COLORADO OIL AND GAS INDUSTRY

COLORADO OIL AND GAS INDUSTRY

Updated Economic Assessment of Colorado Oil and Gas Ballot Initiatives in 2014

September, 2014 study conducted by Brian Lewandowski and Richard Wobbekind

Business Research DivisionLeeds School of Business

University of Colorado Boulder

420 UCB

Boulder, CO 80309-0420

Telephone: 303-492-3307

leeds.colorado.edu/brd

Business Research Division

The Business Research Division (BRD) of the Leeds School of Business at the University of Colorado Boulder has been serving Colorado since 1915. The BRD conducts economic impact studies and customized research projects that assist companies, associations, nonprofits, and government agencies with making informed business and policy decisions. Among the information offered to the public are the annual Colorado Business Economic Outlook Forum—now in its 49th year—which provides a forecast of the state’s economy by sector, and the quarterly Leeds Business Confidence Index, which gauges Colorado business leaders’ opinions about the national and state economies and how their industry will perform in the upcoming quarter. The Colorado Business Review is a quarterly publication that offers decision makers industry-focused analysis and information as it relates to the Colorado economy.

BRD researchers collaborate with faculty researchers on projects, and graduate and undergraduate student assistants, who provide research assistance and gain valuable hands-on experience.

SUMMARY

SUMMARY

In late 2013, the Business Research Division (BRD) of the Leeds School of Business, University of Colorado Boulder began researching the economic implications of a statewide fracking ban on the state economy. In March 2014, the BRD published a paper titled, Hydraulic Fracturing Ban: The Economic Impact of a Statewide Fracking Ban in Colorado, which described a scenario where a 95% reduction in new activity constituted an average decrease in gross domestic product (GDP) of $8 billion in the first five years and $12 billion between 2015 and 2040. The impact reduced Colorado jobs on average by 68,000 over the first five years and by 93,000 jobs on average between 2015 and 2040.

This paper refines the work completed in March and describes the economic impacts of the two ballot initiatives that were frontrunners for restricting industry growth (ballot initiatives 88 and 89) prior to the compromise that was achieved on August 4, 2014, effectively ending all four 2014 oil and gas ballot initiatives. This summary also updates various oil and gas economic and fiscal metrics based on 2013 data to provide context into the industry’s economic footprint leading up to 2014.

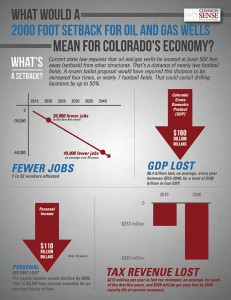

Based on estimates provided by the oil and gas industry, a 2,000-foot setback would curtail drilling locations by 25% to 50%. Extrapolating this to indicate a reduction in new production, coupled with the quickly depleting yields from existing wells, leads to an average decrease in GDP between $2.2 billion and $4.4 billion in the first five years and an average decrease between $3.2 billion and $6.4 billion from 2015 to 2040. The impact on total employment ranges between 18,000 jobs and 36,000 jobs in the first five years on average, and between 24,000 and 49,000 jobs from 2015 to 2040.

Under an expanded setback scenario, it is unclear how a reduction in land access would ultimately manifest in reduced production given the variation in production by basin and by well, technological improvements that allow for horizontal drilling, as well as the opportunity for property owners to consent to drill within the setbacks, which was written into the initiative. Under a local control scenario, the impact on production due to the speculation on which communities would pass moratoriums on fracking is even more unclear. Front Range metropolitan counties1 (excluding Weld) accounted for 1.7% of assessed taxable oil and gas activity in 2013, and cities accounted for 4.6% of activity. While the signal from communities that have passed fracking bans or moratoriums indicates an urban, metropolitan movement, the local control initiative is not written exclusively for metropolitan communities. This report does not quantify the potential economic impacts of a local control measure.

Overall, Colorado’s oil and gas industry continued to expand in 2013, building on growth that transpired following a dip in production during the recession. More drilling permits were recorded in 2013 than in 2012, and oil production increased while gas production fell compared to 2012. Weld County and Garfield County continue to be the center of new activity, garnering more than four out of five drilling permits.

Employment and wages grew in the upstream and midstream industry sectors in 2013 (Extraction, Drilling Wells, Support Activities, Oil and Gas Pipeline and Related Structures Construction, and Pipeline Transportation). An estimated 33,897 people worked in the upstream and midstream oil and gas industry in 2013, earning total wages of $3.5 billion, or $104,626 per worker. The year marked the greatest number of industry workers on record in Colorado. Wage growth in the industry outpaced wages growth for the state overall (4% compared to 0.6%).

The public revenue stream, related to upstream and midstream activities, was estimated at more than $1.1 billion in 2013, the largest source of which was the tax on production.

This paper was prepared using the Regional Economic Models, Inc. (REMI) Tax-PI model built for Colorado and calibrated with Colorado revenues, expenditures, employment, and population. Researchers from the BRD researched the known, quantifiable industry metrics, ranging from production and prices to employment, wages, and taxes.

ECONOMIC IMPACT OF ALTERNATIVE SCENARIOS

This paper is an update to the March 2014, the BRD published a paper titled, Hydraulic Fracturing Ban: The Economic Impact of a Statewide Fracking Ban in Colorado.

In early 2014, there were 22 proposed ballot initiatives related to the oil and gas industry. These initiatives can be categorized into three areas:

- Setbacks (Initiatives 82, 85, 86, 87, 88, 117, 118, 119, 120)

- Local Control (75, 89, 90, 91, 92, 93, 103, 115, 116) 2

- Pro-Industry (121, 137)

Many of these initiatives have been withdrawn, and as of July 31, 2014, four ballot initiatives related to the oil and gas industry appeared to have the greatest likelihood of appearing on the November ballot. (See Appendix 1 for a summary.)

- Ballot Initiative 88

- Ballot Initiative 89

- Ballot Initiative 121

- Ballot Initiative 137

On August 4, 2014, a compromise was reached on local control of oil and gas drilling that will remove all initiatives from the November ballot. Industry-supported backers agreed to drop both Initiative 121, which would have withheld state oil and gas revenue from communities banning drilling, and Initiative 137, which required a fiscal impact note for all initiatives. On the opposing side, U.S. Rep Jared Polis, agreed to withdraw two initiatives that would have required drilling rigs to be set back 2,000 feet from homes and the addition of an environmental bill of rights to the state constitution. The…

Download the complete report in pdf format >>

Pdf file (1.1MB)

1Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, El Paso, Gilpin, Jefferson, Larimer, Park, Pueblo, and Teller counties. Excludes Weld County.