructure). In contrast, tax policy can and does change abruptly. This situation facilitates statistical measurement of the effect of tax policies on the migration behavior of taxpayers because such policies vary largely independently of more persistent, relative state attributes.

Using recent Internal Revenue Service (IRS) Statistics on Income (SOI) data, the pattern of migration of tax filers between Colorado and the other 49 states is examined statistically. This allows us to associate the rate of migration of tax filers and the income they report with the relative tax rates levied in Colorado versus its competitor states.

5.1. Data Used

The Internal Revenue Service aids the study of tax effects on migration by assembling and publishing data annually on the changes in taxpayer location that occur between tax years. The IRS Statistics of Income (SOI) data allow the researcher to observe gross and net migration between any two counties or states in the United States.

The measures reported in the SOI are the number of filers, the Adjusted Gross Income (AGI) associated with the filed returns and the number of exemptions claimed on the filed returns. The filer data permits measurement of the migration of taxpayers, while the AGI and exemptions data provide some indication of the economic characteristics of the taxpayers.

Data on tax rates, by type of tax, state and year was obtained from the sources cited earlier in the employment growth study. A variety of measures of tax potency are available, such as effective average tax rates, effective marginal tax rates, and various measures of statutory rates. For the reasons given earlier in this report, we expect the top marginal tax rates to be the most influential in affecting behavior on the margin, including migration.

5.2. Study Method

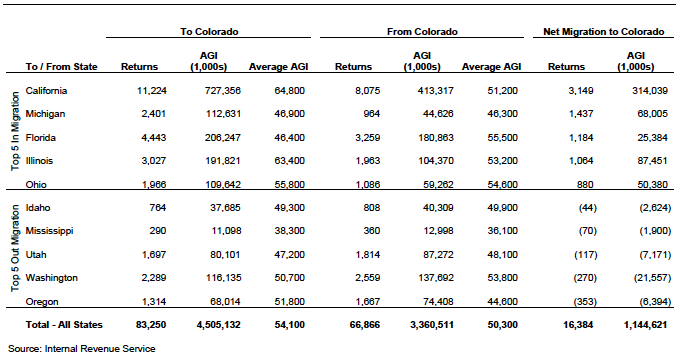

For most of the past two decades, Colorado has enjoyed positive, net in-migration of taxpayers, as illustrated by the data displayed in Table 3 for migration activity between the 2007 and 2008 tax years. Between those two years, for example, 83,250 filers moved from another state to Colorado, while approximately 66,850 moved from Colorado to another state, adding about 16,400 net filers over the course of this one-year. This net migration effect, of course, is in addition to indigenous changes in the number of tax filers that were in Colorado in each year.

Table 5: Migration To and From Colorado Between 2007 and 2008

Even with the proposed tax increases, climate, esthetic and other persistent characteristics may continue to yield net in-migration. The effect of tax policy thus will be revealed in changes relative to this background trend, and the statistical analysis needs to be set up accordingly. Some features of even the background trend bear adversely on the prospects for the tax policies advanced in the proposed measures.

On average, filers moving to Colorado tend to have higher adjusted gross income than filers leaving Colorado. However among the top five states from which Colorado attracts filers, state income taxes appear to affect the makeup of migration. For example, Florida has no individual income tax—filers leaving from Colorado for Florida have higher average incomes than those entering Colorado from Florida. Oregon and Washington also highlight the potential impact of tax rates on migration. Oregon and Washington have similar climates, demographics, and natural amenities. However, Washington has no state income tax and Oregon has one of the highest state income taxes in the US. The average income of those leaving Colorado to Washington is 6 percent higher than the average income of those moving to Colorado from Washington. In contrast the average income of those leaving Colorado to Oregon is 14 percent lower than the average income of those moving to Colorado from Oregon.

The research presented here measures changes using SOI data for the years 1993 through 2008, coupled with data on state-level personal, corporate, and sales tax rates. This study focuses exclusively on the migration of taxpayers in and out of Colorado. As far as we know, this is the first Colorado-specific tax migration study to be published.

Presentation of the statistical details of the study is not appropriate here. However, the key elements of the study method are as follows:

- The tax migration measures are calculated as the net of gross in-migration and outmigration. The migration measures include the number of filers and the associated AGI.

- Tax rates are measured using the highest (statutory) marginal tax rate, in keeping with the theoretical expectation that behavior on the margin (such as net migration) is influenced by differences between marginal tax rates levied in Colorado versus its “competitor” states.

