Key Findings

- Proposition 119 on the 2021 Colorado ballot proposes to establish the Learning Enrichment and Academic Progress Program (LEAP) funded by a 5% tax on recreational marijuana. It would be administered by a new state agency responsible for allocating funds directly on behalf of students, rather than through the existing school system, for out-of-school learning and enrichment programs, such as tutoring, therapy services, career and technical education and training, and other opportunities outside of the school day.

- The program is intended to prioritize low-income students first. At full implementation of the 5% recreational marijuana tax increase to fund the LEAP program, 94,600 students could use the full benefit for tutoring, which equates to more than 100% of K-12 students under 150% of the federal poverty line.

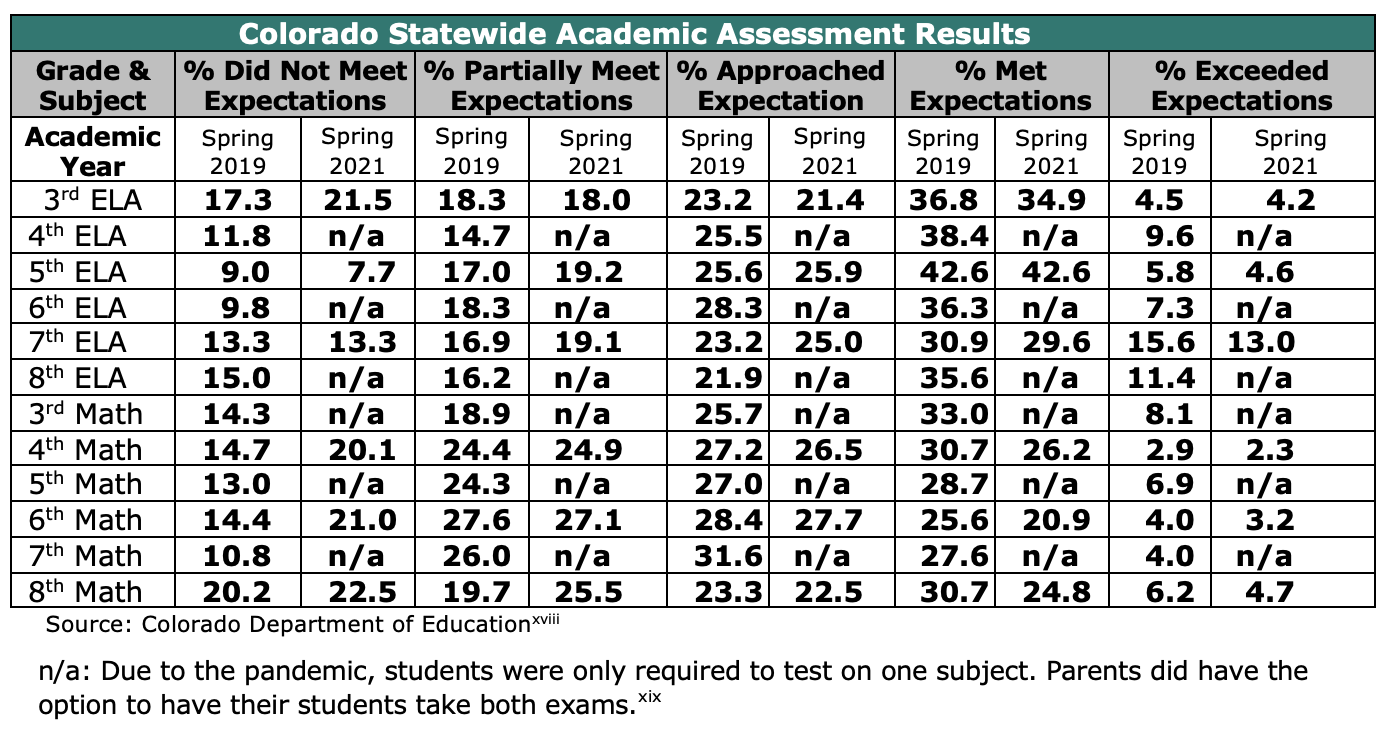

- The latest statewide education assessment results show 73% of students tested between grades 3 through 8 did not meet expectations in math, an increase of 6.0 percentage points from pre-COVID levels. That is more than 145,000 students in just those grades.

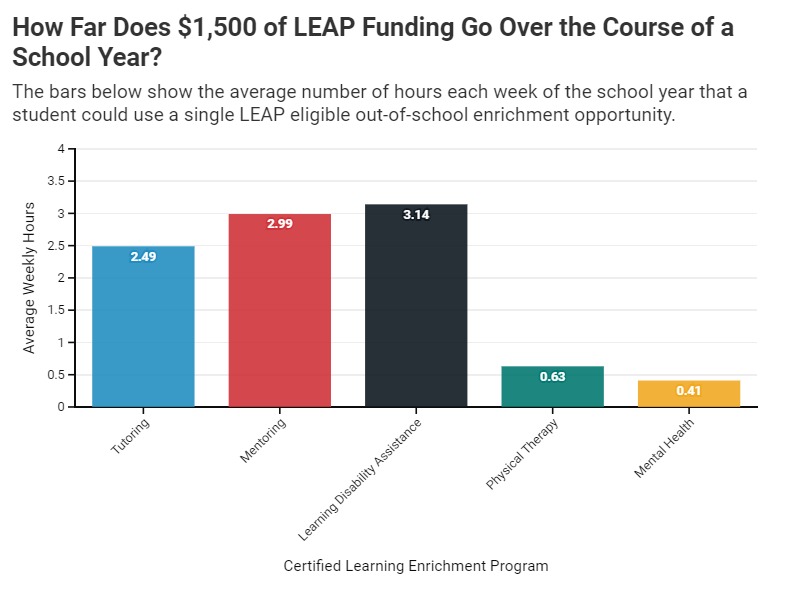

- A single student could receive approximately 2.5 hours of tutoring every week during the school year with the full use of LEAP funds.

