Testing the Resilience of Our Free Enterprise System: Observations on the Economic Impacts of COVID-19 on Colorado

As of March 24th, 2020

AUTHOR: CHRIS BROWN

ABOUT THE AUTHOR

Chris Brown is the Director of Policy and Research with the Common Sense Policy Roundtable where he leads the research efforts of CSPR to provide insightful, accurate and actionable information on the implications of public policy issues throughout the state of Colorado.

ABOUT COMMON SENSE POLICY ROUNDTABLE

Common Sense Policy Roundtable is a non-profit free-enterprise think tank dedicated to the protection and promotion of Colorado’s economy, our mission is to research and promote common sense solutions for the most pressing public policy issues facing Colorado. We examine the economic impact of policies, initiatives, and proposed laws by employing dynamic modeling that accurately measures the impact of each measure on the Colorado economy and individual opportunity. To fully achieve our mission, we actively promote these solutions through the education of policy experts, lawmakers, community leaders, and the general public.

CSPR was founded in 2010 by a concerned group of business and civic leaders that saw divisive partisanship was overwhelming the issues, and objective economic analysis was not being presented to lawmakers and voters empowering them to make fact-based and common sense decisions.

AUTHOR’S NOTE

This report does not stand in judgment of any policy, any decision or any action aimed at protecting the vital public health interests of Colorado and the nation amid this crisis. Aggressive steps to slow the spread of the Coronavirus are indisputably critical. Colorado’s political leaders have, by in large, approached these decisions in a bipartisan way, and with sober and sensible resolve. This report does, however, frame the nature of the trade-offs for the people of Colorado if sweeping policies that prevent large segments of the citizenry from working stay in effect over-time. It has been said — to govern is to choose. As policy makers weigh these difficult decisions in the coming weeks, this report gives color to both the systemic and the highly-personal impact of one range of scenarios on the people of this state.

COVID-19: A Health and Economic Crisis

The unprecedented events that have transpired in the US over the last two weeks are aimed at saving lives. By taking extreme measures to limit contact between people in hopes of slowing the spread of the COVID-19, there will likely be success in preventing an overwhelming rush of patients in need of ventilators and other treatments that our healthcare system could otherwise not accommodate. Yet, while American states may be successful in slowing the spread of the virus, the US economic system has ground to a near halt and the potential economic and fiscal impacts are just beginning to be understood.

A core part of CSPR’s work, is to detail the potential economic and fiscal impacts of public policy. In the last several weeks, there have been no greater policy shifts enacted in history. While we remain hopeful that the most significant impacts of the actions to prevent the spread of the COVID-19 will be felt in the short-term, it is important to be aware and consider the potential longer-term impacts on the economy as well.

CSPR plans to release periodic updates related to the current crisis via a new blog at https://commonsenseinstituteco.org/covid19/ that describe the latest research related to the economic and fiscal impacts to Colorado due to COVID-19. Especially given how quickly the circumstances surrounding the pandemic and both federal and state policy responses are changing.

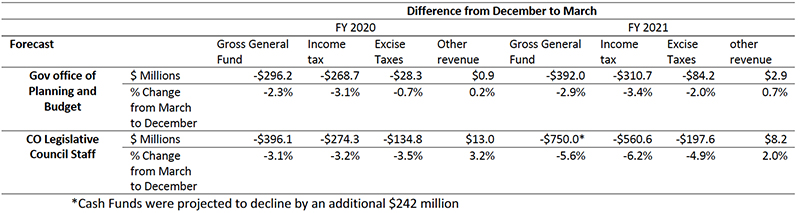

The March 2020 economic forecasts, produced by the Governor’s Office of Planning and Budget and the Colorado Legislative Council Staff, paint a fairly grim picture. While differing slightly, both forecasts project large cuts in expenditures will be necessary even before the end of this fiscal year and indicate there could be as much as $1 billion less in revenue for the next fiscal year than was projected just three months earlier. For perspective, $495 million of the general fund were transferred to transportation in the last full budget cycle, representing 17% of all sources of funds. While these projections showed a difficult future, they acknowledged the incredible amount of uncertainty in how the current crisis will unfold, and potential for even greater reductions.

Since the release of these forecasts, some of the most austere public policy measures our country has ever seen have gone into effect and it has become clear that the negative downside risks alluded to in the state’s forecasts have come to pass.

It is still unclear given the rapid pace of change, exactly what the full impacts to our economy will be. However, we can begin to develop economic modeling scenarios to gain important insights, as lawmakers look to curtail the worst of the economic effects.

While it is clear that the direct impact of extreme social distancing will be felt well beyond just retail, ski resorts, restaurants, bars and other businesses where larger crowds usually form, using the REMI PI+ economic model, we have formed two scenarios to isolate the potential impacts of severe reduction in economic activity in just those sectors.

