Colorado Budget: Then and Now

A Snapshot of State Appropriations and How They Have Changed

December 2022 Annual Release

![]() 2022 FINAL REPORT: PDF | POWERPOINT

2022 FINAL REPORT: PDF | POWERPOINT

SIXTH ANNUAL RELEASE OF COLORADO BUDGET: THEN AND NOW

Colorado Budget Then and Now illuminates the changes in Colorado state budget appropriations over the last twenty years. The following figures provide a summary overview of revenue allocated to state departments through the budgeting process. The trends in appropriations reflect the shifting priorities brought on as a direct result of the laws and budgets passed each legislative session.

METHODOLOGY

The findings of this report are generated from the annual appropriations reports compiled by the Colorado Joint Budget Committee Staff. These reports draw from each of the annual legislative bills, which authorize funding for each state department. The reports include appropriations from all funds including General Funds, Cash Funds, Federal Funds, Reappropriated Funds, and Capital Construction Funds. Appropriations for FY 2022 are considered final given they are for the most recent full fiscal year. FY 2023 appropriations are considered initial given they reflect an amount authorized by the legislature but may change over course of the fiscal year. FY 2024 appropriations are from the Governor’s proposal, but the full initial appropriations will be authorized by the legislature through the creation of the Long Bill during the 2023 session.

General Funds: General-purpose revenue is deposited into the General Fund and used for the state’s core programs, such as education, health care, human services, corrections, and general government (i.e., the legislature and Governor’s office). Cash Funds: are special-purpose funds that exist outside of the General Fund. They are funded with taxes, user fees, and fines earmarked for specific purposes and programs. Other large categories of cash fund revenue include revenue to other TABOR enterprises, employee pension contributions and interest income, voter-approved revenue, property sales, damage awards, and gifts. Federal Funds: are moneys received from the federal government to support specific purposes and programs. For some programs, such as Medicaid, state funding is matched with federal funding. Further, General Fund revenue is the only major state revenue source available to fund capital construction projects which is further appropriated from the GF.

Reappropriated Funds represent transfers of money from one department to another after the initial appropriation. To avoid double counting when showing all agency totals all Reappropriated Funds are removed. The department totals do include Reappropriated Funds to better represent the relative size of each department. Capital Construction Funds are excluded from totals specified as operating appropriations. Fund transfers and other obligations are not included with annual totals except where noted.

Source: https://leg.colorado.gov/explorebudget/

Key Findings

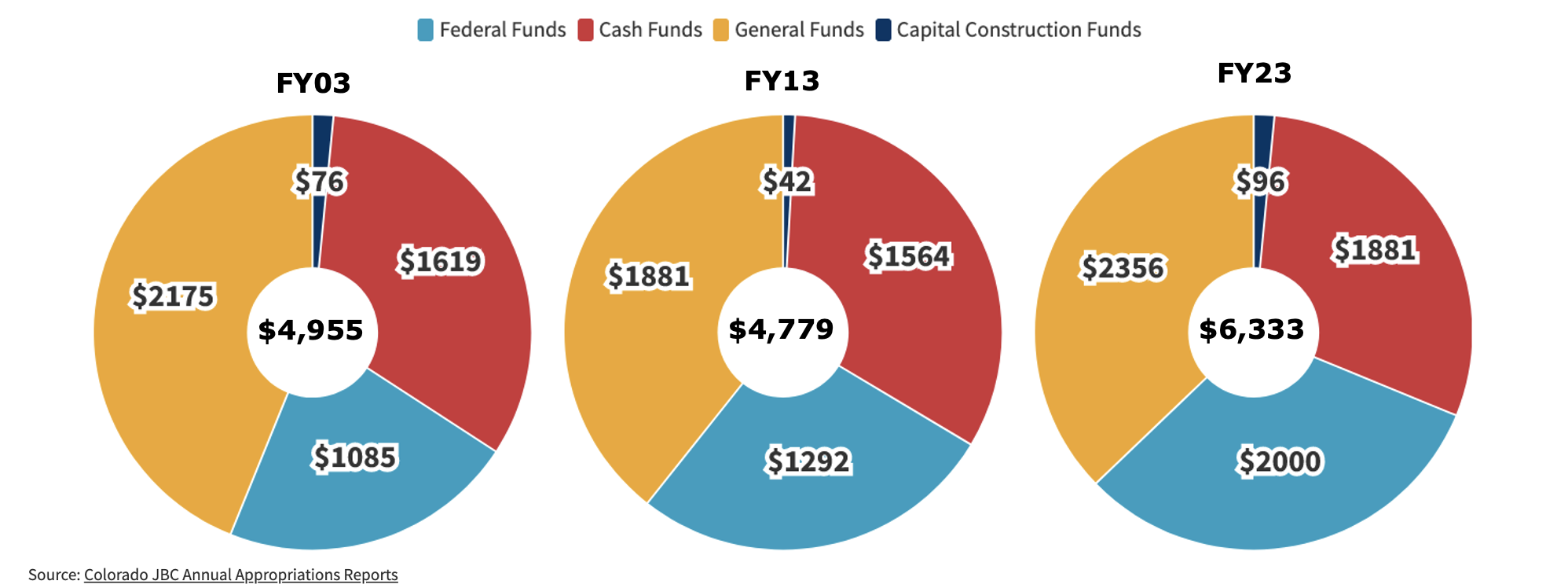

- Total state appropriations per Coloradan, adjusted for inflation, has increased by 28% over the last 20 years from $4,955 to $6,333 in FY2023.

- Though federal funds account for the largest increase, population- and inflation-adjusted spending from the General Fund and Cash Funds has also increased.

- In the last 20 years, the Department of Health Care Policy and Financing (HCPF) budget has increased by 459% from $2.5 billion to $14.2 billion while increasing its share of the total budget from 19% to 36%. In comparison, the Department of Education budget has grown by 130% over this same period from $3.1 billion to $7.2 billion, with the FY24 budget proposal per-pupil program spending by 9%, yet the educations department’s share of the total budget has decreased from 24% to 18%.

- HCPF accounted for 61% of the General Fund appropriation increase in FY23 and is 43% of the proposed FY24 increase.