- The specification of the model also recognizes that the larger the two competing economies are, and the closer they are in space, the greater are the prospects for crossinfluence (and the potential for migration). As in other spatial economics analysis, a socalled, “gravity model” specification is used to characterize this phenomenon. Such specifications have been used to study both domestic and international US migration. See, for example, Greenwood (1985) and Karemera et al. (2000).

- The data is arranged as a pool of cross-sections, where each cross section pairs Colorado with each of the other 49 states.

- The model is estimated econometrically and yields coefficients on each tax variable that can be interpreted as the effect of a one-percentage point increase in Colorado’s tax rate on the net migration between Colorado and an average “other” state. The total migration effect is thereby measured across all forty-nine other states.

- Other coefficients allow measurement of net migration between Colorado and other states in the absence of tax changes, and the effect of the size and separation between Colorado and another state due to the gravity model effects.

5.3. Results and Implications for the Proposed Tax Measures

The results of this study are consistent with theoretical expectations and the findings of the large literature cited earlier in the literature review. Specifically:

- Increases in personal, corporate, and sales tax rates each have a negative effect on net inmigration trends. That is, relative to background trends, fewer tax filers will remain in or migrate to Colorado than would be the case without the tax increase.

- The effects are largest and most significant statistically for personal income tax and sales tax rate increases.

The implications of this research for the effects of the proposed Colorado measures are substantial. It suggests that large and persistent reductions in Colorado’s generally positive trend in net in-migration will result from the passage of any of the measures.

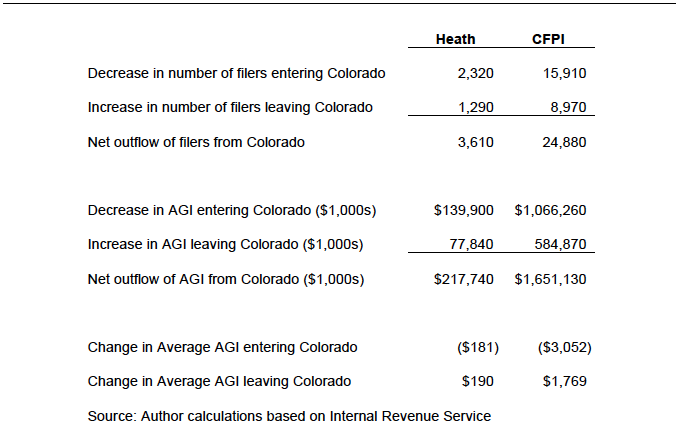

Table 6: Taxpayer Migration Impacts of Tax Measures

Table 6 shows the projected impacts of the tax measures relative to the base levels of migration provided in Table 5. Current net in-migration is 16,400. The Heath Measures would reduce net in-migration by 3,610 to 12,790. Under the Heath Measure, Colorado would see an approximately $218 million less adjusted gross income entering the state than it would see under the current tax rates. Under the Heath Measure, the average income of a filer entering state would be $181 lower than the average income of a filer currently entering the state. The average income of a filer leaving the state would be $190 higher under the Heath Measure. These findings suggest that the tax increases may not raise the revenues that its proponents hope it will raise.

The CFPI Measures would cause substantial changes to Colorado’s migration patterns. Our statistical analysis indicates that the CFPI Measures would cause Colorado to shift from a state enjoying net in-migration to a state suffering net out-migration of 8,490 filers. In addition, the CFPI Measures would lead to a form of capital flight in which the incomes of those leaving the state would be higher than the incomes of those leaving the state.

6 Summary and Conclusions

Measurement of the future effects of policy changes is a difficult statistical exercise. The economy is itself dynamic and can be influenced by myriad policy and economic conditions. At this time in US history, there are many major policies in flux and world economic conditions are volatile. Therefore, any forecast of the effects of a single state’s policies should be embraced cautiously. This is true of the analysis presented in this report as well as projections made by others.

Nevertheless, absent other dramatic and offsetting forces, we believe that the proposed tax increases will harm the Colorado economy in the long run. This paper reports two separate efforts to quantify the potential impact of the tax measures. Both approaches use historical data specific to Colorado relative to tax rates of the 50 states to reveal the influence that Colorado’s tax rate policy has had on its economy.

