Author: DJ Summers

Following the loss of Proposition HH on the November ballot, Governor Jared Polis called a special legislative session to address significant increases in property taxes next year for most Colorado homeowners and businesses. Under a limited directive for the scope of the session, the legislature passed seven bills, 3 of which were directly related to property tax relief.

- HB23B – 1001 – Emergency Rental Assistance Grant Program | Colorado General Assembly

- HB23B – 1002 – Increased Earned Income Tax Credit 2023 | Colorado General Assembly

- HB23B – 1003 – Property Tax Task Force | Colorado General Assembly

- HB23B – 1008 – Appropriation For Department Of Treasury | Colorado General Assembly

- SB23B – 001 – 2023 Property Tax Relief | Colorado General Assembly

- SB23B – 002 – Summer Electronic Benefits Transfer Program | Colorado General Assembly

- SB23B – 003 – Identical TABOR Refund | Colorado General Assembly

Pending Tax Increase

Impact of Special Session

The special legislative session lowered the residential assessment rate for the 2023 tax year to 6.7% from 6.765% and allowed homeowners to exempt $55,000 of their home’s value from taxation. The average Colorado homeowner could still see a property tax bill increase of 25% (+$590) next year, even after the changes. That is down from 36% (+$847) under prior law. However, it is still significantly higher than seen in the past three decades. Barring additional changes in 2024, the assessment rate will rise to an estimated 6.976% for single family and 6.8% for multifamily residences in tax year 2024 in accordance with SB22-238.

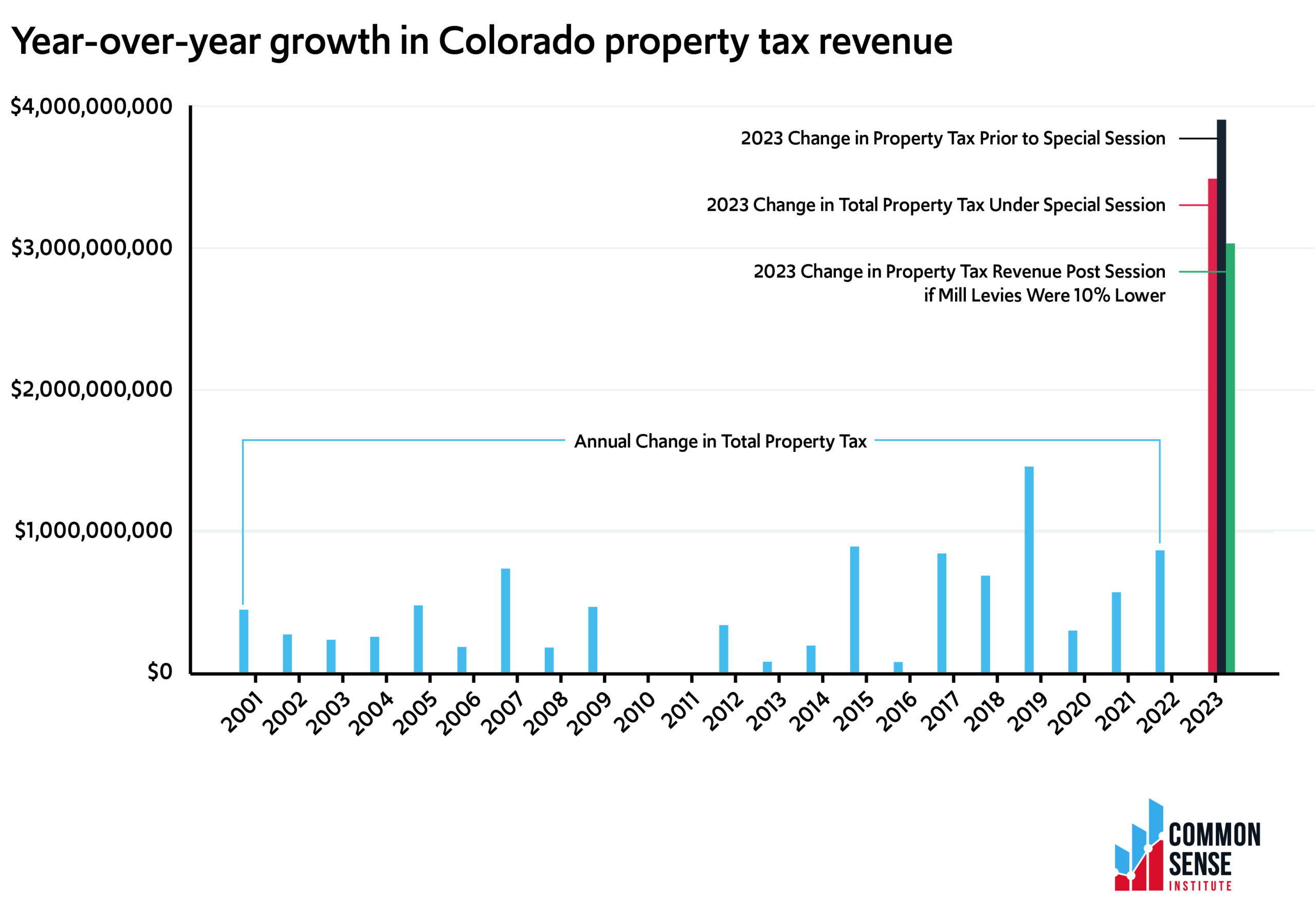

Between 2001 and 2023, Colorado total property tax revenues rose an average of $400 million per year. Under the new laws passed in November, they could rise $3.5 billion this year. That is compared to a $3.8 billion increase, that could have occurred, prior to the actions taken during the special session.

Impact of Local Mill Levy Reductions

While the state legislature reduced certain statewide property tax assessment rates, final property tax bills will also depend on final mill levies which are the specific tax rates applied by each local taxing jurisdiction e.g. City, county, school, fire, etc. Mill levies are currently being certified, and tax bills will be sent out shortly. That will determine exactly how much property taxes increase. If counties lowered their mill levies 10%, it would reduce the state’s projected property tax revenue from $3.5 billion to $3 billion. Therefore, even if actions were taken at local levels to reduce mill levies, property taxes will likely still climb well beyond the historical rate.

Bottom Line

It remains very likely that property tax revenue on a statewide level will outpace inflation. The Denver-Aurora-Lakewood Consumer Price Index rose 8% in 2022 and 5.22% in 2023, higher than national inflation. Property tax revenue, in comparison, rose 7% in 2022 and could increase by 27% or $3.5 billion in 2023. Coloradans will learn more in the coming weeks, just how much local governments choose to lower their mill levies to further offset annual revenue growth.

The property tax relief passed during the special legislative session only applied to one year. However, lawmakers also established a task force to study long-term reforms and recommend a path forward. This committee is convening and is required to have its report complete by March 2024.

To learn more about CSI’s research on all of these topics, please check out our reports here at www.commonsenseinstituteco.org