- The Department of Education’s share of the General Fund declined from 42% to 32% over the past 20 years. If it had maintained the same share, its FY23 appropriation would have increased by $1.3 billion.

Annual Appropriations

How Much Money Does the Colorado State Government Appropriate?

Each year, the state’s legislature approves a budget that dictates how public tax revenue will be allocated to the different government departments. The current budget cycle, fiscal year 2023, runs from July 1, 2022, through June 31, 2023. As of November 2022, the total initial appropriations for FY 2023, inclusive of operating appropriations minus reappropriations plus capital construction appropriations, are estimated to be $37,373,960,242.

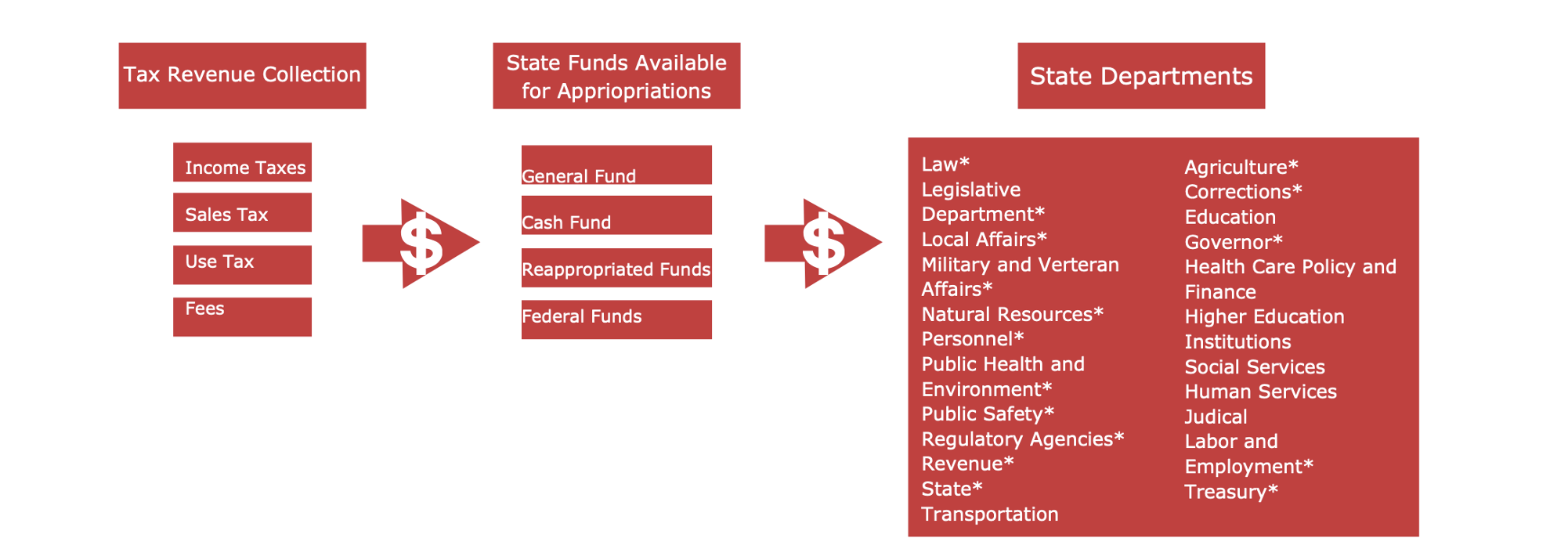

State government spending flow of tax revenue to state departments

The image above displays the flow of state appropriations from the tax revenue source to the state department that is authorized to spend the revenue by the state legislature. There are many different state agencies within each department, but for the purpose of this report, appropriations are only shown by the fund or department type. For formatting purposes, state departments with an * are often combined in the following figures and labeled as “Other Departments.” Combined, these other departments represent about 10% of total appropriations.