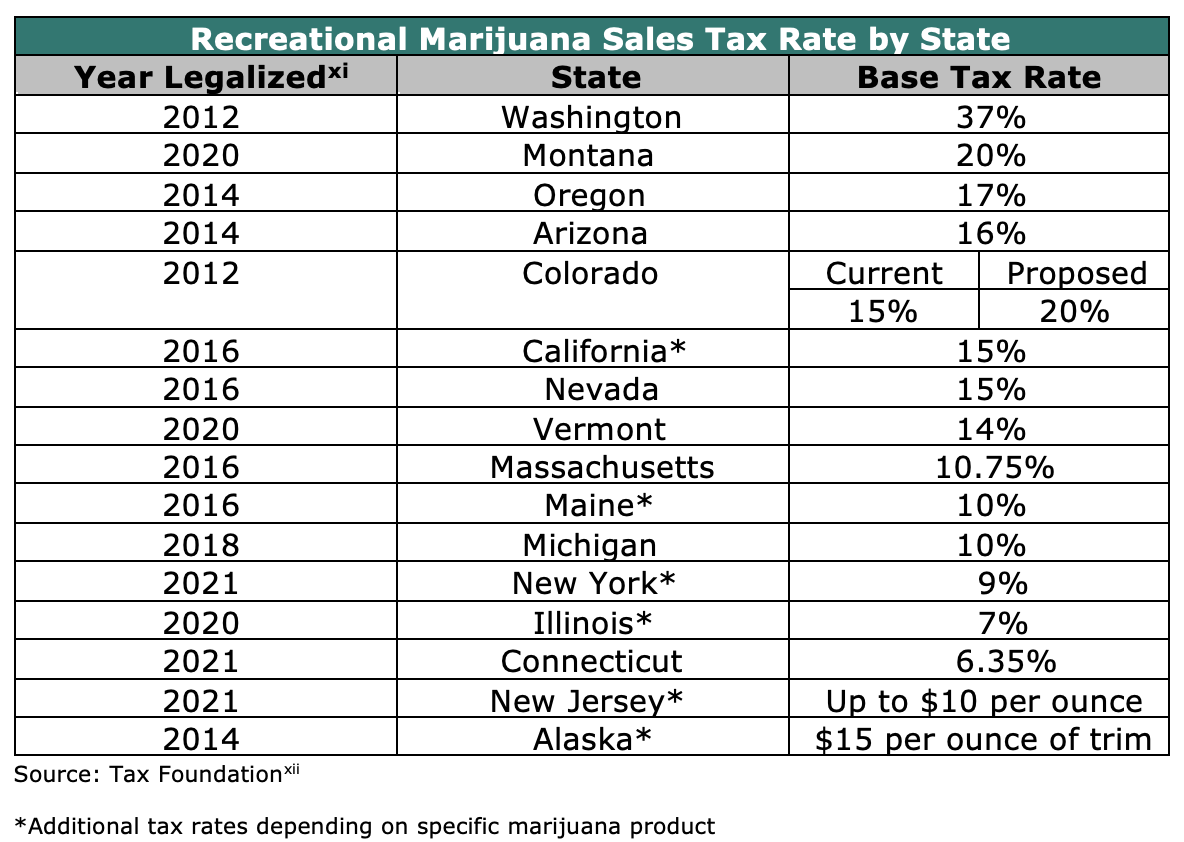

- The increased tax to fund LEAP would be the second highest base tax rate on recreational marijuana in the country when fully phased in by year 2024-25. It is projected to generate $137.7 million in funding for LEAP to distribute to Colorado K-12 students to obtain up to $1,500 in out-of-school learning and support opportunities annually.

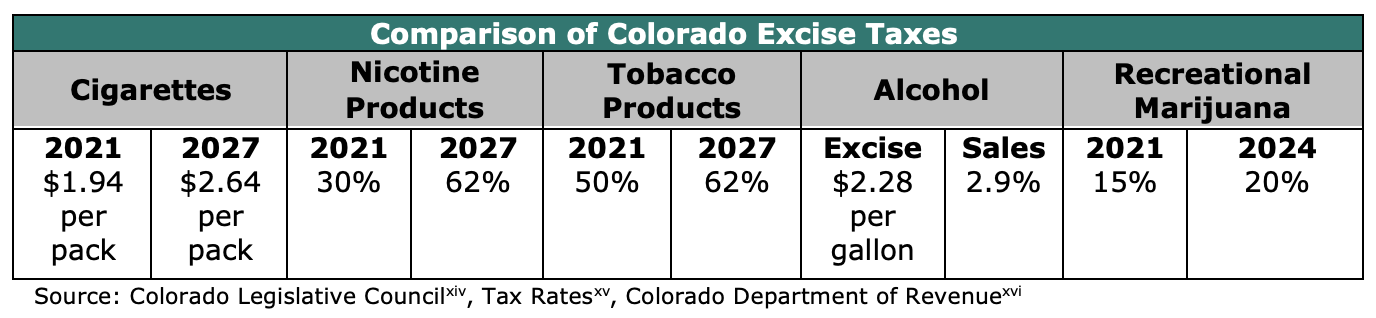

- The 20% state sales tax on recreational marijuana would be less than 1/3 of the fully phased in 2027 state tax rate on tobacco and nicotine products of 62%. Cigarettes will have an effective tax of 36% by 2027.

