Colorado’s Revenue Outlook Has Rapidly Changed from Record Highs to a Potential $3 Billion Shortfall

AUTHORS: CHRIS BROWN | SIMON LOMAX

APRIL 2020

ABOUT THE AUTHORS

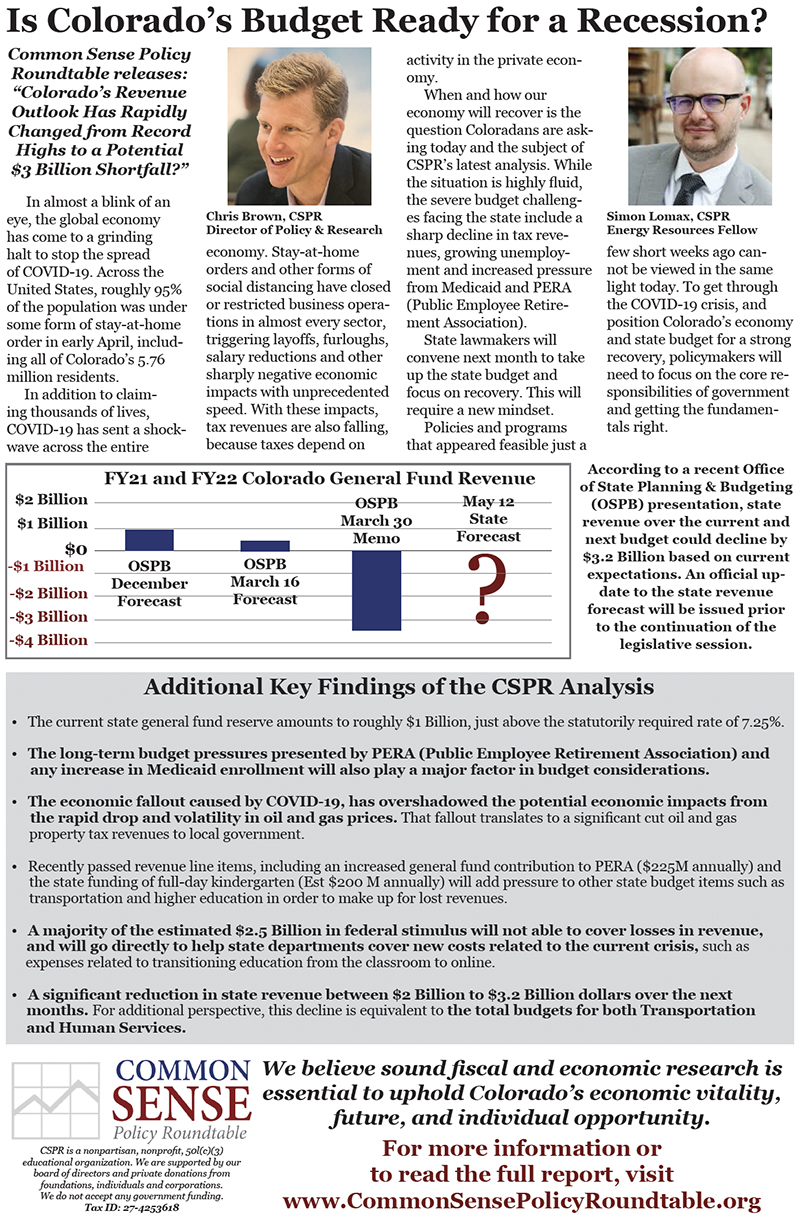

Chris Brown is the Director of Policy and Research with the Common Sense Policy Roundtable where he leads the research efforts of CSPR to provide insightful, accurate and actionable information on the implications of public policy issues throughout the state of Colorado.

Simon Lomax is the Energy Resources Fellow with the Common Sense Policy Roundtable where he brings more than 20 years working in journalism, government and public affairs in the United States and Australia. Mr. Lomax is a former congressional fellow with the American Political Science Association and a former energy and environmental reporter for Bloomberg News. Since 2012, he has worked with think tanks, trade associations and business groups to advocate for limited government and free-enterprise approaches to public policy.

ABOUT COMMON SENSE POLICY ROUNDTABLE

Common Sense Policy Roundtable is a non-profit free-enterprise think tank dedicated to the protection and promotion of Colorado’s economy, our mission is to research and promote common sense solutions for the most pressing public policy issues facing Colorado. We examine the economic impact of policies, initiatives, and proposed laws by employing dynamic modeling that accurately measures the impact of each measure on the Colorado economy and individual opportunity. To fully achieve our mission, we actively promote these solutions through the education of policy experts, lawmakers, community leaders, and the general public.