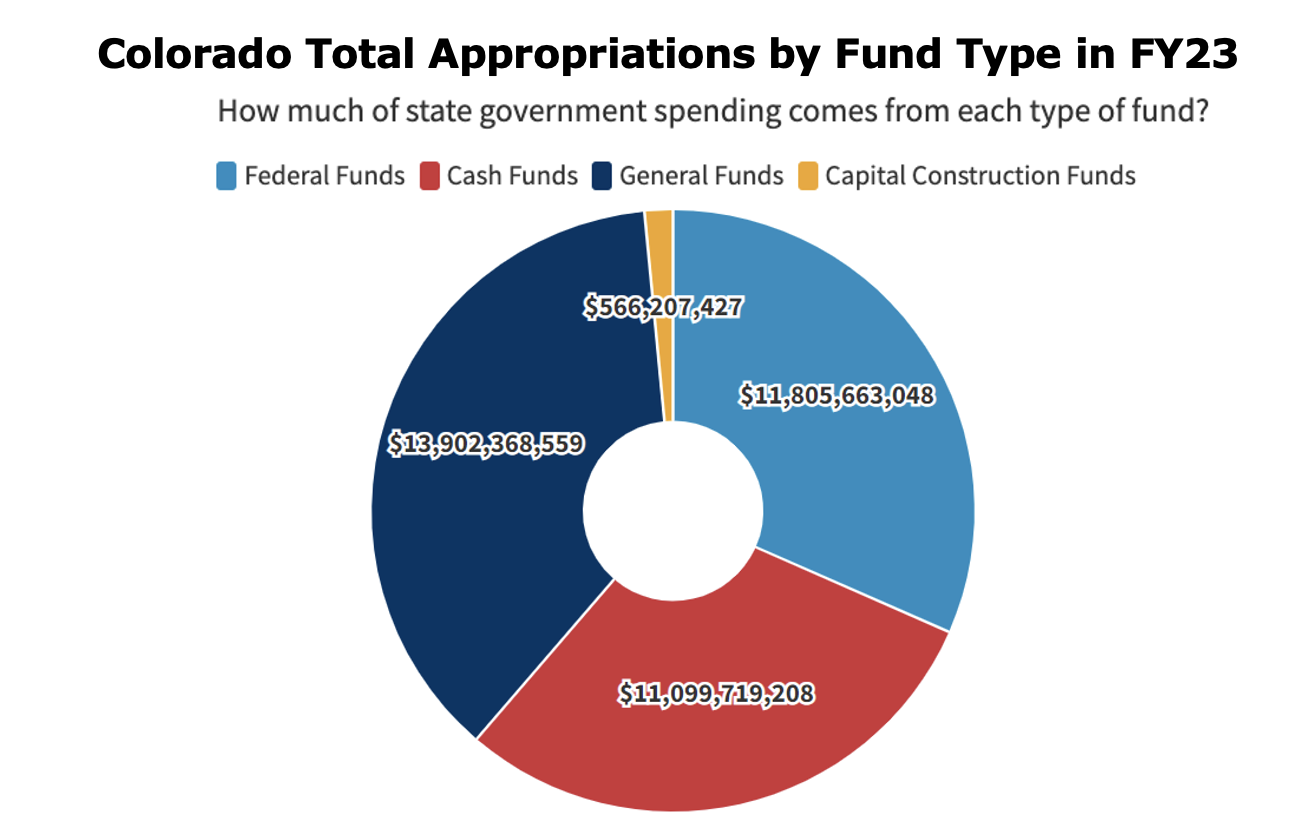

Colorado Total Appropriations by Fund Type in FY23

Total appropriations in FY22 are $34,632,958,735. General fund appropriations are 36%, federal funds constitute 33%, cash funds constitute 30%, and capital construction funds make up less than a percent of the total appropriations in FY22.

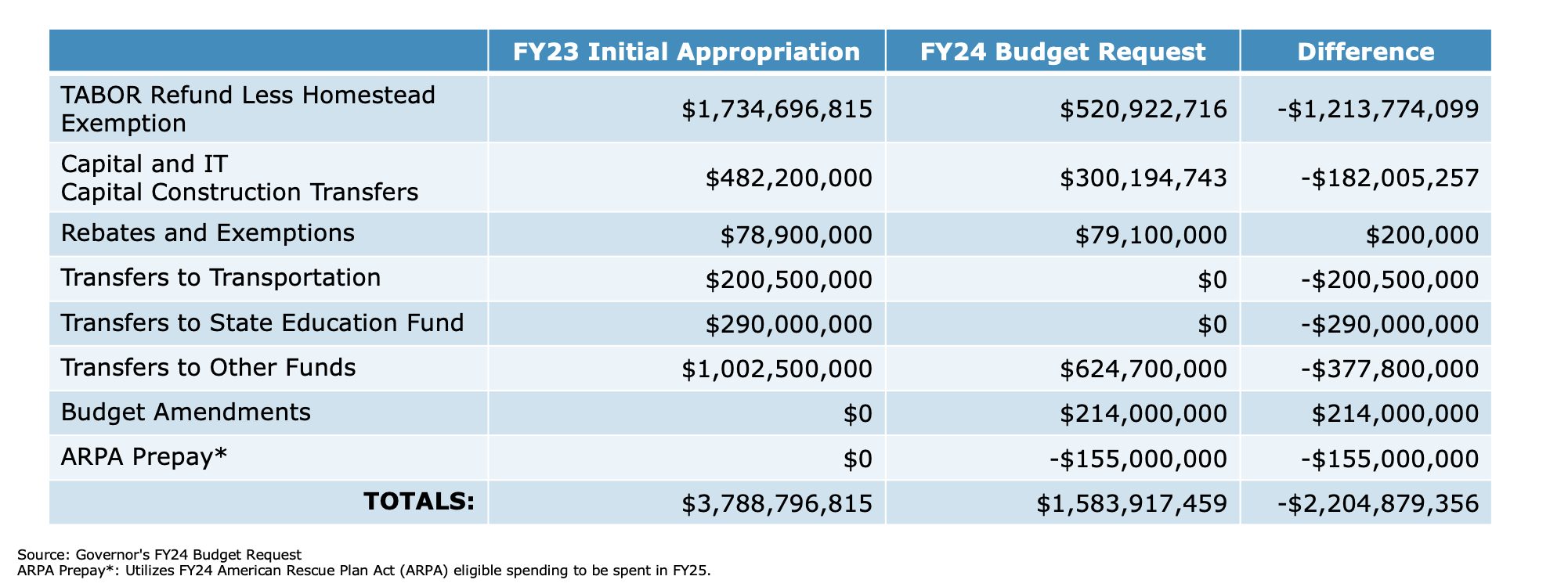

Significant Changes to Transfers in the Proposed FY24 Budget

The value of transfers, refunds, reappropriations, and investments brings the total size of the proposed FY24 budget to just over $42.6 billion. Transfers do not count towards a department’s appropriation. The transportation and K–12 education sectors received a combined total of almost $500 million in transfers in FY23 but will receive none in FY24. Education will not receive additional transfers because the FY23 budget bought down its budget stabilization factor through FY25.

