How a One-time $500M Payment to PERA Could Save Teachers, Schools and Coloradans $871M Over the Next Decade

About the Authors

Zachary Christensen is a Managing Director of the Pension Integrity Project and a Senior Policy Analyst at Reason Foundation. The Pension Integrity Project aims to promote solvent, sustainable retirement systems that support retirement security for government workers while reducing taxpayer and pension system exposure to financial risk and reducing long-term costs for employers/taxpayers and employees. The project offers pro-bono consulting to public officials and other stakeholders to help them design and implement policy solutions aimed at improving plan resiliency and promoting retirement security for public employees. It has provided technical assistance to several successful pension reform efforts in recent years, including in Michigan, Colorado, Arizona, New Mexico, South Carolina and other states tackling persistent pension solvency challenges.

Amy Slothower is a management consultant with more than 20 years of leadership experience in both the private and nonprofit sectors. She currently provides strategic planning services to organizations in the health care and education industries. Her current and past clients include Secure Futures Colorado, Children’s Hospital Colorado, the Colorado Health Foundation, the Colorado Office of Early Childhood, the Colorado Charter School Institute, Colorado Access and numerous smaller nonprofits, charter schools and independent schools. Slothower typically is hired by the Board of Directors of her client organizations, and often provides them with guidance on effective governance.

Chris Brown is the Common Sense Institute Vice President of Policy & Research where he leads the research efforts of CSI to provide insightful, accurate and actionable information on the implications of public policy issues throughout the state of Colorado. Since joining CSI, Chris has led several reports on a range of policy and economic issues facing the state of Colorado including, measuring the impacts of potential 1% growth-caps imposed in the state’s major metro areas, analyzing the need and options for PERA reform, simulating the economic impacts if Colorado schools were #1 and measuring the economic and fiscal impacts of a 2,500-ft setback for new oil and gas drilling.

About Common Sense Institute

Common Sense Institute is a non-partisan research organization dedicated to the protection and promotion of Colorado’s economy. CSI is at the forefront of important discussions concerning the future of free enterprise in Colorado and aims to have an impact on the issues that matter most to Coloradans. CSI’s mission is to examine the fiscal impacts of policies, initiatives, and proposed laws so that Coloradans are educated and informed on issues impacting their lives. CSI employs rigorous research techniques and dynamic modeling to evaluate the potential impact of these measures on the Colorado economy and individual opportunity. Common Sense Institute was founded in 2010 originally as Common Sense Policy Roundtable. CSI’s founders were a concerned group of business and community leaders who observed that divisive partisanship was overwhelming policymaking and believed that sound economic analysis could help Coloradans make fact-based and common sense decisions.

About REASON Foundation

REASON Foundation is a national 501(c)(3) public policy research and education organization with expertise across a range of policy areas, including public sector pensions, transportation, infrastructure, education, and criminal justice. For more information about the Pension Integrity Project at Reason Foundation, visit reason.org.

About Secure Futures Colorado

Secure Futures Colorado is a nonprofit, nonpartisan, stand-alone organization created to promote the urgent need for substantive PERA reform. We believe Colorado’s approach to retirement for public employees must be fundamentally overhauled – for the good of the state, for the good of our communities, and for the good of public sector employees.

Building Back Stronger: An Opportunity to Invest in Colorado’s Future by Paying Down Future Expenses

The federal American Recovery Plan Act (ARPA) is estimated to deliver an additional $3.9 billion to the Colorado state government. At the same time, however, state revenues are rebounding as the Colorado economy emerges from the COVID-19 recession. Compared to the FY20 budget, state general fund revenues in FY22 are forecasted to grow by $936 million. The anticipated influx of federal funding, combined with the rising state government revenues, has presented a unique opportunity for Colorado to make bold investments in its future.

State leaders have a chance to use the surge in available funding to improve the financial health of state government. They can do this by reducing the expenses that taxpayers must support over the long-term. Primary among Colorado’s long-term, high-cost expenses is the state’s unfunded pension liabilities.

