Updated Economic Assessment of Colorado Oil and Gas Setback Discussion

Research conducted for the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable by the:

BUSINESS RESEARCH DIVISION

Leeds School of Business

University of Colorado Boulder

420 UCB

Boulder, CO 80309-0420

Telephone: 303-492-3307

leeds.colorado.edu/brd

RESEARCH TEAM

Brian Lewandowski

Richard Wobbekind

August 2015

Business Research Division

The Business Research Division (BRD) of the Leeds School of Business at the University of Colorado Boulder has been serving Colorado since 1915. The BRD conducts economic impact studies and customized research projects that assist companies, associations, nonprofits, and government agencies with making informed business and policy decisions. Among the information offered to the public are the annual Colorado Business Economic Outlook Forum—now in its 51st year—which provides a forecast of the state’s economy by sector, and the quarterly Leeds Business Confidence Index, which gauges Colorado business leaders’ opinions about the national and state economies and how their industry will perform in the upcoming quarter. The Colorado Business Review is a quarterly publication that offers decision makers industry-focused analysis and information as it relates to the Colorado economy.

BRD researchers collaborate with faculty researchers on projects, and graduate and undergraduate student assistants, who provide research assistance and gain valuable hands-on experience.

SUMMARY

The Business Research Division (BRD) has studied the contributions of the oil and gas industry in Colorado since 2010. In 2014, the BRD began analyzing policy and price impacts on the oil and gas industry and the implications on the state economy using the REMI model with support from the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable. Three papers describe policy and price impacts:

- Colorado Oil and Gas Industry: Updated Economic Assessment of Colorado Oil and Gas Ballot Initiatives in 2014 (September 2014)

- Oil and Gas Prices – the Upside and the Downside (January 2015)

- Colorado Oil and Gas Industry: Updated Economic Assessment of Colorado Oil and Gas Prices (August 2015)

This paper refines the work completed in 2014 and 2015, isolating potential policy impacts on production in Colorado. This research conducted for the Metro Denver Economic Development Corporation, the Denver South Economic Development Partnership, and the Common Sense Policy Roundtable.

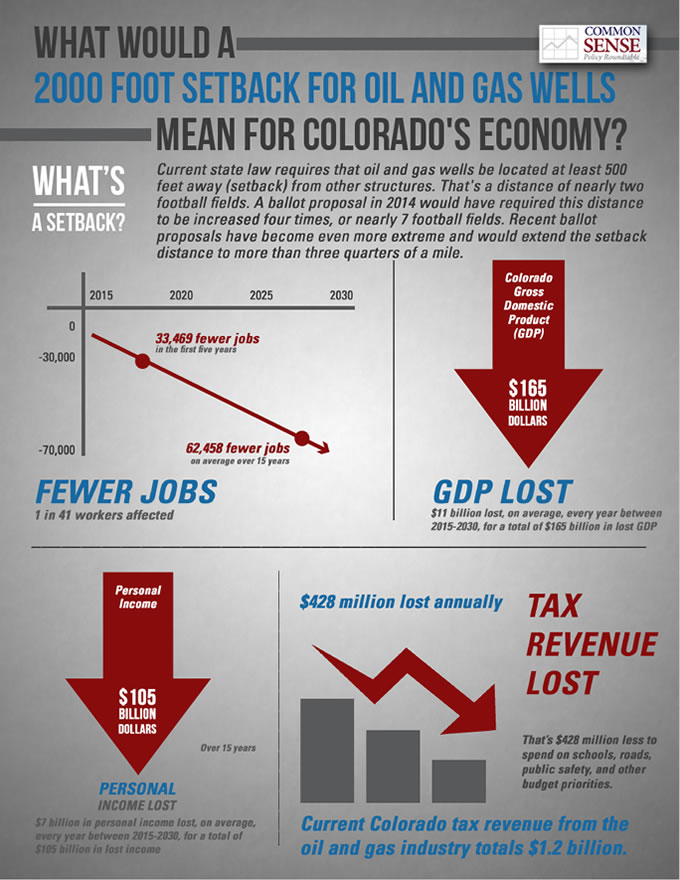

Prices versus Policy

Commodity prices began falling in mid-2014, reshaping the industry globally and locally. Prices and policy at face value have the similar effect—a decrease in oil and gas activity. However, each sends a different signal about uncertainty and long-term potential. While uncertainty surrounds prices in the short term, the expectation is that in the medium-term horizon, prices will rebound and production will follow. Comparatively, uncertainty is relatively low for a setback measure—producers can be fairly certain about drilling that would be inaccessible and production would be lost, and the reduction in total production would be significant (estimated between 25% and 50%). Local control measures, however, are less predictable than setbacks regarding where activity would be curtailed, as well as the rules that local communities would put in place, making local control initiatives highly uncertain and potentially resulting in a high long-term reduction in production.

Price Impact

In the August 2015 paper Colorado Oil and Gas Industry: Updated Economic Assessment of Colorado Oil and Gas Prices, BRD researchers established that the value of production will decrease by one-third from 2014 to 2015 before increasing in 2016. The paper demonstrated that:

- Wells drilled over the past five years produce more in the first year than wells drilled prior.

- The depletion rate for wells drilled in the past five years is faster than wells drilled prior.

- The current rig count in Colorado is not great enough to keep constant new well production

- With a lower number of drilling rigs, wells drilled and oil and gas production will drop from record levels recorded in 2014.

Production Reduction Due to Setbacks

The price environment provides a new baseline for expected industry growth. A reduction in new production would have a compounding impact on industry output. Based on estimates provided by the oil and gas industry, a 2,000-foot setback would…