One of the efforts looks at this issue from the standpoint of job growth, and the other from the standpoint of net migration of taxpayers. The effects are not additive. Instead, each approach should be view as an alternative viewed of how behavior is affected by tax policy. Nevertheless, each approach reveals a common scale and direction of effects that should serve as a warning to those who seek to increase Colorado’s taxes. These effects are (1) slower job growth, (2) weaker net in-migration of future taxpayers and (3) selectively, a net tendency for higher income filers to live elsewhere.

The reduced employment growth will slow Colorado’s recovery from the recession. Reduced employment is associated with reduced revenues to state and local governments, while increased unemployment is associated with increased costs to state and local agencies. The net effect would be increased challenges to balance state and local government budgets.

The CFPI Measures will move Colorado much higher up in the ranking of state tax burden. Evidence from other states shows that as the income tax burdens increases, especially the burden on upper incomes, the make-up of net in-migration shifts. In particular, it leads to a form of capital flight in which the incomes of those leaving the state tend to be higher than the incomes of those entering the state.

Our measures of impact aside, one can find little support in the literature for the notion that raising tax rates and diversion of resources away from the private sector will be anything but counterproductive to a recessed economy. Specifically, the literature does not support the notion that raising marginal tax rates and diverting resources away from the private sector is somehow growth enhancing. Indeed, numerous threads of the literature suggest the opposite:

- US and international studies of tax policy both conclude that taxation of corporate and personal incomes depresses economic growth.

- Both theory and empirical study support the notion that the public sector has slower productivity growth. Thus allocation of an economy’s resources away from the private sector will impair future economic prospects. To better advance the prosperity of Colorado overall (including public employment and programs), resources should not be diverted from sectors with the greatest prospects for increasing productivity and the ability to retain and create private market jobs.

We accept that preservation of government spending in areas such as education and transfer payments temporarily eases the painful burden on some caused by the weakened economy. However, the side effect of doing so comes at the expense of the private sector. As in medicine, these side effects must be balanced against short-term treatment of the pain. Theory and evidence show that diversion of private resources for short run benefit may aggravate job loss or the duration of job loss in the long run.

Sources

Barro, R. J. (1991). Economic growth in a cross section of countries. Quarterly Journal of Economics, 106(2):407–443.

Barro, R. J. (1996). Determinants of economic growth: A cross country empirical study. Working Paper No. 5698, National Bureau of Economic Research.

Bartik, T. J. (1991). Who Benefits from State and Local Economic Development Policies? W. E. Upjohn Institute, Kalamazoo, MI.

Bartik, T. J. (1995). Economic development strategies. Working Paper 95-33, W. E. Upjohn Institute for Employment Research.

Baumol, W. J. (1967). Macroeconomics of unbalanced growth: The anatomy of urban crisis. American Economic Review, 57(3):415–426.

Bucks, B. K., Kennickell, A. B., Mach, T. L., and Moore, K. B. (2009). Changes in U.S. family finances from 2004 to 2007: Evidence from the Survey of Consumer Finances. Federal Reserve Bulletin, pages A1–A56.

Cebula, R. J. (2009). Migration and the Tiebout-Tullock hypothesis revisited. American Journal of Economics & Sociology, 68(2):541–551.

Center for Public Integrity (2007). Ratio of lobbyists to legislators 2006. http://projects.publicintegrity.org/hiredguns/chart.aspx?act=lobtoleg.

Colorado Fiscal Policy Institute (2008). Are Colorado’s corporations paying their fair share? April 8.

Colorado Fiscal Policy Institute (2010). The economic impact of the Making Work Pay tax credit in Colorado. Issue Brief. April 14.

Colorado Legislative Council (2011). Focus Colorado: Economic and revenue forecast. State of Colorado. March 18.

Cox, W. and McMahon, E. J. (2009). Empire State exodus: The mass migration of New Yorkers to other states. Empire Center for New York State Policy.

Ducking higher taxes. [Editorial]. (2010). Wall Street Journal. December 21.

Esteve, H. (2010). Oregon tax revenues from Measure 66 coming up short of predictions. Oregonian. August 30.

Fruits, E. and Pozdena, R. (2009). Tax policy and the Oregon economy: The effects of Measures 66 and 67. Cascade Policy Institute.

Gatlin, L. (2004). Bush country. Wall Street Journal. August 23.

Gentry, W. M. and Hubbard, R. G. (2004). The effects of progressive income taxation on job turnover. Journal of Public Economics, 88(11):2301–2322.

