Economic Impacts and Opportunities for Improving Affordability and Access

ABOUT THE AUTHORS

Chris Brown is the Vice President of Policy and Research with CSI where he leads the research efforts of CSI to provide insightful, accurate, and actionable information on the implications of public policy issues throughout the state of Colorado.

Alexa Eastburg is a Research Analyst with Common Sense Institute. Her experience covers analyzing workforce, crime, and education issues in the state of Colorado.

Alethea Gomez is the Director of Programs and Initiatives at Executives Partnering to Invest in Children (EPIC). She has extensive experience overseeing large educational institutions in both leadership and administrative capacities, working privately and professionally with families, and creating vision, structure, and growth in the departments she has led.

Nicole Riehl has served as the President and CEO of Executives Partnering to Invest in Children (EPIC) since September of 2019. Her leadership experience spans across the private and non-profit sectors, with her career beginning as an early childhood teacher at Storagetek’s on-site employee child care program.

TEAMS & FELLOWS STATEMENT

CSI is committed to independent, in-depth research that examines the impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI’s commitment to institutional independence is rooted in the individual independence of our researchers, economists, and fellows.

At the core of CSI’s mission is a belief in the power of the free enterprise system. Our work explores ideas that protect and promote jobs and the economy, and the CSI team and fellows take part in this pursuit with academic freedom. Our team’s work is driven by data-driven research and evidence. The views and opinions of fellows do not reflect institutional views of CSI. CSI operates independently of any political party and does not take positions.

ABOUT COMMON SENSE INSTITUTE

Common Sense Institute is a non-partisan research organization dedicated to the protection and promotion of Colorado’s economy. CSI is at the forefront of important discussions concerning the future of free enterprise in Colorado and aims to have an impact on the issues that matter most to Coloradans.

CSI’s mission is to examine the fiscal impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI employs rigorous research techniques and dynamic modeling to evaluate the potential impact of these measures on the Colorado economy and individual opportunity.

Common Sense Institute was founded in 2010 originally as Common Sense Policy Roundtable. CSI’s founders were a concerned group of business and community leaders who observed that divisive partisanship was overwhelming policymaking and believed that sound economic analysis could help Coloradans make fact-based and common sense decisions.

ABOUT EXECUTIVES PARTNERING TO INVEST IN CHILDREN

Executives Partnering to Invest in Children (EPIC) is a group of prestigious business executives partnering to serve as the business community’s non-partisan voice for early childhood. As leaders in their companies and industries, EPIC Members are leaving a legacy of true impact and lasting change by leading efforts to build infrastructure and advance policies that support the workforce of today while developing the workforce of tomorrow.

The EPIC membership of business leaders is committed to a future where access to affordable child care and workforce preparedness are not roadblocks to business success and economic growth. Together, they are initiating change and shaping the future of Colorado through nonpartisan policy solutions, innovative partnership work with employers, and action-oriented conversations with business associations, government leaders, and other organizations to raise awareness and increase business engagement in early childhood.

Executive Summary

Colorado’s Child Care Business Model

The success of a flourishing economy, community, and workforce is dependent upon child care that is both accessible and affordable. But in Colorado, the business model for providing child care services have been strained for years. The COVID-19 pandemic has exacerbated the issue and brought to light how crucial it is for an economy to have access to affordable child care. The high-cost drivers of the child care business model keep profit margins low and leave many operating with bare minimum requirements and quality standards. In addition, the industry’s talent pipeline suffers, as child care businesses struggle to find, hire, and retain workers for a multitude of reasons.

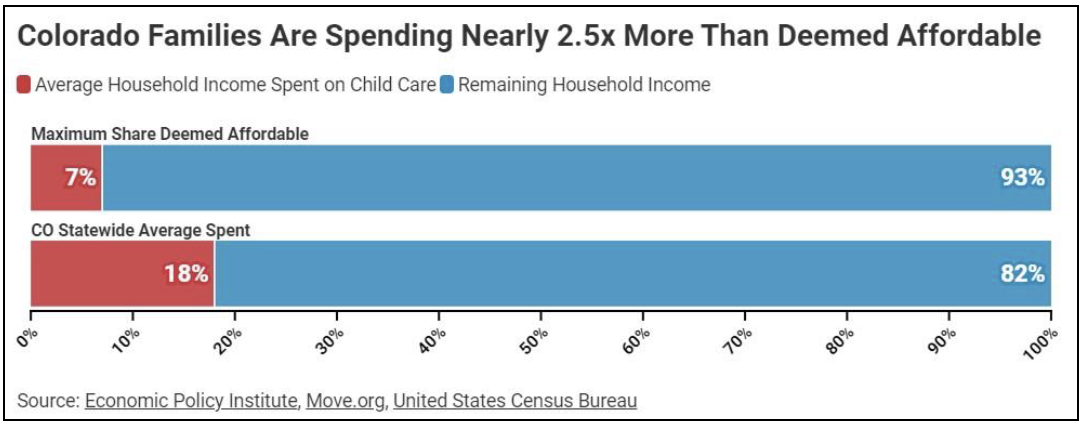

On average, a Colorado family spends about 18% of its annual household income on child care. However, the Department of Health and Human Services has stated that the affordable amount of household income a family should be allocating to child care is only 7% annually. The average annual cost of full-time infant care in Colorado is about $15,325, however, the actual costs of offering care for very young infants who require a great deal of one-on-one attention often exceeds $20,000 annually. Compared to other states, Colorado ranks eighth for the most expensive cost of early child care. The lack of supply of child care slots and the inaccessibility to affordable child care is a significant issue for Colorado families and the economy.

Why Does Fixing the Child Care Business Model Matter?

- The large economic impacts that effect Coloradan families and the economy.

- Unattractive hours and pay for teachers which has a compounding effect.

- Increased public spending to help child care businesses stay afloat.

If the challenges plaguing the business model are not addressed, the current system that provides child care in Colorado communities will quickly lead to less access for fewer children and families. Access to child care in Colorado is getting worse and the public cost of subsidizing the issue is only increasing. This analysis highlights how the model is already causing a financial burden for Coloradan families and impacting all facets of the child care business. Parents will continue to pay more and more as tuition rates continue to increase given they are the primary source of revenue for most child care operators. At the same time, qualified educators will continue to opt out of careers with low pay, high stress environments, and limited opportunities for advancement. Household expenditures on child care consume an unsustainably large share of each household’s budget. As the monthly child care expenditure continues to grow, spending in other areas of the economy will be crowded out. The result of the potential increase will put further demands on taxpayers.

Key Findings

The success of a flourishing economy, community, and workforce is dependent upon child care that is both accessible and affordable. Yet, the business model for providing child care services in Colorado has been strained for years and both supply and access have been declining. To become sustainable, the regulatory environment governing the child care business model needs to be overhauled. EPIC’s Child Care Design Lab Financial Model takes a deep dive into the total revenue and expenses for a child care business and incorporates the regulatory requirements they face. In using EPIC’s model, it is clear that the child care business model is strained and unsustainable. It is leaving most child care programs in Colorado unable to provide high quality services, pay wages that attract and retain qualified educators, and charge tuition that is affordable for parents without incurring major financial losses or receiving financial support from the government.

