Update as of April 2021

The shutdowns and business closures associated with the COVID-19 pandemic produced record-high unemployment levels in Colorado. As of February 2021, the state’s total employment level was still 5% below what it was in January 2020. Official forecasts project that state employment will not recover to its pre-pandemic level until 2022.

Colorado’s Unemployment Insurance Trust Fund was unprepared for even a minor recession: despite some efforts to bolster it in early 2020, its pre-pandemic reserve was sufficient only to handle 78% of the state’s historic high unemployment insurance demand.[i] As a result of the demand for unemployment benefits reaching new heights and this prevailing financial instability, the fund quickly depleted and, in August 2020, fell into debt.

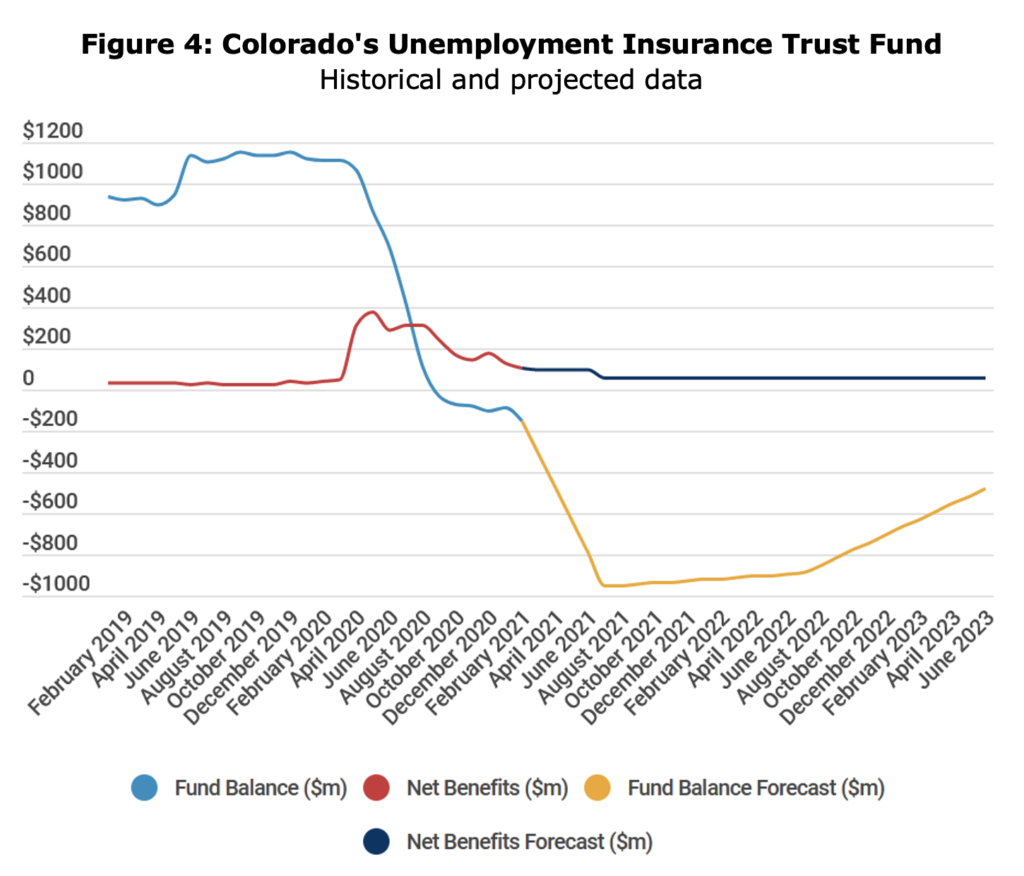

Total unemployment insurance benefits paid by the Trust Fund is expected to exceed fund income in every month from April 2020 through November 2022. During that time, the fund will have depleted from its pre-pandemic level by about $2 billion. Until the fund recovers, Colorado’s unemployment insurance program will remain reliant upon supplementary loans from the U.S. Treasury. Though income to the fund through higher employer taxes will automatically increase at the start of each calendar year, it will still take years to repay federal loans and rebuild the reserve.

