Proposition HH: The Taxpayer Dilemma

Evaluation of the Long-term Impacts of Prop HH

Authors: Mike A. Leprino Free Enterprise Fellow Lang Sias and Chris Brown

Free Enterprise Fellowship

The Mike A. Leprino Free Enterprise Fellowship was established by Laura Leprino and Matthew Leprino in honor of the late Mike A. Leprino, who was a pillar in the Denver community. The son of Italian immigrants, he was a banker, developer and community servant. Some of the greatest treasures and neighborhoods in our state were built and funded by Mike. He gave back relentlessly to his state and country, something that he also instilled in each of his children. A great defender of free enterprise and the American dream, Mike is someone who from humble beginnings built an enviable legacy in Colorado. Thanks to Mike A. Leprino’s legacy, we can all take a lesson in hard work, the entrepreneurial spirit, and the power of free enterprise. The Mike A. Leprino Fellowship will focus on issues reflected in the values and accomplishments of this former pillar of the community.

ABOUT THE AUTHORS

Lang Sias is a former Colorado State legislator, attorney and Navy and Air National Guard fighter pilot. As a Colorado State Representative from 2015-2019, Lang represented House District 27 in Jefferson County. The ranking member on the business committee, Lang also served on the education, public health and health exchange oversight committees, and was a member of the legislative tax simplification task force and the JeffCo school safety task force. Over 85% of the bills Lang sponsored were bipartisan. He focused on solving problems in the areas of education, health care and small business, and on government transparency and accountability. He played major roles in passing legislation expanding public school choice, increasing healthcare transparency and reforming the public pension system to benefit retirees and taxpayers. Lang currently serves on the legislative subcommittee that oversees Colorado’s state pension fund. He was the Republican candidate for Lieutenant Governor in 2018 and State Treasurer in 2022.

Chris Brown is the Vice President of Policy and Research for the Common Sense Institute.

About Common Sense Institute

Common Sense Institute is a non-partisan research organization dedicated to the protection and promotion of Colorado’s economy. CSI is at the forefront of important discussions concerning the future of free enterprise and aims to have an impact on the issues that matter most to Coloradans. CSI’s mission is to examine the fiscal impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI employs rigorous research techniques and dynamic modeling to evaluate the potential impact of these measures on the economy and individual opportunity.

Teams & Fellows Statement

CSI is committed to independent, in-depth research that examines the impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI’s commitment to institutional independence is rooted in the individual independence of our researchers, economists, and fellows. At the core of CSI’s mission is a belief in the power of the free enterprise system. Our work explores ideas that protect and promote jobs and the economy, and the CSI team and fellows take part in this pursuit with academic freedom. Our team’s work is informed by data-driven research and evidence. The views and opinions of fellows do not reflect the institutional views of CSI. CSI operates independently of any political party and does not take positions.

Introduction

On November 7, 2023 Colorado voters will approve or reject Proposition HH, Property Tax Changes and Revenue Change Measures. Proposition HH was referred to the ballot by the State Legislature following the passage of SB23-303.

As the title suggests, Proposition HH is a complex proposal. It modifies or reduces taxation rates and exemptions for multiple types of property while at the same time increases taxes by allowing the state to retain more tax revenue. It would distribute excess revenue to school districts and other government entities without new stipulations.

Proposition HH gives Coloradans a choice; trade some property tax relief, for a long-term increase in state taxes. Though any revenue forecast is uncertain, under normal economic conditions taxpayers would bear the full tax increases under Proposition HH even if the economy faced a sizeable downturn. While all Coloradoans benefit from TABOR refunds, only property owners would see direct benefits of the property tax decrease.

After voters repealed the Gallagher Amendment in 2020, which had moderated growth in residential property taxes for more than 30 years, the state legislature made temporary changes to the state assessment rate in 2021 and 2022 SB21-293 and SB22-238 but has not implemented a long-term solution to rising property taxes.

Recent survey results from county assessors indicate that home values across Colorado increased 40% on average over the last two years. The 2023 tax bill for the median priced home in multiple front range counties is expected to increase by more than $1,000, representing a significant cost to households.

Voters, advocates, and opponents are assessing the proposition’s potential impact on taxation, local revenue, and TABOR refunds. Proposition HH will be the only measure that voters face this fall that addresses property taxes. A separate citizen-led measure, currently known as Initiative 50, is in the signature-gathering phrase for the 2024 ballot and would place a 4% cap on property taxes.

This report is intended to provide a deeper understanding of the long-term impacts and tradeoffs associated with Proposition HH.

Key Findings

Any gain in property tax reductions could be outweighed by long-term pain in state tax increases. If Prop HH passes, the increase in property taxes will be slightly less than under a current law adopted by the General Assembly in 2022, but households could lose $5,119 in TABOR refunds over the next decade.

If Prop HH passes, the state of Colorado will be able to collect and spend an additional $9 billion, funded by the significant increase in taxes Prop HH allows.

Prop HH authorizes a 25% increase in the annual growth rate in the state spending limit, adding dollars to the state’s largest budget on record.

If Prop HH were extended by the state legislature through 2040, which is allowed without voter approval, it could produce a $21 billion net tax increase, as property taxes are reduced by $21.49 billion while state taxes increase by $42.38 billion.

While the full tax impacts depend on revenue growth, historic trends indicate revenue is likely to continue outpacing the Proposition HH spending cap.

Renters are the Biggest Losers

These joint filers will lose an estimated $5,119 in TABOR refunds over the next decade.

Renters will not see benefits from any of the TABOR refunds being redirected to slow the pace of property tax increases. Thus, renters will bear much of the cost for the $9 billion in new spending Prop HH requires.

Bottom Line

When comparing the property tax increase to lost TABOR refunds, most taxpayers will pay more over the next 10 years if HH passes than if HH fails. Prop HH does not provide certainty or help to regulate the fluctuations in property taxes. A median priced home under current law would see a 36% tax increase from 2022 to 2023, and under Prop HH that same median average home still sees a large tax increase of 26%.

What will HH cost me if I own my home?

The average homeowner would face a net tax increase of $478 through 2032. While they would see $4,641 in property tax savings, they would have a $5,119 increase in state taxes paid for by loss of TABOR refunds.

What will HH cost me if I rent my home?

768,000 or 33% of all Colorado households that are renters would not directly receive a property tax reduction, yet joint filers would lose $5,119 in future TABOR refunds. If landlords choose to pass on property taxes as is usually the case, renters are likely to see an increase in rents over time as well.

Where does the funding go?

Over 80% of additional money retained from Proposition HH would go to education with no accountability measures or spending guidelines.

- Estimates suggest even more, 95% of money retained under TABOR spending limit, would go to schools rather than the backfill to local governments.

Up to 20% of tax increase would go to reimburse local governments for lost property tax revenue, though it is likely much less than that will be needed as local government assessed value surpasses the backfill threshold.

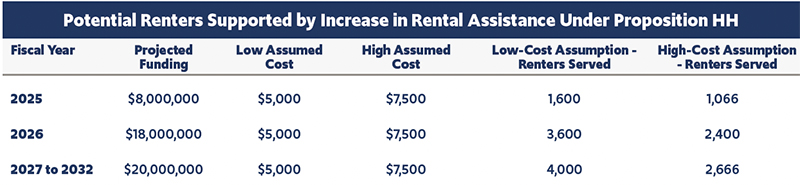

Up to $20 million annually for rental assistance.

If Not Prop HH Then What?

Prop HH will be the only measure on property taxes voters see on the 2023 ballot, and the only policy, barring a special session, that could impact their 2023 taxes. However, there remain numerous other policy options that could be adopted by the legislature or voters that provide greater taxpayer certainty. A 4% property tax growth cap without an increase in the state spending limit, currently titled Initiative 50 is currently collecting signatures for the 2024 ballot.

About Colorado Property Taxes

Property taxes serve as a major source of revenue for most local government entities. They are assessed on the value of the underlying property by type. Property taxes for residential, commercial, industrial, agricultural, and vacant land are authorized by Article X of the Colorado Constitution and Title 39 of the Colorado Revised Statutes.

The formula governing how property tax revenue is determined is shown by the following equations.

Actual Value x Assessment Rate = Assessed Value

Assessed Value x Mill Levy = Property Tax

The determination of a property’s value is primarily done by the county assessor’s office. Figure 1 shows the total actual value of property by classification in 2022.