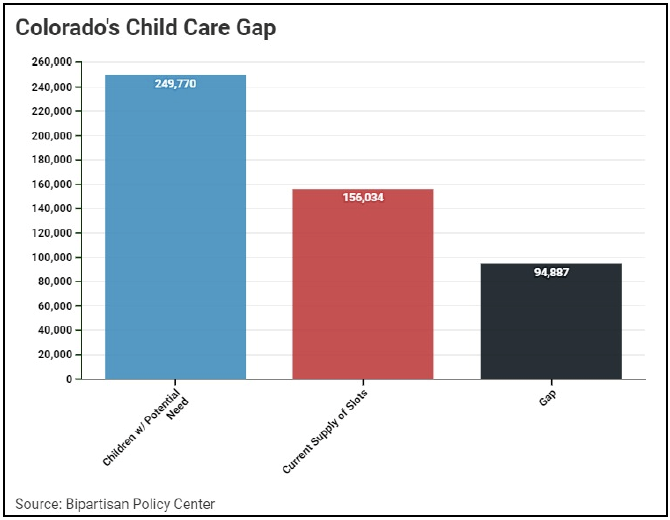

- The Child Care Gap Is Growing: As of the most recent data, Colorado has a child care gap of 94,887 children, meaning about 38% of children need child care but their families cannot reasonably access it.

- Providers Are Struggling to Get Started and Stay Open: From April 2018 to April 2021, a total of 913 child care programs permanently closed while only 486 programs opened in Colorado. Child care operators face higher occupancy costs, little to no flexibility in revenue generation, and logistical challenges many parallel industries do not face in a free enterprise environment.

- Families Are Still Paying Too Much: Colorado has the 8th most expensive child care in the nation. The Department of Health and Human Services recommends affordable child care should cost no more than 7% of a family’s annual income. But Colorado families are spending closer to 18% of their total income on child care. That’s equivalent to a family of four’s groceries for a year and a half, at a weekly cost of $191.30. The sample child care models demonstrated in this study will show how targeted investments in the business model itself will help to close that gap of affordability for Colorado families and significantly impact the viability of child care as a business, increasing access across the state.

- The High Cost is Impacting the Workforce: A family in Colorado with an infant and a 4-year-old on average would spend 37.9% of their household income on child care, topping what most spend on a mortgage. That would make child care the #1 household expense, which has driven many women out the workforce, especially mothers. According to Common Sense Institute’s (CSI) June report on “Colorado Jobs and Labor Force Update: May 2022,” there are 43,581 fewer women in the workforce than there would be if Colorado’s May labor force participation rate of women was the same as it was before the pandemic.

- Comprehensive Operational and Regulatory Reform Are Needed: While strides have been taken at the state and national level to address direct costs to families and expand the care spectrum, policy must be leveraged in order to streamline regulatory requirements in the industry, address barriers to entry, and reduce the significant operational costs providers are facing. Rather than creating additional government and public funding streams, targeted policy, and regulatory reform should be utilized to address the operating gaps in the child care business model, such as cost of care differentials for younger children, regulatory compliance, rent, and state/local taxes. This, in turn, will reduce the amount of additional public investment required.

Opportunities to Improve the Child Care Business Model

- Commercial property taxes, rent, and debt are the largest cost drivers in the child care business model that are primary areas for reform and do not sacrifice the quality of care the children receive.

- There is a glaring gap in data and a need for improved industry survey and analysis efforts related to the demographics, start-up barriers to entry, operations, financial health, and overall business needs for child care programs.

- Policymakers need to help support child care industry partners in collecting, analyzing, and reporting child care industry data so achievable solutions can be created, and success can be built upon.

- Opportunities to reduce ongoing facility expenses and taxes being paid to the state and local governments should be considered.

- The exploration of new methods to offer a co-signing or guarantee program could be beneficial to the child care industry as the financial barriers to entry are significant.

- State and local regulatory partners should explore ways to streamline application, review, and approval processes for child care businesses and provide a single point of contact who can serve as a navigator and liaison throughout the child care business process.

RELATED NEWS

Report: High costs preventing 38% of Colorado kids from child care access

“Colorado’s child care industry also continues to see consolidation, the report found. Between April 2018 and April 2021, more than 913 child care centers permanently closed in the state while 486 new programs opened. ‘The reality of that number translates into women staying out of the workforce and incredible strain on family budgets,’ said Alexa Eastburg, a Research Analyst at CSI.”

KPVI 6: July 19, 2022 by Robert Davis

Read >>

As child-care gap widens in Colorado, experts urge ‘creative’ ideas

“A new report from the Common Sense Institute and Executives Partnering to Invest in Children found that the gap in child care is growing – nearly 95,000 kids in Colorado need child care but can’t access it, which translate to about 38% of the state’s families…. A big part of the problem, the CSI report said, is the lack of affordability of child care. Colorado is the eighth-most-expensive place for child care in the U.S., costing families nearly 18% of their income.”

The Gazette: July 19, 2022 by Lindsey Toomer

Read >>

Introduction

The success of a flourishing economy, community, and workforce is dependent upon child care that is both accessible and affordable. Yet, the business model for providing child care services in Colorado has been strained for years and both supply and access have been declining. The COVID-19 pandemic has exacerbated the issue and brought to light how crucial it is for an economy to have access to affordable child care. The high-cost drivers of the child care business model keep profit margins low and leave many operating with bare minimum quality standards and requirements. In addition, the talent pipeline for the industry suffers, as child care businesses struggle to find, hire, and retain workers for a multitude of reasons, primary among them low wages and long hours. The pandemic has further strained this problem as fewer people are choosing to go back into the workforce, causing an even larger worker shortage for the child care industry. In January 2020, there was just over 1 million employees in the child day care services sector nationally. As of May 2022, there are only 937,000 employees in the sector.[i] While the child care workforce is down, demand for child care remains high, while quality care remains unaffordable and inaccessible for many families.

On average, a Colorado family spends about 18% of its annual household income on child care.[ii] However, the Department of Health and Human Services has stated that the affordable amount of household income a family should be allocating to child care is only 7% annually.[iii] The average annual cost of full-time infant care in Colorado is about $15,325, however, the actual costs of offering care for very young infants who require a great deal of one-on-one attention often exceeds $20,000 annually.[iv] Colorado ranks eighth for the most expensive cost of early child care in the nation.[v] The lack of supply of child care slots and the inaccessibility to affordable child care is a significant issue for Colorado families and the economy.

The Case for Free Enterprise

There is no greater engine to an economy than the free enterprise system. When competition drives market choices, consumers have the power and goods or services become more affordable. Unfortunately, an intense regulatory environment coupled with limited revenue and lack of access to capital and financing opportunities has rippled through the child care system, leaving businesses burdened with excess costs and reliant on funding from government and other sources to survive.

Regulatory requirements at the federal, state, and local levels, dictating student to staff ratios, square footage per student, minimum qualifications for teachers, and health and safety requirements in addition to others such as varied zoning and building processes that must be addressed in the development of a child care program, often create higher than normal costs across the landscape, with little promise of profitability or return on investment. These limiting factors have created a very rigorous business model leading to minimal opportunity for innovation or disruption.

According to the free enterprise argument, a business that cannot sustain itself would perhaps be allowed to fail and make room for the stronger competitors. However, the business of delivering child care services is increasingly viewed as a public good, deserving of public funding. Unlike car dealerships, restaurants or lawyers, child care services have received increased attention in the last decade from advocates interested in using public dollars to subsidize child care business.

One example is Colorado’s investment of $271 million of federal stimulus to support child care programs/providers statewide and to make quality child care easier to access and afford for Colorado families. [vi] This is an expensive proposition but can perhaps be addressed even more creatively by examining the child care business model itself.

While Coloradan parents have the choice of who will provide care for their children and how they will be cared for, child care programs do not currently operate competitively. Due to the supply constraints of the child care industry, the child care business model is not as profitable as it could be, and competition suffers. The average annual cost of full-time infant care in Colorado is about $15,325, however, the actual costs of offering care for very young infants who require a great deal of one-on-one attention often exceed $20,000 annually.[vii] The true costs of properly caring for very young children (infants and toddlers) are so high that very few parents can afford the true cost of care. This creates a restriction of affordable supply of child care in the market.

