About the Measure

If passed, Proposition FF will provide free meals to all K–12 students within participating districts.[i] It will also increase wages for school food preparation workers and subsidize the use of Colorado-grown and produced food. To fund the program, the law will impose an income tax increase on Coloradans earning more than $300,000 a year. The tax will generate up to $104.2 million in the first year of the program, under current projections; however, the program is at risk of being overfunded or underfunded depending on cost and revenue outcomes into the future.[ii]

Key Findings

- If all Colorado public school food authorities participate in the program, an additional 615,000 students will become newly eligible to receive free meals at school, a 125% increase.[iii]

- To fund the program, the initiative will raise income tax increases on Coloradans who earn more than $300,000 per year; roughly 4.4% of Colorado filers will be impacted.

- If all eligible children participate, each affected taxpayer will sponsor free meals for about six additional students, regardless of their parents’ ability to provide.

- The average additional burden upon these taxpayers will be $884 in the first year of the program and could increase thereafter if the number of taxpayers above the $300,000 threshold does not increase and legislators must increase the tax to keep the program solvent.

- The program will cost the state between $71.4 million and $101.4 million in its first year of full implementation. The tax increase will raise enough revenue to cover the maximum cost of the program under most projections. However, there is a real risk that the funding will be much higher than necessary or too low to completely fund the program.

- The program is likely to grow and in 10 years, the number of Coloradoans who will earn more than $300,000 by 2033 is projected to be between 198,868 and 338,754, which would amount to between $166 million and $293 million in additional revenue.

Underfunding Risk

- If costs are not carefully managed and revenues fall short of projections, the program could run a deficit as early as 2024 (between -$1.8 million and -$4.2 million), grow to $72.4 million in 2033, and deficit could grow as high as -$506 million by 2050.

- According to the USDA’s “School Nutrition and Meal Cost Study,” the average school meal program operates at a slight deficit. The study also found that the reported cost of offering school meals generally exceeds the federal reimbursements allotted for those meals.[iv]

- The inflation rate on food rose 10.4% earlier this year as compared to 2021. Should inflation rates continue to rise, the cost to sustain the free lunch program will escalate beyond current projections.

Over Collected Taxes Will Not be Returned to Taxpayers & Could Be Used for Other Budgetary Expenditures

- If the program’s total cost is lower than the taxpayer revenue collected, the surplus, can be allocated to the general fund and once in the general fund could be reallocated for other budgetary priorities at the discretion of the state legislature which could be tens of millions, and would not be refunded to taxpayers.

- Projections for over collected (surplus) revenue in 2033, 10 years into the program, are between $52.9 million and $180 million.

- The potential cumulative over collected (surplus) revenue by 2033 is $1.02 billion, see figure 5.

- Projections for over collected (surplus) revenue in 2050, 27 years into the program, are between $211 million and $1.0 billion.

- The potential cumulative over collected (surplus) revenue by 2050 is $10.6 billion, see figure 5.

Other Considerations

- Lack of oversight– Nationally, according to the Office of Management and Budget, the National School Lunch Program lost nearly $800 million owing to improper payments in fiscal year 2018, while the School Breakfast Program lost $300 million. The Office of Management and Budget call these programs ‘high-priority’ programs because of the misspending. The state will need to ensure accountable and transparent reporting is maintained for such a large program.

- Wasted food– According to one PMC study, an estimated $1.2 billion worth of school food is wasted each year. Skeptics of free meals for all schoolchildren fear that waste will only continue to rise if universally free school meals are an option.[v]

- High costs– School-made meals generally cost more to prepare than parent-provided meals. If parents who previously prepared their kids’ meals opted into the program, the cost per meal borne by the taxpayer would be greater than the money saved by the parent. Because the law will raise wages for school lunch workers and incentivize local sourcing of products, regardless of cost implications, the cost of free school meals will be even higher relative to parent-provided meals than in the past.

Who Does the Program Benefit?

During the 2021 school year, 273,688 students were eligible for free school meals, 55,912 were eligible for reduced-price meals, and 561,211 were ineligible for both. Depending upon the participation of local school authorities, more than 615,000 students could begin receiving free school lunches for the first time, a 125% increase, see figure 1.[vi] Because free-meal eligibility is currently restricted to low-income families, most of the kids who will qualify for free meals upon Proposition FF will be from middle- and upper-income families.

Figure 1: Eligibility of Colorado Students for Free Meals under Proposition FF

Currently, 31% of students are eligible to receive free meals through the National School Lunch Program, 6% are eligible for reduced-price meals, and 63% are ineligible for both.