Key Takeaways Concerning the UI Trust Fund’s Status and Future Tax Increases

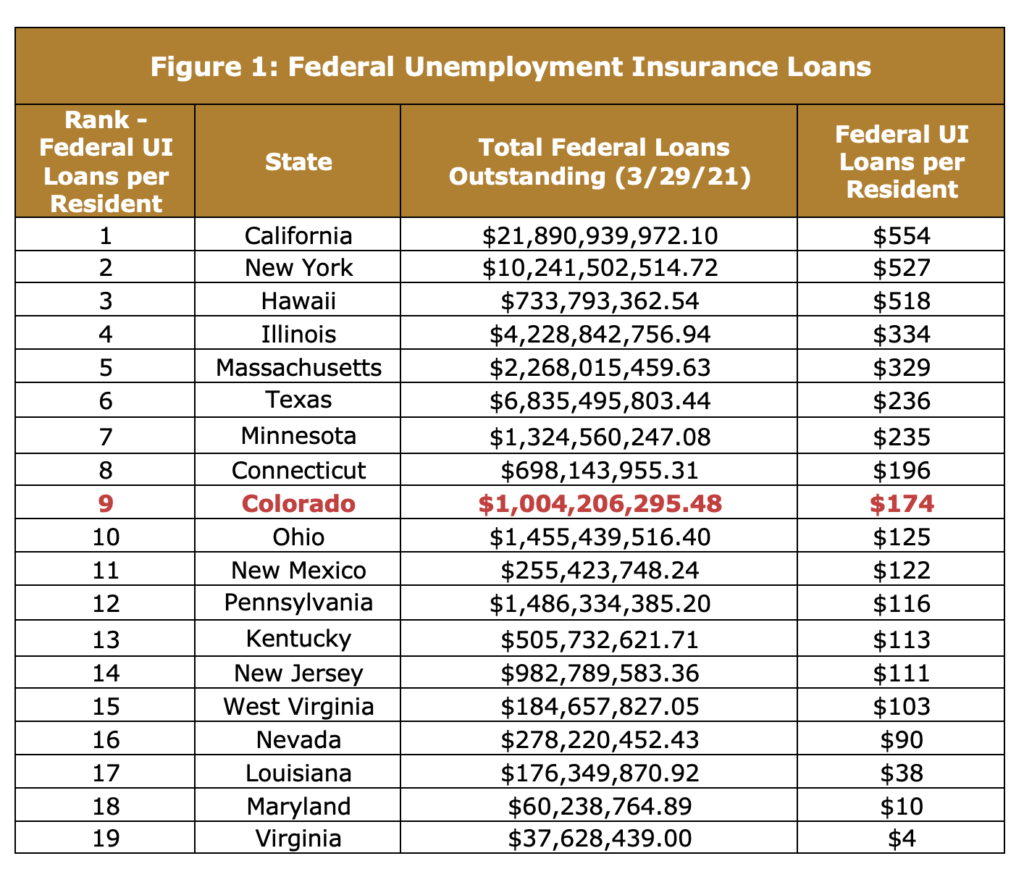

- Colorado, alongside states like California, New York, and Connecticut, has one of the country’s highest burdens of federal loans to its unemployment insurance fund. As of April 8th, Colorado is one of 19 states currently reliant upon federal loans[ii] and has the 9th-greatest amount of money outstanding in both absolute and population-adjusted dollars.