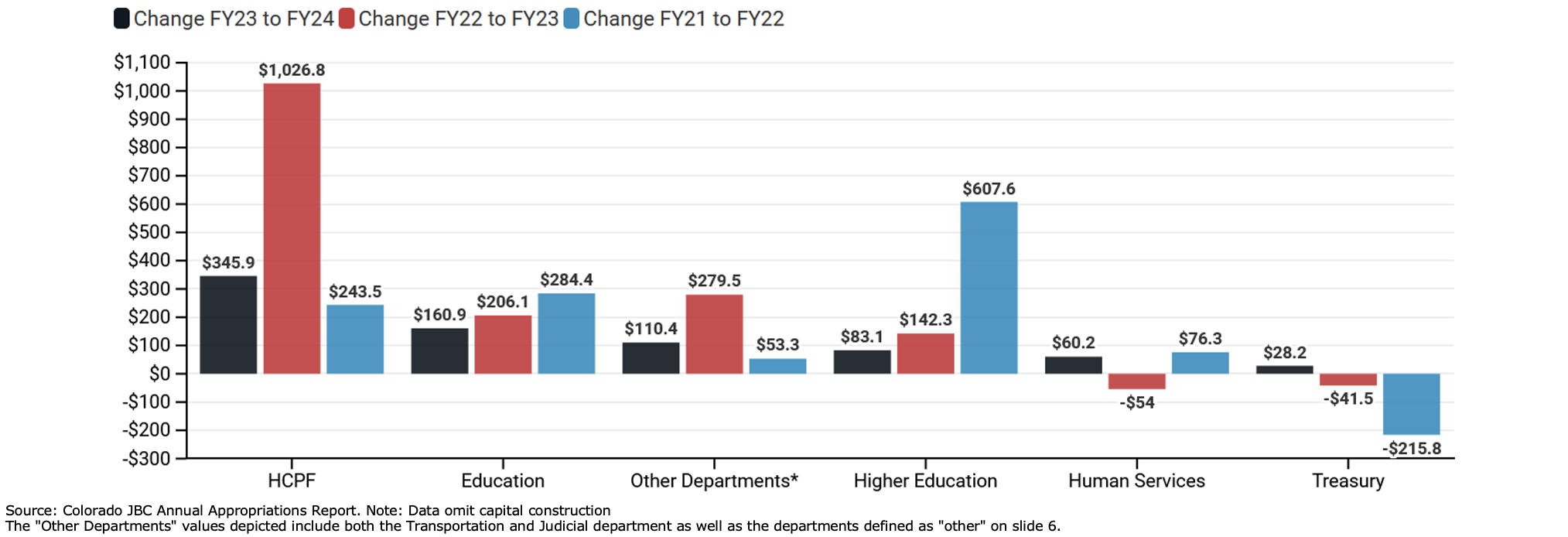

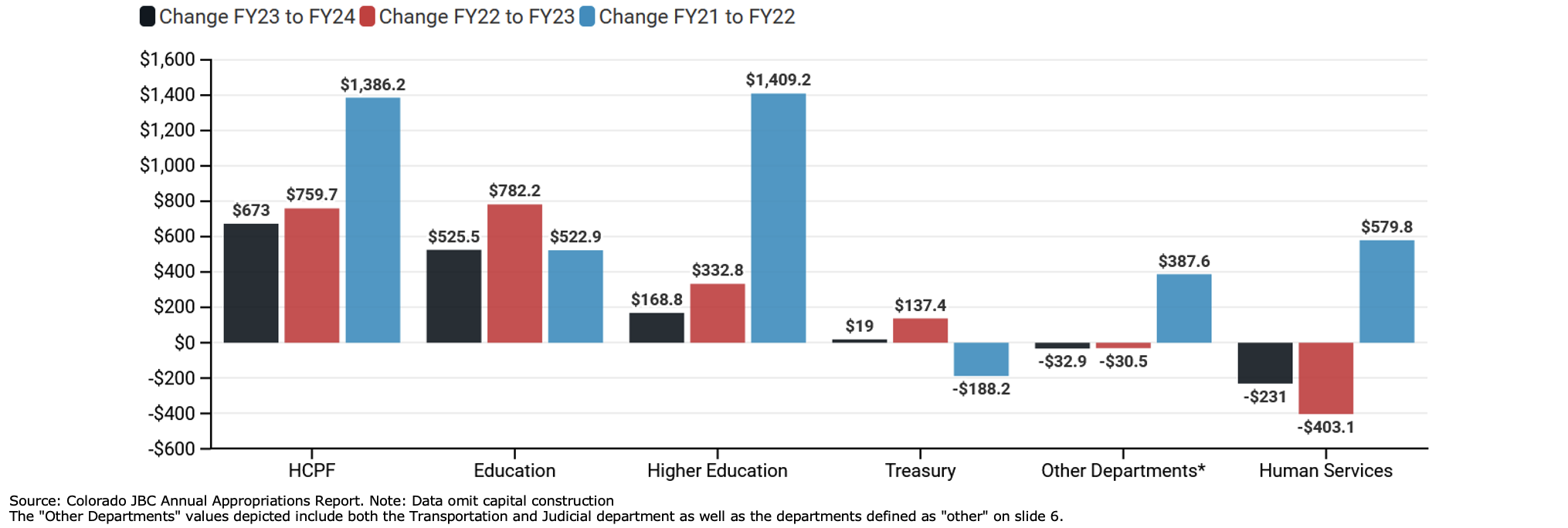

Change in Total Appropriations By Department

From FY21 to the FY24 Governor’s Budget Request (units in millions)

The total operating appropriations in FY21 were $31.23 billion and $34.64 in FY22. Current estimates suggest a net $2.16 billion increase from FY22 to FY23. A significant portion of growth has come from one-time federal funds. After accounting for 40.6% of the total budget increase from FY21 to 22, & 35.1% of the total increase from FY22 to 23, Health Care Policy and Financing (HCPF) is set to account for 56.1% of the FY24 total budget increase. Between FY20 & FY24, HCPF’s budget has grown 37.3%, compared to Colorado’s education budget which has grown just 15.6%.

Change in General Fund Appropriations By Department

From FY21 to the FY24 Governor’s Budget Request (units in millions)

From FY21 to FY23, the General Fund’s operating total grew from $11.2 billion to $13.9 billion, a 24% increase. Based on the FY24 initial budget proposal, the General fund is expected to increase another $783 million to $14.7 billion, a further 5.6% increase. The largest portion of this $783 million increase will be to Health Care Policy and Financing which will see $346 million added to its budget, accounting for 44% of the total increase.