- Under the LEAP ballot measure, fewer state land dollars will be transferred to the State Land Trust. As a result, the State Land Trust’s principal will not grow as quickly as it otherwise would, and the State Land Trust will produce less interest that could be used to support the K-12 education system.

Proposition 119 Introduction

This November, Colorado voters will see Proposition 119 the Learning Enrichment and Academic Progress (LEAP) program on the ballot. This proposition proposes to increase the recreational marijuana sales tax to fund out-of-school learning enrichment and educational opportunities for eligible Colorado students ages 5-17. If Proposition 119 passes, the recreational marijuana sales tax would increase from the current rate of 15% to 20% by 2024.[i] This proposition is estimated to increase annually to raise $137.7 million in tax revenue by fiscal year 2024-25.[ii] An additional $20 million a year will be directed to the LEAP program from the Colorado Land Board Trust. This will generate an estimate of $157.7 million in annual funding for the LEAP program after the full implementation of the tax increase.[iii]

The Colorado Learning Authority will consist of a nine-member board of directors appointed by the Governor. The authority will oversee approving certifications for out-of-school learning opportunity providers. School districts and other local education agencies will be pre-certified program providers, while teachers will have priority approval. The certified providers will then become the people, programs, and places that students can use their approved LEAP funds.

The out-of-school learning opportunities include but are not limited to tutoring, mentoring, emotional and physical therapy, mental health services, social and emotional learning, career and technical education training and support for students with special needs and learning disabilities.[iv] Rather than have the new funding go through the school finance formula and be allocated to school districts, this program allows Coloradans to make their own decisions on the out-of-school learning opportunities that best fit their children’s individual needs.

Discussion on Benefits and Costs

The benefits of LEAP include addressing both the immediate issue of learning loss during the pandemic and the longer-term issue of the widening achievement gap between different groups of students. The LEAP program is intended to improve student outcomes by increasing access to learning opportunities outside of the school day for low-income students. Research has shown that out-of-school learning can be an effective tool for closing achievement gaps, but that not all families can afford it.[v]

The primary cost of LEAP is the increased sales tax on recreational marijuana, which would increase from 15% to 20% by fiscal year 2024-25. This directly and indirectly impacts both consumers and the recreational marijuana industry. The increased sales tax on recreational marijuana could pull more consumers from the legal marijuana market to the black market for recreational marijuana purchases.[vi]

Additional funding will come from the state’s General Fund in an amount corresponding to state land revenues. Because fewer state land dollars will be transferred to the State Land Trust, the principal will not grow as quickly as it otherwise would, and the State Land Trust will produce less interest that could be used to support the existing K-12 education system.

LEAP Eligibility and Funding Distribution Requirements

The proposition specifies three criteria for student eligibility for obtaining LEAP benefits.

- Each child must reside in the state of Colorado.

- Each child must be between the ages of 5–17.

- Each child must be or will be eligible for public school admission within Colorado.

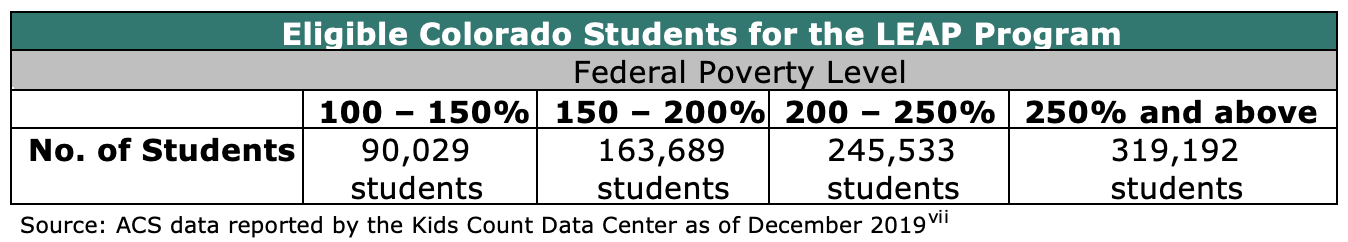

While the details of LEAP funding prioritization will be decided and finalized by the LEAP authority, the text of the measure does specify that funding will prioritize low-income students. Low-income prioritization will start with students at or below 100% of the federal poverty line and then continue to 150% at or below and so on. Figure 1 displays the number of eligible students in each level of income relative to the federal poverty level.