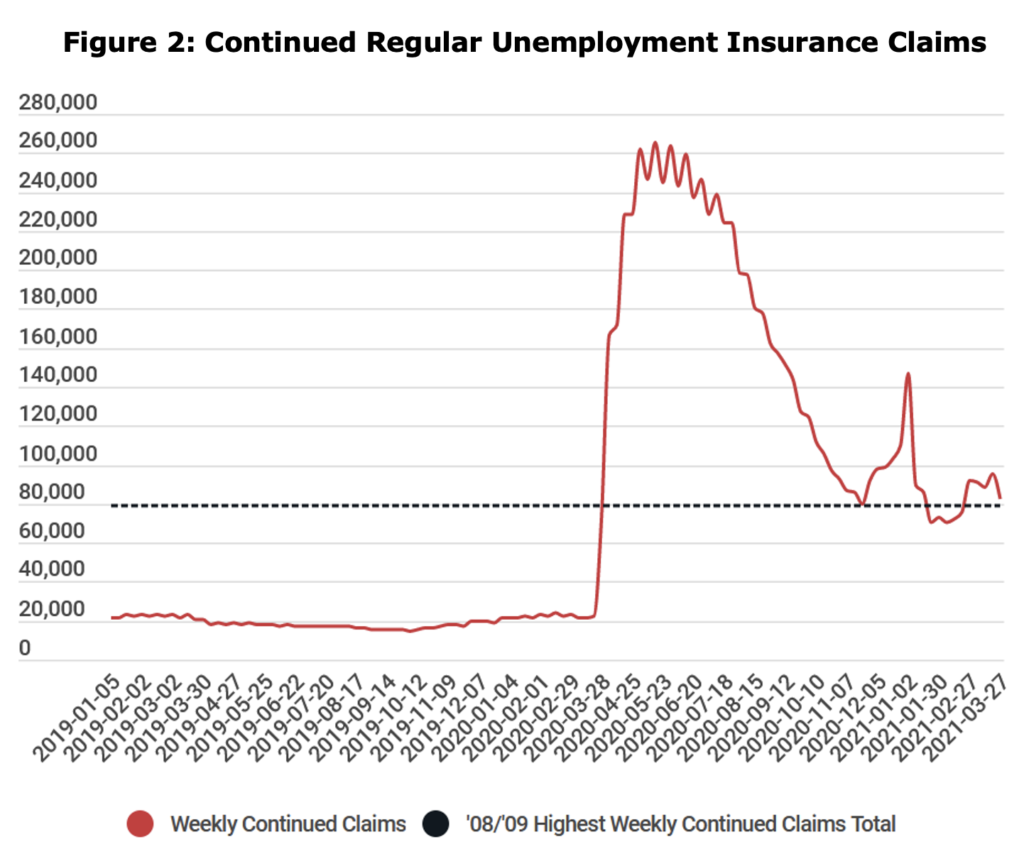

- The state is still borrowing approximately $100 million of federal money every month and isn’t expected to begin repaying it anytime soon. Since October, outstanding federal loans has grown by an average of just over $100 million per month, and Colorado’s unemployment insurance program will continue to demand supplementary funding until the UI Trust Fund recovers to an even balance. Demand for benefits remains exceptionally high—though Colorado’s economy has started to recover, continued unemployment insurance claims remain higher than they ever were during the ’08/’09 financial crisis almost every week.[iii]

