2020 Research

Colorado Budget: Then and Now

Colorado Budget Then and Now illuminates the meaningful changes in Colorado state spending over the last twenty years. The following figures provide a summary overview of state spending across different state funds and agencies. The trends shown reflect the shifting priorities brought on as a direct result of the laws and budgets passed each legislative session.

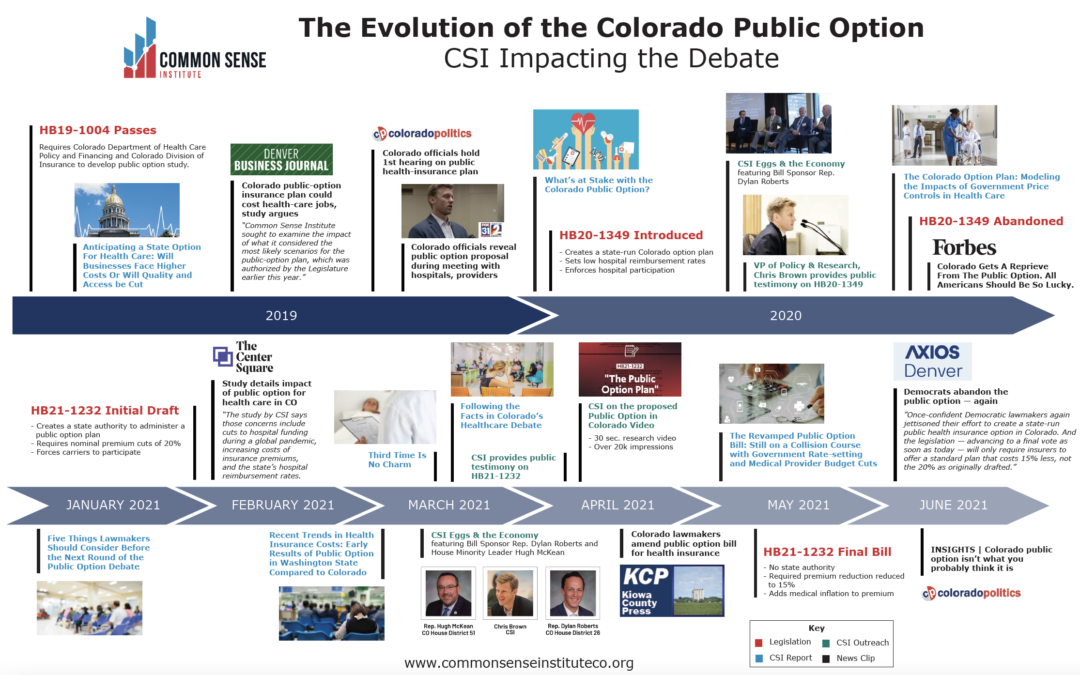

The Evolution of the Colorado Public Option: CSI Impacting the Debate

The State of Colorado’s Unemployment Insurance Trust Fund

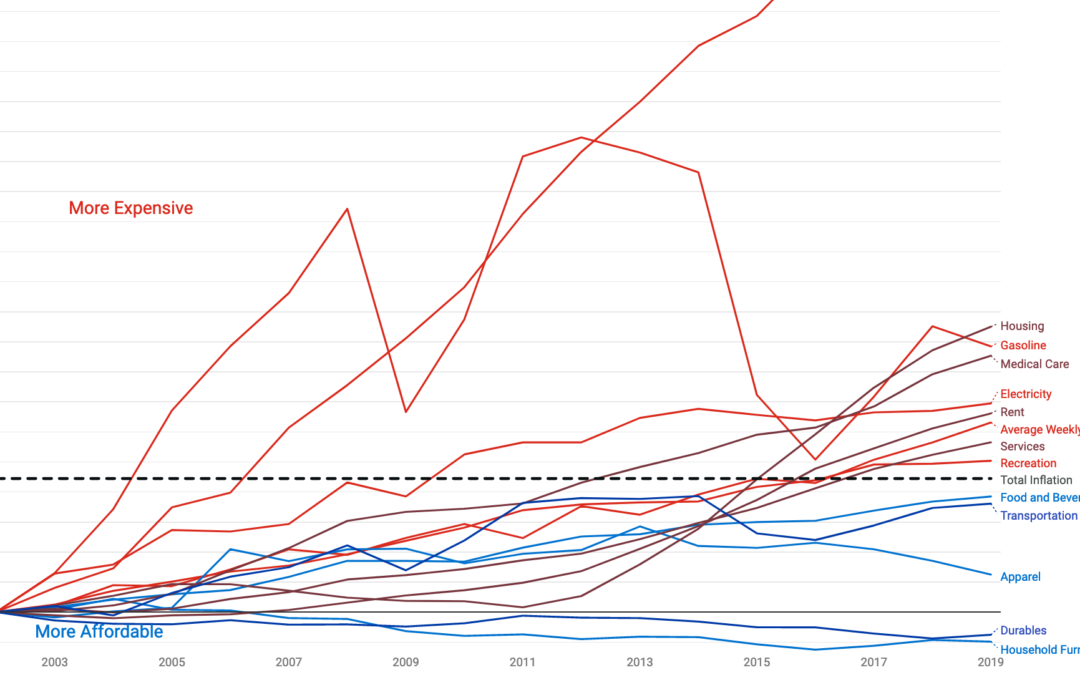

Colorado Prices in the 21st Century

2020 Annual Report

Colorado’s Labor Force & Jobs Report COVID-19

Property Tax in Colorado Post Gallagher: What Can Be Understood From Other States?

New Spending in Denver to Reduce Greenhouse Gas and Adapt to Climate Change: Get It Right and Avoid Further Tax Increases

The Road to Recovery Initiative

Economic Impacts of the Colorado Oil and Gas Conservation Commission Series 1200 Proposed Oil and Gas Setbacks

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic

Proposition 118: A Statewide Paid Family and Medical Leave Program for Colorado but At What Cost?

Proposition 118: How Will It Affect Your Bottom Line?

Amendment B: The Inherent Tradeoffs in Amendment B

Proposition 116: Dynamic Economic and Fiscal Impacts of a Cut to Colorado’s State Income Tax Rate

The Price of Higher Education in Colorado

A Path Forward: A Common Sense Strategy for the Continued Viability of Colorado’s Transportation Network

Digging Into the Data on Colorado Charter Schools

Proposition 117 – Voter Approval of New Fee Based Enterprises

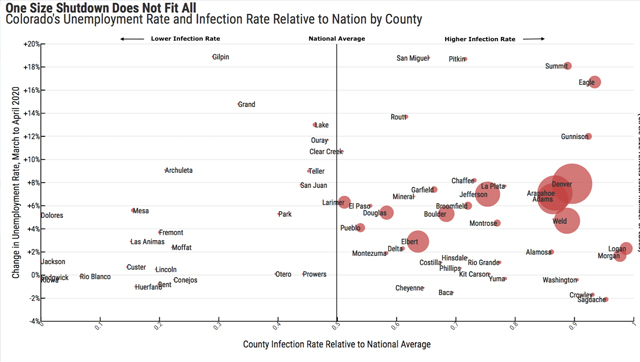

One Size Shutdown Does Not Fit All

$4 Billion in New Taxes and Fees on the Table

The Economic Impacts of Oil and Gas Setback Ballot Measures in Colorado: A Historical Review

The Colorado Option Plan: Modeling the Impacts of Government Price Controls in Health Care

Putting Students First: Strategies to Mitigate the COVID Slide