CSPR was founded in 2010 by a concerned group of business and civic leaders that saw divisive partisanship was overwhelming the issues, and objective economic analysis was not being presented to lawmakers and voters empowering them to make fact-based and common sense decisions.

AUTHOR’S NOTE

This report does not stand in judgment of any policy, any decision or any action aimed at protecting the vital public health interests of Colorado and the nation amid this crisis. Aggressive steps to slow the spread of the Coronavirus are indisputably critical. Colorado’s political leaders have, by in large, approached these decisions in a bipartisan way, and with sober and sensible resolve. This report does, however, frame the nature of the trade-offs for the people of Colorado if sweeping policies that prevent large segments of the citizenry from working stay in effect over-time. It has been said — to govern is to choose. As policy makers weigh these difficult decisions in the coming weeks, this report gives color to both the systemic and the highly-personal impact of one range of scenarios on the people of this state.

Executive Summary

In almost a blink of an eye, the global economy has come to a grinding halt to slow the spread of COVID-19. Across the United States, roughly 95% of the population was under some form of stay-at-home order in early April, including all of Colorado’s 5.76 million residents.1

In addition to claiming thousands of lives, COVID-19 has sent a shockwave across the entire economy. Stay-at-home orders and other forms of social distancing have closed or restricted business operations in almost every sector, triggering layoffs, furloughs, salary reductions and other sharply negative economic impacts with unprecedented speed. And because taxes depend on activity in the private economy, tax revenues are also falling.

At this point, it is highly uncertain when stay-at-home orders will be eased, to what degree businesses will be able to function once they are and how long it will take for the economy to return to its pre-COVID-19 levels. As a result, our state economy and state budget are in a deep dive, and little is known about when things will level off and start to recover.

While the situation is highly fluid, at the time of publication, the severe budget challenges facing the state and key findings of this report include:

- Current expectations suggest that while the most severe economic contractions will occur in the near-term, impacts to the state budget will play out for years to come.

- Recent statements from the Colorado Joint Budget Committee, and information contained within a presentation released by the Governor’s Office of State Planning and Budget, suggest rough estimates of a reduction in state revenue between $2 Billion to $3.2 Billion dollars over the next 15 months, or the remainder of FY20 and the full 2021 fiscal year. This amounts to between $871 and $1,305 per Colorado household.

- For additional perspective $3 Billion equals the total budgets for state spending on Transportation and Human Services combined. It is also equal to the state appropriations to 16 state agencies combined including public safety, judicial, public health and the environment along with 13 others.

- The current state general fund reserve amounts to roughly $1 Billion, just above the statutorily required rate of 7.25%.

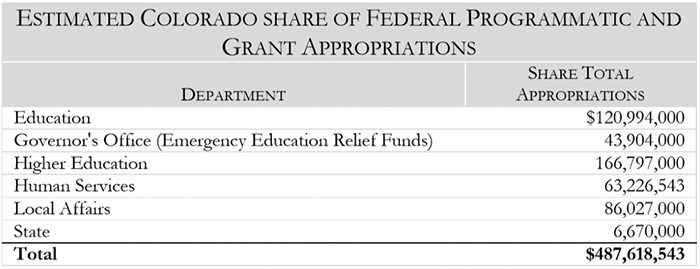

- While details still need to be filled in, a majority of the estimated $2.5 Billion in federal stimulus will not able to cover losses in revenue, and will go directly to help state departments cover new costs related to the current crisis, such as expenses related to transitioning education from the classroom to online.