Figure 1

Total Funds Available for LEAP

New Revenue

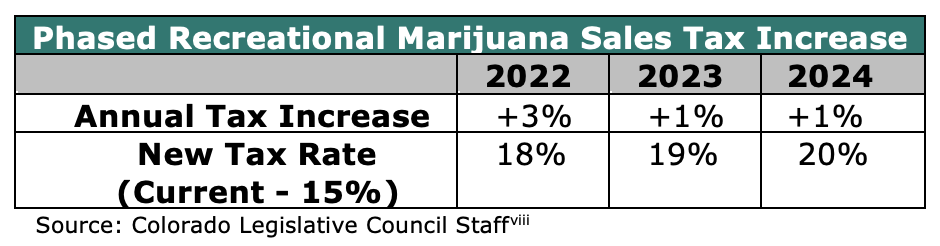

Proposition 119 proposes a phased tax increase from 2022 to 2024. In fiscal year 2021-22, the recreational marijuana sales tax will increase by 3%, making the new tax rate 18%. In fiscal year 2022-23, the recreational marijuana sales tax rate will increase by an additional 1%, making the new tax rate 19% and an additional 1% increase in fiscal year 2023-24. This will leave the recreational marijuana sales tax rate at 20% by 2024-25.

Figure 2

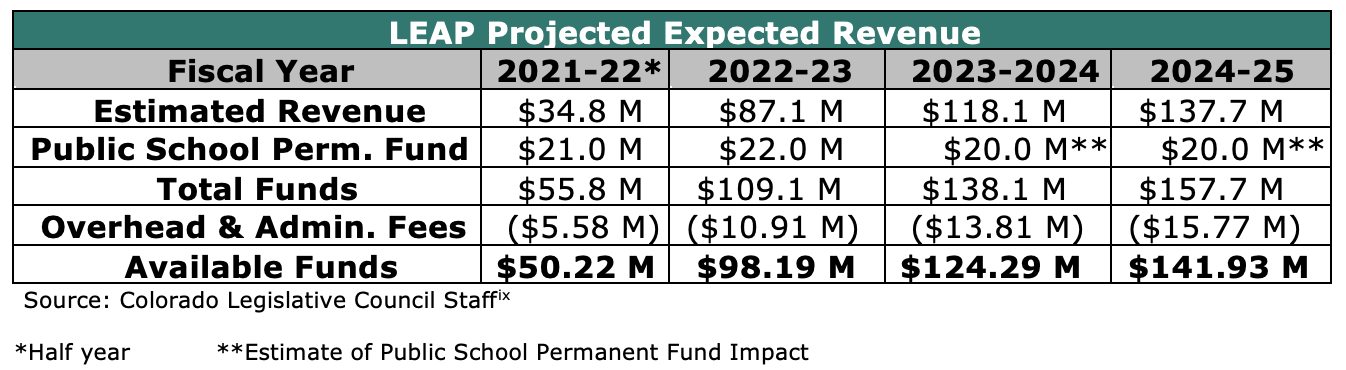

The Colorado Legislative Council Staff estimates the revenue generated from the increased sales tax on recreational marijuana to grow from $87.1 million in the first full year to $137.7 million by fiscal year 2024-25.

Figure 3

Historic Marijuana Tax Revenue

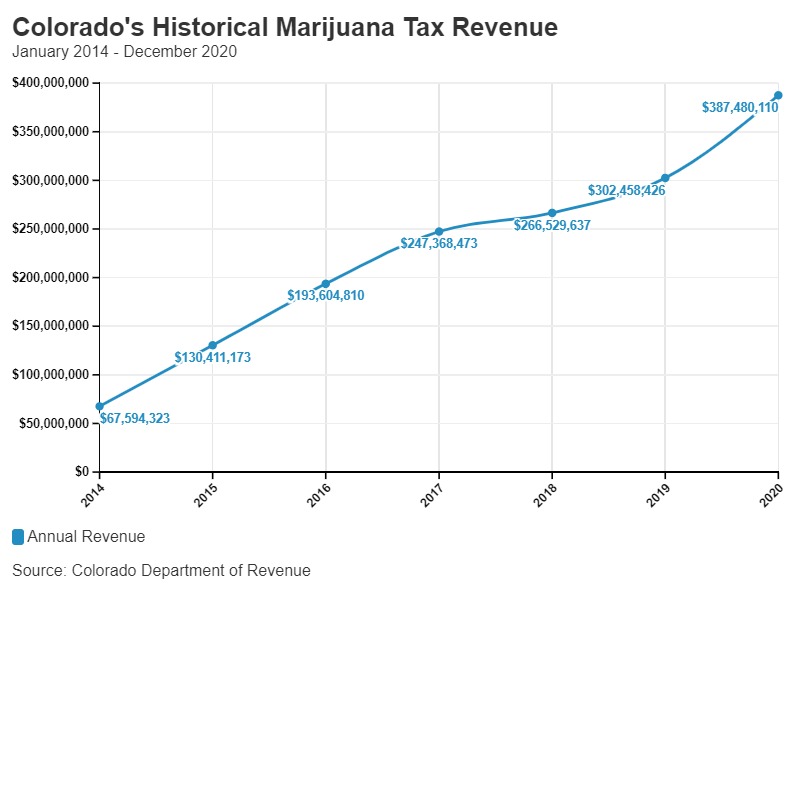

Since 2014 when recreational marijuana sales began in Colorado, marijuana tax revenue has continuously increased annually.[x] There is no evidence at this time to assume that marijuana tax revenue will not continue to increase annually.