Figure 1:

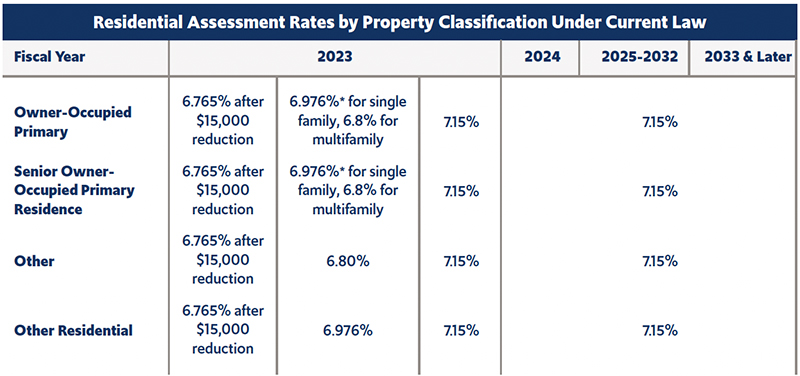

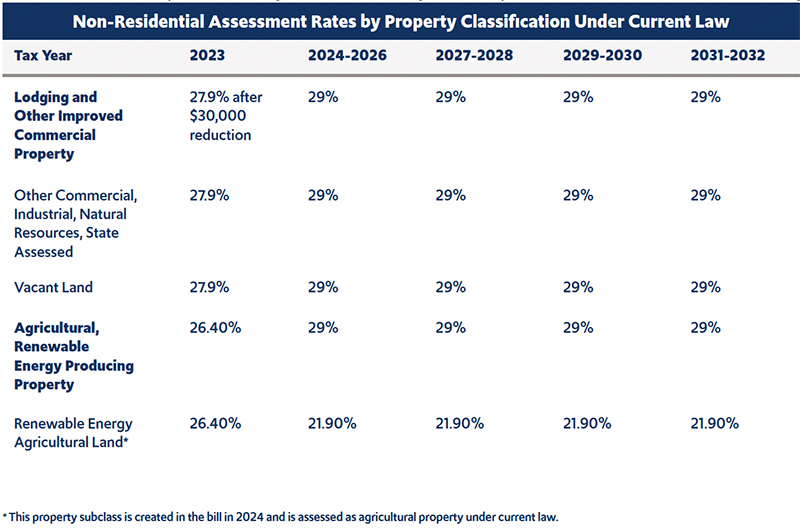

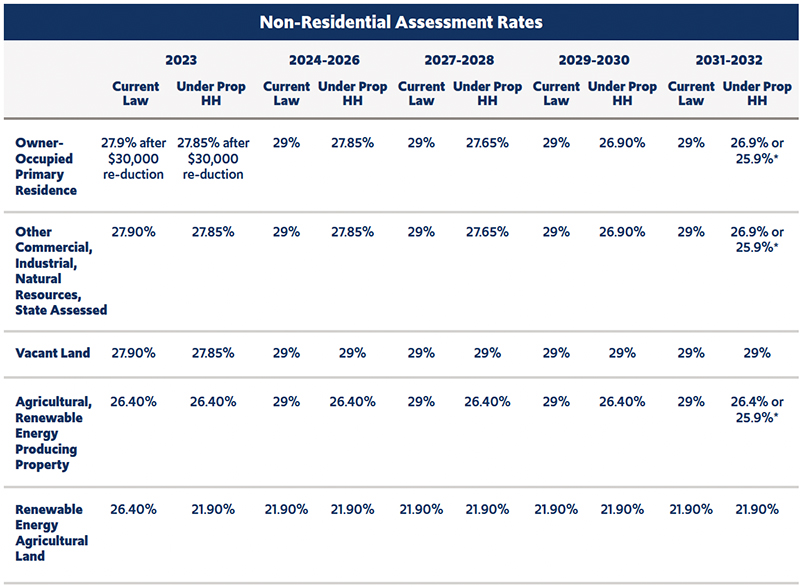

The actual value of each property is multiplied by the assessment rate for its classification. Assessment rates are the same statewide under current law and are shown in Figure 2. The assessment rate for 2023 is 29% for non-residential property and 6.765% for residential property. The latter rate was set at 7.15% by voters in 2020, when they repealed the Gallagher Amendment, but the General Assembly passed legislation in 2021 and 2022 that temporarily reduced rates to 6.95% and 6.765% respectively. Rates will rise in 2024 and 2025 under current law as Figure 2 shows.

Figure 2:

Local taxing authorities apply mill levies to the taxable assessed value of each property. Mill levies are established by counties, cities and towns, school districts, and special districts that provide fire protection, water and sanitation, parks and recreation, health service, ambulance, libraries, and other services. Mill levies can be raised with voter approval, or by the taxing authority themselves if they have voter approval to override the provisions of TABOR. One mill equals one tenth of one penny 1/1000th of a dollar or $1 for every $1,000 of assessed value.

The total amount of property tax revenue collected in 2022, based on 2021 property values, totaled $12,757,147,364i. That is an amount equal to 72% of the state’s general fund expenditures. As Figure 3 shows, half (50.9%) of property tax revenue goes to public school districts. County governments receive 22.7%, special districts, 20.5% municipalities 4.6%, and local colleges 1.2%.

Figure 3:

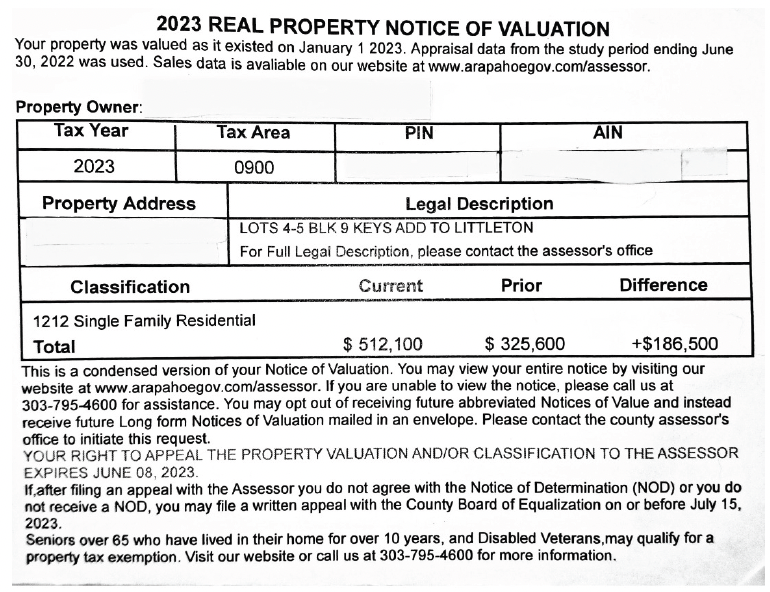

In Arapahoe County, for example, there are 486 taxing districts throughout the county. Properties are subject to as few as 58.19 mills and as many as 228.99 mills.ii For example, a house in the City of Littleton with a market value of $325,600 and an assessed value of $22,027 ($365,600 x 6.765%) is subject to a 101.525 mill taxation rate (.101525) to support Littleton Public Schools (67.06 mills), Arapahoe County government (12.750 mills), the fire protection district (9.288 mills), City of Littleton (2.0 mills), parks and recreation (8.426 mills), Urban drainage and flood (1.0 mills), and developmental disabilities programs (1.0 mills).iii The total tax for the year on this house under the 2023 rate is $2,236. As temporary state assessment rates expire, property taxes will rise in 2024, 2025, and thereafter. Even if the property’s actual value and the area’s mills remained the same, the assessed value will rise as the following calculations show.

In 2023: $325,600 x 6.765% = $22,027 x 101.525 mills (.101525) = $2,263 in taxes.

In 2024: $325,600 x 6.976% = $22,714 x 101.525 mills (.101525) = $2,306 in taxes.

In 2025 and thereafter: $325,600 x 7.15% = $23,280 (.101525) = $2,364 in taxes.

Why Are Property Taxes Increasing this Year?

- Recent survey results from county assessors indicate that home values across Colorado increased 40% on average over the last two years.

- Following the repeal of the Gallagher Amendment in 2020, which previously had moderated the growth in residential property taxes, property owners face property tax bill increases that could rise as much as their home value has increased.

- The 2023 tax bill for the median priced home in multiple Front Range counties is expected to increase by more than $1,000. The median priced home in Douglas County is expected to increase by $1,720, Arapahoe by $1,077 and Adams by $1,064.

County assessors conduct a reevaluation of property every odd numbered year. This year’s assessment found the median home value up 40% over the last assessment.iv Along the Front Range, rate increases ranged from 35% in Elbert County to 47% in Douglas County. Some mountain resort communities saw home values rise as much as 70%.v

There are several reasons for the significant rise in property values including high demand for housing relative to supply and high levels of inflation impacting all goods and services. The increase in taxation, however, is not entirely due to higher property values. The voter-approved repeal of the Gallagher Amendment to the Colorado Constitution in 2020 played a role. While the Gallagher Amendment produced a set of challenges and problems, it also was the only mechanism that moderated residential property tax growth.

Voters approved the Gallagher Amendment in 1982. At the time, most types of property were assessed at 29% of the value. The amendment set the nonresidential assessment rate at 29% and the residential property rate at 21% and mandated that residential property taxes could not make up more than 45% of the total property tax base. As home values grew faster than nonresidential property values, the state lowered the residential assessment rate. In 2020, the rate had dropped to 7.15%. Lower home property taxes benefited homeowners and even renters whose rents reflected the cost savings. Between 1982 and 2020, homeowners saved $35 billion.vi

In 2020, the Colorado legislature referred Amendment B to the ballot to repeal Gallagher and voters passed the repeal 58%-42%. While there were calls at the time for a longer-term fix, only temporary stopgap measures have been passed since then.

Without Gallagher’s limit on the proportion of the tax base comprised of residential property taxes, residential property taxes could rise relative to commercial property taxes. Meanwhile home values rose between July 1, 2020, and June 30, 2022, the period analyzed by county assessors, while some commercial property lost value during the pandemic. When assessors sent out required forms in spring 2023, many residential property owners were alarmed by the higher-than-expected 2023 value assessments and worried about corresponding future tax increases.

Figure 4:

After the rise in home values, taxes on the house in the City of Littleton in the example now has an actual value of $512,100 and an assessed value of $34,644 subject to 101.525 mills and a state assessment rate of 6.765%, the owner’s new tax bill will be $3,517, a $1,254 increase over the prior year. Taxing districts including the school district, municipality, county, and special districts will receive $1,254 more than in the last assessment period. In 2024 and 2025 as the state assessment rate increases, the house’s taxes will rise to $3,627 and then $3,717. Around the state, county, municipal, and special district agencies are poised to receive a windfall of new funding.