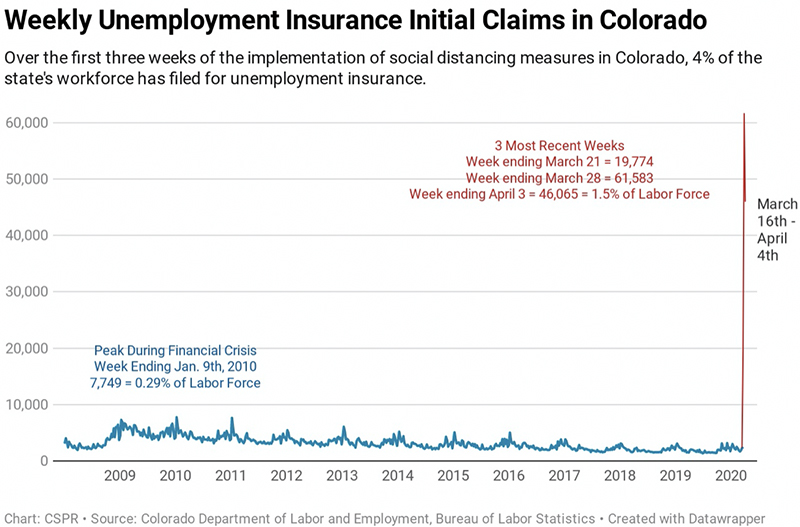

- Unemployment claims through the first three weeks of the crisis indicate 4% of the state labor force has filed for unemployment insurance. Those numbers are only expected to increase, and with no clear picture of how long or how severe of social distancing measures will be in place, any new regulation or direct increase in costs will only exacerbate the problem workers and businesses face.

- While it may be tempting to continue to pursue policies which appeared feasible and attractive just a few (long) weeks ago, the circumstances today are dramatically different and require an entirely different set of policy priorities.

- The long-term budget pressures presented by PERA and any increase in Medicaid enrollment will also play a major factor in budget considerations.

- PERA was already planning contribution increases over the next two years, which almost certainly will not be enough to keep the funds on track to pay off the unfunded liability within 30 years.

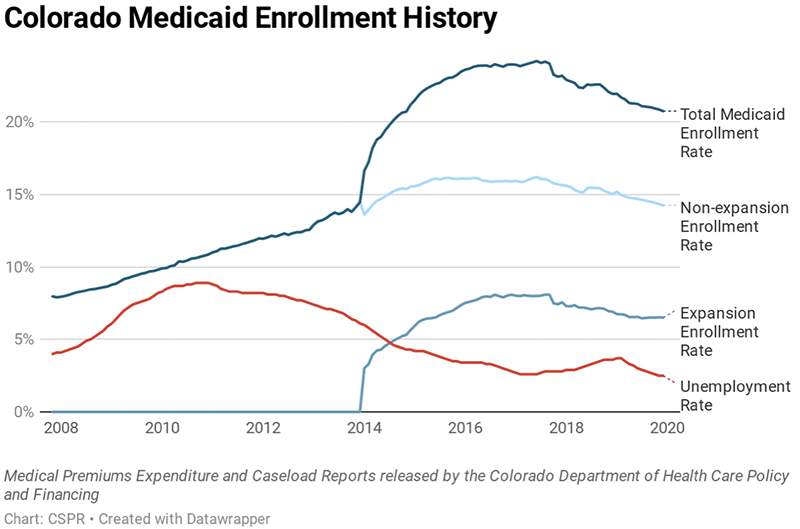

- While JBC estimates that federal stimulus will cover more of the state’s costs of Medicaid patients, those funds are temporary and won’t cover any increased enrollment over the long-term. The share of the state’s population enrolled in Medicaid, who are not part of the expansion population, climbed from under 9% in 2008, to over 16% in 2017, and has only dropped to just of 14% today.

- The economic fallout caused by COVID-19, has overshadowed the potential economic impacts from the rapid drop and volatility in oil and gas prices, that stand to cut a significant amount of local government oil and gas property tax revenues.

- Recently passed revenue line items, including an increased general fund contribution to PERA ($225M annually) and the state funding of full-day kindergarten (Estimated at $200M annually) will add pressure to other state budget items, such as transportation and higher education, in-order to make up for lost revenues.

Congress, the White House and the Federal Reserve have approved trillions of dollars of economic relief in response to COVID-19. But it remains to be seen how quickly these federal measures can stabilize the economy, both nationally and here in Colorado. It is also unclear exactly how much financial support the federal government will extend to state and local governments, and how much flexibility state and local governments will have in spending that money.

Therefore, the challenge awaiting Colorado policymakers will be ensuring state and local government can still function in this new, completely unexpected and highly uncertain environment. Balancing the state budget, without causing undue harm to schools and other essential public services, will be extremely difficult and require the full attention of state and local officials alike.

At the Colorado state Capitol in particular, this will require a new mindset. Policies and programs that appeared feasible just a few short weeks ago cannot be viewed in the same light today. Almost overnight, any room that existed for new priorities in the state budget disappeared, and it will be a struggle to save many existing programs from steep cuts.

