Research conducted for the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable by the:

BUSINESS RESEARCH DIVISION

Leeds School of Business

University of Colorado Boulder

420 UCB

Boulder, CO 80309-0420

Telephone: 303-492-3307

Colorado.edu/business/brd

June 2016

Business Research Division

The Business Research Division (BRD) of the Leeds School of Business at the University of Colorado Boulder has been serving Colorado for nearly 100 years. The BRD conducts economic impact studies and customized research projects that assist companies, associations, nonprofits, and government agencies with making informed business and policy decisions. Among the information offered to the public are the annual Colorado Business Economic Outlook Forum—now in its 52nd year—which provides a forecast of the state’s economy by sector, and the quarterly Leeds Business Confidence Index, which gauges Colorado business leaders’ opinions about the national and state economies and how their industry will perform in the upcoming quarter. The Colorado Business Review is a quarterly publication that offers decision makers industry-focused analysis and information as it relates to the Colorado economy.

BRD researchers collaborate with faculty researchers on projects, and graduate and undergraduate student assistants, who provide research assistance and gain valuable hands-on experience.

Visit us at:

www.colorado.edu/business/brd

SUMMARY

The Business Research Division (BRD) has studied the contributions of the oil and gas industry in Colorado since 2010. In 2014, the BRD began analyzing policy and price impacts on the oil and gas industry and the implications on the state economy using the REMI model with support from the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable. Three papers describe policy and price impacts:

- Colorado Oil and Gas Industry: Updated Economic Assessment of Colorado Oil and Gas Ballot Initiatives in 2014 (September 2014)

- Oil and Gas Prices – the Upside and the Downside (January 2015)

- Colorado Oil and Gas Industry: Updated Economic Assessment of Colorado Oil and Gas Prices (August 2015)

This paper refines the work completed in 2014 and 2015, isolating potential policy impacts on production in Colorado. This research was conducted for the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable.

Prices versus Policy

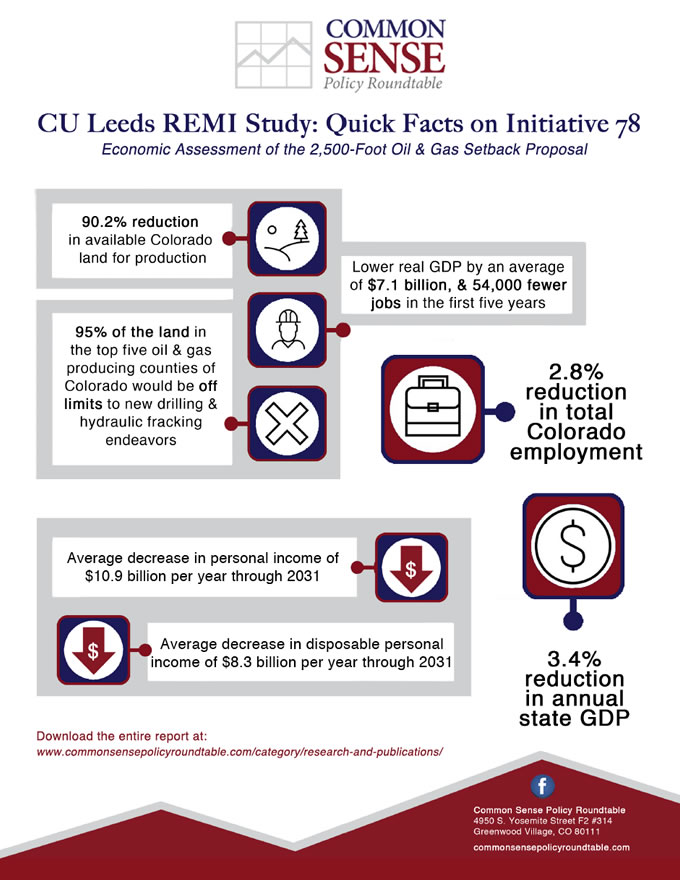

Commodity prices began falling in mid-2014, reshaping the industry globally and locally. Prices and policy at face value have the similar effect—a decrease in oil and gas activity. However, each sends a different signal about uncertainty and long-term potential. While uncertainty surrounds prices in the short term, the expectation is that in the medium-term horizon, prices will rebound and production will follow. Comparatively, uncertainty is relatively low for a setback measure—producers can be fairly certain about drilling that would be inaccessible and production that would be lost. (According to the Colorado Oil and Gas Conservation Commission [COGCC], a 2,500-foot setback measure would result in a 90.2% reduction in accessible land.) Local control measures, however, are less predictable than setbacks regarding where activity would be curtailed, as well as the rules that local communities would put in place, making local control initiatives highly uncertain and potentially resulting in a significant long-term reduction in production.

Price Impact

Nationally, the deterioration in oil and gas prices has resulted in some benefits and implications for the economy. Consumers and industry have benefited from lower gasoline prices for transportation, as well as lower natural gas prices for heating and industrial energy. Economies (nation and specifically, energy-intensive states) have also measured the economic costs, notably through

- Lower drilling permits and rig counts,

- Decreased fixed investment,

- Falling industry employment,

- Decreased industry wages,

- Energy-industry company bankruptcies,

- Increased commercial vacancy/shadow vacancy, and

- Lower public revenues (severance taxes, royalties, ad valorem taxes, property taxes, income taxes, etc.).

Technology and prices have led to the following observations about Colorado oil and gas industry…