Figure 4

Figure 5 depicts the recreational marijuana sales tax rates for each state that recreational marijuana has been legalized. By fiscal year 2024-25, Colorado’s proposed sales tax rate (20%) on recreational marijuana would be tied with Montana for the second highest base sales tax rate, sitting behind Washington’s rate of 37%.

Figure 5

Colorado voters approved a tax rate of 62% for all tobacco products and nicotine products by 2027 as well as an increase on the tax per pack of cigarettes from $1.94 to $2.64 per pack by 2027. That is a 36% tax increase on cigarettes by 2027.[xiii] While the increased tax on recreational marijuana may be implemented quicker than the cigarette and nicotine taxes, the recreational marijuana tax under Proposition 119 would still be lower relative to these other products.

Figure 6

Source: Colorado Legislative Council[xiv], Tax Rates[xv], Colorado Department of Revenue[xvi]

Source: Colorado Legislative Council[xiv], Tax Rates[xv], Colorado Department of Revenue[xvi]

Transfer to LEAP from Existing Revenue Source

Additional funding will come from the state’s General Fund in an amount corresponding to state land revenues. Under the LEAP ballot measure, the first $20 million of state land revenues will be transferred to the State Land Trust. Any amount above $20 million will be transferred to the Public School Fund to support K-12 education. Simultaneously, the exact same amount going into the Public School Fund will be transferred from the state General Fund to LEAP.

Example: State land revenues are $40 million. Under LEAP, the first $20 million would be transferred to the State Land Trust, $20 million would be used to fund K-12 education, and $20 million would be transferred from the General Fund to LEAP.

Because fewer state land dollars will be transferred to the State Land Trust, the trust’s principal will not grow as quickly as it otherwise would, and the State Land Trust will produce less interest that could be used to support the existing K-12 education system.

Colorado Statewide Assessment Results

The Colorado Department of Education recently released results from the 2020-2021 statewide English language arts and math assessments. While participation in the test taking was low in many areas of the state, overall, the results show a sizeable decrease in the percentage of students who met grade level expectations in reading, writing and math.

- The share of students who did not meet expectations or partially met expectations in math increased by 6.7 percentage points to 47% of all the students tested.

- The share of students who did not meet expectations or partially met expectations in English language arts increased by 2.3 percentage points to 33% of all the students tested.

In specific areas, the 2021 test results marked all-time low points in the performance of Colorado students. Only 28.5% of fourth graders and 24.1% of sixth graders met or exceeded grade level expectations for math.[xvii] Figure 7 shows pre-pandemic student performance compared to spring 2021 results. Each grade level was only required to take one of the subject area tests (either math or English language arts [ELA]); thus, the 2021 scores are recorded across every other grade level.

Figure 7

Source: Colorado Department of Education[xviii]

Source: Colorado Department of Education[xviii]

There are nearly 370,000 students in grades 3 through 8 in Colorado, making up 45% of the K-12 population. If we assume no change from the 2019 scores for the tests not given in 2021, the following statements reflect the number of students across different test categories and their performance.

- 121,941 students did not meet or partially met expectations in language arts

- 164,695 students did not meet or partially met expectations in math

A study done by the RAND Corporation on “The Value of Out-of-School Time Programs” provides evidence that additional out-of-school learning programs can improve educational outcomes. RAND conducted a study that included out-of-school math lessons four days a week for a full academic year. [xx] This study found that the students who participated in the math lessons performed better on math assessments than those who did not participate in the study. This research, along with other studies, indicates that out-of-school learning programs like LEAP could help close achievement gaps for Colorado students.

In order to measure the effectiveness of LEAP funding, the new state authority should ensure the collection and reporting of clear data which can be used to assess the effectiveness of both the individual certified providers along with the program in aggregate.

How Many Students Could the LEAP Program Reach?

Estimated Hours of Additional Learning Per Student Using Full Benefit

Figure 8 shows how many hours, on average, a student could get per week of school if they choose to use all their funding on a single type of out-of-school learning program. For example, a student could receive about two and a half hours of tutoring per week of school, in a 32-week academic year, using $1,500 of LEAP funds. Two and a half additional hours of tutoring would be beneficial for Colorado students as the statewide assessment results found that learning loss from COVID-19 is significant. Many policy and education leaders have pointed to “high-dosage tutoring” as an evidence-based solution for making up for COVID-19 induced learning loss.[xxi]

