Download a pdf of the Key Findings >>

Download a pdf of the full report >>

ABOUT PROPOSITION CC

On the November 2019 ballot, Coloradans will cast their vote on Proposition CC. Through a referred measure from the Colorado General Assembly, Proposition CC asks voters if they want to allow the state to retain and spend all revenue above the current TABOR spending limit, substantially altering Colorado’s fiscal policy structure.

Here is the language that appears in the Voter Blue Book 1:

Proposition CC proposes amending the Colorado statutes to:

Allow the state government to keep all of the money it collects every year beginning in the 2019-20 state budget year; and require that any money the state government keeps over its existing revenue limit be spent for public schools, higher education, and transportation projects, rather than returned to taxpayers.

What your vote means:

YES/FOR NO/AGAINST

A “yes” vote on Proposition CC changes state law and means the state can keep all of the money it collects over its revenue limit to spend on education and transportation.

A “no” vote on Proposition CC means that any money the state collects over its revenue limit must be returned to taxpayers, as required under current law.

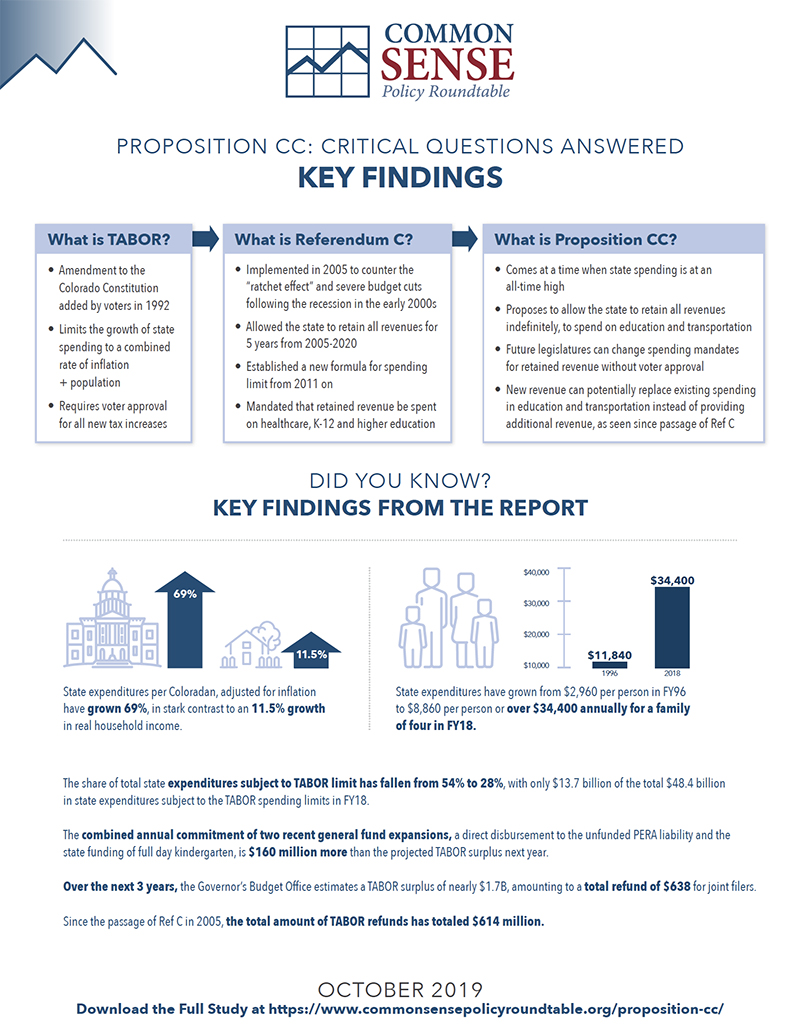

The Taxpayer Bill of Rights, often referred to as TABOR, is an amendment to the Colorado constitution, which was added by voters in 1992. The provisions of TABOR impact public finances in Colorado in two distinct ways:

I. TABOR limits the growth of state spending to a rate no greater than population plus inflation.

II. TABOR requires that all new tax increases first be voted on by the people.

The two components of TABOR currently apply to both state and local governments, though many local governments have already had voter-approved removal of spending limits. Proposition CC would only impact state government and would not change any of the provisions of TABOR that require state and local governments to put tax increases to a vote of the people.

Given Proposition CC does not have a sunset clause, if passed it would mean Coloradans would no longer receive additional refunds due to revenue being in excess of the TABOR spending limits. Thus, it would be a permanent “De-Brucing,” in reference to the original author of TABOR.