Those scenarios show that if 50% of the industry sectors including retail, arts/entertainment/recreation, accommodations and food service/beverage for on premise consumption is reduced for a full quarter in 2020, the ripple effects could cost as many as 183,000 jobs or 4.6% of all jobs in Colorado.

The purpose of dynamic modeling is to better capture the ways in which the impacts on one sector, or one business, end up impacting so many others. It captures the way in which our economy is connected through trade and the buying and selling of goods and services. This is especially useful in the current situation as specific sectors are being disproportionately impacted, and yet the ripple effects of those disruptions will not just be a social inconvenience, but rather will impact economic activity across many other sectors.

As of Sunday March 23rd, Governor Polis required a reduction in non-critical workforce by 50%. This effect, coupled with the massive disruptions across the rest of the country and globe, should only increase those negative effects and cause swift economic declines unprecedented in recent history.

At the height of the 2009 recession, there were 148,000 Coloradans on unemployment insurance, yet the number of claims in a single week never rose past 8,000. Given the publicly reported increase of claims of more than 25,000 in just the past week, coupled with these new policies, it is increasingly likely this crisis will cause a swell in unemployment that surpasses those levels seen during the last recession.

What Are the Most Recent Economic and Fiscal Projections for Colorado?

Every quarter, both the Colorado Governor’s Office of Planning and Budget, and the Colorado Legislative Council Staff issue both an economic and budget forecast for the state. By sheer coincidence, the March 2020 releases12, coincided with the dramatic policy responses to implement social distancing and effectively grind much of the economy to a halt. Those forecasts, for now, will serve as the basis for what lawmakers will may use when the 2020 Colorado Legislative Session resumes and the FY2021 budget has to be set.

Given the uncertainty of the situation, and the fact that these forecasts have come out fairly early into the crisis, it is very likely future estimates will show a very different picture. The next official forecast release date is not until June, however it is likely that select legislative committees, such as the Colorado Joint Budget Committee will receive updated briefings between now and then. While there are other economic factors that have also changed since the release of the December 2019 forecast, namely a sharp drop in the price of oil, the difference between the two forecasts can be mostly explained by revisions caused by the COVID-19 pandemic.

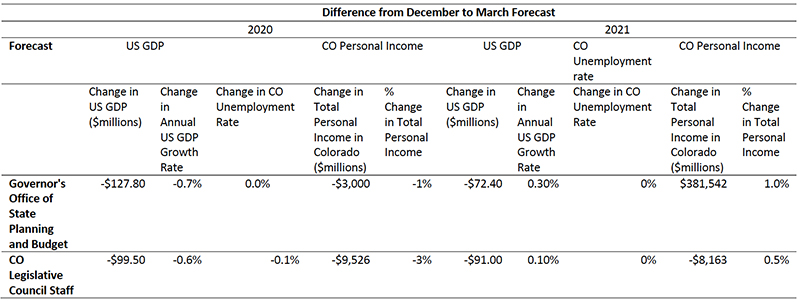

To begin, the assumption for the overall US forecast were revised downward. The average US GDP growth rate between the two state forecasts was reduced from 1.85% to 1.2%. While the annual average growth rate remained above 1%, it represented a nearly 33% reduction in the projected annual growth. For Colorado that meant a 1% to 3% drop in total personal income, or between $3 billion and $9 billion, from the previously forecasted level.

Of note, both forecasts assumed no substantial change to the annual average unemployment rate. This may indicate that the expectation at the time of release of these projections was that the severe drop-in economic activity would hurt total income and consumption and therefore revenue, however the job loss would be temporary, or not very severe.

Figure 1: Macroeconomic Difference from December to March in State of Colorado Forecasts

Figure 2: General Fund Revenue Difference from December to March in State of Colorado Forecasts

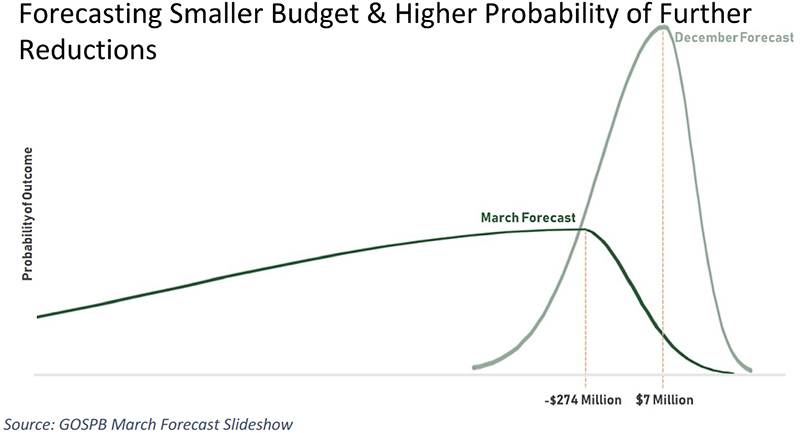

What Are the Left-Tailed Risks?