Oftentimes, this operating deficit is addressed by lowering wages or omitting benefits for teaching staff and by realizing small profits by serving children (pre-k/preschool) who are less expensive to care for. The net result is that the cost burden imposed by regulation and revenue structure leaves child care businesses little room to compete on price. If child care programs did not have to face such limited options for revenue and navigate numerous layers of complicated local, state, and federal regulations, application fees, and licensing requirements, the child care business model would likely be able to deliver more care at higher quality and lower costs.

An Insufficient Supply of Child Care & Lack of Affordability

While the pandemic led to additional funding for child care programs, those funds were largely one-time investments and barely enough to keep the programs open. According to the 2021 Bipartisan Policy Center’s (BPC) report “Child Care in 35 States: What we know and don’t know,” in 2019 Colorado had a potential need of 249,770 children but a supply of only 156,034 slots. This leaves a child care gap of 94,887 children, or 38% of children in Colorado.[viii] The BPC’s definition of a child care gap is the “number of children who potentially need care but whose families cannot reasonably access formal child care.” Although the BPC’s report was based on 2019 data, it is undeniable that the pandemic has reduced the supply of available child care slots. From April 2018 to April 2021, a total of 913 child care programs permanently closed while only 486 programs opened in Colorado.[ix]

While the pandemic led to additional funding for child care programs, those funds were largely one-time investments and barely enough to keep the programs open. According to the 2021 Bipartisan Policy Center’s (BPC) report “Child Care in 35 States: What we know and don’t know,” in 2019 Colorado had a potential need of 249,770 children but a supply of only 156,034 slots. This leaves a child care gap of 94,887 children, or 38% of children in Colorado.[viii] The BPC’s definition of a child care gap is the “number of children who potentially need care but whose families cannot reasonably access formal child care.” Although the BPC’s report was based on 2019 data, it is undeniable that the pandemic has reduced the supply of available child care slots. From April 2018 to April 2021, a total of 913 child care programs permanently closed while only 486 programs opened in Colorado.[ix]

According to the 2019 Census, the median household income of a Colorado family is approximately $77,100 annually.[x] On average, a Colorado family spends about $13,900 or 18% of their total income on child care for one child. That’s equivalent to a family of four’s groceries for a year and a half, at a weekly cost of $191.30.[xi] However, a typical family in Colorado with an infant and a 4-year-old would have to spend 37.9% of their household income on child care.[xii] The Department of Health and Human Services (DHHS) states that affordable child care should cost no more than 7% of a family’s annual income, which also aligns with other national level recommendations.[xii]

Based on this standard, Colorado families are spending nearly two and a half times more than the DHHS ideally expects families to pay for child care. Colorado ranks eighth for the most expensive cost of early child care in the nation.[xiv] The monumental cost of child care is compounding with inflation and the rising cost of living, and it is impacting Colorado families’ ability to afford and access quality care and learning environments for their children. At the same time, it is affecting Coloradan parents’ ability to justify returning to a career, which in many cases does not pay enough to cover the cost of child care tuition.

Economic Impact of Child Care Constraints

The lack of access to affordable child care has several ripple effects across the Colorado economy. For parents of young children that want to work, rising tuition prices or long wait times for slots can often mean removing oneself from the workforce. The cost of child care is expensive, and it is even more expensive when families have more than one child. The large amount of household income being spent on child care crowds out other opportunities for investment and growth.

The impacts of this were especially pronounced through the COVID-19 pandemic. According to Common Sense Institute’s (CSI) June report on “Colorado Jobs and Labor Force Update: May 2022,” there are 43,581 fewer women in the workforce than there would be if Colorado’s May labor force participation rate of women was the same as it was before the pandemic.[xv]

In a recent study conducted by McKinsey and Marshall Plan for Moms, 45% of mothers with children aged five and under who left the workforce during the COVID-19 pandemic cited child care as a major reason for their departure, compared with just 14% of fathers who said the same.[xvi] In the same report, 53% of working mothers with children five and under who left the workforce, decreased their hours or switched to a less demanding job chose to do so because of child care responsibilities. The financial burden and stress of the high costs of child care in Colorado often influences women, specifically mothers, to exit the workforce and for some, never return.

Modeling the Impact of Changing Costs to Improve the Business Model for Child Care Services

EPIC’s Child Care Design Lab Financial Model takes a deep dive into the total revenue and expenses for a child care business and incorporates the regulatory requirements they face. While many operators have unique considerations, the model includes assumptions for spacing requirements, staff to child ratio regulations, tuition rates, the number of staff and each position’s wage, and annual facility expenses (debt, rent, utilities, capital expenditures, insurance, and commercial property taxes, etc.). While using EPIC’s model, it is clear the child care business model is stressed and unsustainable, leaving most child care programs in Colorado unable to provide high quality services, pay wages that attract and retain qualified educators, and charge tuition that is affordable for parents without incurring major financial losses or receiving financial support from the government. To become sustainable, the funding and regulatory environment governing the child care business model needs to be overhauled.

To understand the impact of specific changes to the profitability of child care businesses across Colorado, CSI modeled multiple scenarios across four counties.

Model Scenario Counties

- Denver

- Larimer

- Pueblo

- Routt

EPIC’s model identified the largest non-labor cost drivers to be rent, commercial property taxes, and debt.

Model Scenario Variable Changes

- Debt

- Property Taxes

- Rent

- Tuition

Wages are one of the largest expense drivers, but while maintaining appropriate staff ratios is important, most indications from both sample and actual business models show that child care staffing to child ratios are in fact increasingly facing shortages. The number of staff and teachers required to support a child care program is key to maintaining a safe, sustainable, and quality learning environment. Despite its financial impact, reducing wages or limiting staff is not an appropriate solution to fixing the strained child care business model. In fact, one of the goals of reforming the current model is to increase staffing wages to create more quality care, retain staff, provide more career opportunities, and reduce staffing turnover. Instead, other cost drivers that can be impacted through policy and regulatory reform can be addressed to help drive access and sustainability for child care operations.

Cost Drivers with Opportunity for Regulatory Reform

| Commercial Property Taxes | 3% |

|---|---|

| Debt | 4-5% |

| Rent | 9-11% |

These percentages of the largest non-labor cost drivers are derived from the sample scenarios that CSI and EPIC chose to model for this report, and are not representative for every child care business model in the state. Addressing these cost drivers are the primary areas available for reform that do not sacrifice the quality of care the children receive. The percentage of total expenses that commercial property taxes, debt, and rent consume are based on local market characteristics. This analysis’ estimates are conservative as some child care programs in Colorado face lower operating expenses. There is not currently sufficient data for exactions. As a whole, child care businesses often have much higher commercial property taxes, debt, and rent expenses than modeled. In aggregate, these three expenses can account for 20% of total expenses for the program and are likely even more than this analysis’ estimates.

Opening and Operating a Child Care Program is Expensive and Time Consuming

Just like any other business, there are major startup and operating costs for a child care business. To open a child care business, a commercial building or space most often needs to be purchased or leased and, in some cases, built from the ground up. Once a site is identified, significant renovations and updates are typically required to comply with regulatory requirements that must occur before the building can be used for a child care business.

Some Expenses for a Child Care Business:

- Capital Expenditures

- Commercial Property Taxes

- Debt

- Equipment

- Food (if provided)

- Insurance

- Professional Services

- Rent

- Software

- Staffing and Administrative Wages

- Staffing Background Checks

- Staffing Benefits

- Staff Training and Development

- Technology

- Utilities

Space requirements and operating expenses are also unique and higher than most industries per occupant, which are based on the age of the children that the child care business serves. It takes more staff, resources, supplies, and space (at least 50 square feet indoor) for infants, ages 6 weeks–18 months. Children between 1 and 6 years old are required to have a minimum of between 30–45 square feet per child, while quality standards recommend more. An additional 1,500 to 2,500 of outdoor square feet is also typically required for a child care business. That is equivalent to about half the size of a National Basketball Association court.