Each of Proposition FF’s three major provisions—food standards, the expansion of free school meals, regardless of need, and the tax increase—will impact segments of Colorado’s population in different ways.

- Most low-income families qualify for free or reduced cost school meals. Assuming grants for Colorado-grown or non-processed foods increase the nutritional value of school meals, poor students will have access to healthier meals.

- Middle-income families will benefit from the subsidy and without paying higher taxes.

- Based upon data from a 2012 study, CSI estimates that the average family that does not currently qualify for price assistance could save $438 per year under Proposition FF’s program.[vii]

- The new tax will burden high-income Coloradans, many of whom do not have school-age children in public schools, by imposing an average additional tax of $884 upon them.

Despite potential benefits for low- and middle-income families, Proposition FF’s program encourages inefficiency. On average, due to administrative costs, employee wages, and ingredient costs, school meals are more expensive than home-packed meals. Proposition FF will drive this price disparity wider by requiring food authorities to purchase more expensive ingredients and increasing overhead costs by raising operating expenses, wages, and state government employment.

Who Pays for the Program?

Because the program, passed by the General Assembly during the last session (House Bill 22-1414), authorizes a tax increase, voter approval is required. If approved, Proposition FF will increase state revenues by raising income taxes and will increase state expenditures.

Coloradans who report adjusted gross incomes of at least $300,000 will have to cap their deductions at $12,000 for single filers and $16,000 for joint filers when calculating state income taxes. Currently, single filers may take a deduction of $12,950 or $19,400 for head of household or $25,900 for joint filers.

This change will affect 4.4% of Colorado returns. Figure 2 shows that the tax increase in Prop FF will raise between $109 million and $111.6 million in FY24, between $166 million and $293 million in FY33, and will increase thereafter to anywhere between $450 million and $1.24 billion in FY 2050. The revenue raised by Prop FF will increase each year’s TABOR spending limit and be available for the state to spend in its entirety.

Figure 2: Revenue and Cost Projects (2023 – 2050) under Prop FF

How Much Will the Program Cost? And is it Sustainable?

The fiscal note developed by the State estimates the cost to be between $71.4 million and $101.4 million in the first year of full implementation. However, the rate of school participation and the amount of additional federal funding sought under federal programs will impact the overall cost to implement. Figure 3 shows the projected number of taxpayers that will be impacted by the $300,000 AGI threshold will be anywhere between 199,000 and 339,000 by 2033 and between 679,000 and 1,066,000 by 2050. The jumps in each of the revenue streams occur when more taxpayers reach the $300,000 threshold and are subject to the Prop FF tax.

CSI estimated the range of projected cost and the range of revenue collected for Prop FF, shown above in figure 2. Assumptions for costs and revenue are detailed in the appendix. By 2050, revenues are estimated to be between $450 million and $1.24 billion. Costs range between $239 million and $956 million.

Figure 3: Number of Colorado Taxpayers in the $300,000 Plus Tax Bracket

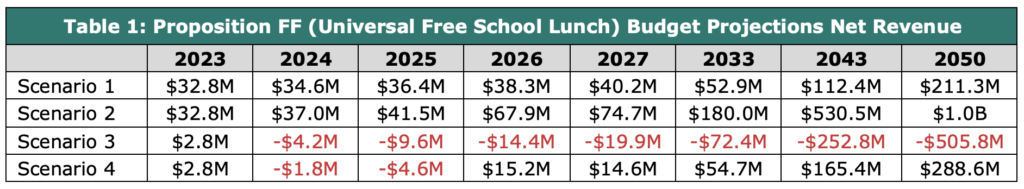

CSI analyzed the budget using the baseline revenue and cost estimates from the proposition in 2023 to calculate net revenue. The four scenarios are based on high and low assumptions of future costs of the program and revenue generated by the new tax using the assumptions outlined in the appendix:

- Scenario 1 – Net Cost Low & Revenue Low

- Scenario 2 – Net Cost Low & Revenue High

- Scenario 3 – Net Cost High & Revenue Low

- Scenario 4 – Net Cost High & Revenue High

The results of these scenarios are shown in table 1 and figure 4. Under the assumptions for scenarios 1 and 2, where costs are low, the program is solvent from the first year going forward. However, under scenarios 1 and 2, and scenario 4, where revenues are high, very large surpluses develop, ranging from $211.3 million to $1.0 billion. As the bill is currently written, these surpluses can be transferred to the general fund and used for other programs completed unrelated to the universal free lunch program. In effect, the tax is a combination non-discretionary tax and a discretionary tax.