To get through the COVID-19 crisis, and position Colorado’s economy and state budget for a strong recovery, policymakers will need to focus on the core responsibilities of government and getting the fundamentals right. In this new reality we face, getting back to basics is necessary to get Colorado back on track.

Colorado Fiscal Outlook

Just as the Colorado State Legislature suspended on March 18th, its top priority was finalizing the details of the next state budget for fiscal year 2021. Legislators had a hint of the potential revenue declines anticipated from the COVID-19 crisis, yet much more information on the likely depth of the crisis has come to light since then.

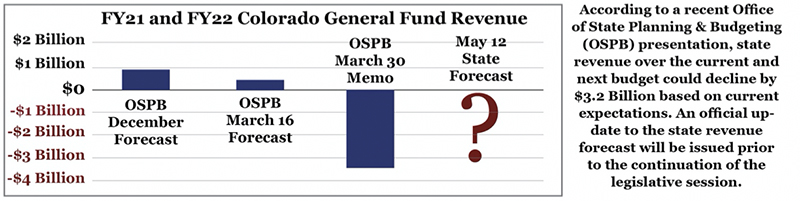

The budget outlook offered by the Colorado Legislative Council this past December which indicated legislators would have $833 million in additional general fund revenue to save or spend, was revised downward on March 16th by over $750 million. The revenue estimates for the current fiscal year, ending at the end of June, were reduced by over $400 million, yet still indicated there would be overall revenue growth.

There will not be an official update to the state’s fiscal outlook until at least May 12th, yet presentation slides released by the Governor’s Office of State Planning and Budget on March 30th indicated the expectation is that state revenue will decline much more than previously expected. The OSBP showed a $3.2 billion shortfall in revenue below the current level of demand for the remainder of FY20 and the full 2021 fiscal year.

While these numbers are not official, and will likely change, they reflect the staggering reversal in economic activity we have all watched unfold over the past several weeks. And while virtually everyone is trying to rapidly determine just how bad the fiscal outlook could get, and just how long this will last, nearly every day a new set of predictions and forecasts is released that seems to progressively get worse and worse.

It is critical to understand the implications of this budget forecast reversal. From a state budget perspective, the impact of the crisis has caused demand for government services and resources to increase, at exactly the same time the revenue to support those programs is drying up.

Uncertainty Regarding Just How Far Revenue Will Decline

We Don’t Know how much of the Economy can Operate Under Social Distancing Guidelines

Even when the legislature resumes, there will be considerable uncertainty around how much of the economy can operate after the stay-at-home orders are lifted. Without a vaccine, it appears that social distancing of some degree will be required to continue to limit the spread of the virus and prevent a rapid increase in new cases that would overwhelm our health care system.

A recent CSPR survey conducted between March 30th and April 3rd, intended to help inform research, indicated that 12% of respondents worked for companies that were completely closed during the current stay at home orders. Of those respondents that indicated their businesses were still open, they were only operating at 71% of normal levels.

And while a near 30% reduction in economic activity is staggering, of the respondents that indicated they were still open, 40% suggested they could only stay in business for less than a month. Some respondents indicated that the federal stimulus would change this calculation, however it was too early to tell for many businesses.

More data and information is expected over the coming weeks and months that will begin to shed more light on the magnitude and the scope of the disruption. The monthly job numbers for March are expected to be released soon and will partially show more detail on the impact across different sectors.

Revenue Will Not Rebound to Pre COVID-19 Projected Levels for Many Years

It took several years for the Colorado general fund to recover to the same level as before the financial crisis that began in 2008. It took even longer to return to levels it was projected to grow to from pre-recession forecasts. As total state spending was partially stabilized from federal stimulus during the heart of the recession, there was not a decline in total state spending until FY 2012, a budget cycle that began 2-and-a-half years after the start of the recession.

As more information has come to light, a sharp “V” shaped recovery is less and less likely, leading to sustained lower revenue than was expected just a few weeks ago. From simple math you can understand this dynamic. If you start at 100 at the beginning of year one, and then see a 6% decline you are now at 94. If you then see a 10% increase the following year you are only back at 103.4 and it is now two years later. If you had just grown at 2% each year you would be at 104.04.

While the exact scale of the decline and the rebound are unclear, the evidence from the previous recession suggests lower revenue relative to demand for years to come.