Space Requirements per Child

| Age | Space Requirement in Sq. Ft. | Approx. Cost per Child at $16 - $21 / Sq. Ft. |

|---|---|---|

| 6 weeks - 18 months | 50 | $800 - $1,050 |

| 1 - 3 years | 45 | $720 - $945 |

| 3 - 4 years | 30 | $480 - $630 |

| 4 years and older | 30 | $480 - $630 |

It is important to note that the startup costs for opening a child care business are not directly included in the county models of this analysis for simplicity. However, this additional expense is indirectly based on how much debt the owner carries over into the child care business’ operations and presents another opportunity for regulatory reform and expedited support for current and potential operators.

RELATED NEWS

Report: High costs preventing 38% of Colorado kids from child care access

“The report, which was compiled by the Common Sense Institute (CSI) and Executives Partnering to Invest in Children (EPIC), analyzed the total revenue and expenses of running a child care center and juxtaposes those findings against the regulatory environment where the center operates.”

The Daily Sentinel: July 19, 2022 by Robert Davis

Read >>

CONVERSATIONS | Affordable & accessible child care: Colorado’s workforce challenge

“‘There is no greater stress for a working parent than finding a child care solution that fits the needs of your family. If something falls through, your life is upended really quickly. As a mom of four, I know that reality all too well.’ Said Kristin Strohm, President and CEO of Common Sense Institute in Greenwood Village.”

The Denver Gazette: July 19, 2022

Watch >>

Components of Child Care Business Operations and Model Assumptions Staffing and Wages

As stated, staffing wages can easily occupy between 50 and 70% of expenses in a typical child care business model. Both market and competitive wages per hour for each staff member were applied in this analysis with consideration for both industry competition and county norms. It is almost impossible for a child care business to attract and retain qualified employees if the business chooses to pay wages lower than the current market average, creating and compounding costs required to keep staff consistent and maintain quality supports for children.

Wages continue to be a primary driver for staff turnover in Colorado and across the nation. The July 2021 report released by the NAEYC found that 81% of the survey’s respondents stated low wages were the reason educators and staff leave the child care industry.[xvii] While 54% said that educators leave the industry because of the lack of benefits, followed by 33.3% saying the turnover was because of exhaustion and burnout. Only 8% said the strict regulations were the reason for staffing recruitment and retention problems.

High turnover rates in the child care industry leads to increased recruiting, training, and certification costs for new hires. In the state of Colorado, there are over 10 different pre-service and orientation courses child care staff are required to complete before being able to work at a child care business.[xviii] Additionally, there are eight areas of competencies that child care staff must complete. This covers at least 12 hours of training on child growth and development, child observation and assessment, family and community partnership, guidance, health, safety, and nutrition, professional development and leadership, program planning and development, and teaching practices. There are three additional hours of training on social emotional development.[xvix] All training requirements must be successfully completed before a new hire can begin to work with children in a child care business. This can be time-consuming and costly for both business operations and the employees themselves.

Debt

Most child care businesses require significant startup capital for renovations, equipment, and other capital investments to keep up with safety regulations, space, and other requirements associated with child care operations. Child care operators may acquire loans and other debt that must be paid back over time. For simplicity, $35,000 to $60,000 worth of annual debt service was applied to each of the sample child care business profiles. It is possible for some child care businesses to have significantly more or less debt based on their size and operational/startup needs. According to data shared with EPIC by the Reinvestment Fund, Small Business Administration (SBA) loan data indicates some Colorado child care businesses are carrying a debt of up to $5.5 million for new child care facilities that were constructed over the past five years. Reducing the debt load of a child care business is one crucial area that would have a positive impact on the sustainability of operations overall.

Occupancy and Enrollment

Due to space and other requirements, child care businesses face significantly high rent and associated costs of occupancy. After discussions with child care stakeholders and those operating child care businesses in Denver, Larimer, Pueblo, and Routt Counties the rent expense ranged between $16 and $21 per square foot or about $129,000 and $222,000 annually. In CSI’s estimates, the rent expenses in each county example are conservative estimates as many building owners may charge more than $21 per square foot. Because there are regulations on the square footage requirements per child, the higher the occupancy capacity of the business is, the more expensive the rent expense will be.

Infant and toddler care is by far the highest need in Colorado, however, when businesses choose to serve more infants and toddlers than children aged 3 to 6 years old, the cost of care per child far exceeds the potential for revenue. The occupancy costs of running a business exclusively for infants and children under 3 years old is the most difficult service to provide and simultaneously generate profit. This age range requires smaller child to teacher ratios, more square footage per child, and has a lower maximum group size allowed per classroom.

While there are some small child care businesses that can function on this operating basis, there are very few in the state of Colorado. Most child care businesses of this size operate in either the owner’s personal home or in a space free of occupancy costs like a church or other donated space. To breakeven or have a chance at profitability, Colorado’s child care businesses must serve children aged 3 to 6 in addition to infants and toddlers, driving scarcity and making programs less affordable for families.

Commercial Property Taxes

Commercial property taxes play a crucial role in the child care business model. In Colorado, commercial property taxes are currently estimated at 29% for child care businesses. However, it is estimated that over the next four years Colorado’s property taxes will increase by more than 20% if a statewide solution is not solidified soon.[xxi] Before the 2022 legislative session, all child care businesses in Colorado were subject to paying commercial property taxes unless they owned their building and were a nonprofit organization. However, House Bill 22-1106, the “Child Care Center Property Tax Exemption” became law on June 1st, 2022 and changed that requirement for some child care businesses.[xx] This bill expands state property tax exemptions to include property that is owned/rented and used strictly by a nonprofit child care business.

The passage of this bill may lead to improved access to affordable facilities for child care, allowing for more longevity and potential for increased wages and more affordable tuition. Several state officials have estimated that through the new law, about 56 existing child care businesses would be eligible for the property tax exemption.[xxii]

Tuition

The primary source of revenue for child care businesses is the tuition paid by families. Child care fees and tuition are inelastic, meaning the demand for child care and the change in price of child care does not move at the same rate. At the same time, parents’ ability to pay higher fees and tuition is inelastic.[xxiii] Because of this dilemma, many child care businesses are unable to generate sufficient revenue to cover the fixed costs each business has on a monthly and annual basis.

The Colorado Child Care Assistance Program, also known as CCCAP, provides tuition support for families with lower household incomes. The program is administered by individual counties, which each have their own unique payment rates, invoicing processes, and administrative policies. A Pueblo County child care provider serving a child between 6 and 12 months old would receive a maximum daily payment of $76.66 while the same provider located in the neighboring Huerfano County would receive $67.47.[xxiv] Alternatively, providers serving the same child in the same quality level program in Denver and Larimer Counties would receive $94.60 each day. Routt county, which comes closest to covering the true cost of care for an infant, would pay $136.50 each day while the neighboring Moffatt County would pay $84.66. The significant variation in payment rates, policies, and duplicative administrative processes can make it difficult for child care businesses to serve families who are struggling to find and afford child care, and often dissuades them from participating in the program entirely.

While there are loans and donations available for some child care businesses, as well as state funding for some subsidized grant programs, funding does not fully cover the cost of care and is often applied toward sustaining the bottom line of the business as opposed to operational or structural improvements such as wages or expansion. CSI used EPIC’s Financial Model Resource from their inaugural Employer Based Child Care Design Lab to better depict the high sensitivity the highest cost drivers have on sample child care business models in Denver, Larimer, Pueblo, and Routt Counties.