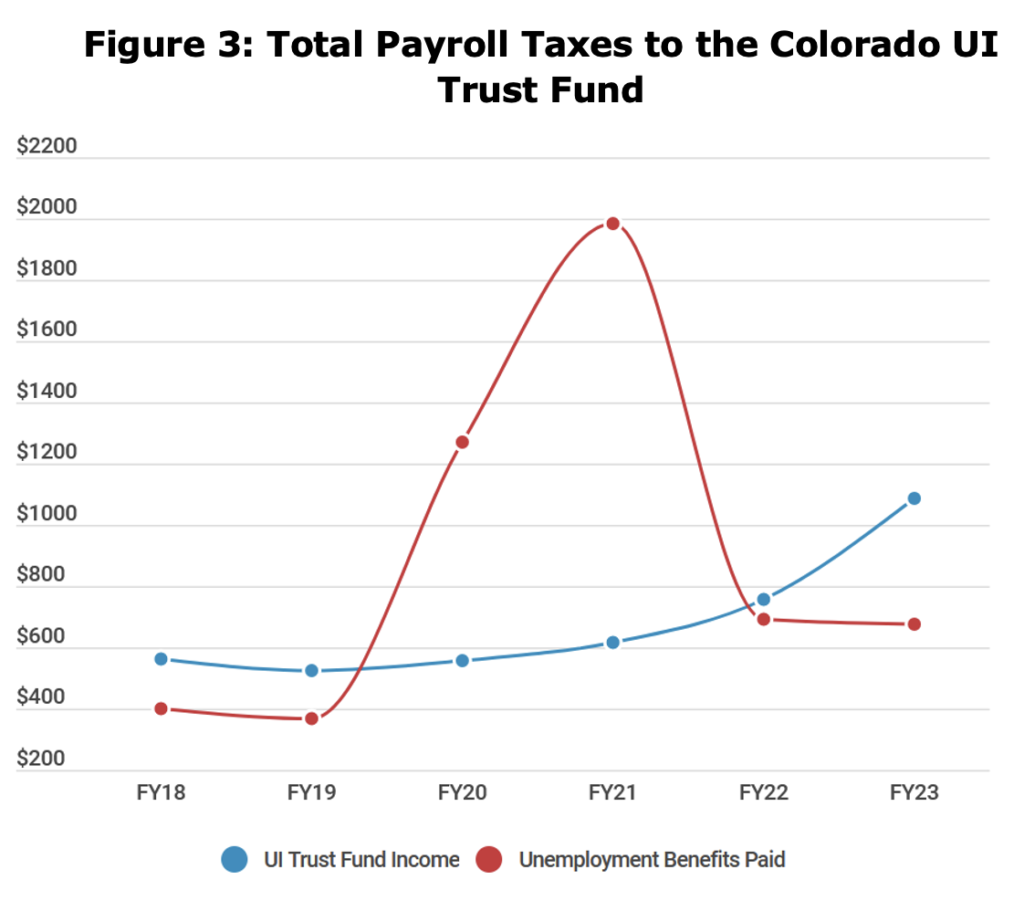

- Repaying the UI Trust Fund’s debt will require nearly 25% more payroll tax revenue per year, on average. Between FY20 and FY23, total revenue to the fund is projected to grow at an average annual rate of 24.8%. For the fund to be restored to its pre-pandemic solvency by 2028, five years after the end of the latest projection, contributions will have to exceed payments by an average of almost $316 million in each year after 2023. Figure 3 displays the historical and projected figures which describe the amounts of payroll taxes paid annually to the UI Trust Fund from employers and the total annual values of unemployment benefits paid from the fund.

Before the pandemic, the Trust Fund had a reserve of $1.11 billion. By November, it had depleted by over $1.2 billion to a balance of -$114.35 million. At the start of the next fiscal year this July, the fund is projected to be $954.5 million in debt;[iv] this amounts to nearly as much as the state has already borrowed in federal aid and about $212 per adult Coloradan. As long as the Trust Fund’s balance remains negative, debts continue to accumulate which must be financed by federal loans. Figure 4 displays the historical trends associated with benefits paid and Trust Fund balance alongside Legislative Council Staff projections of the latter two.