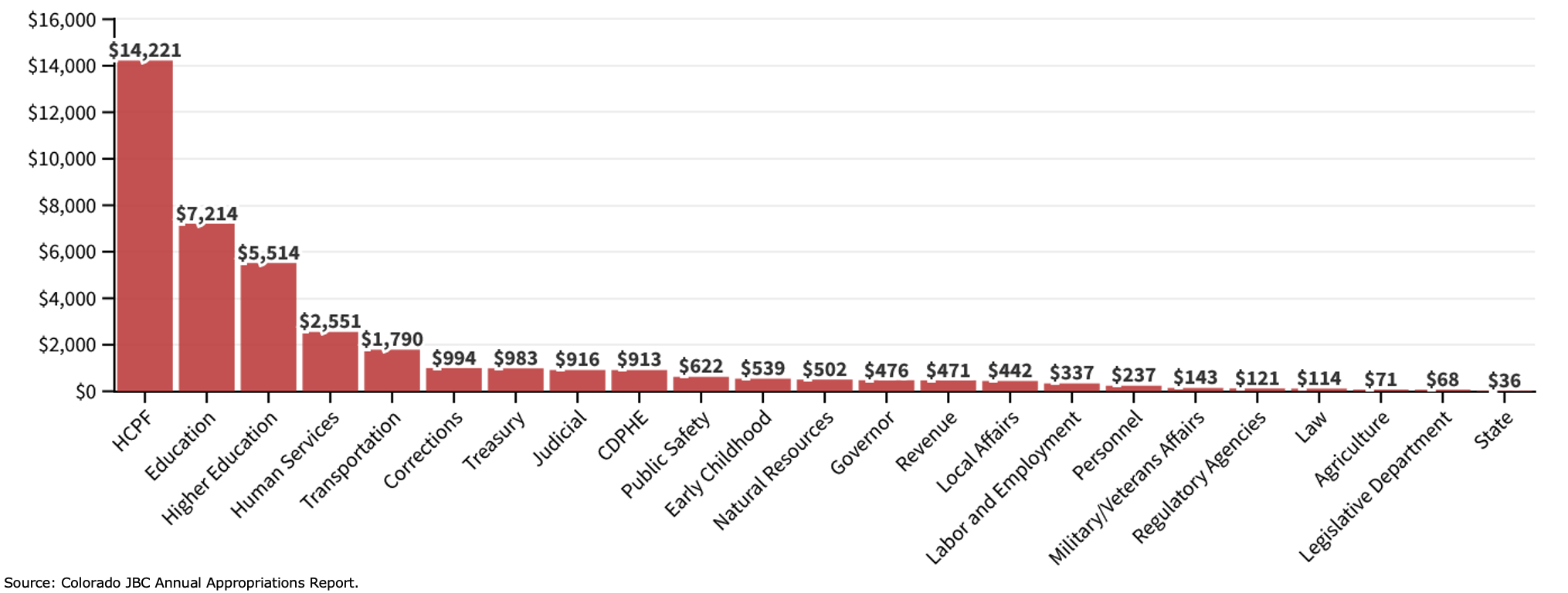

Colorado Total Appropriations to Each Department in FY23 (units in millions)

The top five departments, HCPF, Education, Higher Education, Human Services, and Transportation, were appropriated 80% of the budget in FY23. Departments such as Labor and Employment and the legislature received less than 1% of the total appropriations. The Governor’s FY24 budget request estimates that these top five departments will again receive 80% of the total statewide appropriations.

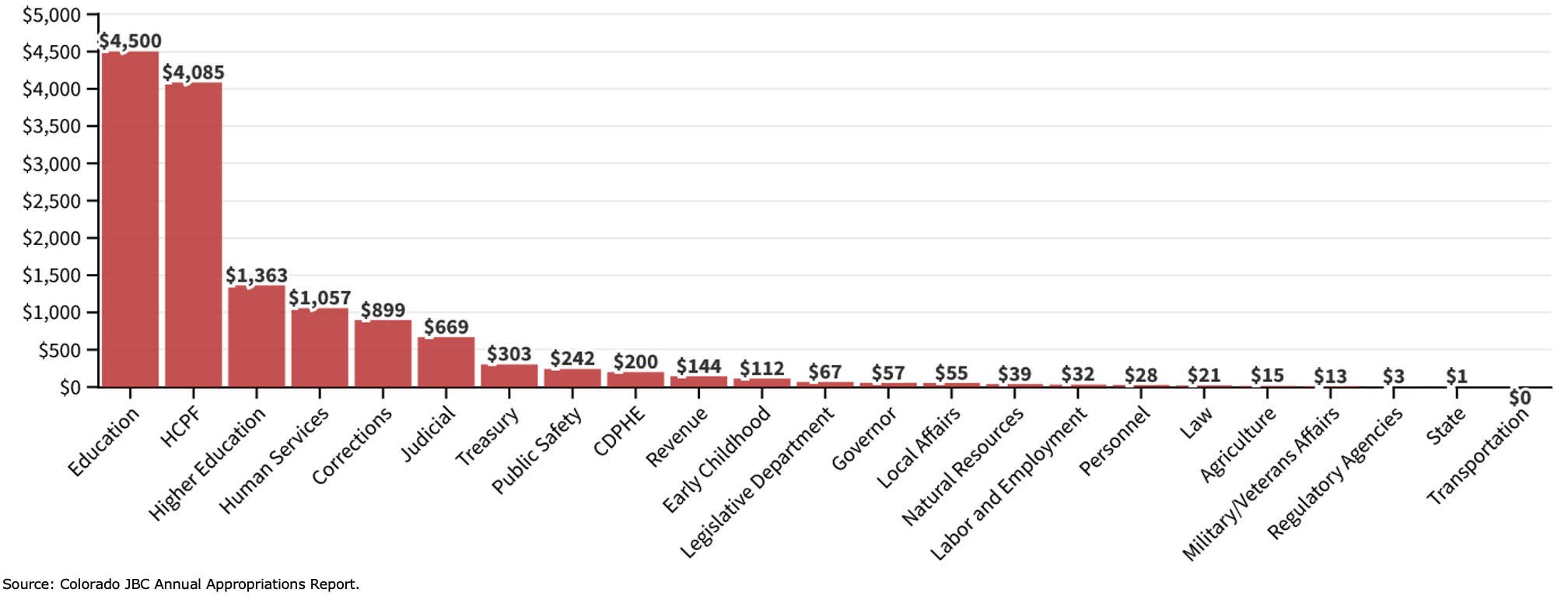

Colorado General Fund Appropriations to Each Department in FY23 (units in millions)

The departments of Education, Corrections, HCPF, Higher Education, Human Services, and the Judicial Branch make up 90.4% of General Fund appropriations in FY23. Often, money is transferred from the general fund to the Highway Trust Fund to be used for transportation projects. This transfer does not show up as an appropriation.