Gius, M. P. (2009). The effect of income taxes on interstate migration: An analysis by age and race. Annals of Regional Science.

Goldmacher, S. (2010). Plunge in state revenue dashes hopes of an easy budget fix. Los Angeles Times. May 4.

Goodland, M. (2011). Initiative proposes tax hikes. Colorado Statesman. March 4.

Greenwood, M. J. (1985). Human migration: Theory, models, and empirical studies. Journal of Regional Science, 25(4):521–544.

Hartwig, J. (2010). Is health capital formation good for long-term economic growth? Panel Granger-causality evidence for OECD countries. Journal of Macroeconomics, 32(1):314– 325.

Heckman, J. J., Lochner, L., and Taber, C. (1998). Tax policy and human-capital formation. American Economic Review, 88(2):293–297.

Helms, L. J. (1985). The effect of state and local taxes on economic growth: A time series-cross section approach. Review of Economics and Statistics, 67(4):574–582.

Hoover, T. (2011). Colorado senator to take tax-hike measure to voters. Denver Post. March 1.

Johansson, Å., Heady, C., Arnold, J., Brys, B., and Vartia, L. (2008). Tax and economic growth. Working Paper No. 620, OECD Economics Department.

Karemera, D., Oguledo, V. I., and Davis, B. (2000). A gravity model analysis of international migration to North America. Applied Economics, 32(13):1745–1755.

Kolko, J. (2009). Are the rich leaving California? Public Policy Institute of California.

Lee, Y. and Gordon, R. H. (2005). Tax structure and economic growth. Journal of Public Economics, 89(5–6):1027–1043.

Liebig, T., Puhani, P. A., and Sousa-Poza, A. (2006). Taxation and internal migration: Evidence from the Swiss census using community-level variation in income tax rates. IZA Discussion Paper No. 2374, Institute for the Study of Labor.

Millionaires go missing. [Editorial] (2009). Wall Street Journal. May 27.

Mueller, D. C. (2003). Public Choice III. Cambridge University Press.

Mullen, J. K. and Williams, M. (1994). Marginal tax rates and state economic growth. Regional Science and Urban Economics, 24(6):687–705.

Myles, G. D. (2007). Economic growth and the role of taxation. Working Paper, University of Exeter and Institute for Fiscal Studies.

Myles, G. D. (2009). Economic growth and the role of taxation: Aggregate data. Working Paper No. 714, OECD Economics Department.

Office of Economic Analysis (2011). Oregon economic and revenue forecast. State of Oregon. 31(1).

Oliveira Martins, J., Boarini, R., Strauss, H., de la Maisonneuve, C., and Saadi, C. (2007). The policy determinants of investment in tertiary education. Working Paper No. 576, OECD Economics Department.

Orszag, P. and Stiglitz, J. (2001). Budget cuts vs. tax increases at the state level: is one more counter-productive than the other during a recession? Center on Budget and Policy Priorities, Washington, DC.

Padovano, F. and Galli, E. (2001). Tax rates and economic growth in the OECD countries (1950–1990). Economic Inquiry, 39(1):44–57.

Plosser, C. I. (1992). The search for growth. In Policies for Long-Run Economic Growth. Federal Reserve Bank of Kansas City.

Prescott, E. C. (2004). Why do Americans work so much more than Europeans? Federal Reserve Bank of Minneapolis Quarterly Review, 28(1):2–13.

Reed, W. R. (2008). The robust relationship between taxes and U.S. state income growth. National Tax Journal, 61(1):57–80.

Reed, W. R. (2009). The determinants of U.S. economic growth: A less extreme bounds analysis. Economic Inquiry, 47(4):685–700.

Romans, T. and Subrahmanyam, G. (1979). State and local taxes, transfers and regional economic growth. Southern Economic Journal, 46(2):435–444.

Tiebout, C. M. (1956). A pure theory of local expenditures. Journal of Political Economy, 64(5):416–424.

Vock, D. C., Prah, P. M., Fehr, S. C., Maynard, M., Gramlich, J., and Leonard, K. (2009). Beyond California: States in fiscal peril. Pew Center on the States.

Wasylenko, M. (1997). Taxation and economic development: The state of the economic literature. New England Economic Review, pages 37–52.

Yamarik, S. (2000). Can tax policy help explain state-level macroeconomic growth? Economics Letters, 68(2):211–215.