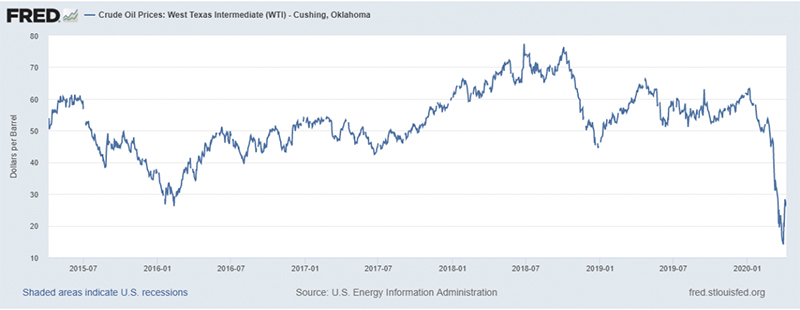

The Fall in Oil Prices Would be Front-Page Headlines if Not Overshadowed by The Pandemic

At the same time states and local budgets are being hit by the economic crisis incurred by COVID-19, the price of a barrel of oil dropped from above $50 a barrel to $20 a barrel in less than a month.

In addition to COVID-19’s impact on the global economy, the energy sector was also destabilized by a price war between Russia and OPEC nations. In effect, Russia and OPEC’s production volumes continued to increase even though demand was collapsing, sending the price of oil much lower than COVID-19 would have alone.

In early April, a truce was declared in the price war, and record-setting production cuts were announced. However, it remains highly uncertain where the price of oil will settle after the events of the past several weeks.

The rapid decline in oil prices will have significant implications for Colorado and local budgets. A memo from Legislative Council Staff released earlier this year showed oil and gas production contributed $775 million in state and local taxes during FY19.2 64% of that revenue went to local governments in the form of local property taxes.

Based on these FY19 estimates, if revenues from oil and gas production were to decline by half, it would reduce local tax revenue by $247 million dollars. However, this does not account for the indirect revenue that is generated by sales, income, and property taxes from the oil and gas workers and industry supply chains, which are already being negatively impacted.

Figure 1: History of Oil Prices and Recent Volatility

Growing Demand for State Revenue

Unemployment Insurance

The clearest indications of the economic fallout have been in the recent increases in unemployment insurance claims. In just the first three weeks of the crisis, the number of new initial claims suggest 4% of the Colorado workforce, or 127,000 people, have had to file for unemployment insurance as a result of the crisis. That number is only expected to climb in the coming weeks, as nationally, the figure is 10%.

The state’s unemployment insurance fund currently stands at between $1.1 and $1.2 Billion. Recent estimates from the Tax Foundation suggest that this current level of funds would be enough to cover just 27 weeks, or about 6 months of payments based upon the claims as of April 4th, ranking 15th amongst all states.3

As the number of new claims is only expected to climb in the coming weeks, the amount of time that the trust fund will be able to cover payments will almost certainly shrink. This indicates another pending crisis, because if the number of claims does not subside in the coming months, more revenue would have to be contributed to the fund. The unemployment insurance fund is supported through a tax on Colorado businesses. Therefore, if more federal funds are not made available, business that are struggling and laying off workers, may face an increase in taxes to fund this program. As the 2019 Unemployment Insurance Trust Fund Summary Report puts it:

“Dependent upon the timing, severity, and duration of the next recession, the trust fund may again become insolvent and borrowing will be required to make legally obligated benefit payments. This will inflict substantial costs to employers in the form of various surcharges, administrative costs and interest expenses. These will take effect at the same time the premium rate schedule shift to their higher levels thereby compounding the financial stress upon employers.”4

Figure 2: Colorado Unemployment Insurance Claims History

Medicaid

Medicaid provides state-supported health coverage for more than 1 million Coloradans. As unemployment swells, or wages are cut, it is very likely that enrollment in Medicaid will increase.

Following the financial crisis and previous recession in 2009, Medicaid enrollment has grown from 8.5% of the state’s population to over 20%. 6% of that is attributed to the expansion of Medicaid that occurred as a result of the Affordable Care Act, which was primarily funded by the federal government. This has caused the Colorado Department of Health Care Policy and Financing (the Medicaid administrative agency) to see its share of the general fund increase by over 7% in the last 10 years, crowding out other spending priorities. For a full picture this these changes please see our 2019 Budget Then and Now report, released December 2019.5

A major provision of the first federal reform in response to the COVID-19 crisis increased the federal match for Medicaid enrollees from the start of 2020 through the end of the federally declared state of emergency. Current estimates suggest this increased match will save Colorado $87.8 Million per quarter, and an estimated $175.6 Million from the FY20 budget. Those savings would increase to $351.2 Million for the full FY 21 budget should the federal state of emergency stay in effect that long.