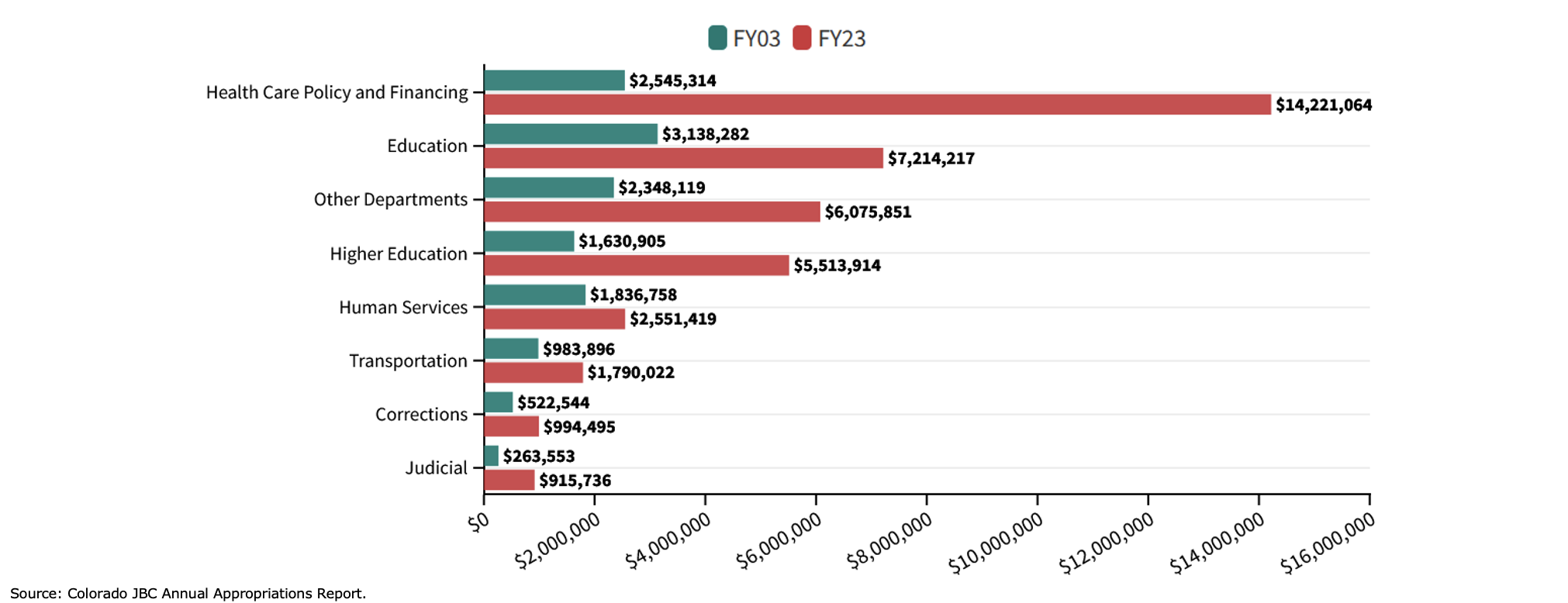

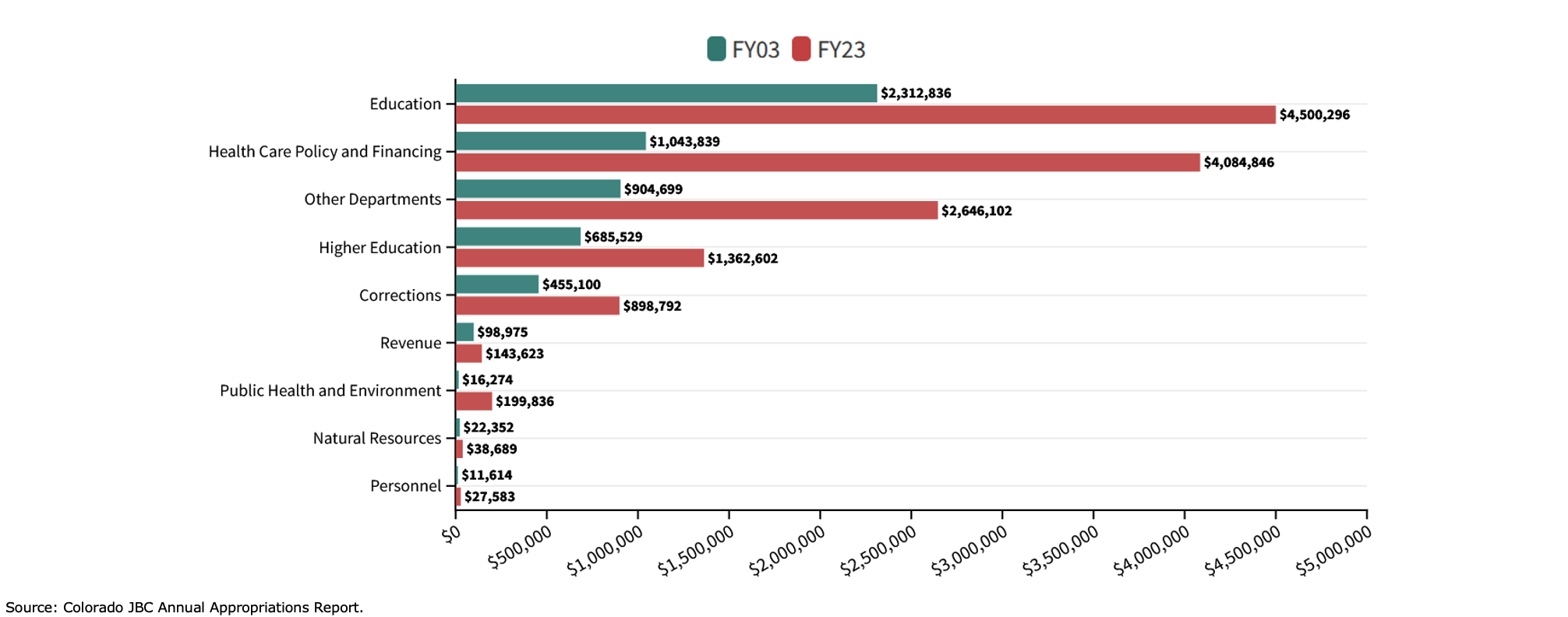

Total Colorado State Government Appropriations in FY03 compared to FY23 (units in thousands)

The difference in spending between FY03 and FY23 reflects both an increase in overall economic and population growth but also a shift in state spending priorities. In nominal terms, HCPF appropriations increased 459% over the last twenty years while the Colorado population grew just 30%.