Child Care Business Model Scenarios

The businesses CSI chose to model reflect a diverse range of sizes, wages, tuition rates, and operating costs. Denver, Larimer, Pueblo, and Routt Counties were chosen to illustrate a sample child care business reflective of each county’s child care gap and demographic data considerations and include both rural and metro communities. A single sample child care business profile was modeled in each of the four counties, to clearly demonstrate the highest impact areas in the cost of care, as well as the common assumptions that impact quality, access, and affordability.

It is important to note that these models are not representative of all child care businesses in each of these counties nor all child care businesses in the state. However, each county specific model represents a realistic market example of the child care business model in each of these areas.

Denver County Market Business Model Scenario

Denver Co. Business Model Basics

| Revenue | $2,175,570 |

| Expenses | $2,167,323 |

| Annual Net Profit | $8,247 |

|---|

Denver County Model Parameters

| Capacity | 136 children |

| Children under 3 years old | 26% |

| Enrollment Rate | 81% |

| Colorado Shines Quality Rating | Level 3 |

| CCCAP Eligibility | 5% |

| Monthly Tuition | $1,550 - $2,066 per child |

| Staffing and Administrative Salaries | $16 - $30 per hour |

| Wages as a Share of Revenue | 59% |

| Staffing Benefits & Taxes | $318,816 |

| Benefits & Taxes as Share of Revenue | 15% |

| Facility Square Footage | 10,060 sq. ft. |

| Rent per Square Foot | $21 per sq. ft. |

| Provides Food? | No |

| Net Profit | $8,247 annually |

|---|

The Denver County model has a capacity of 136 students, a level at which a child care business can generally be profitable. At this capacity, there is sufficient enrollment to generate revenue to cover average expenses and serve enough older children to help balance the cost of care. Metro Denver has some of the highest occupancy rates per square foot, therefore child care businesses that serve less children face more financial difficulty and sustainability challenges when there are fluctuations in enrollment and staffing, as sudden changes in revenue can quickly overcome profits with high fixed occupancy costs.

Additionally, this model shows that to achieve even a low margin of profitability, wages must be kept at low market rates and a high and consistent enrollment level must be maintained, in this case above 75%. The business must stay within the minimum space requirements for children to keep occupancy costs down and is not able to provide food or serve a higher population of families eligible for tuition assistance through the Colorado Child Care Assistance Program (CCCAP), which does not cover the full cost of care per student.[xxv] These limitations, especially regarding wages, influence attrition rates and the overall quality of the business and the services it can provide. For example, the wages in this model are kept near 60% of total revenue to ensure a profitable run rate. If wages increased by $2 per employee in the business, the profit becomes a net loss of $152,133. If enrollment drops to 50%, the business’ profit becomes a loss of $1,079,538 annually. This demonstrates not only the high sensitivity in the financial assumptions, but the sometimes-uncontrollable conditions that can quickly change the operational viability of a child care business.

Larimer Co. Business Model Basics

| Revenue | $1,763,357 |

| Expenses | $1,746,602 |

| Annual Net Profit | $16,755 |

|---|

Larimer County Model Parameters

| Capacity | 98 children |

| Children under 3 years old | 37% |

| Enrollment Rate | 83% |

| Colorado Shines Quality Rating | Level 3 |

| CCCAP Eligibility | 10% |

| Monthly Tuition | $1,603 - $2,043 per child |

| Staffing and Administrative Salaries | $16 - $30 per hour |

| Wages as a Share of Revenue | 58% |

| Staffing Benefits & Taxes | $257,094 |

| Benefits & Taxes as Share of Revenue | 15% |

| Facility Square Footage | 9,020 sq. ft. |

| Rent per Square Foot | $20 per sq. ft. |

| Provides Food? | No |

| Net Profit | $16,755 annually |

|---|

The Larimer County model presents a business with a capacity of 98 children. However, with about 40% less capacity than the modeled Denver business, and a similar wage range, Larimer’s model profit is more than double Denver’s profitability. This illustrates the incredible challenge that marginal differences can have on the child care business model, and the limitations that come with the need and desire to decrease tuition, raise staff wages, and increase quality in the environment. If this business decided to lower tuition to 15% of the median income in Larimer County ($75,186) to better meet affordability recommendations and make the program more accessible to families with the highest need, its net profit would become a net loss of $734,165.[xviii] If this business paid its lead teachers a minimum starting wage of $21 per hour, its annual profit would become a net loss of $22,125, making it impossible to do so without significant capital support or expense mitigation.

Pueblo Co. Business Model Basics

| Revenue | $1,444,108 |

| Expenses | $1,436,160 |

| Annual Net Profit | $7,948 |

|---|

Pueblo County Model Parameters

| Capacity | 100 children |

| Children under 3 years old | 36% |

| Enrollment Rate | 86% |

| Colorado Shines Quality Rating | Level 3 |

| CCCAP Eligibility | 15% |

| Monthly Tuition | $1,315 - $1,750 per child |

| Staffing and Administrative Salaries | $16 - $28 per hour |

| Wages as a Share of Revenue | 68% |

| Staffing Benefits & Taxes | $88,355 |

| Benefits & Taxes as Share of Revenue | 6% - no benefits offered |

| Facility Square Footage | 8,080 sq. ft. |

| Rent per Square Foot | $16 per sq. ft. |

| Provides Food? | No |

| Net Profit | $7,948 annually |

|---|

The Pueblo County model calls out a business with a mid-range capacity of 100 children, 36% of which are under the age of three. With the decision to keep tuition below $2,000 per month per child and serve more families enrolled into CCCAP, the business is unable to generate the revenue required to pay staffing wages in the same range as the Denver or Larimer County models and the program is unable to offer benefits to staff. While wages occupy well over half of the revenue generated, the wage range for this model is still lower than the Denver and Larimer County models. This model helps to demonstrate the challenges businesses face in serving communities with lower median incomes and high need populations while attracting and retaining a quality workforce, maintaining quality, and keeping sustainability for their bottom line.

Routt Co. Business Model Basics

| Revenue | $1,166,835 |

| Expenses | $1,185,074 |

| Annual Net Profit | ($18,239) |

|---|

Routt County Model Parameters

| Capacity | 68 children |

| Children under 3 years old | 26% |

| Enrollment Rate | 87% |

| Colorado Shines Quality Rating | Level 3 |

| CCCAP Eligibility | 10% |

| Monthly Tuition | $1,555 - $1,792 per child |

| Staffing and Administrative Salaries | $16 - $28 per hour |

| Wages as a Share of Revenue | 58% |

| Staffing Benefits & Taxes | $170,586 |

| Benefits & Taxes as Share of Revenue | 15% |

| Facility Square Footage | 6,530 sq. ft. |

| Rent per Square Foot | $20 per sq. ft. |

| Provides Food? | No |

| Net Loss | ($18,239) annually |

|---|

The Routt County model calls out a business with a capacity of 68 children, a relatively small business, 26% of which are under the age of three. This business experiences a loss for several significant reasons. Regardless of its high enrollment rate, this business has set its tuition rates at the most affordable level possible for its community needs, while striving to provide an attractive benefits package to offset the lower end wages being paid to maintain its tuition levels. In addition, rural counties face unique and significant workforce and economic challenges due to location, size and housing availability, and compounding issues of access and affordability in these areas.

Rural, frontier, and resort regions are often in desperate need of child care but lack the facilities and trained staff required for child care programs. Even at the current wage rate, wages occupy well over half the model’s total revenue. This model would require a $500 per month tuition increase to breakeven and provide an hourly wage range of $18-20 for their educators and $21-30 for leadership, which is considered a more competitive wage range. Otherwise, the business would likely not be able to provide benefits for staff or serve the community’s child care needs. Without reducing key cost drivers, the quality and viability of this provider will continue to quickly decline.

The Routt County model demonstrates the challenges faced by child care centers outside of the metro Denver and front range areas. Like many others, this program struggles to benefit from economies of scale given the high fixed operating costs and administrative staffing associated with a child care business.

