$4 Billion in New Taxes and Fees on the Table

Will it bring jobs back or just prolong the recession?

Today in Colorado, a series of legislative proposals and proposed ballot measures would impose billions of dollars of higher taxes and fees on a state economy that’s struggling to restart after the COVID-19 shutdown.

Under normal economic conditions, reasonable minds can differ about the appropriate size and scope of government and the commensurate level of taxation needed to support it. But after an unprecedented economic shock, there are serious and immediate consequences to permanently raising taxes, fees or other government-mandated costs.

With so many businesses on the brink of survival, and hundreds of thousands of Coloradans needing jobs, is now the right time to make it more expensive for businesses to stay open and put people back to work? That is the question confronting policymakers and the public in the days, weeks and months ahead.

Initially, legislative leaders answered this question with a three-part test: To win approval, all new laws must be “fast, friendly and free.” But things are changing fast.

Initially, legislative leaders answered this question with a three-part test: To win approval, all new laws must be “fast, friendly and free.” But things are changing fast.

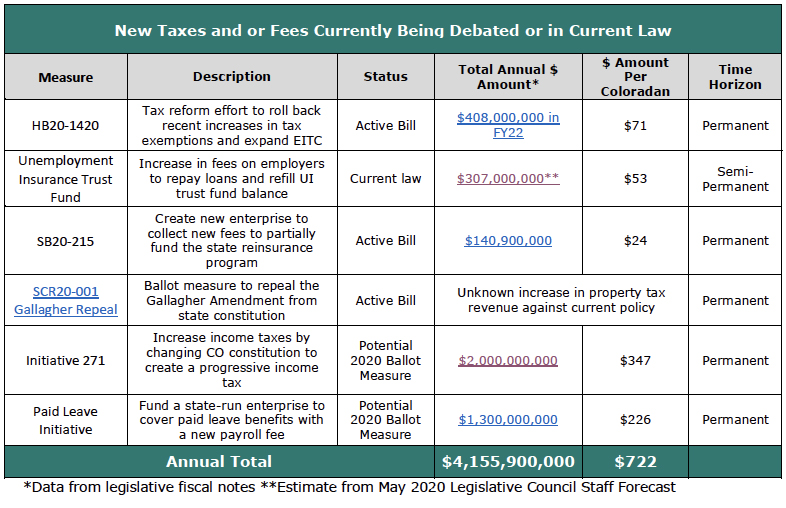

As of early June 2020, the Common Sense Institute has identified a series of bills and ballot measures that would collectively impose $4.156 Billion in new taxes, fees and other costs on businesses and working families in Colorado:

These measures don’t even include the list of new regulatory changes which will add new costs to businesses in order to comply– but their price tag has yet to be fully calculated.

Without a doubt, the COVID-19 shock has created massive budget challenges for state lawmakers. In effect, the free-enterprise system and all the tax revenue it generates was shut down without warning and has just started to reopen. The faster the free-enterprise system can recover, as businesses return to profitability and workers return to their jobs, the faster tax revenues and the state budget will rebound.

Proposals that simply increase taxes, fees and other costs in the short term should be closely scrutinized for unintended consequences that slow down, not speed up, the recovery of Colorado’s free-enterprise system and the tax revenue it generates.

Learn more at www.commonsenseinstituteco.org