The Colorado Public Employees Retirement Association (PERA) has long been a source of financial challenges for the state. For decades it has experienced  market returns below expectations, higher than expected costs, and chronic underfunding, which has led to an unfunded liability of $30 billion. Major 2018 state legislative reforms, through SB18-200, set PERA on an improved financial path, however those came at a large cost to both PERA members and to taxpayers. SB18-200 increased contribution rates for employees and employers. It established an annual commitment of $225 million from the state’s general fund, and it created requirements for future automatic adjustments to annual contribution rates and retiree cost-of-living increases (COLAs). The purpose of these changes was to maintain a fixed amortization period of 30 years for paying off PERA’s more than $30 billion in unfunded liabilities.

market returns below expectations, higher than expected costs, and chronic underfunding, which has led to an unfunded liability of $30 billion. Major 2018 state legislative reforms, through SB18-200, set PERA on an improved financial path, however those came at a large cost to both PERA members and to taxpayers. SB18-200 increased contribution rates for employees and employers. It established an annual commitment of $225 million from the state’s general fund, and it created requirements for future automatic adjustments to annual contribution rates and retiree cost-of-living increases (COLAs). The purpose of these changes was to maintain a fixed amortization period of 30 years for paying off PERA’s more than $30 billion in unfunded liabilities.

In the first two years following SB18-200, the state has already triggered two of the potential four automatic increases in contribution rates, and in 2020 missed one $225 million direct disbursement payment. This means that public employees and taxpayers will have to contribute a combined 2% more of pay towards PERA, without seeing any increase in benefits. It also means that PERA retirees will see the growth in their annual benefit payments slow by .5%. While these changes may seem small, they are added to the more than 30% of member pay that is already contributed to PERA annually and amounts to an additional cost of nearly $180 million per year.

Through its 2018 reform, Colorado made a commitment to bring the state’s public pension back to full funding. An additional payment of $500 million would protect that commitment today and would help to ensure that the promises made to Colorado workers and taxpayers are kept. Using state funds, a one-time supplemental payment of $500 million to PERA would restore the positive fiscal trajectory of the 2018 reform and allow for lowering employer and employee contributions next year, which benefits taxpayers, governments and employees alike. This rate reduction would ultimately depend on PERA’s market results, but the reduced rate would hold for a least a decade even if their annual investment returns stay around 6%, instead of the currently assumed 7.25%.

Improving Colorado’s Fiscal Health and Saving Money

Benefits – A One-time, $500M Contribution to PERA Would…

- Roll back one of the recent contribution rate increases, thereby lowering ongoing costs and saving both taxpayers and public employees money.

- Make up for the missed $225 million payment in 2020, and build a buffer against any additional market turbulence that could come in the future. The lower contribution rates would hold for 10 years even if annual investment returns are near 6% instead of the currently assumed/needed 7.25%.

- Improve the state’s financial outlook and credit rating. Pension liabilities are a major factor considered by credit rating agencies, and the decision to skip the 2020 supplemental payment sparked a warning from Moody’s.[i]