Figure 8

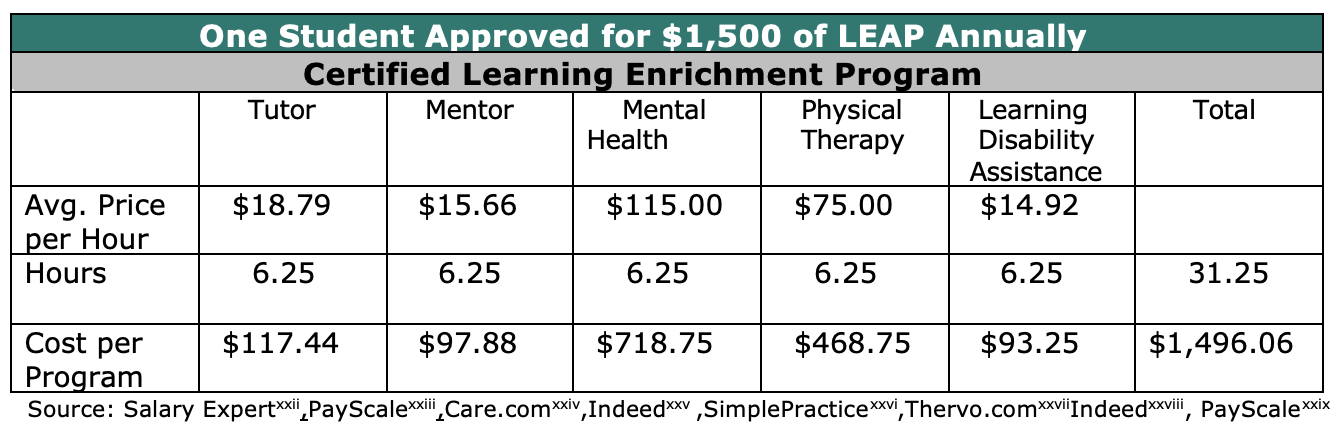

A student could maximize $1,500 of LEAP funding by choosing to receive about six hours of each certified learning enrichment program. If a student chooses to split up their funds this way, they could receive about 31 hours total of additional learning through LEAP.

Figure 9

Source: Salary Expert[xxii],[xxiii],Care.com[xxiv],Indeed[xxv] ,[xxvi],[xxvii]Indeed[xxviii],[xxix]

The price of each certified learning enrichment program will vary. The prices shown in Figure 9, and used as the basis for other estimates of program reach, are averages of several different program’s hourly price. The exact number of hours of additional learning each child may receive will depend on the price of the program they choose to use through LEAP. The prices may vary depending on region, grade level or subject.

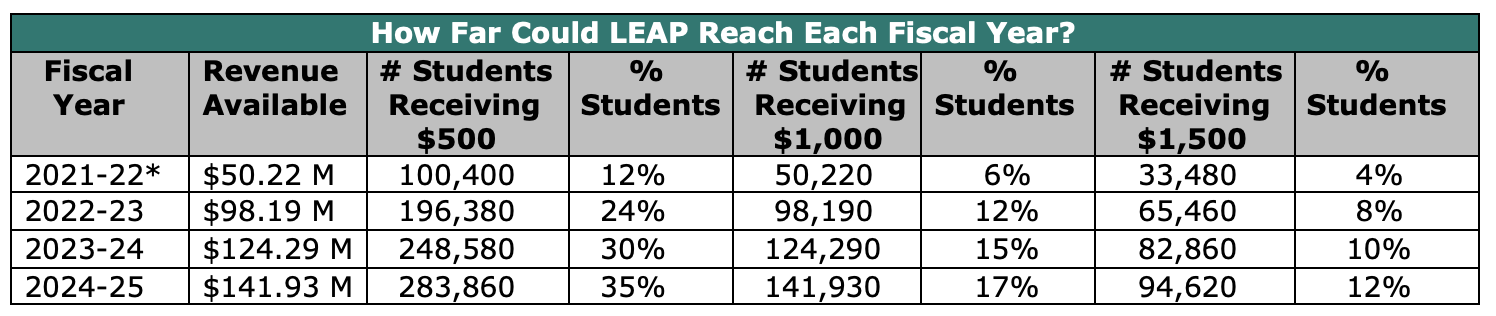

Estimated Number of Students That Could Use the Full Benefit

Although the first fiscal year 2021-22 is a half year, not every eligible student living below the 100% federal poverty level will be able to obtain LEAP funding in the first year. The next scenario shows the number of eligible students that would benefit from LEAP if they applied for $500, $1,000 or $1,500 each fiscal year. By fiscal year 2024-25, approximately 94,600 eligible students could be approved for $1,500 or approximately 283,860 eligible students could be approved for $500.

Figure 10

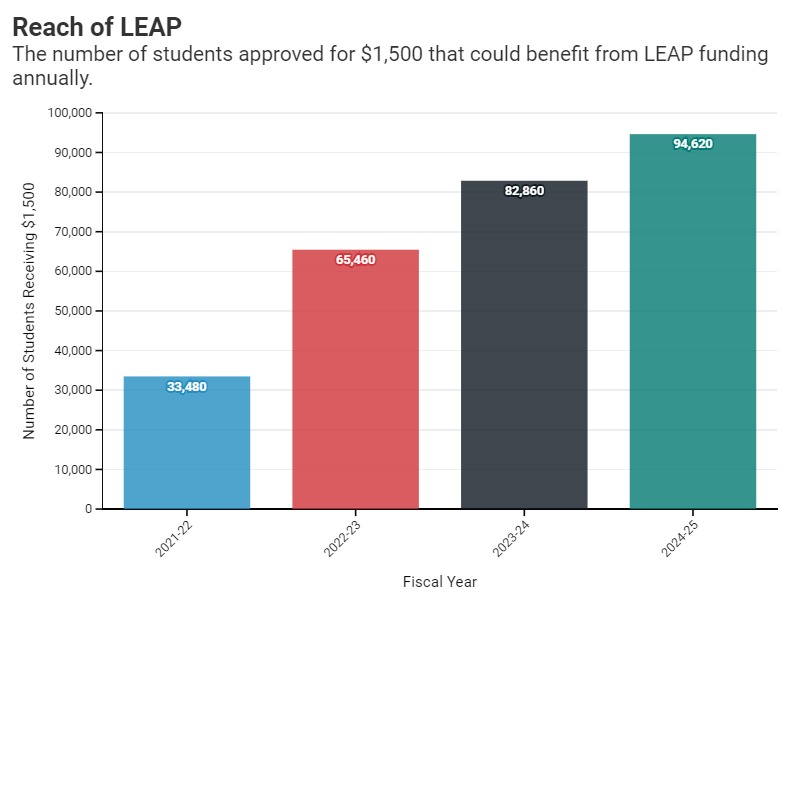

Figure 11 shows the number of students that could benefit from the LEAP program with use of the full benefit. In fiscal year 2021-22, about 4% of students could benefit from LEAP. However, by fiscal year 2024-25, roughly 12% of students could benefit from LEAP.