Model Assumptions Across Scenarios

While each of the county models highlights different areas of the child care business model, there are a few key expense areas to keep in mind. The first being that no food is provided in all the county models, which assumes that the families supply all food their children need throughout the day. If lunch and snacks were added into each county’s model, it would increase each child care business’ costs by $40,000 – $100,000 annually. Additionally, the square footage used in each of these models uses the state licensing minimums per child, not high-quality recommendations which ensure children and educators have ideal space for learning, play, and enrichment. Due to this and other considerations, the Colorado Shines Level has been maintained at Level 3 (Level 5 being the highest quality level possible) across the county models.

The modeled tuition rates are above the median for most of the county examples. However, lower staffing wages were used across all models in the analysis. The Pueblo County model provides no benefits to its staff to obtain profitability. Lastly, the example models do not account for any payment or compensation being made to the owner of the child care business. It is common in the child care industry for the owner to also be the administrative director of the business. In that case, the compensation to the owner would be included in the modeling.

Can Policy and Regulatory Changes Create Sustainability?

To provide examples of the sensitivity and impact of the key cost drivers in the child care business model and demonstrate the challenges child care businesses face, adjustments were made within the models. Without business model reform, the child care industry and its constraints will only worsen.

Child care businesses are struggling inequitably within the current operational constraints to solve the challenges that restrict their growth, longevity, and success. Regulatory and policy shifts that help mitigate occupancy and other significant cost drivers can help balance costs to operators, supporting greater success and sustainability over time for child care, as well as impacting affordability to families and improved wages for staff. While child care businesses strive to set lower tuition rates for families, it is nearly impossible to achieve unless the quality and viability of the business suffers significantly, as tuition remains the primary and often only source of revenue. Rent is another cost that the business cannot decrease directly without additional grants or more specialized in-kind tenant agreements, and the less square footage a business has, the fewer children they can care for in that business, reducing their ability to generate revenue effectively. Child care businesses have some control over the cost of capital expenditures and debt, but not often enough to impact the infrastructure as a whole.

The first scenario that was analyzed looked at a model simply increasing tuition costs to mitigate profit margins. Higher tuition rates (increased by 25%) with commercial property taxes and rent below the market rate (both decreased by 25%) and no debt, essentially the perfect scenario for everyone but Coloradan parents. All other variables were held at each business’s profile rate. In this scenario, each of the four counties were profitable and achieved the excess capital needed to increase wages by about 10 – 15% per employee depending on the county the child care business is located in.

Scenario #1: Higher Tuition, Lower Rent, No Debt, Lower Taxes

| Denver County | Larimer County | Pueblo County | Routt County | |

|---|---|---|---|---|

| Revenue | $2,691,566 | $2,162,363 | $1,755,792 | $1,426,873 |

| Expenses | $2,043,545 | $1,654,408 | $1,359,142 | $1,106,856 |

| Profit | $648,021 | $507,955 | $396,650 | $320,017 |

| Change from Original Model | $639,774 | $491,200 | $338,702 | $338,256 |

Again, this would be the perfect situation if it did not require the child care businesses to charge parents above the market rate for tuition, as it is already inaccessible and unaffordable for many families. As demonstrated here, small changes or reductions in occupancy and tax obligations are not enough to prevent businesses from having to increase their tuition significantly and periodically to remain sustainable, passing that cost to Colorado families, keeping many of them from reentering the workforce with concerns of tuition outweighing their potential income. Instead, regulations, community partnerships, and future policy that focuses on drastically reducing or eradicating occupancy rates and property tax obligations for child care businesses can allow for a greater balance of operations and opportunity for longevity.

The second scenario explores a model in which tuition is affordable for most families, teachers are paid at competitive wages and the center has managed to operate without debt. In theory, this might be an ideal scenario for child care businesses and families. However, EPIC’s financial model demonstrates that in this scenario, the loss of tuition impacts the bottom line dramatically, making it impossible to sustain operations when tuition is at a level families can afford, and wages are set at a level that supports retention of qualified educators. All county scenarios were unprofitable in this scenario, as the main revenue driver was reduced, and the greatest cost driver was increased.

Scenario #2: Lower Tuition, Higher Wages, No Debt

| Denver County | Larimer County | Pueblo County | Routt County | |

|---|---|---|---|---|

| Revenue | $1,659,574 | $1,364,350 | $1,132,424 | $906,796 |

| Expenses | $2,498,103 | $2,021,984 | $1,659,003 | $1,354,405 |

| Profit/Loss | ($838,529) | ($657,634) | ($526,579) | ($447,609) |

| Change from Original Model | ($846,776) | ($674,389) | ($534,527) | ($465,848) |

What if the Rent Expense is Eliminated?

Using EPIC’s financial model, CSI modeled a child care business that eliminated the rent expense while holding all other variables at the previous rate. This situation would be possible if a space was already owned and gifted to a child care business for use. For example, a church could offer up its space for free (charging no rent) so a child care business could operate within the community. Many child care businesses are based in churches across the U.S. for this very reason. In December 2020, The Bipartisan Policy Center found in a national poll that 31% of working-parent households used center-based care, and over half, or 53%, of these families used one that was affiliated with a faith organization.[xxv] In addition, spaces owned by the state or other entities that wish to invest in or support child care access could be offered at little or no cost to the operator, without having to further directly subsidize the tuition or ongoing operations of the center.

Keeping the idea of having a free space to utilize for a child care business in mind, CSI wanted to see how the profitability of a child care business would change, if at all, when the rent expense is taken out of the child care business model.

Child Care Business Profitability Without a Rent Expense

| Denver County | Larimer County | Pueblo County | Routt County | |

|---|---|---|---|---|

| Revenue | $2,175,570 | $1,763,357 | $1,444,108 | $1,166,835 |

| Expenses | $1,945,563 | $1,566,202 | $1,306,879 | $1,054,474 |

| Profit/Loss | $230,007 | $197,155 | $137,228 | $112,361 |

| Change from Original Model | $238,254 | $213,910 | $145,176 | $130,600 |

The profitability for every county model, when this singular cost driver is eliminated, ranges from a 616% to 2,690% increase in profitability. As stated, due to the space requirements, liability, and ongoing costs of operating a unique environment like a child care center, reduction, or elimination of occupancy costs like rent are enough to impact the bottom line significantly and help make the difference between 2 and 10 years of operation.

While strides have been taken at the state and national level to address direct costs to families and expand the care spectrum, policy must be leveraged in order to streamline regulatory requirements in the industry, address barriers to entry, and reduce the significant operational costs providers are facing. Rather than creating additional government and public funding streams, targeted policy and regulatory reform should be utilized to address the operating gaps in the child care business model, such as cost of care differentials for younger children, regulatory compliance, rent, and state/local taxes. This, in turn, will reduce the amount of additional public investment required.