Figure 5:

What is TABOR?

Colorado’s Taxpayer’s Bill of Rights (TABOR) was approved by Colorado voters in 1992 as a constitutional amendment with the goal of restraining government spending and providing taxpayers with greater control over proposed tax increases. The bill outlines limitations for the state’s revenue collection and expenditure growth as outlined by a formula based on inflation and population growth as seen below:

Total Spending Limit = Previous Year’s Spending + Previous Year’s Spending × Inflation Factor + Previous Year’s Spending × Population Growth Factor

While TABOR has worked to maintain state spending at a rate of population growth plus inflation, both the state legislature and voters have approved revenues sources that grow outside of the TABOR spending limit. The largest source of state spending outside of TABOR has been Enterprise-based fees. Prior CSI research found that in the year 2000, fees amounted to $222 per Coloradan, while General Fund spending amounted to $1,174 per resident. By 2018, fees equaled $3,136 per Coloradan, and General Fund spending equaled $1,864. This means that for every $1 increase in general fund revenue per Coloradan, enterprise fees have gone up $4.22 – more than four times faster.vii

What is Proposition HH?

- Proposition HH is a statewide ballot measure that will appear before voters during the November 2023 election. The measure was referred to the ballot by the state legislature during the final few days of the 2023 legislative session.

- Proposition HH impacts both property taxes and TABOR refunds. If passed it will reduce the assessed value for certain residential and commercial property classes and will allow the state to retain more taxpayer revenue under the provisions of TABOR.

- The policy and tax changes authorized by Proposition HH will be active through 2033. However, the state legislature has the ability to extend the effects of Proposition beyond then, without a further vote of the people.

- The additional revenue retained through the increased TABOR spending limit, and reduction of TABOR refunds, will be distributed in three ways;

- Local government backfill – Up to 20% of revenue will be transferred to local governments that have not experienced 20% growth in assessed value relative to 2022.

- Rental assistance – Up to $20 million annually can be used to augment the state rental assistance program.

- Education funding – 80% of the additional money retained plus any money not used for the local government backfill will be transferred to the state education fund for the purpose of allocating to schools.

- Proposition HH will create a new spending limitation for certain local governments, referred to as a truth in taxation measure, however it will not apply to many jurisdictions including home rule municipalities and school districts.

On May 8, a majority in the legislature passed SB 23-303 on a partisan vote. The law placed Proposition HH on the upcoming November ballot. If approved by voters, Proposition HH will marginally reduce property tax assessment values for primary residential properties and commercial properties while gradually eliminating TABOR refund payments. The legislation will be in effect for 10 years beginning with the current 2023 tax year and ending in 2033. However, the measure can be extended by the legislature without a vote of the people.

IMPACT ON PROPERTY TAXES

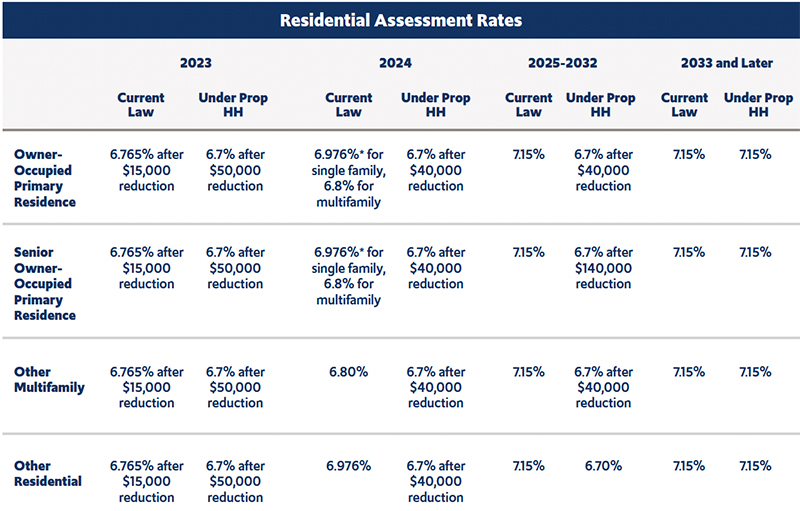

Proposition HH will reduce certain residential and commercial assessment rates used in the calculation of property taxes. Proposition HH will change the residential assessment rate on owner occupied homes from 6.765% to 6.7% for taxes owed next year and from 6.97% to 6.7% in 2025. The rate will remain 6.7% until 2033. Residential property owners will also be able to exempt the first $50,000 in their home value from the 2023 tax year, and $40,000 in the following year and thereafter.

Figure 6:

Starting in 2025 Proposition HH will create two new sub classifications of residential property.

– Owner-occupied primary residences

– Qualified-senior primary residences

Property owners will be required to fill out a form with their local assessor in order to qualify under these classes. Residential properties that are not owner-occupied, such as second homes, will pay a higher tax rate. Seniors aged 65 and older who qualify for the senior homestead exemption under existing law will receive the same property tax benefit for a new primary residence home bought in 2025 and thereafter. The senior property tax exemption allows qualified seniors to exempt 50% of the first $200,000 of the actual value of their primary home from property tax. Under current law, seniors must have resided in their house for 10 or more years in order to take the exemption.

With the exception of property tax assessment rates for vacant land, non-residential property tax assessment rates will also be reduced. The assessment rate for lodging, commercial, industrial, and natural resources property will decline from 27.85% to 26.9% or 25.9%. Agricultural land property tax assessment rates will drop to 26.4% or 25.9%. The difference in the two rates depends on the increase in property valuation in the 32 counties with the smallest revenue increases. Renewable energy agricultural land tax assessment rates a new class of property under the law will drop to 21.9% by 2032. Such land is utilized for agriculture and photovoltaic solar panels, for example.

IMPACT ON TABOR REFUNDS

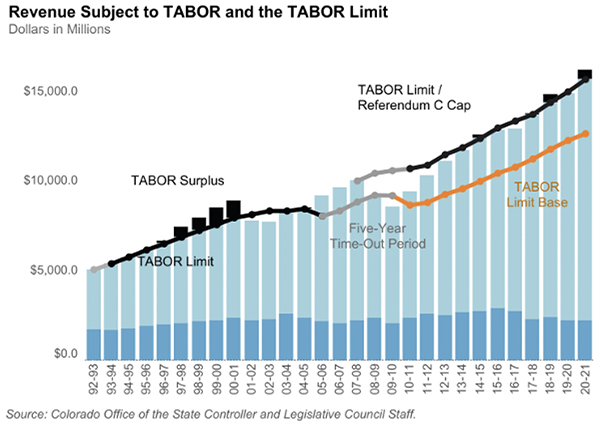

The Taxpayer Bill of Rights TABOR, approved by Colorado voters in 1992, adds several limitations to the ability of Colorado government to raise taxes and increase spending. It requires a vote of the people for new tax increases and limits the amount of money the state can collect and spend each year. The spending cap increase is determined by population and inflation. When the state collects a surplus of tax revenue beyond the constitutional limit, the state must refund the money to taxpayers.

Refunds vary year to year depending on economic conditions and legislative changes. In 2017, the legislature passed a bill to require the Colorado Department of the Treasury to reimburse local governments for the property tax revenues not received due to property tax exemptions taken by seniors and disabled veterans. Once these reimbursements are distributed, the remaining surplus funds are refunded to taxpayers.

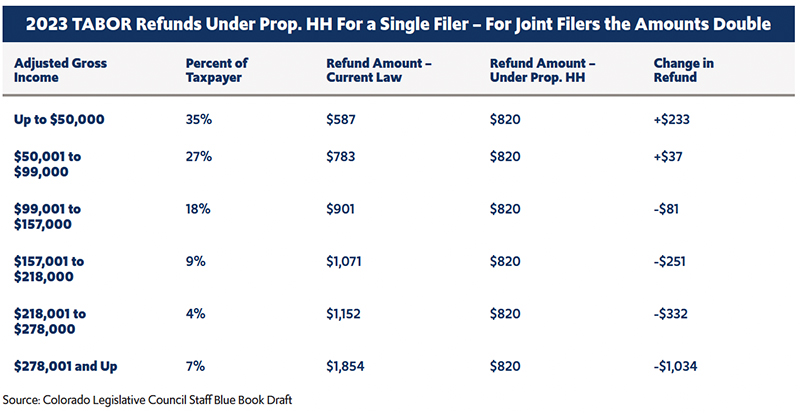

In the past, funds have been distributed through a tiered system according to income with those who make more money and generally pay more in income taxes, receiving larger surplus checks. Last year, the governor signed legislation to give all taxpayers refunds of $750 for individuals and $1,500 for joint filers from the surplus generated during the 2021-2022 fiscal year.

Figure 7 shows the history of revenue subject to the state spending limit. Following the passage of Referendum C by voters in the mid-2000’s, revenue subject to TABOR had only surpassed the spending limit 4 times through FY21.

Figure 7:

The General Assembly’s Legislative Council Staff reported in June that the TABOR revenue limit was exceeded by $3.31 billion for the 2022-2023 fiscal year.viii Because the refund mechanism under current law reverts to the tiered refund system, single filers will receive between $454 and $1,434 depending on their income. Accompanying the passage of SB23-303 at the end of the 2023 legislative session, the majority passed HB23-1311 to require the state to refund the same amount to all taxpayers if voters approve Proposition HH.