General Fund Appropriations by Department in FY03 and FY23 (units in thousands)

General Fund appropriations increased for almost all departments from FY03 to FY23. Education GF appropriations grew 95% from FY03 to FY23, whereas HCPF GF appropriations grew 291% from FY03 to FY23. Therefore, HCPF’s share of GF appropriations grew from 19% to 29%, while education’s share shrank from 42% to 32%.

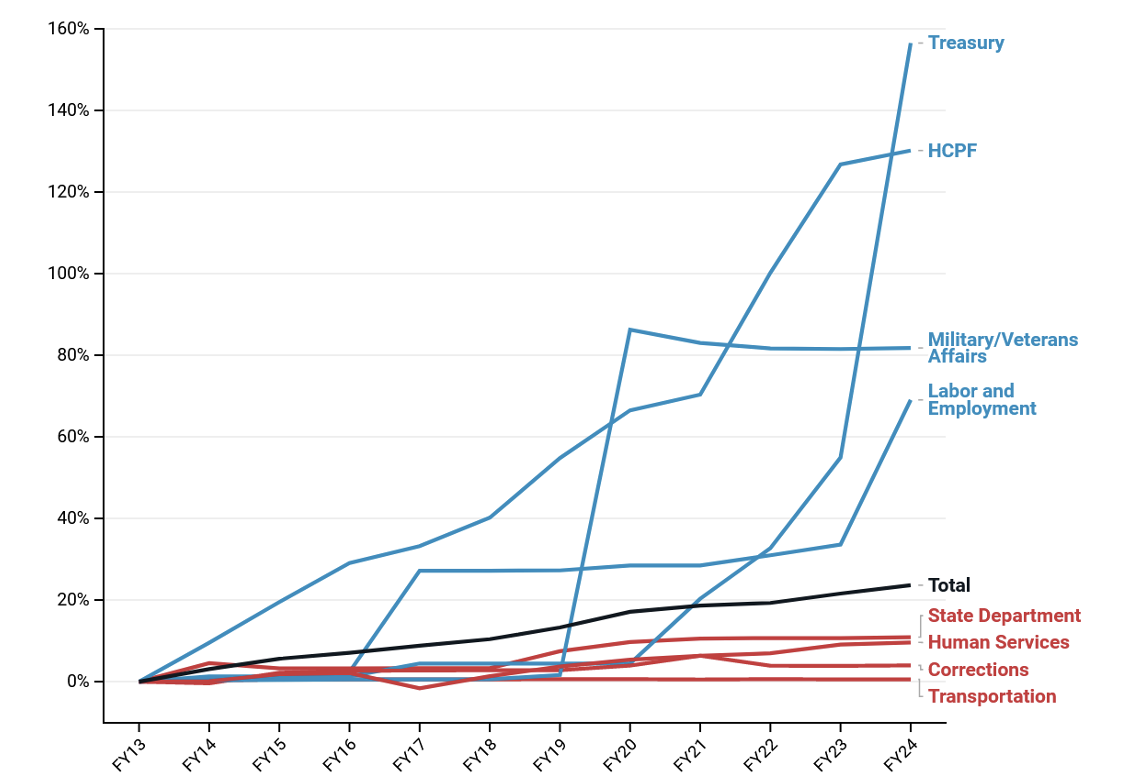

Colorado Full Time Employment (FTE) Growth by Department – Top and Bottom Four

Over the last 10 years, Colorado state government FTE has grown from 52,077 to 64,384. The Treasury Department has seen the largest FTE percentage growth at 156%, although the Department is still relatively small with only 80 FTE. HCPF was second in FTE growth rate with 130% FTE growth since FY13. The Department of Transportation has remained almost completely neutral, only growing 0.5% over the last decade.