The Impact on the Colorado Economy and Jobs

CSI estimates that child care programs operating at a net loss would need to increase their tuition rates by 15% on average to breakeven. As of the year end of 2021, there were a total of 3,726 child care programs in the state.[xxvi] This means that the statewide total tuition increase required for programs to breakeven would be about $249 million per year. Modeling the required 15% average tuition increase in the REMI Tax PI Economic Model, it would result in 1,975 jobs lost and a loss of $167 million to Gross Domestic Product (GDP) in Colorado. This illustrates the unsustainability of the average child care financial model in Colorado. While the issue of affordable and accessible child care directly impacts the parents of the children that need care, it also affects the overall economy and serves as a limiting factor to Colorado’s growth and competitiveness. Creating more access to affordable child care would have immense benefits on Colorado’s economy.[xxvii]

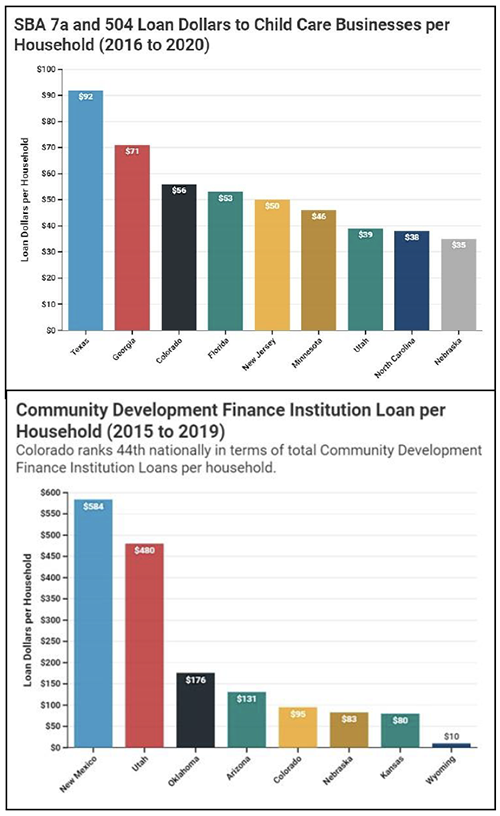

Lack of Access to Capital Financing and Funds

In addition to the lack of child care slots, Colorado child care businesses are also lacking in their ability to start new programs and access funds. A data analysis completed by the Reinvestment Fund for EPIC in 2022 revealed that child care businesses in Colorado are lagging in access to Small Business Administration (SBA) and Community Development Finance Institution (CDFI) lending when compared to other states and other industries. From 2016 to 2020, there were 89 U.S. SBA 7a and 504 program loans given to child care businesses. The average SBA loan size was $1.35 million, and the total amount was $120 million. For comparison, full-service restaurants were given 325 loans totaling about $179 million and beauty salons were given 76 loans totaling $20.5 million within the same time frame.

In Colorado from 2015 to 2019, a total of 2,059 loans were given to businesses certified by CDFI’s, totaling $23.5 million. Of the 2,059 loans, only 22 of them were for child care projects, totaling $1.3 million in certified loans. These 22 projects accounted for 5.5% of the total CDFI certified business loans.

The SBA and CDFI lending data indicates that, on average, child care businesses obtain significantly larger loans than other businesses for start-up, and in almost every case, the only child care businesses that obtained SBA loans for construction of new facilities were associated with large, national franchised operators with significant financial backing. Due to the space and specialized requirements for child care facilities, child care businesses often require 2.5 to 10 times the amount of funding seen in other industries for initial startup.

How Colorado Ranks in Access to Capital for Child Care

Colorado is the third state in the nation for Small Business Administration (SBA) loan dollars given to child care businesses per household from 2016 to 2020. While the additional funding is beneficial for these businesses, the money remains a loan and the businesses will eventually have to pay the loans back with interest. SBA 7a and 504 loans are only beneficial for child care businesses that are for-profit. According to the U.S. Small Business Administration, nonprofit businesses are ineligible to apply for SBA 7a and 504 loans.[xxviii]

Colorado is the third state in the nation for Small Business Administration (SBA) loan dollars given to child care businesses per household from 2016 to 2020. While the additional funding is beneficial for these businesses, the money remains a loan and the businesses will eventually have to pay the loans back with interest. SBA 7a and 504 loans are only beneficial for child care businesses that are for-profit. According to the U.S. Small Business Administration, nonprofit businesses are ineligible to apply for SBA 7a and 504 loans.[xxviii]

Colorado ranks 44th nationally for total Community Development Finance Institution loans per household, with only $95 given per household on average. Child care businesses should have access to and be made aware of the option to apply for CDFI loans when thinking of ways to start their businesses. While Colorado’s rankings for child care funding and investments may seem discouraging, it is difficult to compare child care businesses and their funding in different states. Each state has their own set of regulations, requirements, and staffing ratios, so funding may vary based on the different standards of child care.

It is not as simple as looking at which state is ranked first in each funding category and emulating how they support their child care businesses, but instead evaluating the potential impact being missed by child care businesses by not having access or engagement of these funds.

Sustainability and Profitability of the Child Care Business Model

After running numerous scenarios in EPIC’s Child Care Design Lab Financial Model, it is clear that child care businesses who care for less than 50 children are not profitable and therefore unsustainable. Facilities serving fewer children are not able to benefit from economies of scale and have fixed operating expenses to spread across fewer children and less revenue. While the child care business’ administration has some choice of the location their business will be in, the administration does not have much say on the price of rent each month. For the scenarios CSI ran, the rent per square foot ranged from $16 to $21 per square foot and there are buildings that charge well above $21 per square foot. CSI’s scenarios assumed state licensing minimums as well as quality recommendations for square footage allowance per child.

Debt is another area of expenses that is extremely difficult to reduce when operating a child care business, especially when starting a business. To prepare a building to house a child care business, there are many specific regulations and requirements that the building must meet, and the business owner must pay for. Usually, these renovations are not subtle changes and would require significant capital funding or approval of loans to pay back in the future. The range of debt service cost used in the financial model was $40,000 to $60,000 annually. A business larger than 100 children could have much higher debt and debt service costs.

Commercial property taxes are another large expense for child care businesses. The tax amounts used are based on conversations CSI and EPIC had with child care business owners and those involved in the industry. The estimated commercial property taxes in these sample business profiles were between $35,000 and $60,000, depending on the capacity and location of the mock business. These estimates are conservative as some child care businesses serving more than 100 children report paying between $80,000 and $120,000 per year on commercial property taxes.

It is important to note that nonprofit child care businesses in Colorado will become exempt from paying commercial property taxes because of House Bill 22-1006 “Child Care Center Property Tax Exemption” becoming law.[xxix]

HB22-1295 Department of Early Childhood and Universal Preschool Program

As the 2022 legislative session comes to an end, one bill may influence the child care business model. HB22-1295, Department Early Childhood and Universal Preschool Program, was signed by Governor Polis on April 25th, 2022.[xxx] The signing of this legislation means that by fall 2023, all children in the year before kindergarten in the state will be able to attend 10 hours per week of preschool for free during the school year. According to state estimates, this program will save Colorado parents of children in the year before kindergarten an average of $4,300 per year in child care costs.[xxxi]

Under the legislation, parents will choose a licensed preschool provider within their community where their children will have access to preschool. HB22-1295 also establishes the new Department of Early Childhood, which will create a single application for the preschool program. The new department will aim to streamline the early childhood system and relocate the early childhood related programs that the Department of Human Services and the Office of Early Childhood are currently tasked with. The universal preschool program and the Department of Early Childhood will cost more than $365 million through 2024.[xxxii] Funding for this legislation will come from taxes on nicotine and tobacco products (more than $190 million) and the state’s general fund or education fund ($127 million).[xxxii]

While HB22-1295 is a step in the right direction for Coloradan parents accessing affordable child care, Colorado should take steps to avoid unintended consequences on the child care system altogether. The state is facing a dire need for additional early childhood teachers and related support positions like therapists, interventionists, and mental health specialists. The bill focuses solely on giving parents of children in their year before kindergarten 10 free hours per week of preschool. Some child care businesses may decide to transition current infant classrooms to classrooms for preschool children due to the cost of care for infants and toddlers and the potential increased need for preschool care.

Opportunities to Improve the Child Care Business Model

Through their Building Up Initiative, EPIC has convened industry partners, child care operators, and a variety of subject matter experts to identify ways to provide relief and create improved sustainability for the child care business model. [xxxv] Through conversations and explorations of this analysis, several policy and reform opportunities have risen to the top of the list.