The initiative raises the cap on the amount of taxpayer revenue the state can retain under TABOR. Under the new revenue cap, taxpayers will receive smaller refund checks or no check at all.ix

The majority of changes to property taxes and TABOR refunds will remain in effect through state budget year 2031-2032 and can be extended by the state legislature without voter approval for 20 additional years.

IMPACT ON LOCAL GOVERNMENTS

The state will spend up to 20% of retained TABOR surplus funds to reimburse local governments for monies uncollected due to the reduction in the state property tax assessment rates and the exemption of $40,000-$50,000 in home values from the assessed value, up to $20 million for rent subsidies, and the rest on public education.

For some local taxing districts, Proposition HH will limit property tax increases to no more than the prior year’s revenue plus inflation. The proposal exempts school districts which account for more than 50 percent of property taxes and home rule cities. In Colorado, 103 of the 272 municipalities have home rule status, including several of Colorado’s largest cities such as Denver, Aurora, Colorado Springs, Ft. Collins, Lakewood and Pueblo.x Moreover, any local government can waive the limit by adopting an ordinance after a public hearing. Most counties, municipalities, and school districts have already eliminated local TABOR revenue caps and it is likely that Proposition HH limits will be likewise dispatched.xi

School districts will not only be fully reimbursed, but they will reap millions in additional funds. Surplus funds not used to backfill local taxing districts will be transferred to the State Education Fund. As a previous CSI report noted, “It is estimated to increase state spending on education by a growing amount annually increasing from $94 million in FY23 to $330.4 million by FY26.”xii

Exactly How Does Proposition HH Impact Taxes and Spending?

The following sections detail the potential long-term impacts to property taxes, state taxes and the net impacts for individual property owners.

KEY FINDINGS:

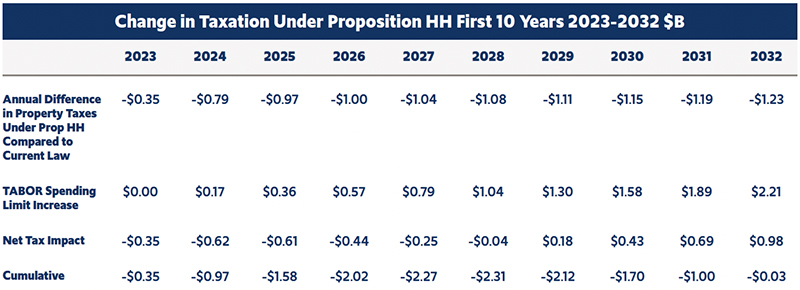

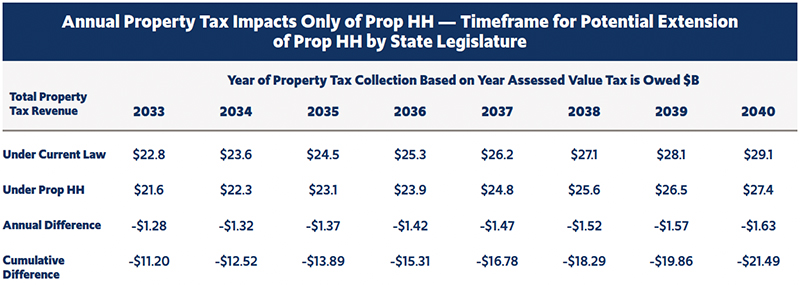

- The potential property tax revenue reductions under Proposition HH amount to $9.92 billion through 2032, while the potential reduction in TABOR refunds total $9.9 billion. Should the legislature choose to extend Proposition HH through 2040, there could be a net tax increase of $20.1 billion. If the legislature does not extend the tax effects of Proposition HH, the measure sets up a $1.3 billion tax increase in 2033.

- Less than 5% of the potential reduction in future TABOR refunds under Proposition HH will likely be needed to backfill local governments. More than $9.5 billion beyond current K-12 spending could be redirected from TABOR refunds to school districts by 2032.

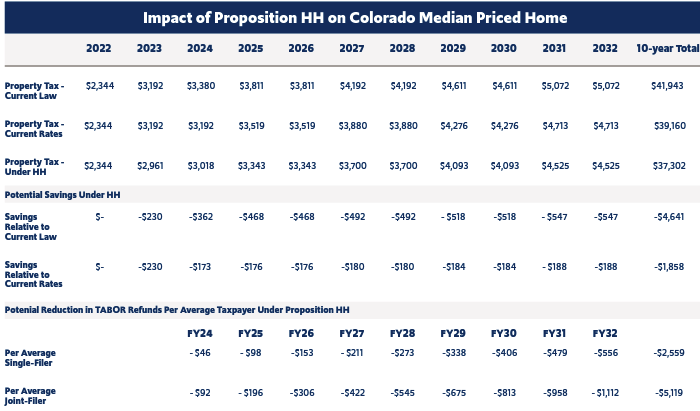

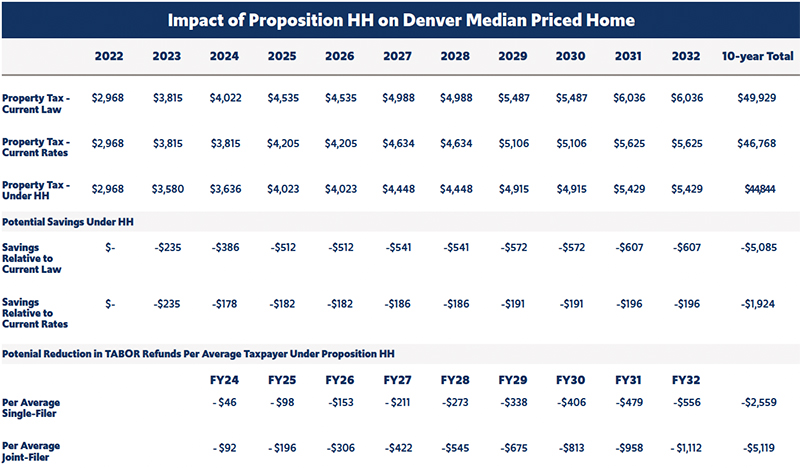

- Under Proposition HH, it is possible that most Coloradans would see a net tax increase through 2032. The median priced home in Colorado could see a larger increase in state taxes than the reduction in property taxes. The median priced home in Colorado could see a reduction in taxes of $4,641 against current law, while seeing an increase in state taxes of $5,119 with two taxpayers in the household. The net impact being a $478 tax increase by 2032.

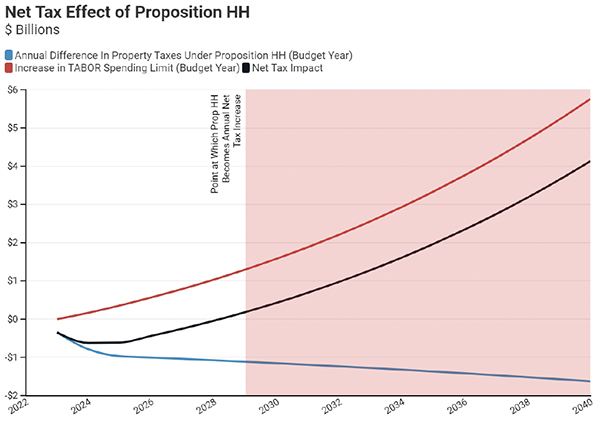

Proposition HH will reduce local property taxes while increasing state taxes. The proposition increases state taxes by reducing future TABOR refunds. Though each taxpayer will face a different calculation when determining their net tax effect, Figures 8 through 10 show the statewide net effects of the potential impacts on both property taxes and state taxes.

Figure 8 shows the cumulative potential reduction in property tax revenue over 10 years through 2032, and over 17 years through 2040. While the net effects of the opposing tax changes are minimal through 2032, the potential net tax increase grows to $20.9 billion by 2040.

Figure 8:

Figure 9 graphs the values shown in the table in Figure 10. While property tax reductions under Proposition HH would continue to increase through 2040, the potential state tax increases grow at a much faster rate. As a result, the annual net effect of Proposition HH flips from a net tax reduction to a potential net tax increase in 2029.

Figure 9:

Figure 10:

IMPACT ON PROPERTY TAXES

KEY FINDINGS:

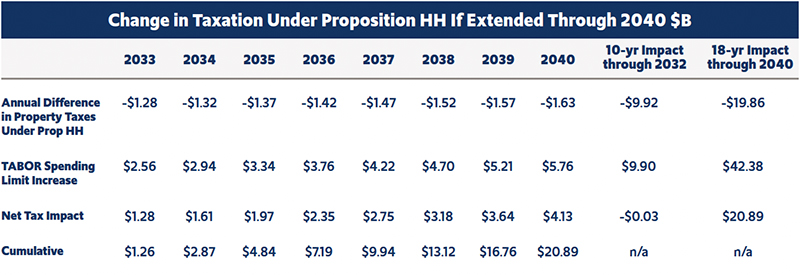

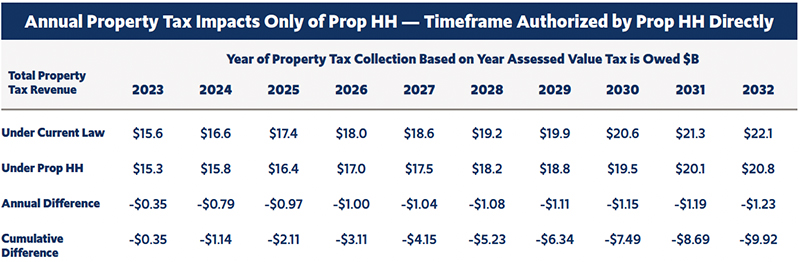

- Property taxes would continue to grow under Proposition HH.