While the increased federal contribution for Medicaid will certainly help, enrollment in traditional Medicaid continued to grow well beyond the 2009 recession and even as job growth began to pick up. Therefore, the long-term budgetary impacts of increased Medicaid enrollment must be considered, as the federal support may only be temporary.

Figure 3: History of Medicaid Enrollment and Unemployment Rates In Colorado

Large Drop in Financial Markets Could Put the Solvency of PERA at Risk

The financial health of PERA, the Public Employees’ Retirement Association, primarily depends upon the performance of US and global financial markets. PERA has assumed it can generate an annual average rate of return of 7.25% on current investments, to allow the pension fund to maintain the same level of annual contributions and eliminate its unfunded liability within the next 30 years.

In 2018, nearly a decade after the start of the financial crisis, the Colorado State Legislature passed comprehensive reforms of PERA in an attempt to improve the financial footing of the state’s retirement fund for public employees. Despite being years into the economic recovery, PERA still faced over $30 Billion in unfunded liabilities and the projected payoff timeframe was well beyond the desired 30 years. Those reforms included a combination of benefit reductions and contribution increases, including a first-ever direct disbursement from the state’s General Fund of $225 Million per annum. At the time of the policy reform debate in 2018, CSPR released research suggesting the benefit reductions would need to go even further.6

Since the 2018 reforms, even before the current crisis, lower than expected financial returns triggered automatic contribution increases from its members. While current law restricted those annual rate increases to no more than 2%, the current scheduled rate increases will almost surely not be enough to cover the needed annual contribution increases to cover the anticipated growth in the unfunded liabilities.

Estimates of exactly how much more in contributions will be needed to improve the programs financials, will largely depend upon how quickly the financial markets recover. The shortfall could be massive. The 3.5% decline in PERA’s 2018 weighted returns was enough to require the full 2% increase in contributions allowed under the 2018 passed reforms. That amounts to over $180,000,000 in additional contributions, based on 2018 covered payroll alone.

While the full cost to taxpayers and PERA members won’t be known for some time, given the very recent history of reforms, lawmakers should recognize the magnitude of the budget pressure they will face for years to come.

Budget Outlook

The sharp contraction in economic activity caused by COVID-19 will ultimately lead to significant reductions in new tax revenue, at the same time new expenses are expected to be incurred to support the health crisis and allow agencies to transition in way that allows them to better operate during the pandemic. How well the state budget fares will depend on two factors: the existing state reserve and federal stimulus.

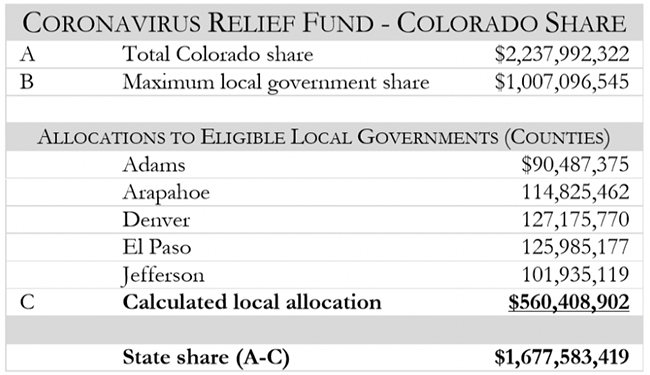

The current state reserve fund stands at $1 Billion, just over the required reserve ratio 7.25%. The recent letters from the Joint Budget Committee indicate there is roughly $2.1 Billion in current federal direct stimulus coming to support different parts of state government, and that figure will only increase given certain known allocations can’t currently be estimated. The OSPB slides suggest the federal stimulus will be $2.5 Billion.

Summary Federal Stimulus Will Likely Only Partially Cover the Projected Shortfall in Revenue

While the full dollar amount of direct federal stimulus to support the state budget is unclear, two memos from the Colorado Joint Budget Committee have articulated the amounts that are currently estimated for the two major federal COVID-19 relief reforms.