Data

While this report has peeled back several layers of the child care business model, there is still much that remains unknown about the child care business model and the child care industry. There is a glaring gap in data and a need for improved industry survey and analysis efforts related to the demographics, startup barriers to entry, operations, financial health, and overall business needs for child care programs. Colorado policymakers need to find ways to support child care industry partners in collecting, analyzing, and reporting data so solutions can be created, and successes can be built upon. Without ample data on the child care industry, it is extremely difficult for policymakers and business leaders to find effective solutions to address the stressed and unsustainable business model.

Public and Private Investment

As Colorado legislators and policy leaders consider investment of public dollars, opportunities to reduce ongoing facility expenses and taxes being paid to the state and local governments should be considered. Tax credits that reduce tax liability of for-profit child care businesses may be highly effective in freeing up revenue that can be used towards higher wages for teaching staff, higher quality care, and lower tuition costs for families. Given the high cost of providing care for infants and toddlers, and the lack of available care for those age groups, any additional investments of public funding into direct tuition assistance for families (such as CCCAP) or child care businesses should be targeted to those younger age groups while ensuring payment rates reflect the cost of care being provided. Tuition assistance programs for families should also be streamlined for efficiency, consistency in payment practices, reduced administrative burden, and ease of access for child care businesses.

Employers and private entities are reliant upon a well-functioning child care industry to attract and retain the talent they need to support their growth, operations, and ability to compete within their own industry. As such, it is critical for these entities and their leaders to not only advocate for the importance of this work, but to also find ways to invest in the child care supply and needs of their communities. While some employers across Colorado have launched new on-site child care facilities, others are working to impact these issues through their corporate philanthropy or have created consortiums of multiple employers to establish new child care programs within communities.

Real Estate

Investments that help local child care business operators find lower cost real estate, build their teaching workforce, and start new businesses without significant debt burdens should also be prioritized. Child care businesses have a greater chance at long-term sustainability and can serve families and children better if they have minimal operating expenses associated with their facilities. Underutilized real estate owned by public entities, political subdivisions, and faith-based institutions may present an ideal opportunity for child care. Tax credits and other financial benefits or grants may incentivize landlords, developers, and real estate owners (including individual homeowners) to utilize their assets to expand child care options within their communities. New technology or database solutions may also be beneficial to connect potential child care business owners with technical assistance, information, and lower cost real estate opportunities within their communities.

While this report did not specifically address the financial models of in-home child care, family child care homes can be an effective way to meet the unique schedule, language, or cultural needs of families while providing affordability and consistent care to children over their years of development. Family child care homes are also critical for rural communities where real estate and workforce can be limited and economies of scale are difficult to achieve for child care centers. Given the closure of hundreds of family child care homes over the past decade and reports that home ownership and affordability have become barriers for this portion of the sector, strategies to support individuals in accessing affordable homes that can also serve as family child care home programs may also present an opportunity to address the child care gap.

Financing

With lending opportunities declining and in short supply for most child care businesses, access to capital, flexible underwriting, and support with navigating potential funding sources has emerged as a critical need. The significant up-front investment required to renovate or construct thousands of square feet of real estate for child care purposes can lead to significant debt, and access to an organized and blended combination of public, private, and philanthropic capital funding to support such expenses could make a significant difference in the success of a child care business. The child care business model is exceedingly difficult to underwrite from a traditional lending perspective and the exploration of new methods to offer a co-signing or guarantee program could also be beneficial to the industry.

Regulation

Starting a child care program is a daunting task for any individual or organization choosing to pursue such an endeavor. Simply navigating and understanding the multiple stages and layers of regulatory rules, applications, and compliance is often difficult enough to dissuade even the most committed business owners from entering the industry. Other conversations with child care business owners have revealed lengthy and complex zoning review and building permitting processes that have made it nearly impossible for a new child care business to pay its debt obligations for months, or sometimes even years, without any revenue. Given these challenges, state and local regulatory partners should explore ways to streamline application, review, and approval processes for child care businesses and provide a single point of contact who can serve as a navigator and liaison throughout the process. Similar models have begun to emerge for social equity business incubator programs in the cannabis industry and affordable housing sector, also highly regulated, and may be beneficial to replicate for child care. In addition, streamlined inclusionary zoning or “by right” zoning recommendations, often cited as solutions for streamlining and supporting affordable housing, may also prove to be beneficial for the child care industry.

Conclusion

Virtually all child care operators face significant and unique barriers in sustaining and operating their businesses. Affordability and access to quality child care is an issue that must be addressed in Colorado’s communities to further economic growth and thrive far into the future. While there are no single or blanket solutions to remedy this issue, this landscape analysis and subsequent recommendations serve to not only daylight these barriers, but also highlight the areas of greatest impact and most feasible regulatory shifts to combat this issue and begin to reverse the crisis that has encroached upon the child care industry. Recognition and a deeper understanding of the cost of care and the child care business model will help to generate partnerships, contributions, and ideas that can begin to affect fundamental change in the child care industry in Colorado. Through this report, planning and development of solution-oriented policy and regulatory action will continue, as well as further comprehensive analysis of current and future issues in early care and education, with the ongoing goal of increasing access, affordability, and quality.

© 2022 Common Sense Institute

[i] BLS Data Viewer | Beta Labs

[ii] Average Cost of Child care by State | Move.org

[iii] Child care costs in the United States | Economic Policy Institute

[iv] Child care costs in the United States | Economic Policy Institute

[v] Child care costs in the United States | Economic Policy Institute

[vi] Financial Support for Colorado Child Care Programs and Professionals | Growing Forward

[vii] Child care costs in the United States | Economic Policy Institute

[viii] Child care Gaps in 2019 – Colorado | Bipartisan Policy Center

[ix] Fewer Colorado Child care providers closed during COVID | Chalkbeat Colorado

[x] 2019 Median Household Income in the United States | U.S. Census Bureau

[xi] Your Family’s Food Budget: How Much to Spend on Groceries | Prioritized Living

[xii] Average Cost of Child care by State | Move.org

[xiii] Child care costs in the United States | Economic Policy Institute

[xiv] Child care costs in the United States | Economic Policy Institute

[xv] Colorado Jobs and Labor Force Update: May 2022 | Common Sense Institute

[xvi] The conundrum of Child care for working parents | McKinsey

[xvii] Progress and Peril: Child care at a Crossroads | NAEYC

[xviii] Colorado Office of Early Childhood | Oec_providers | Providers

[xix] Colorado Office of Early Childhood | Oec_providers | Providers

[xx] Colorado property tax rates poised to skyrocket in coming years, report by business group finds | Legislature | Colorado Politics

[xxi] Child care Center Property Tax Exemption | Colorado General Assembly

[xxii] House committee approves bill to exempt non-profit Child care centers from property tax. Assembly | Colorado News

[xxiii] The Importance of Ensuring Adequate Child care in Planning Practice | American Planning Association

[xxiv] CHATS Mod County Rate Plans | Colorado Department of Early Childhood

[xxv] Colorado Child Care Assistance Program For Families | Colorado Department of Early Childhood

[xxvi] Examining the Role of Faith-Based Child care | Bipartisan Policy Center

[xxvii] Fewer Colorado Child care providers closed during COVID | Chalkbeat Colorado

[xxviii] The conundrum of Child care for working parents | McKinsey

[xxix] Eligible and Ineligible Industries for SBA 7(a) Loans | SBA7a.Loans

[xxx] Child care Center Property Tax Exemption | Colorado General Assembly

[xxxi] Gov. Jared Polis signs bill for free universal preschool | Government | The Denver Gazette

[xxxii] Department Early Childhood And Universal Preschool Program | Colorado General Assembly

[xxxiii] HB22-1295 Department of Early Childhood and Universal Preschool Program | Bill Text | Colorado General Assembly

[xxxiv] HB22-1295 Department of Early Childhood and Universal Preschool Program | Bill Text | Colorado General Assembly

[xxxv] Get Involved | Become an EPIC Member