- The bill fiscal note estimates Proposition HH would lower property tax revenue growth from 23% to 19% in its first year.

- Property taxes would grow 73% by 2032 under current law and by 63% by 2032 under Proposition HH.

- Total property tax revenue could be reduced by $9.922 billion over 10 years, though some property owners will not see any net reduction in property taxes. This amounts to a 5.2% reduction in estimated property taxes over that period.

Proposition HH reduces the statewide property assessment rates for residential and commercial property owners. Reducing statewide assessment rates lowers the amount of property value that can be taxed by local governments.

Refer to the earlier section in the report, “What is Proposition HH?” to see the specific changes in property classifications and assessment rates.

The statewide assessment rate is just one variable in the determination of property taxes. Estimating the future impacts to property tax revenue depends upon several other factors.

- While property owners already received their initial 2023 actual value notices, many have appealed and are awaiting a judgement from their county assessor.

- The mill levy, or tax rate, that every local government authority will apply to properties within their area will not be finalized until December and can be changed in future years subject to different factors such as whether the taxing district adheres to existing growth restrictions or the new restrictions imposed by Proposition HH.

- Future property value growth rates depend on market conditions within the two-year assessment period; and as recent markets have demonstrated, can be highly volatile.

Despite this uncertainty, it is possible to create simulations of property tax changes over the next decade with and without Proposition HH.

The following table shows annual property tax revenue projections. The assessed value growth rates for 2023, 2024 and 2025 for both current law and under Proposition HH come from the SB23-303 fiscal note. xiii The assumed assessed value growth rate from 2026 through 2032 is 3.5%.

Figure 11:

Figure 12:

Figure 11 shows the annual difference in property tax revenue under Proposition HH relative to current law which grows more quickly over the first three years, given the annual changes in assessment rates. The difference starting in 2026 going through 2032 is more constant, as assessment rates do not change, or change very slightly, during that period under current law or under Proposition HH.

The cumulative potential reduction of local property taxes under Proposition HH total $9.92 through 2032. This represents a 5.2% reduction in total property tax revenue from current law.

Figure 12 shows the potential impacts to property tax revenue starting in 2033 if the state legislature chooses to extend the provisions of Proposition HH. Should the legislature choose not to extend Proposition HH, starting in 2033 there would be an effective $1.28 billion tax increase as assessment rates revert from the lower rates under HH, to higher rates under current law. If the legislature does not extend the property tax reductions, it could no longer retain TABOR surpluses.

The potential statewide total impact on property taxes is important to consider in combination with the state tax impacts discussed in the following section.

IMPACT ON TABOR AND STATE TAXES

KEY FINDINGS:

- Proposition HH would allow the state to retain and spend an additional $9.9 billion through FY2032. Should the state legislature choose to maintain the increase in Proposition HH beyond FY2032, the cumulative amount of additional tax revenue that the state could retain and spend would increase by $42.4 billion by 2040.

- The Proposition HH spending limit would grow from an annual amount of $170 million in FY24, to $2.2 billion in FY32, to potentially $5.8 billion by FY40.

- The impact on TABOR refunds will depend on annual revenue growth. If revenue grows near the historic average the full effects of the tax increase under HH will occur, greatly reducing future TABOR refunds. If revenue is below the historic average, or if there is a reduction in revenue due to a recession, then it is more likely that TABOR refunds will be eliminated under Proposition HH but not under the current spending limit.

Proposition HH impacts the amount of state taxes Coloradans will pay in the future by increasing the state spending limit under TABOR. Currently, the provisions of TABOR limit the growth of a portion of state spending to no more than the rate of population growth plus inflation growth. State tax revenue subject to TABOR above the spending limit is refunded back to taxpayers. Proposition HH would add an additional 1% to the state spending limit growth rate.

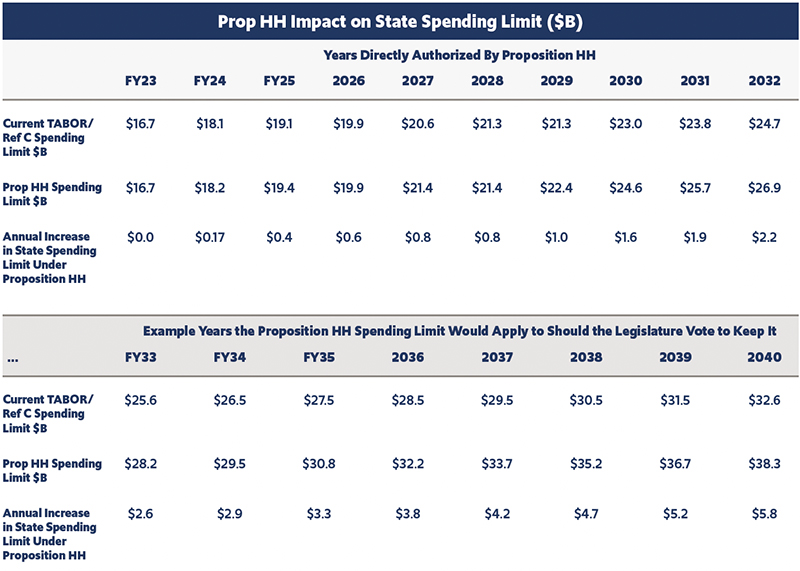

Figure 13 shows a projection for both the current state spending limit approved by voters in 2005 through Referendum C, and the spending limit proposed under Proposition HH. Under current law, the TABOR spending limit, which is determined by inflation plus population growth, is estimated to grow by 40% over 10 years, from $16.7 billion in FY2023, last year’s budget, to $25.3 billion in FY2032. Under Proposition HH, the spending limit would grow by 51% over that same period, from $16.7 billion in FY2024 to $27.6 billion in FY2032.

Because of the higher spending limit, the state could retain a potential additional $9.9 billion through 2032. Under Proposition HH the state legislature would not need to go back to voters to approve the increase in the state spending beyond 2032. As shown in Figure 13, the increased state spending limit extended through 2040, will increase the amount of money the state could retain in revenue subject to TABOR to $38.3 billion. The annual difference between the current spending limit and the proposed Proposition HH spending limit would grow from $170 million in FY24, to $2.2 billion in FY32 to $6.1 billion by FY40 due to the compounding nature of the additional 1% growth allowance.

Figure 13:

Figure 14:

While the state would have the authority to spend additional state tax revenue, the actual annual impacts on state taxes and spending will depend on the performance of revenue relative to the new spending cap. Over the next two fiscal years, the Colorado Legislative Council Staff project that even under Proposition HH, Coloradans will receive refunds. However, beyond the state’s official forecast window, as the gap between the current spending limit and the Proposition HH spending limit grows, there are many scenarios under which state TABOR refunds are eliminated.

REVENUE SCENARIOS

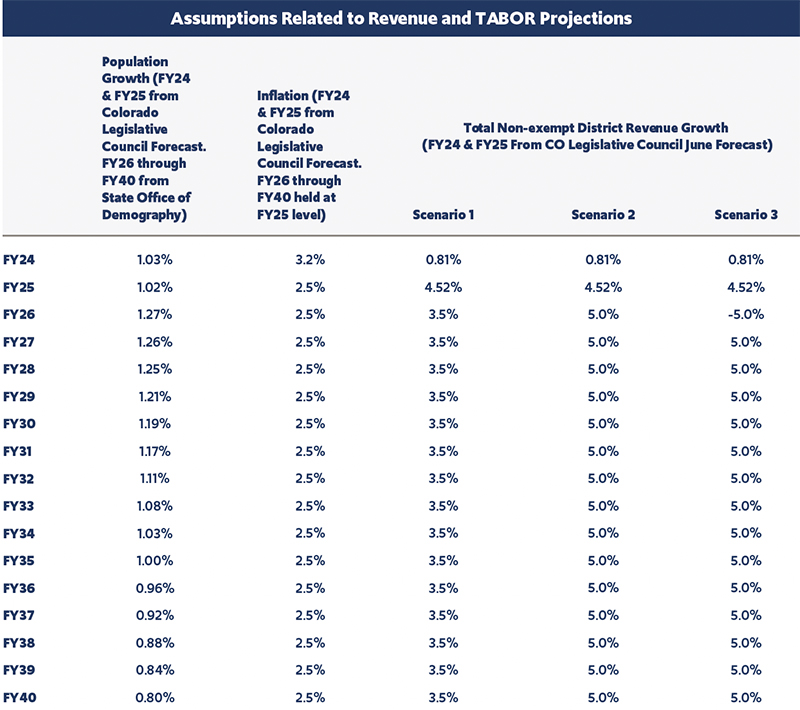

Figure 15 through 17 show three scenarios for revenue growth, and how TABOR refunds would be impacted under Proposition HH. Full scenario assumptions are available in the Appendix. Under Scenario 1, revenue subject to TABOR grows at 3.5%. This scenario reflects slower revenue growth than the state’s 20-year geometric mean annual growth rate of 4.24%. A lower revenue growth rate is plausible given population growth is slowing.

In this scenario, revenue continues to surpass the Proposition HH spending limit through 2031. Taxpayers would receive TABOR refunds under current law from 2023 through 2040. If Proposition HH passes, however, TABOR refunds would be available through 2031, the point at which revenue falls below the Proposition HH spending limit.