- Families First Coronavirus Response Act – Signed March 18th

- Coronavirus Aid, Relief, and Economic Security (CARES) Act – Signed March 27th

The Families First Coronavirus Response Act covered several areas of increased funding to Colorado.

- $2.4 million for Home Delivered Nutrition Services

- $1.2 million for Congregate Nutrition Services

- $87.8 million in Medicaid savings for every quarter there exists a federal state of emergency.

- JBC staff is working with the respective departments to determine the total amount of relief funding Colorado will receive under Families First for SNAP, local food banks, WIC, and unemployment insurance. JBC staff does believe SNAP and WIC benefits will increase in duration and increase in eligibility through the Families First Act.

This act also required employers with fewer than 500 employees to cover paid sick leave benefits for employees who exhibit symptoms of COVID-19, who are required to quarantine or who have to care for a child due to school closures. There are several other provisions that dictate the benefit level and duration.

The larger stimulus reform, referred to as the CARES Act authorized over $2 Trillion dollars nationally, an amount worth nearly 10% of US GDP. The two areas of the CARES Act that directly impact the state budget are the Coronavirus Relief Fund and funds dedicated to supporting a health care response and change in agency operations.

The initial estimates are shown below, however, they come with several stipulations. First, the direct aid to states from the Coronavirus Relief Fund “cannot be used to address revenue losses but only unanticipated expenses due to COVID-19.”7

The JBC memo frames it as the following:

This funding is to be used “to cover those expenditures that:

- are necessary expenditures incurred due to the public health emergency with respect to [COVID-19];

- were not accounted for in the budget most recently approved as of the date of enactment of this section for the State or government; and

- were incurred during the period that begins March 1, 2020 and ends on December 30, 2020.”

Figure 4: JBC Staff Memo State and Local Share of Coronavirus Relief Fund

Figure 5: JBC Staff Memo: Currently Estimated Colorado State Share of CARES Act Appropriations for Health Response and Agency Operations

The same guidance for these appropriations holds, as the JBC memo states, “However, current federal guidance is that the funding provided through the CARES Act is intended to supplement, not supplant, current state funding for the affected programs.”

Areas of the budget that are likely to be hit the hardest such as higher education and K-12 education are expected to receive $166.7 Million and $120.9 Million respectively. While this will go far to cover some of the increased costs that education institutions have experienced due to COVID-19, $167 Million represents less than 3.5% of total state revenue to higher education (which includes tuition), and just 2.2% of K-12 education spending.

It currently appears that the projected state revenue reductions will almost entirely need to be made up for by the state reserve and indirect revenue growth from federal stimulus to households and businesses. While the current stimulus levels may be possible to support individuals and businesses during the short-term, should the very disruptive levels of social distancing be required over longer-term, it most surely won’t be enough.

The same OSPB chart depicts a roughly $2 Billion difference between projected demand and available funds for the FY22 budget, with reserve and federal stimulus able to cover the FY20 and FY21 reductions. It is likely these figures will be revised and the next released of the economic and fiscal projections will shed more light on just how well the state budget can fare over both the next 15 months and the next three years.

Recent Spending Increases Will Put Pressure on Budget Cuts

The previous two legislative session saw significant increases in spending on new state priorities. As previously discussed, the 2018 PERA reforms committed an additional $225 million a year from the state’s general fund. The 2019 expansion of state funding of full-day kindergarten is estimated to cost $200 million a year.

While citizens of Colorado consistently identify spending priorities to be transportation and higher education, these will most likely become the funding categories cut amidst this crisis. Many of the spending increases in recent years are set in statute, and therefore have become mandatory. This leaves limited options for lawmakers, absent rolling back some of those changes.

This will mean that the same funding categories which perennially are seen as top priorities will again face the brunt of the cuts given there is more discretion allowed by the law.

Legislative Priorities Prior to COVID-19 Shutdown Would Pose Even Larger Risks Now

In the space of a few weeks, Colorado’s economic and fiscal outlook has radically changed. Policymakers will have to adjust from adding new programs and spending to managing the fallout of major budget cuts. But another consideration must be setting the right conditions for the Colorado’s economy to rebound as quickly as possible. A return to growth in the private sector is the only way tax revenues will recover.