Figure 11

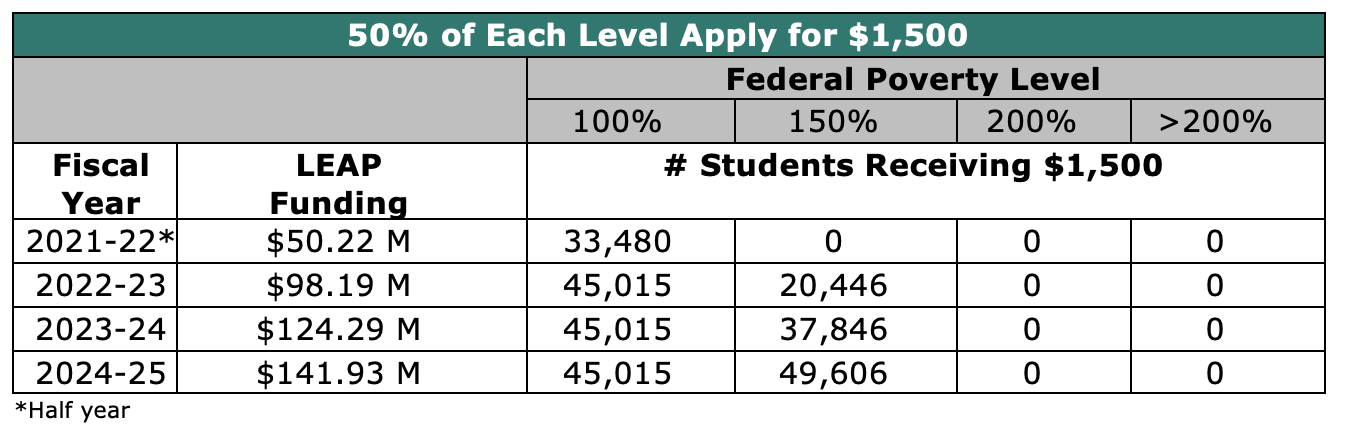

What if Half of Students in Each Income Level Apply for $1,500 of LEAP Funding?

In fiscal year 2021-22, if 50% of all eligible students in each level of poverty applied for and received $1,500, 33,480 students would receive LEAP funding. Some eligible students between 100% and 200% below the federal poverty level would be able to receive LEAP funding by fiscal year 2022-23. At full implementation of the tax, if only 50% of each income level apply for the full LEAP benefit, only students up to 200% of the federal poverty level would theoretically be awarded funds given the priority for low-income students.