As noted in both the Legislative Council Staff and Governor’s Budget Office report, there is an extremely high level of uncertainly with any current projections, and the downside risks have only increased in probability. Those downside risks are often referred to as left-tailed risk, given those potential outcomes lie to the left of the mean in a distributional chart.

This image from the OSPB March Forecast slideshow clearly shows this concept.

Figure 3: Increased Left-tailed risk for Colorado Forecast

Since the release of the state reports, many virtually unprecedented policies have come into effect, from the closing of all in-person dining at restaurants and bars, the closing of all schools and ski mountains, to even the closing of crossings at the US- Canada border. As of Friday March 19th, nearly a quarter of the entire US population was ordered to isolate themselves in their homes as California, New York and several other states have issued shelter-in-place orders. Each of these measures in isolation would be enough to cause economic havoc across every industry and millions of lives. When taken together, the potential economic impacts are staggering.

The only certainty in any of this, is the longer the shutdown of economic activity lasts, the more consequential the fiscal impacts become.

CSPR has the unique ability to run economic simulations, using a leading dynamic economic forecasting and simulation model available commercially in the US. That model, developed by REMI, can help understand the full economic consequences of these actions, and provide a sense of the scale of what we may have in store.

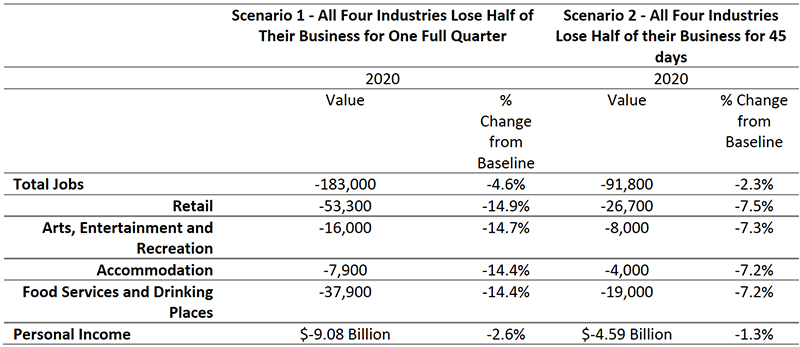

Just to highlight the severity of the economic impacts we may be faced with, Figure 4 shows two scenarios. The first estimates the impact of a loss of 50% of all sales across four industries for a full quarter. The second scenario is very similar; however it only assumes a 50% reduction in sales for those same four sectors for half of a quarter or roughly 45 days.

Those four industries include:

- Retail

- Arts, Entertainment and Recreation

- Accommodation

- Food Service and Drinking places

This isolates the impacts that are occurring to the recreation and tourism sectors, including ski resorts and hotels. It also includes restaurants and bars. Scenario 1 shows that roughly 180,000 jobs would be lost and over $9 billion in personal income.

Figure 4: Economic Impact Scenarios of Shutdown of Just Four Industries; Restaurants, Ski Resorts, Bars, Gyms, and others

The implications of this are profound. While it may still be the case that the loss in jobs are relatively temporary, even if every employee that gets laid off is able to get their job back, the financial impacts will be significant.

Clearly, the potential for massive job loss is significant. Without those jobs, tens of thousands of Colorado families will be faced with mounting costs and severely reduced income. That loss in income translates to direct reductions in consumption. Ultimately, this is where the entire economy stalls.

What Are National Forecast Saying?

While these impacts are severe in the short-term, they could amount to even more disruptive consequences in the long-run. Epidemiology modeling released on March 16th, estimates that even with the extreme social distancing policies we have in place today, without a vaccine, any loosening of restrictions will only bring about renewed spread of the virus that would quickly overwhelm the health care system and lead to many more unfortunate deaths and illnesses3. This modeling paints a picture where we may actually experience waves of brief periods of near normalcy followed by periods of more extreme isolation for as long as 18-months.

While the Colorado state forecasts released thus far, point to significant reductions in both state revenue and economic activity, the probability of seeing even greater negative impacts is growing.

Here is a summary what different national forecasts are saying about the trajectory of the US economy.

For the second quarter of 2020, Oxford Economics have projected the US economy will decrease on an annual rate of 12%. JPMorgan Chase suggests the rate is 14% and Goldman Sachs has warned of a 24% reduction.

Now these figures only project what the outcome may be over the next three months. The Anderson forecast from UCLA projected a decline in Q2 of 2020 -6.4%. For the entire year, they projected negative growth of just -0.4%.