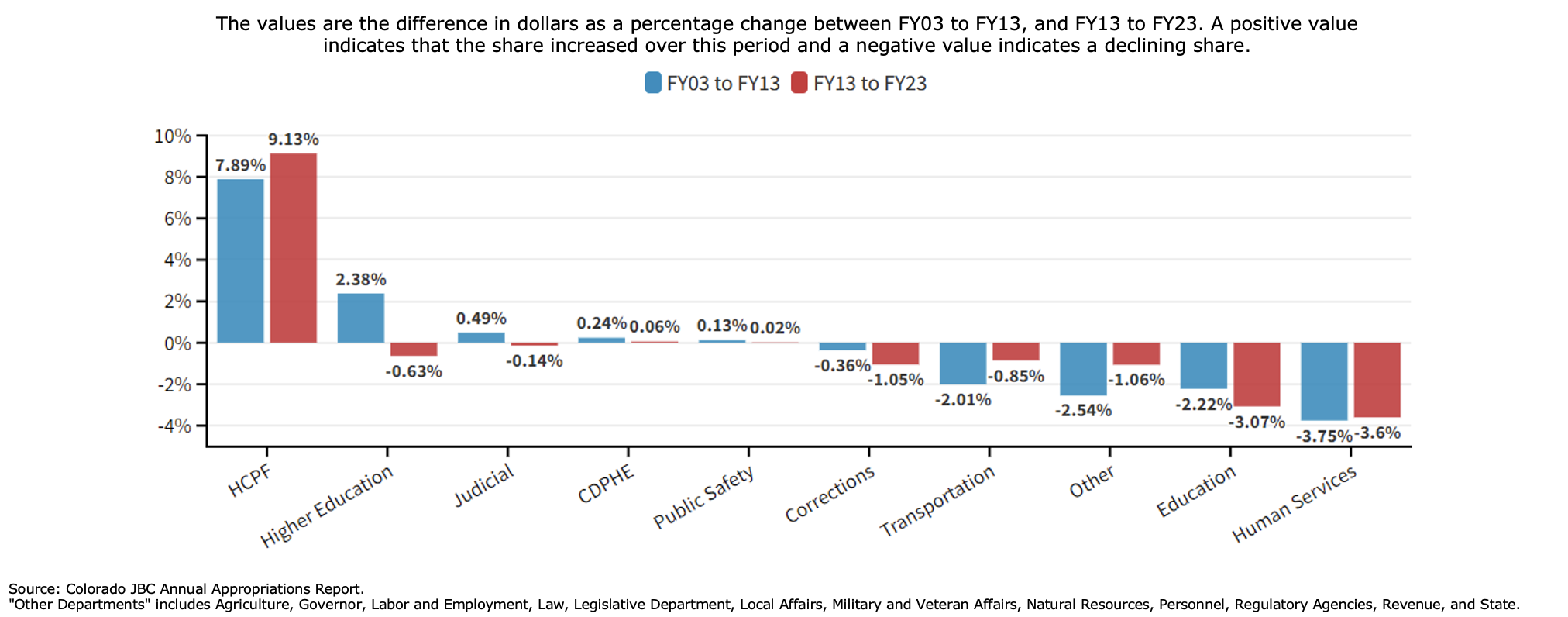

The Difference in the Share of Colorado’s Total Appropriations

The values are the difference in dollars as a percentage change between FY03 to FY13, and FY13 to FY23. A positive value indicates that the share increased over this period and a negative value indicates a declining share.

From FY02 to FY12, HCPF and Transportation were the only major departments to increase their shares of total appropriations. The share of appropriations to HCPF accelerated in last decade from FY12 to FY22, gaining an additional 10.1%, making it the only department to see its share increase. During that same time period, Education’s share decreased by 4.8%.

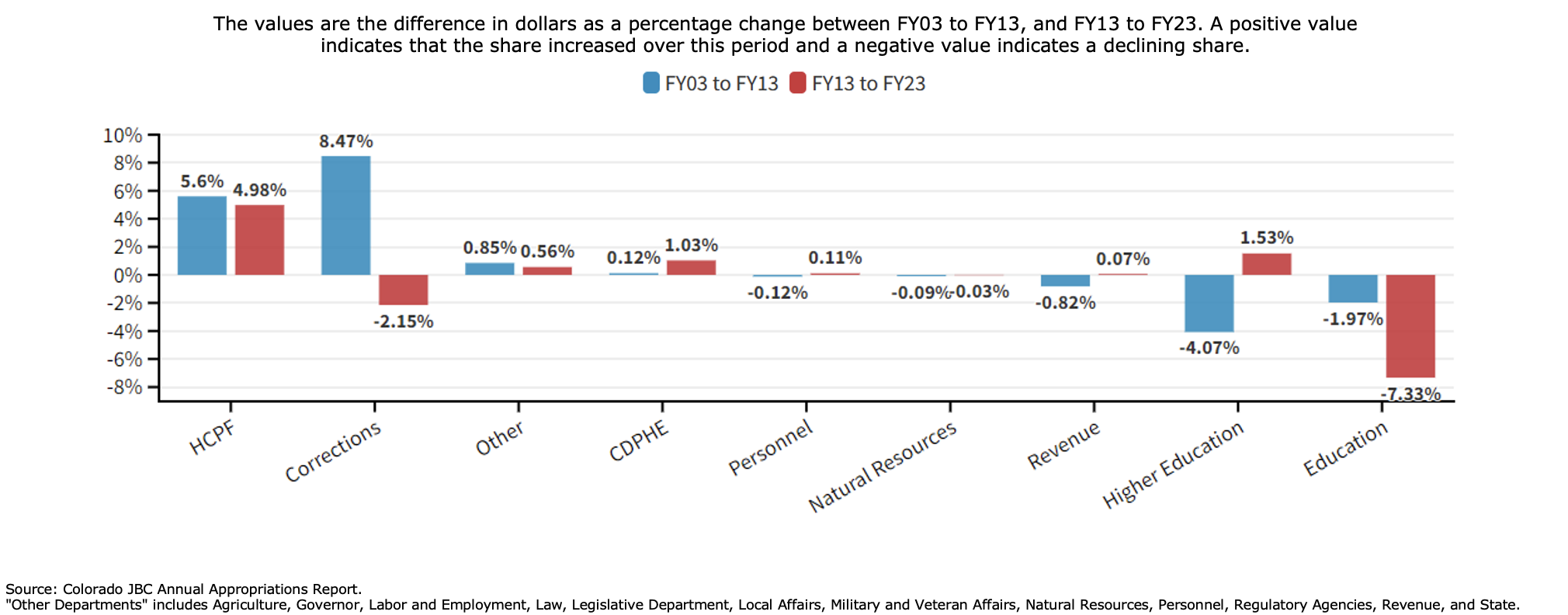

The Difference in the Share of Colorado’s General Fund Appropriations

The values are the difference in dollars as a percentage change between FY03 to FY13, and FY13 to FY23. A positive value indicates that the share increased over this period and a negative value indicates a declining share.

Most departments’ shares decreased from FY03 to FY13; this could be attributed to the impact of the Great Recession along with the large increases in the shares to HCPF and Corrections. HCPF’s share grew by 10.58 percentage points from FY03 to FY23, while the shares appropriated to the Departments of Higher Education and Education shrunk by 2.54 and 9.3 percentage points, respectively.

Total State Appropriations per Coloradan Citizen

Appropriations are adjusted for the population and inflation

Adjusted for inflation and population growth, total state government appropriations increased by 84% from FY03 to FY23. Population estimates come from the Colorado Demographer’s Office and annual inflation is derived from the Denver MSA CPI developed by BEA.

![]() 2021 FINAL REPORT: PDF | POWERPOINT

2021 FINAL REPORT: PDF | POWERPOINT

![]() 2020 FINAL REPORT: PDF | POWERPOINT

2020 FINAL REPORT: PDF | POWERPOINT

![]() 2019 FINAL REPORT: PDF | POWERPOINT

2019 FINAL REPORT: PDF | POWERPOINT