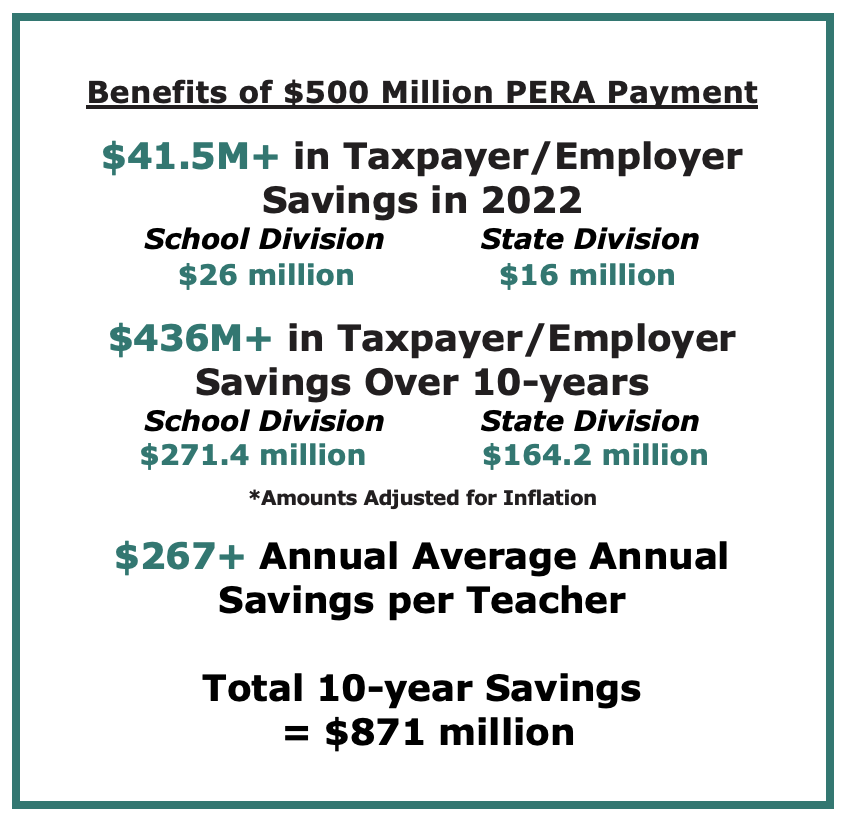

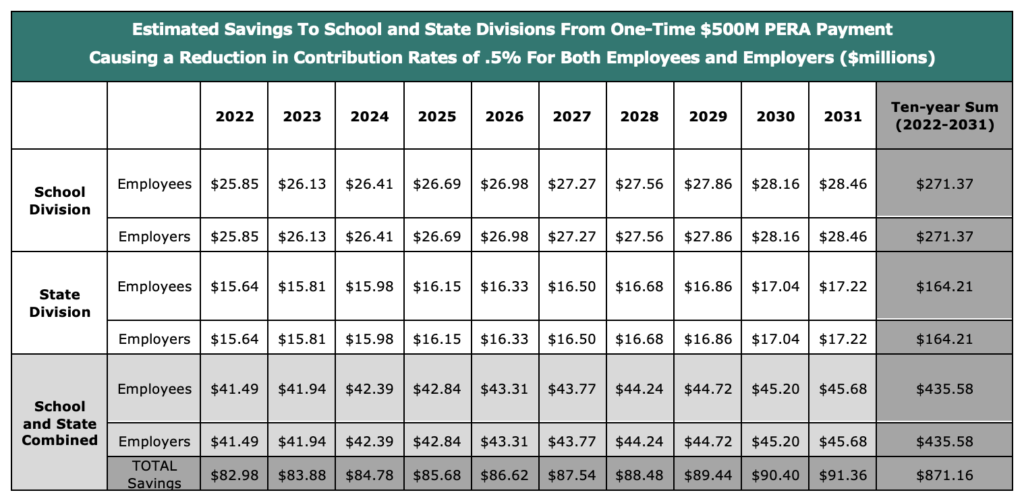

- Lower annual payment requirements to PERA by a total of $83 million in 2022 and a total of $871.1 million over the next 10 years. Half of those savings or $41.5 million annually and $435.6 million over ten years would accrue to taxpayers and the other half to employers.

- Save school division employees an $26 million in 2022. That would translate to an annual savings of $267 for the average salary of $54,000.

- Save the state and its employees a total of $31.3 million in 2022 and $328.4 million over the next decade.

About this Analysis

To study the direct impact of supplemental payments on PERA’s automatic adjustments, and the eventual savings from those results, the Pension Integrity Project at Reason Foundation uses actuarial modeling of the funding and contributions for the School and State divisions (which make up 87% of PERA’s total liability). This analysis uses the same actuarial assumptions on payroll growth, inflation, and demographic factors (hiring and retiring rates) as PERA. This modeling allows for an analysis of complex outcomes with many interacting factors, but much of the actual outcomes will depend on the plan’s market returns.

[i] https://www.pionline.com/pension-funds/moodys-dings-colorado-dropping-225-million-pension-contribution-budget