How will Policy Measures Counteract These Risks?

Policymakers are quickly understanding the risk COVID-19 poses to human health; specifically, the elderly and those with pre-existing health conditions. Many also understand the economic harm caused by the significant measures put in place to prevent the spread. Yet while the policies that have caused these disruptions have been swift, the policies to mitigate the economic fallout have yet to be finalized. This makes sense for many reasons yet causes a lot of anxiety and uncertainty in the meantime.

Colorado Actions to Mitigate the Impacts

At the state level, the main source for stabilizing the balance sheets of many households, is the unemployment benefit fund. Through the month of February, there were just over 32,000 Coloradans who received unemployment benefits. While the full March figures won’t be released for a few weeks, just in the past few days, several press releases from the Colorado Department of Labor and Employment have indicated major spikes in unemployment benefit insurance claims.

Estimates from the Colorado Office of Legislative Council Staff’s March forecast indicate the Unemployment Insurance Trust Fund has sufficient funds to withstand a very sharp increase in claims, yet this will be a key are to monitor going forward.

Colorado Governor Jared Polis has signed several executive orders in attempts to bring direct relief to many Coloradans. Those orders cover several topics:

- Increasing access to unemployment insurance funds by waiving certain requirements such as you must be looking for work or requiring a one week waiting period before receiving funds;

- Reducing penalties and increasing leniency surrounding evictions and foreclosures to ease some of the burden on those who are unable to pay rent due to the crisis;

- Reducing utility disconnections and penalties for those that are unable to pay their utility bill as a result of the crisis;

- Extending the income tax filing deadline by 90 days, and grants extensions for those required to make estimated 2020 tax payments;

- Allowing retailers licensed to sell alcohol for on-premise consumption to sell, deliver and provide takeout for sealed alcoholic beverages for customers who also purchase food; and,

- In coordination with federal changes, small businesses are eligible for up to $2,000,000 as part of the Small Business Administration’s Economic Injury Disaster Loan program.

Federal Actions to Mitigate the Impacts

While two federal pieces of legislation have passed to address the spread of COVID-19, at third, and potential more consequential stimulus package was yet to be passed at the time of this report.

The initial packages were aimed at addressing several issues:

- Early resources for aiding in the prevention and spread of COVID-19

- Make COVID-19 testing essentially free

- Require employers with fewer than 500 employees to provide two-weeks of paid sick leave

- Increase funding to states to support state unemployment claims

- Increase funding to expand access to federal nutrition assistance programs.

The next round of federal legislation is likely to include massive amounts of direct stimulus dollars aimed at propping up household and businesses balance sheets hit hardest by this crisis. One of the ideas that has been discussed and included in versions of draft legislation is a direct payment to households.

If every Colorado household got a $2,000 check that would amount to roughly $4.6 billion dollars or about 1.7% of total annual consumption. Scenario 1 in the REMI modeling discussed earlier in this paper estimated a roughly $6.7 billion decline in total consumption expenditures as a result of the slowdown in just four sectors. This could indicate that greater levels of federal stimulus may be needed or that it may still be inadequate to offset the economic losses completely. Additional modeling will need to be done to explore these offsetting impacts further.

Summary

The reaction to the threat of the spread of the novel COVID-19 has been swift. It has altered the daily lives of nearly every person on the planet. Due to the risk of transmission of the virus, it has meant limiting human contact to an extreme. While this hopefully reduces the threat to human life that an overwhelmed hospital system would lead to, it has impaired the ability of billions of people to work and generate an income to cover normal expenses.

While early estimates released by the state forecasters indicate a potential reduction in total personal income and general fund revenue up to 3% from previous forecasts, the events that have transpired since those forecasts were released suggest the impacts could be more severe.

While many sectors of the economy will be negatively impacted, those that have been forced to close due to the enforcement of extreme social distancing practices will be hardest hit. Preliminary scenarios estimate the loss of 50% of sales across four Colorado industries covering restaurants, bars, ski resorts, events and retail for a full quarter, suggest over 180,000 jobs will be lost, or over 4.5% of the state total. Given the many other sectors experiencing major slowdowns in business, these impacts could be much larger.

Much of the short and long-term impacts will depend on both state and federal policy responses. The ability for expenses to be delayed or reduced could go a long way for individuals and families hit the hardest. Significant federal stimulus, in the form of loans for businesses or direct payments to households, could make the difference in whether many are able to quickly recover, once the health risks subside.

1 https://leg.colorado.gov/sites/default/files/images/lcs/marchforecast.pdf

2 https://drive.google.com/drive/folders/14NxsJhqrct9CXif-IpWmalpZnma_IycN

3 https://www.imperial.ac.uk/mrc-global-infectious-disease-analysis/news–wuhan-coronavirus/