Figure 15:

Under Scenario 2, revenue subject to the spending limit grows annually at 5%. Under this scenario, revenue would continue to surpass the Proposition HH spending limit through 2040. Under this scenario, taxpayers would receive smaller TABOR refunds than they would under current law.

Figure 16:

Actual future revenue growth will be more volatile than assumed in Scenarios 1 and 2. While revenue growth has been consistently positive since 2010, it has varied between 22% growth in FY22 and just .58% growth in FY20. It is also very possible that revenue will decline at some point in the near future.

Scenario 3 shows the long-term impacts if revenue declines by 5% in FY26, the first year beyond the Legislative Council Forecast, and then grows at an annual rate of 5% through 2040. In this scenario, despite the strong long-term growth rate, the single year decline, which is lower than the two-year decline in FY09 and FY10 of -15%, is large enough to cause revenue to fall below the Proposition HH spending limit until FY34. In this scenario, revenue would be below the Proposition HH spending limit, but above the current Referendum C spending limit. Under this scenario, voters would have TABOR refunds under current law, however under Proposition HH, TABOR refunds would not be available from through FY2035 and only small refunds thereafter.

Figure 17:

Where Does the Money Retained by Expanding the TABOR Spending Limit Go and What Are the Net Fiscal Impacts of Proposition HH?

KEY FINDINGS:

- Over the first 10 years of Proposition HH, the increase in state taxes would nearly offset the reductions in property taxes if revenue growth maintains at historic average. The potential property tax decrease of $9.92 billion through FY32 would be nearly offset by a $9.9 billion increase in state taxes through a reduction in future TABOR refunds.

- If the state legislature chose to maintain the spending limit increase beyond FY2032, by 2040 the cumulative increase in the state spending limit would be $42.4 billion, while the potential property tax reduction would be $21.5 billion. Therefore, by 2040 Proposition HH could have a net tax increase of $20.9 billion.

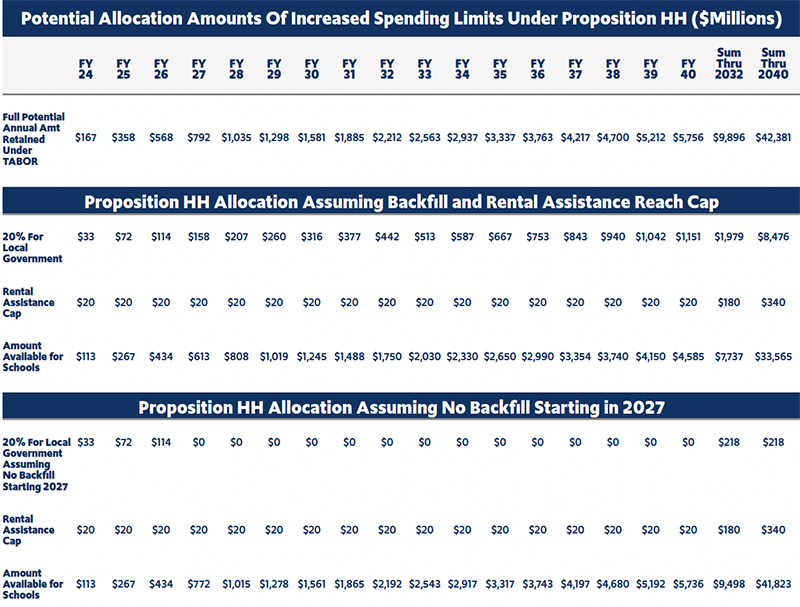

- Less than 5% of the money retained under the TABOR spending limit increase would likely be needed to backfill local governments. Instead, more than 95% of the reductions in TABOR refunds would go to schools.

- Between 2024 and 2033, schools in Colorado have the potential to receive 95% of the money retained by the state by expanding the TABOR spending limit, or $9.5 billion. This is above the current historic level of spending which increased by $1,000 per student, or 9% in the latest budget, increasing the total per-pupil spending to $10,614. By 2032, the additional funding to schools of nearly $2.2 billion would equal $2,246 additional per student.

WHERE WILL THE $10 BILLION POTENTIALLY RETAINED UNDER THE INCREASED TABOR SPENDING LIMIT GO?

Proposition HH will both reduce the growth of local property taxes and will likely increase state taxes. The impact to local governments, schools and individual taxpayers is complex.

Under the scenarios presented in the earlier section outlining the tax and revenue impacts, the potential reductions in total local property tax revenue totaled $9.92 billion over a decade. The potential increase in state revenue under the expanded TABOR cap totaled $9.9 billion over that same period. Therefore, it is possible that reductions in property taxes overall are entirely offset by increases in state taxes. If the state legislature should elect to maintain the increased state spending level past 2032, there would be a significant net increase in state taxes.

According the second draft of the Blue Book developed by Legislative Council Staff, the increase in state tax revenue will be spent in three separate ways:

- Up to 20 percent to reimburse local governments for lost property tax revenue;

- Up to $20 million for rental assistance; and

- The remaining funds to reimburse school districts for reduced property tax revenue as a result of the measure, and for education-related programs, estimated at $125 million in state budget year 2024-25, and up to $2.16 billion in state budget year 2031-2032.

Though the second draft of the Blue Book analysis indicates that $160 million is needed to backfill local governments in the first year, those estimates are based on a December 2022 forecast developed by the Legislative Council Staff. That forecast assumed a statewide increase in residential assessed value of 26.5%, and an increase in non-residential of 18.9%. However, actual increases in property values now appear like they will be much higher.

Based on a survey of preliminary 2023 values released by the Colorado Assessors Association, the average increase in residential property values is just under 44%. Just the four counties of Baca, Dolores, Jackson and Washington, had residential property value growth between 15% and 20%.xiv Therefore, it is very likely that the actual cost of the backfill for local governments under Proposition HH is lower than the current estimates of $160 million in FY35 and $70 million in FY26.

The potential $20 million set aside for a rental assistance program would be allocated to the Housing Development Grant Fund. Just $8 million is projected to be allocated for this program in FY25, growing to $18 million in FY26, before likely hitting the cap in future years. Though the bill does not specify details of eligibility for the program, further analysis is included in the report section titled, “How Does Prop HH Impact Renters?”

The primary beneficiary of the increase in state spending will be public schools. Unlike local governments that have a cap on the amount they can receive to backfill, there is no limit on school funding.

Through the school finance act, the state will have an obligation to increase education funding. The second draft of the Blue Book estimates the state is obligated to increase funding for public schools by $120 million in FY24, by $280 million in FY25, $350 million in FY26 and more in future years.

Figure 18:

On top of the state obligation to maintain school funding at current projected property tax levels, additional funding, from dollars retained under an expanded state spending limit, will be transferred to the State Education Fund. That amount is estimated to be $125 million in FY25, $270 million in FY26, growing to a potential $2.16 billion in FY33. On a per-pupil basis, the FY25 transfer is $126, however the transfer surpasses $1,000 per pupil in FY29. The FY32 transfer amounts to $2,200 per student assuming the student population grows according to the state demographer’s school age population estimates.

The state is spending $9.1 billion on K-12 education in 2023-24. Per state Amendment 23, that spending will grow by inflation each year. The legislature plans to comply with that requirement starting in next year’s budget. On top of that annual inflationary increase, schools are poised to receive an additional $7.7 to $9.5 billion over the next 8 years.

The increase in education spending does not come with any stipulations on how the money will be spent. CSI research has shown that despite a 47% increase in funding per student between 2007 and 2021, average teacher salaries only increased by 27%.xv Work by CSI and others have also shown that the current state funding formula for schools overemphasizes cost-of-living factors rather than student factors, which results in wealthy areas such as Aspen receiving higher funding than areas with more poverty such as Pueblo. Without changes to the school finance formula, it is unclear how a significant increase in state education funding will lead to improved student outcomes or desired increases in teacher pay.

Figure 19:

The projected funding increase for education comes at a time of record spending levels on education. The current FY24 budget increased education funding by 9.4% per pupil reaching $10,614 in state per student spending. The outstanding $141 million remaining in the budget stabilization factor in FY 24, is also projected to be eliminated in next year’s budget. This would mean that schools are fully funded to the required level under Amendment 23.

HOW WILL INDIVIDUAL TAXPAYERS BE IMPACTED?

KEY FINDINGS:

-

- For many homeowners, the estimated reduction in property taxes under Proposition HH will be less than the average TABOR refund reductions over 10 years.

-

- The exact impact of Proposition HH will vary for each property owner depending on where they live, and how each taxing jurisdiction tied to their property adjusts mill levies.

-

- Proposition HH could blunt future rent increases, passed on by multifamily property owners as a result of slowing property tax growth, however the effect would likely be minimal and significantly less than future reductions in TABOR refunds.