The program is in surplus in year one under all scenarios, however, in the second year, 2024, the program is in deficit in scenarios 3 and 4, where the costs are high. Scenario 3 remains in deficit after 2023 over the entire modelling period despite increasing revenue, and in 2050 has increased to -$506 million. Scenario 4 has a deficit in years two and three and then goes into surplus as more taxpayers are breach the $300,000 threshold making them subject to the tax.

Figure 4 – Budget Projection 2023 – 2050 for Prop FF

If the cost to implement the program is less than expected, either because of lower participation rates or higher federal payments, the savings will not be passed along to affected taxpayers. Also, the Prop FF tax rate will not be adjusted accordingly to lower the surplus of revenue, and taxpayers will continue to pay higher rates than necessary to support the program. The potential cumulative surplus revenue is shown in figure 5. By 2033, the potential cumulative surplus estimated at $1.2 billion, and $10.6 billion by 2050.

Likewise, if the program costs more than projections, as in scenario 3 , either because of higher-than-expected participation, higher inflation, fewer taxpayers above the $300,000 threshold, or any combination thereof, the state will have to reallocate revenue from other sources such as the General Fund. In other words, dollars designated for vital transportation, health care, public safety, or other education programs would be shifted to cover the cost of this new program. The potential cumulative deficit is shown in figure 5. By 2033, the potential deficit is estimated to be -$330 million, and -$4.7 billion by 2050.

Figure 5 – Potential Cumulative Surplus Revenues and Deficits

Recommendations

The implementation of Proposition FF, if it passes, will be complicated by the uncertainty of cost projections. According to the state’s own fiscal estimates, the new tax could collect a large excess of revenue (up to $32.8 million in the first fully operational year) above what is required to run the program. If costs remain relatively low, the state could collect even larger excesses in subsequent years, especially if public-school enrollment continues to lag. The measure does not prescribe what will be done with excess revenue; the state will retain it as TABOR-exempt funds that could support other government spending initiatives. It will not return the funds to taxpayers. There is also a risk that revenues will not be enough to support the program. The legislature should use the audit required by the law to determine whether the program has been over- or underfunded and should release the findings.

The purpose of Proposition FF, after all, is to fund school lunches, not to indefinitely increase the amount of revenue which the state government can spend on other priorities. If it becomes clear that this has occurred, the legislature should take action to ensure that taxpayers’ money is being used for the school lunch program as intended and that it is not being spent elsewhere. The legislature should remove its TABOR-exempt status for revenues collected in excess of expenditures and funds should be returned to taxpayers. If the program becomes more expensive than anticipated, lawmakers should either work to secure additional federal funding for it or reduce its scope and expense so that other spending priorities are not compromised.

Appendix – Modeling Assumptions

To estimate the net revenue (revenue – cost) of proposition FF, the following assumptions were used:

- Personal income growth 3.31%, the annual average increase in personal income since 1958. High Revenue Case is one standard deviation, 1.85%, so the high cost is 5.17%

- Student population growth grows at the rate of population growth based on the Colorado Demographers population projections. Population growth high adds the standard deviation, 0.297%, to each year projected population growth rate and it assumes that the 23,055 students decline from 2020 to 2022 reverts and the students return to public schools.

- Inflation rate of food 3.9% (low), based on BLS data 1968 – 2021. High case is 2 times 3.9%. High Inflation Case is one standard deviation ,2.91%, so high inflation scenario is 6.86%.

- Wages for additional food service workers 3.47% per year. High cost is based on a one-standard deviation, 2.85%, so the high-cost assumption is 6.32%. (Average hourly earnings of all employees, food services and drinking places, not seasonally adjusted).

- The Grant to Buy Colorado Grown Food rises with the rate of inflation, 2.3%. The high case scenario adds the standard deviation 1.6%, so the high-cost case is 3.9%.

[i] https://leg.colorado.gov/bills/hb22-1414

[ii]https://leg.colorado.gov/sites/default/files/initiative%2520referendum_proposition%20ff%20final%20lc%20packet.pdf

[iii] 1) Legislative Council Draft [Healthy School Meals for All] (colorado.gov), 3rd draft, page 2, 21-30.

[iv] https://www.fns.usda.gov/school-nutrition-and-meal-cost-study

[v] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3788640/

[vi] https://datacenter.kidscount.org/data/tables/469-students-qualifying-for-free-or-reduced-price-lunch#detailed/2/any/false/2048,574,1729,37,871,870,573,869,36,868/109,110,111/11515,7665

[vii] https://schoolnutrition.org/journal/spring-2022-comparison-of-costs-between-school-and-packed-lunches/