Therefore, while adjusting to the new budget realities confronting our state, officials will have to adjust to new policy realities as well. In order to prevent the rapid spreading of the virus, businesses have had to shutter, and workers are being told to stay home. As such, any new regulatory requirement or cost increase on business during this time would likely only further the economic disruptions that are occurring. Prior to the suspension of the state legislature, several large regulatory reforms were being considered, including policy initiatives related to paid family leave and the Colorado Option Plan.

Paid family and medical leave is a policy which has been debated and failed within state government in Colorado for several years. While the exact form of the proposed legislation has changed from a state social insurance program, to a state mandate and possibly back to a social insurance model, the primary sticking point has remained: A one-size fits all approach to paid leave programs causes of host of economic challenges and complexities for businesses and individuals. Those challenges include both direct financial challenges of covering the required increase cost, along with business operational challenges as staffing consistency and availability becomes less certain.

While many Coloradans will benefit from the current temporary paid leave requirements imposed by federal law changes, caution should be taken to draw direct comparisons between a pandemic and what might be seen as normal operations. Estimates from last year’s paid leave legislative proposal suggested that the annual payroll premium needed to cover the likely level of benefits would be 0.64% of payroll. However, importantly, this program would only remain solvent if only roughly 3.5% of eligible workers took the benefit.

Fast forward to the current crisis, where the rate at which workers will need to take leave has grown significantly. This would only mean that the paid leave benefit fund would quickly become a massive unfunded liability, and similar to the dynamic with the unemployment insurance fund, businesses and workers may face large tax increases in the midst of the economic downturn.

Another consequential piece of legislation that was at the forefront of legislative priorities upon the suspension of the 2020 session was the creation of the Colorado Option Plan. The Colorado Option Plan, or the public option health care plan, as it was previously referred to as, would allow the state to intervene in the private health care market in a potentially very destabilizing way, with major potential unintended consequences.

Through requiring that insurance companies sell a specific health insurance product, along with state-controlled reimbursement rates for patient care, hospitals could see large reductions in revenue as people move from current coverage to the cheaper Colorado option plan. While hospitals are fighting COVID-19 they are also experiencing significant reductions in revenue, the same as other enterprises, as elective medical procedures have essentially stopped. They also face substantial cost increases to change procedures and purchase large quantities or personal protective gear to ensure staff are not infected and contributing to the spread of the virus. The financial fallout for hospitals remains unclear, and the added risk of the Colorado Option Plan would only hinder the financial recovery in the health care sector.

At the same time new spending programs for the state are being shelved, given that the revenue simply will not be there, so too should considerations of new regulatory or financial burdens that add costs to individuals and businesses during this time.

Conclusion

The reaction to the threat of the spread of the novel COVID-19 has been swift. It has altered the daily lives of nearly every person on the planet. Due to the risk of transmission of the virus, it has meant limiting human contact to an extreme. While this hopefully reduces the threat to human life that an overwhelmed hospital system would lead to, it has impaired the ability of billions of people to work and generate an income to cover normal expenses.

While early estimates released by the state forecasters indicate a potential reduction in total personal income and general fund revenue up to 3% from previous forecasts, the events that have transpired since those forecasts were released suggest the impacts could be more severe.

While many sectors of the economy will be negatively impacted, those that have been forced to close due to the enforcement of extreme social distancing practices will be hardest hit. Preliminary scenarios estimate the loss of 50% of sales across four Colorado industries covering restaurants, bars, ski resorts, events and retail for a full quarter, suggest over 180,000 jobs will be lost, or over 4.5% of the state total. Given the many other sectors experiencing major slowdowns in business, these impacts could be much larger.

Much of the short and long-term impacts will depend on both state and federal policy responses. The ability for expenses to be delayed or reduced could go a long way for individuals and families hit the hardest. Significant federal stimulus, in the form of loans for businesses or direct payments to households, could make the difference in whether many are able to quickly recover, once the health risks subside.

1 https://www.businessinsider.com/us-map-stay-at-home-orders-lockdowns-2020-3

2 https://leg.colorado.gov/publications/effective-tax-rates-oil-and-natural-gas

3 https://taxfoundation.org/state-unemployment-compensation-trust-funds-run-mere-weeks/

4 https://spl.cde.state.co.us/artemis/lbeserials/lbe515014internet/lbe5150142019internet.pdf

5 https://commonsenseinstituteco.org/co-budget-then-and-now/

6 https://commonsenseinstituteco.org/co-budget-then-and-now/

7 April JBC Memo