THE ACTUAL IMPACT ON EACH TAXPAYER WILL DEPEND ON MULTIPLE FACTORS

The exact impact of Proposition HH on any single taxpayer will vary based on their class of property, the growth in their property value and where they live. The proposed changes to the different classes of property are described in the earlier section, “What is Proposition HH?”. The property tax that each individual household pays into the future will depend on the actual value growth determined by their county assessor following each two-year re-assessment period. The house price index for Colorado grew an average of 5% annually from 2002 to 2023.xvi It grew an average of 8.9% over the last 5 years. The significant increase in the 2023 assessment cycle is significantly higher than historic averages. Proposition HH will not only change statewide assessment rates for residential and commercial properties, but it will also change assessment rates for specific sub-categories of property. It will increase the portability of the senior homestead exemption and increase the assessment rate for second homes relative to owner-occupied homes. For commercial properties it establishes a new assessment rate for agricultural land with renewable energy production. Beyond determining the specific property classification under Proposition HH, and the future growth in value, the annual property tax impact on any single property will also depend on exactly where it is located. More specifically, it will depend on exactly how the taxing authorities that apply to each property respond to the drop in assessed value under Proposition HH. Given the recent significant increase in property values, there is an argument to be made that mill levies will come down. This would mean that local governments choose to lower their mill levies so that instead of seeing an increase in tax revenue in-line with the increase in value, they will see a lower growth rate in revenue. They may do this to better align their growth in revenue to actual growth in costs and to be responsive to taxpayers. Certain jurisdictions may be more inclined to reduce their mills given the passage of SB23-108, granting local governments the ability to temporarily reduce mill levies in the form of a credit that could later be eliminated or reduced without triggering provision of TABOR.xvii While some cities and counties may elect to lower their mill levies, there are many reasons that this will have a minimal effect on property taxes. School districts represent more than 50% of property taxes and are under statutory obligations to maintain their mill levies to meet their share of local funding. Further, under recent legislation, many school districts are required to increase their mill levies in coming years, raising property taxes by an additional $145.5 million in FY23.xviii While the recent surge in the growth in property value could put pressure on mill levies to come down, the effects of Proposition HH would apply pressure on mill levies in the opposite direction. The fiscal note attached to SB23-303 confirms this. Table 4 of the fiscal note indicates that there will be a difference of $5.3 billion in total assessed property value in 2023, and $12.183 billion in 2024 because of Proposition HH. Rather than taxpayers seeing a tax reduction equivalent to the current state average mill levy of 85.034, the effective tax savings rate is lower. This implies that when the assessed value drops under Proposition HH, certain local taxing jurisdictions will raise their mill levies to offset the reduction in value. This can happen for a number or reasons as certain jurisdictions have floating mill levies that are permitted to automatically adjust relative to either budgetary needs or fluctuations in assessed property value. The Colorado Association of Realtors reported the median priced home was $569,804 in early 2023. According to the survey of county assessors, actual home values increased an average of 44% during the most recent assessment cycle. Given the statewide average mill levy of 85.034, the median priced home in Colorado paid $2,344 in property taxes on the 2022 market value of $396,555. Under current law, the property tax owed on 2023 value would increase to $3,192, or by 36%. Under Proposition HH, the property taxes owed on the 2023 value would be $2,961, or a 26% increase from 2022 after accounting for both the value reduction and the assessment rate reduction. The difference in 2023 taxes would be a reduction of $230 under Proposition HH. Knowing the uncertainty around future value growth and how mill levies will adjust, Figure 20 shows potential property taxes for the median priced home in Colorado through 2032. Value is expected to increase 5% annually, or 10% over the two-year assessment cycle. Figure 20 compares property taxes under Proposition HH to both current law and to current 2023 rates. Under current law assessment rates are set to increase slightly in 2024 and again in 2025 given policy changes enacted by the state legislature in 2021 and 2022. Figure 20:

THE NET IMPACT TO TAXPAYERS WILL DEPEND ON THE FUTURE OF TABOR REFUNDS

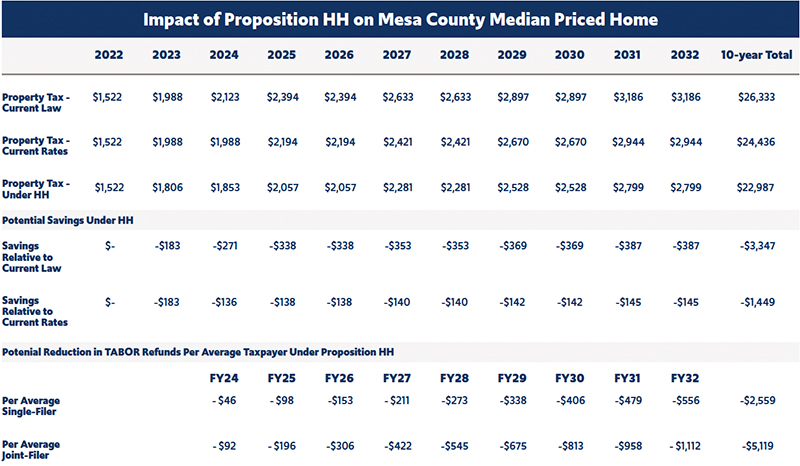

Figure 21 shows the potential tax reduction in property taxes relative to the potential loss in TABOR refunds over the next decade for the median priced home in Colorado at the statewide average mill levy rate.

The reductions in TABOR refunds assume that the total increase in the state spending limit under HH is retained. The total amount retained is then divided by the projected number of eligible filers grown at the rate of population. The annual impact grows from a potential reduction of $46 in 2024 to $556 by 2032 for an individual. The cumulative impact grows to be a reduction in future TABOR refunds of $2,559 for an individual and $5,119 for joint filers.

Though not shown in the figure, the TABOR refund reductions would continue to increase beyond 2032 should the legislature extend the policy changes under HH.

Figure 21:

Figures 22 through 24 show similar property tax projections for Denver, Mesa County and El Paso

Figure 22:

Figure 23:

Figure 24:

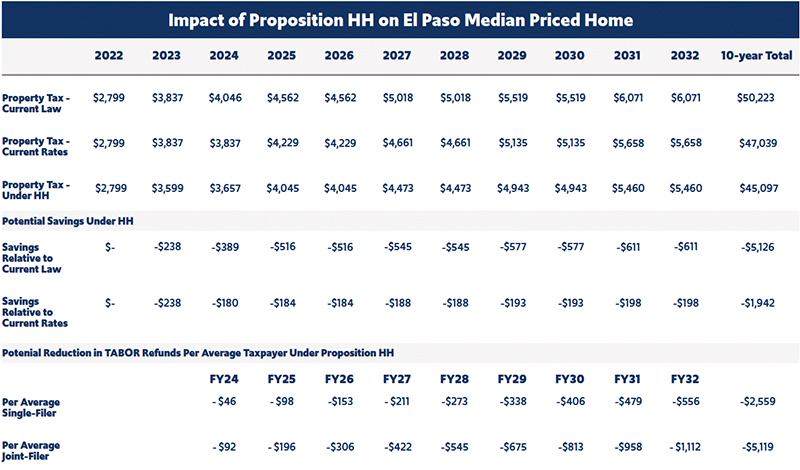

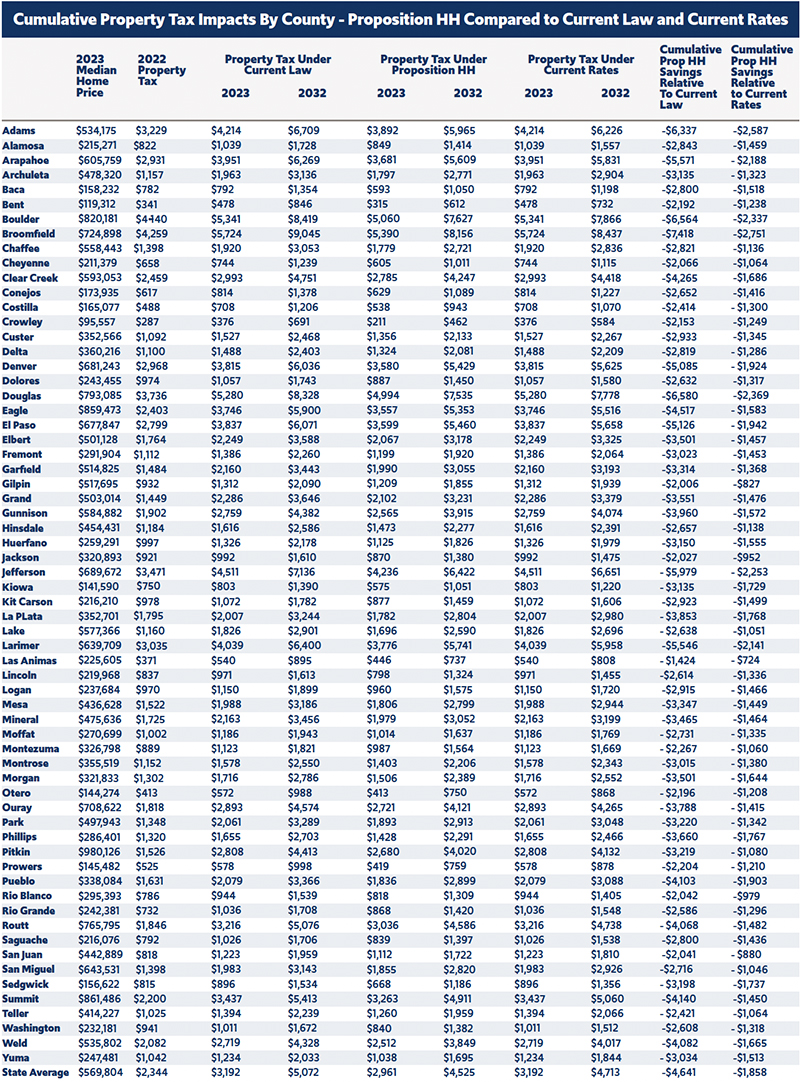

Figure 25 shows the cumulative impact across all counties along with a comparison of property taxes in 2023 and 2032 under current law, under current rates and under Proposition HH.