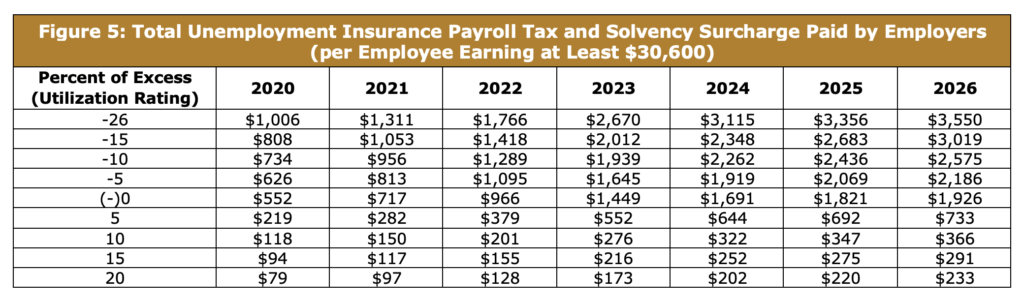

- Fund insolvency, high benefits, and low employment levels will mean especially large tax increases for many businesses. By 2023, an employee’s total UI premium could increase from as little as .07% of wages to as much as 13.1%. This change will occur due to the scheduled base tax rate increase required by the fund’s insolvency, the surcharge triggered by the UI Trust Fund’s depletion to a level prescribed in law, and progressive increases in the taxable wage base imposed by the passage of SB20-207. Each employer’s base contribution rate is determined by his/her employees’ total utilization of the Trust Fund—an employer who tends to retain workers will pays a low rate, whereas an employer who frequently fires workers (who then claim unemployment benefits) pays a high rate. Since total employment remains well below its pre-pandemic level, the tax increases per employee will be especially pronounced. Businesses that have struggled to retain workers during the pandemic are due to receive the largest rate increases. Consider the example of a small business with 15 employees that laid off 5 workers in mid-2020 due to the economic shutdowns, causing its utilization rating to drop from just below 0 to –10. In 2020, it would have paid a total payroll tax of $6,900 to the UI Trust Fund.

-

- If it does not re-hire in 2021, its total UI payroll tax will increase to $9,560, despite having five fewer employees.

- If it does re-hire five employees in 2021, its total payroll tax will increase by up to 208% to up to $14,340.

- If it continues to struggle after the pandemic, maintains a rating of –10, and re-hires to 10 employees in 2024, its total payroll tax will increase to up to $22,620.

Figure 5 displays the ranges of unemployment insurance payroll taxes, inclusive of solvency surcharges, that employers will be made to pay between 2020 and 2026, per employee.

End Notes

[i] https://drive.google.com/file/d/1bv_-Bh5GNYGCPjT1VDd32ktXnNis8qJa/view

[ii] https://oui.doleta.gov/unemploy/budget.asp

[iii] https://cdle.colorado.gov/sites/cdle/files/Colorado_Unemployment_Insurance_Charts_Through_April_3_2021.pdf

[iv] https://leg.colorado.gov/sites/default/files/images/marforecast_0.pdf

Key findings:

- As of January 6th, Colorado is one of 17 states currently reliant upon federal loans and has the 9th-greatest amount of money outstanding in both absolute and population-adjusted dollars.

- Before the pandemic, the UI Trust Fund had a reserve of $1.11b. By November, it had depleted by over $1.2b to a balance of -$114.35m. At the start of the next fiscal year, July 1, 2021, the fund is projected to be $1.08b in debt; this amounts to about $240 per adult Coloradan.

- Between FY20 and FY23, total employer taxes for the Trust Fund are projected to grow at an average annual rate of 22.3%. For the fund to be restored to its pre-pandemic solvency by 2028, five years after the end of the latest projection, contributions will have to exceed payments by an average of over $420m in each year after 2023.

Key Findings:

- The Unemployment Insurance trust fund, from which unemployment benefits are paid, stands to go insolvent soon—likely before the end of June.

- When it does, should the current law remain effective, businesses statewide will be required to pay higher premium rates and be assessed additional insolvency surcharges to help compensate for the fund’s shortfalls. These together will total about $839,200,000 in 2021, an increase of over $300,000,000 from the current year.

- SB20-207, a proposed temporary change in rate-setting policy, would ease the private sector’s burden by over $100,000,000 in 2021, yet would lead to an increase of $800,000,000 or more by 2025.

- Under current law and economic forecasts, the UI trust fund could remain underwater for a decade while employer contribution rates continue to be set at highest level.

- An effective annual tax of just $100,000,000 upon Colorado’s businesses sustained over five years will cost the state up to 2,200 jobs.