Figure 12

States with Similar Programs

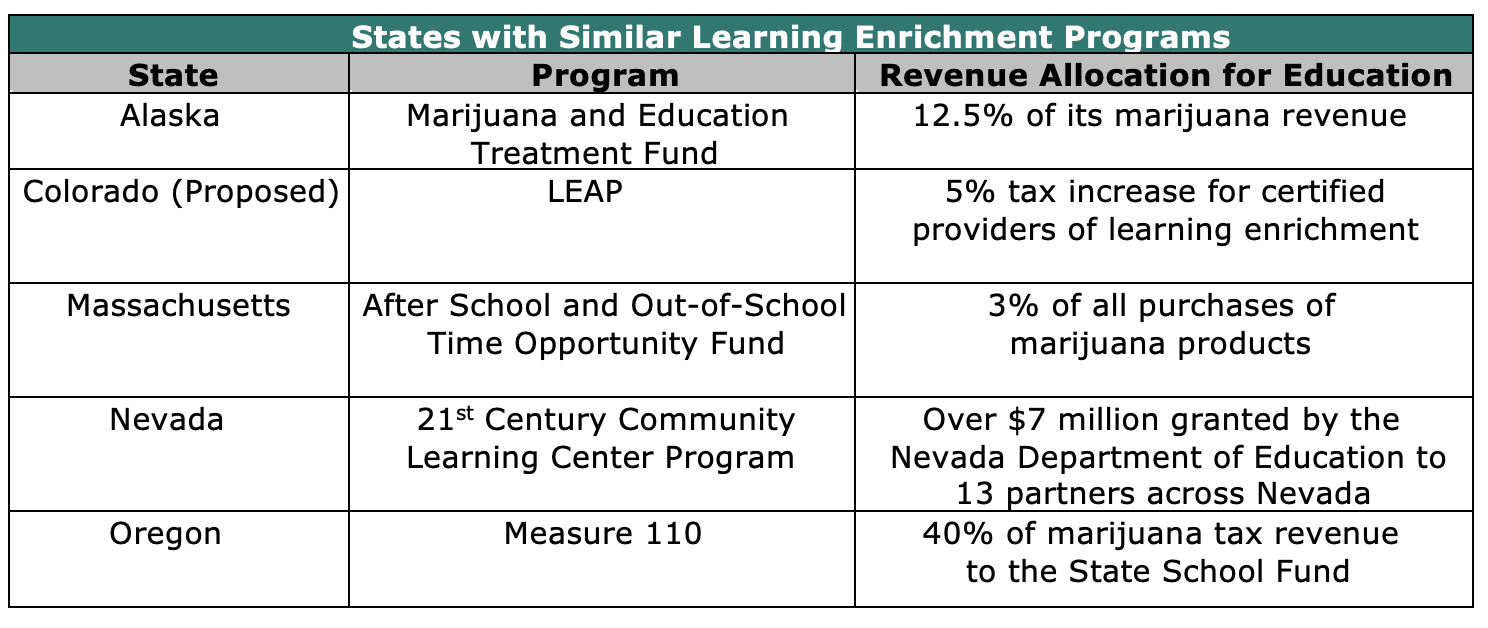

Alaska, Massachusetts, Nevada and Oregon have similar programs to fund out-of-school opportunities for students. Alaska allocates 12.5% of its marijuana sales revenue to fund after school programs for students. [xxx] Massachusetts’ Bill S.260 directs 3% of all purchases of marijuana products to the After School and Out-Of-School Time Opportunity Fund for students. [xxxi] Nevada’s 21st Century Community Learning Center Program granted over $7 million to 13 partners across Nevada to create after school activities designed to complement the students’ current academic programs and resources. [xxxii] Oregon’s Measure 110 allocates 40% marijuana tax revenue to the State School Fund. [xxxiii]

Figure 13

Conclusion

Out-of-school learning opportunities funded through the LEAP program could provide a powerful educational resource for Colorado students to address COVID-19 learning loss and close persistent achievement gaps.

The modeling results show that a student who is given the maximum benefit of $1,500 could receive about 2.5 hours of tutoring per week of the academic year. This equates to nearly 80 hours of tutoring during the school year. By fiscal year 2024-25, the LEAP program could provide out-of-school learning funds for about 94,600 Colorado students using the full benefit.

The LEAP program is financed through a phased 5% tax increase on recreational marijuana and a small transfer from the Colorado General Fund in an amount corresponding to state land revenues.

[ii] 2021%2325FIS_00.pdf (colorado.gov)

[iii] 2021%2325FIS_00.pdf (colorado.gov)

[iv] 25Final.pdf (state.co.us)

[v] https://www.rand.org/pubs/perspectives/PE267.html

[vi] w23632.pdf (nber.org), Study Warns Sky-High Marijuana Taxes Drive Consumers Back to the Black Market (greenentrepreneur.com)

[vii] Child poverty statistics in the U.S. (kidscount.org)

[viii] initiative%20referendum_proposition 119 final lc packet.pdf (colorado.gov)

[ix] initiative%20referendum_proposition 119 final lc packet.pdf (colorado.gov)

[x] Marijuana Tax Reports | Department of Revenue (colorado.gov)

[xi] State Medical Marijuana Laws (ncsl.org)

[xii] State Recreational Marijuana Taxes, 2021 | Tax Foundation

[xiii] blue_book_english_for_web_2020_1.pdf (colorado.gov)

[xiv] blue_book_english_for_web_2020_1.pdf (colorado.gov)

[xv] Colorado Excise Taxes – Gasoline, Cigarette, and Alcohol Taxes for 2021 (tax-rates.org)

[xvi] Marijuana Excise Tax | Department of Revenue – Taxation (colorado.gov)

[xvii] 2021_cmas_ela_math_statesummaryachievementresults

[xviii] 2019 Results: 2019_cmas_ela_math_statesummaryachievementresults

2021 Results: 2021_cmas_ela_math_statesummaryachievementresults

[xix] Assessment | CDE (state.co.us)

[xx] https://www.rand.org/pubs/perspectives/PE267.html

[xxi] https://hechingerreport.org/takeaways-from-research-on-tutoring-to-address-coronavirus-learning-loss/

[xxii] Tutor Salary Colorado, United States – SalaryExpert

[xxiii] Tutor Hourly Pay | PayScale

[xxiv] https://www.care.com/tutors/colorado-springs-co#:~:text=Hiring%20a%20tutor%20in%20Colorado%20Springs%2C%20CO%20on,with%2C%20and%20how%20often%20you%20will%20require%20tutoring.

[xxv] Youth Mentor Salary in Colorado (indeed.com), https://www.indeed.com/career/student-mentor/salaries/Colorado-Springs–CO

[xxvi] https://www.simplepractice.com/blog/average-therapy-session-rate-by-state/

[xxvii] https://thervo.com/costs/physical-therapy-cost

[xxviii] Learning and Development Assistant Salary in Colorado (indeed.com)

[xxix] https://www.payscale.com/research/US/Job=Educational_Assistant/Hourly_Rate/6a79216c/Disability-Support

[xxx] Alaska Department of Revenue – Tax Division

[xxxi] Bill S.260 (malegislature.gov)

[xxxii] The Nevada Department of Education Awards $6.5 Million to Advance Academic Enrichment Programs Statewide (nv.gov)

[xxxiii] State of Oregon: Businesses – Marijuana tax program