Figure 25:

WHAT ARE THE POTENTIAL IMPACTS FOR COMMERCIAL TAXPAYERS?

The 2nd Draft of the Blue Book analysis of Proposition HH indicates that for every $1,000,000 of nonresidential property designated as lodging and commercial, there would be a $34 to $503 tax reduction in 2023. The wide range is based on the potential difference between eligible local governments abiding by the property tax limit compared to if they all waive the limit. Other classes of nonresidential have similar wide ranges of potential impacts.

Much of the reason for the limited tax reduction for commercial and lodging properties is due to the fact that property tax assessment values are already set to decrease in 2023. Commercial and lodging properties had an assessment rate of 27.9% after a 30,000 deduction in 2022. The Proposition HH 2023 assessment rate would drop to 27.85% after a 30,000 deduction. Therefore, under current law, $1,000,000 in commercial property valued would see a property tax reduction of $1,646 between 2022 and 2023. Under Proposition HH, the same $1,000,000 in property value would see a $1,688 reduction in their property tax bills between 2022 and 2023. The additional savings under HH amounts to $41 in this scenario which uses the statewide average mill levy rate of 85.034.

From 2024 through 2026 the assessment rate would remain at 27.85%, however there would be no deduction. While this would act as a tax increase from year to year, the rate would remain lower than the rate in current law during that timeframe of 29%.

Under a scenario where $1,000,000 commercial property grows in value by 8% every assessment period, it would save between 5.6% and 6.5% of the total taxes owed under current law through 2032. This amounts to between $15,200 and $17,500 over the decade. However, cumulative property taxes under HH compared to assuming the current rate of 27.9% after a $30,000 deduction, remain effectively equal through 2032.

How Does Prop HH Impact Renters?

While property owners will bear the brunt of the costs associated with Colorado’s historic property tax increase, renters and tenants will not be spared from higher living costs. However, under Proposition HH renters do not receive property tax relief directly, and still face future reductions in their TABOR refunds.

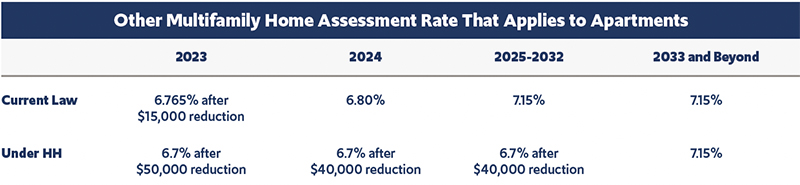

Proposition HH could blunt future rent increases, passed on by multifamily property owners as a result of slowing property tax growth, however the effect would likely be minimal.

Figure 26:

If Proposition HH passes, TABOR refunds will be reduced as the state would retain more tax dollars. Among this projected retained spending is an allocation of up to $20 million per year to be transferred to the Housing Development Grant Fund.xix The 2nd Draft of the Blue Book analysis indicates that if HH passes, the fund will receive $8 million in FY25, $18 million in FY26, and an amount near its cap of $20 million for the remaining years until FY32 when it will expire.

These funds are stated to be used for rental assistance, likely to be administered by the Emergency Rental Assistance Program (ERAP) which was responsible for distributing COVID rental relief money.xx ERAP states that the maximum benefit for a single qualifying applicant is $15,000, however most applicants likely receive far less. The scope of renters impacted by these new funds is shown in Figure 27. With 768,000 or 33% of all Colorado households being renters, Proposition HH’s rental assistance allocation will likely be quite limited in scope as shown below.xxi xxii

Figure 27:

If Not HH, Then What? Other Measures Headed to the Ballot

Proposition HH will be the only property tax related measure on the ballot in 2023, however it is not the only property tax measure voters may face in the future. Several other citizen-led ballot measures were approved by the state’s title board and could have appeared on the ballot in 2023 if the proponents had collected enough signatures. One of these proposals would have initiated a progressive property tax which would have imposed a higher tax rate for higher valued properties.

Another measure was recently approved for signature gathering to qualify for the 2024 ballot. Initiative 50 would impose a 4% annual growth limit on total statewide property tax revenue. While Initiative 50 would not impact property taxes this year, it could prevent significant property tax increases in the future.

Under current law and under Proposition HH, homeowners and commercial property owners face uncertainty about rising taxes. They could experience another significant increase in property values and taxes in the future. A 4% annual cap in property tax revenue comes with other significant impacts but would give property owners and their renters assurance that a large increase in taxes will not occur unless they approve it.

Glossary of terms

Actual value: County assessors determine a property’s value. Homeowners can appeal the valuation.

Assessment rate: The state sets a uniform assessment rate for residential and commercial property. A property’s actual value times the assessment rate equals the assessed value.

Assessed value: The assessed value is determined by multiplying the actual value of the property by the state assessment rate. Local taxing districts used the assessed value to calculate property taxes.

Budget Stabilization Factor: Although Colorado’s constitution (Amendment 23) requires that K-12 spending increase each year by the rate of population plus inflation. Lawmakers have decided they can reduce their portion of the funding, when faced with other budgetary constraints.

Gallagher Amendment: Approved by voters in 1982, the Gallagher Amendment made several changes to how the state calculates property taxes. Under Gallagher, residential property value could constitute no more than 45% of the overall tax base with nonresidential (e.g., commercial, agricultural land) constituting the remainder. As residential property values rose, the state periodically cut the assessment rate. The rate dropped from 21% in 1982 to 7.15% in 2020. The legislature referred a measure to voters to repeal the Gallagher Amendment in 2020 and it passed.

Mill levy: Local taxing authorities apply mill levies to the taxable assessed value of each property. Mill levies can be raised with voter approval, or by the taxing authority themselves if they have voter approval to override the provisions of TABOR. One mill equals one tenth of one penny (1/1000th of a dollar) or $1 for every $1000 of assessed value.

Property tax formula: Property taxes are assessed by multiplying the actual value by the assessment rate to create the assessed value. The assessed value is multiplied by mill levies determined by local taxing districts.

TABOR: The Taxpayer Bill of Rights is a constitutional amendment passed by voters in 1992. TABOR requires voter approval for tax increases. It also limits how much tax revenue the state can retain to an amount determined by inflation and population growth. Revenue above the threshold must be refunded to taxpayers.

Appendix

REFERENCES

i. State of Colorado Fifty-second Annual Report by the Department of Local Affairs Division of Property Taxation, 2022 at https://drive.google.com/file/d/1YKehl5uh-8cNHt6VcKl162EfQxo–y01/view

ii. Arapahoe County Market Trends, Arapahoe County Assessor, April 2023, https://www.arapahoegov.com/DocumentCenter/View/4593/Quarterly-Newsletter-April-2023?bidId=

iii. Taxing District Levy Percentage Tax Year – 2022 https://www.arapahoegov.com/DocumentCenter/View/14433/taxing-district-levy-percentage-2022?bidId=

iv. Jesse Paul, “Use our calculator to determine what your new property tax bill would be under the Colorado legislature’s relief plan” Colorado Sun, May 3, 2023 https://www.denverpost.com/2023/04/26/colorado-home-values-property-taxes-increase/

v. Aldo Svaldi “Unprecedented gains in Colorado home values preview budget-busting property tax hikes next year,” The Denver Post, April 26, 2023 at https://www.denverpost.com/2023/04/26/colorado-home-values-property-taxes-increase/

vi. Brian Eason, “Amendment B explained: What repealing the Gallagher Amendment would mean for Colorado and your property taxes,” The Colorado Sun, September 29, 2020 at https://coloradosun.com/2020/09/29/amendment-b-explained-gallagher-property-taxes/

vii. https://commonsenseinstituteco.org/proposition-117/

viii. Jesse Paul, “Colorado taxpayers will get even larger refund checks next year than predicted. Here’s how much you can expect,” The Colorado Sun, June 20, 2023 https://coloradosun.com/2023/06/20/colorado-tabor-refunds-increase/

ix. Proposition HH: Reduce Property Taxes and Retain State Revenue Second Draft

x. https://leg.colorado.gov/sites/default/files/2018_local_government_handbook_with_cover_0.pdf

xi. Bell Policy Institute, “What is Debrucing,” February 9, 2023 https://www.bellpolicy.org/2019/07/12/what-is-debrucing/

xii. Steven L. Byers, “Colorado’s Housing Affordability Report: The Impact of Home Prices, Interest Rates, and Property Taxes,” Common Sense Institute, May 4, 2023 at https://commonsenseinstituteco.org/may-housing-affordability/

xiii. https://leg.colorado.gov/sites/default/files/documents/2023A/bills/fn/2023a_sb303_r5.pdf

xiv. https://gis.dola.colorado.gov/Residential_Value_Change/

xv. https://commonsenseinstituteco.org/dollars-and-data-a-look-at-pk-12-funding-and-performance-in-colorado/

xvi. https://fred.stlouisfed.org/series/COSTHPI

xvii. https://leg.colorado.gov/bills/sb23-108

xviii. https://leg.colorado.gov/bills/hb21-1164

xix. initiative%20referendum_2023-2024 sb23-303v2.pdf (colorado.gov)

xx. Emergency Rental Assistance Program | Department of Local Affairs (colorado.gov)

xxi. S2502: DEMOGRAPHIC CHARACTERISTICS … – Census Bureau Table

xxii. Renting Statistics [2023]: Facts & Trends in Rental Market (ipropertymanagement.com)