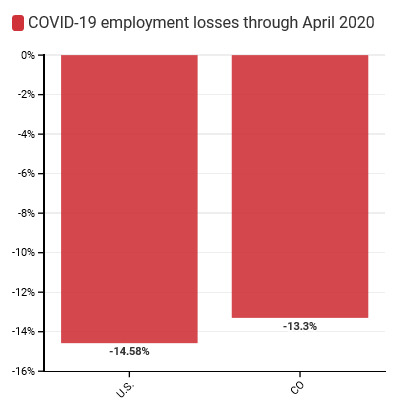

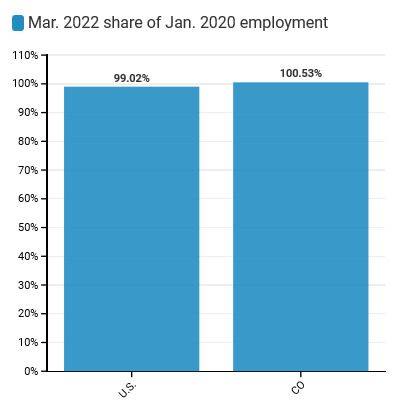

Colorado’s robust economy has added 391,300 jobs since April 2020, eclipsing the 374,500 jobs the state lost in March and April 2020. This represents a recovery rate of 104.5 percent which is 11.6 percentage points higher than the nationwide recovery rate of 92.9. Colorado added 5,800 jobs in March and February’s employment level was revised upwards by 1,800. March nonfarm employment rose to 2,834,500, which is 4.9% higher than March 2021’s 2,703,300. Colorado’s unemployment rate now stands at 3.7%.

Key Findings—Colorado March 2022 Employment Data (BLS CES Survey[i])

- Colorado added 5,800 total nonfarm jobs in March (a monthly change of .21% for a total year-on-year change of 4.9%).

- In March, the state’s employment level continued to recover and is now 15,000 higher than it was before the pandemic.

- To recover to the pre-pandemic unemployment rate of 2.7% by January 2023, Colorado needs to add 7,234 jobs each month, on average.

- The total employment level is up .5% (15,000 jobs) above its pre-pandemic level, ranking Colorado 12th in terms of March ‘22 job levels relative to Jan. ’20.

- Washington D.C. ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 5.1% and 9.4%, respectively.

- Thirteen states have employment levels above what they were at the start of the pandemic. Texas has the highest differential (+251,400 jobs).

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in March and others lost

- The leisure and hospitality industry added 4,200 jobs.

- The construction industry lost 2,300 jobs.

- Though the leisure and hospitality industry has led the recovery by adding 69,900 jobs between Jan. ‘21 and Mar. ‘22, it is still down 11,600 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 10.33% (6,200 jobs).

- Accommodation and food services is down 1.88% (5,400 jobs).

Colorado Labor Force Update

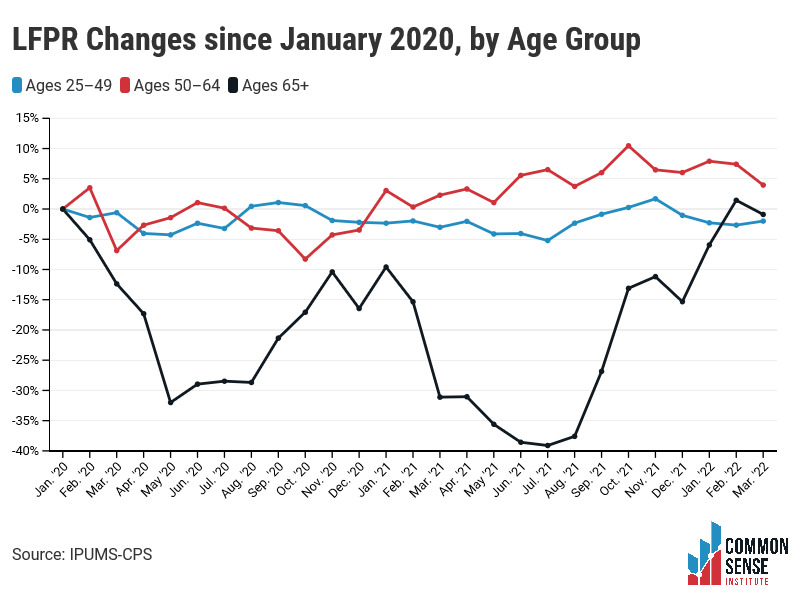

Colorado’s LFPR (labor force participation rate) increased in March to 68.9%, which combined with the strong job growth led to a decline in the unemployment rate to 3.7%. The LFPR of retirement-age (65 years and older) workers is now slightly below the pre-pandemic level by 0.26%. Record high inflation is causing many retirement age workers to re-enter the labor force as they attempt to maintain their standards of living.

Key Findings—Colorado March ‘22 Labor Force Data (FRED[ii], and IPUMS-CPS[iii])

- March’s LFPR increased slightly to 68.9%, .3 percentage points above Jan. ’20’s LFPR of 68.6%.

- March’s unemployment rate dropped by .3 percentage points to 3.7%, which is still 1.0 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- In March, the LFPR of Colorado women decreased from 64.71% to 63.21%. It is now .93 percentage points below its pre-pandemic level.

- The national female LFPR increased by .2 percentage points to 8%, which is .9 percentage points below its pre-pandemic level.

- There are now 21,760 fewer women in the workforce than there would be if Colorado’s March LFPR of women was the same as it was before the pandemic.

Prime-age, Older, and Retirement-age People in the Labor Force

- Since Jan. ’20, the labor force participation rates of all 50–64-year-old workers, regardless of sex, have increased 2.89%

- There are 2,122 fewer retirement-age workers in the labor force today than there would be at the pre-pandemic participation rate. Despite the decrease in March, record-high inflation is likely the reason that this age group has returned to the labor force, as is the fact that 89.5% of these workers have been fully vaccinated against COVID-19.

- The LFPR for prime age workers (25–49) has dropped below its Jan. ’20 level. A few possible explanations are that increased savings accumulated during the pandemic are allowing people to delay reentering the labor force. Another is that high returns in many investment portfolios have allowed many two-income households to become one-income households. Going forward, as savings decline and high inflation strains household budgets, we’d expect to see more workers in this age group to return to the labor force.

[i] https://www.bls.gov/data/

[ii] https://fred.stlouisfed.org/

[iii] https://cps.ipums.org/cps/