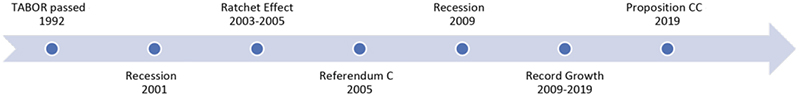

TABOR Timeline

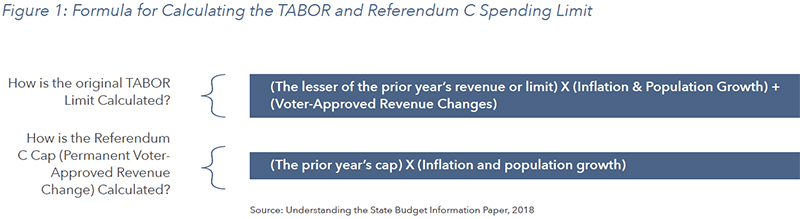

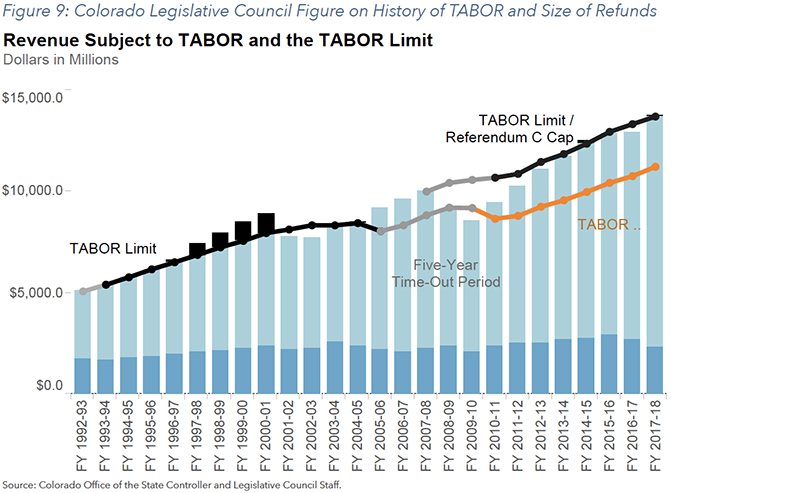

The original TABOR spending limit was calculated as the lesser of the prior year’s revenue OR spending limit multiplied by inflation and population growth. Due to the recession in the early 2000s, state revenue subject to TABOR dropped by over $1 billion from its pre-recession peak in FY022. This substantially reduced the starting point of the budget where TABOR increases were calculated from and flattened the TABOR spending limit from FY03 to FY052. Then as the economy recovered, revenue recovered to pre-recession levels by a percentage greater than the TABOR spending limit increase allowed. This is because the TABOR limit incorporated the lesser of the prior year’s revenue or spending limit. This is often called the “ratcheting effect”. On top of this, the state legislature designated most of the revenue collected by institutions of higher education through tuition, as exempt from the TABOR limit. This additionally caused the revenue base subject to TABOR to drop prompting the ballot question known as Referendum C.

Referendum C was a voter approved revenue change to the state spending limit passed in 2005. It implemented a 5-year time-out, or temporary exemption from the original TABOR spending limit, during which the state was allowed to retain all revenues. Then, a new spending limit formula was established starting in FY11, often referred to as the Referendum C cap.

Referendum C was a voter approved revenue change to the state spending limit passed in 2005. It implemented a 5-year time-out, or temporary exemption from the original TABOR spending limit, during which the state was allowed to retain all revenues. Then, a new spending limit formula was established starting in FY11, often referred to as the Referendum C cap.

The new Referendum C cap was calculated slightly differently from the original TABOR limit formulation. Ref C exempted voter approved revenue increases from being subject to the spending limit, and the annual spending cap increase was calculated from the previous year’s cap, regardless of what happened to actual revenue. This effectively eliminated the potential for a future “ratcheting effect.”

Referendum C was proposed and passed at a time when the state was facing budget cuts while at the same time it was issuing TABOR refunds. Proposition CC arises at a time where state spending is at an all-time high and future revenue is forecasted to grow faster than the rate of population + inflation.

This report summarizes a few critical questions and answers to be considered.

I. SINCE TABOR PASSED, HOW MUCH HAS STATE SPENDING GROWN?

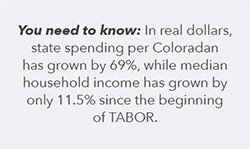

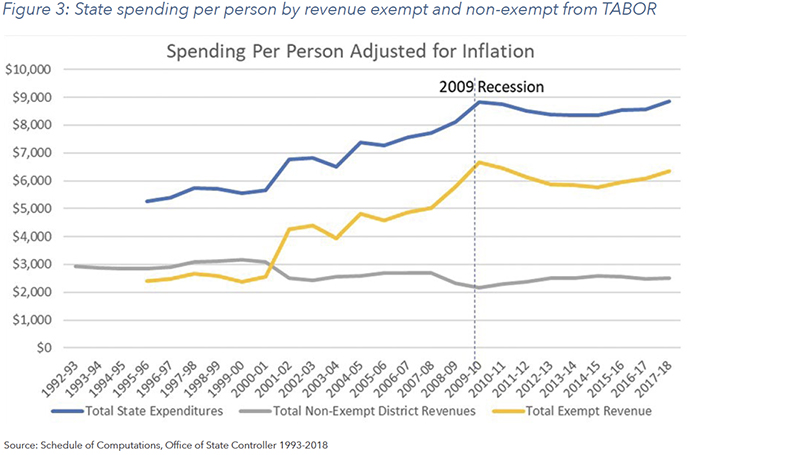

- State expenditures per Coloradan after adjusting for inflation1 have grown 69% since the inception of TABOR in 1992. For comparison, Colorado real household income has grown by only 11.5%.

- State expenditures per person have grown from $2,960 in FY96 to $8,860 or over $34,400 annually for a family of four in FY182.

II. HOW MUCH HAS REVENUE SUBJECT TO THE TABOR LIMIT GROWN?

- Since the inception of TABOR, the share of total state expenditures subject to the TABOR limit has fallen from 54% to 28%. This is largely due to the growth in enterprise revenue from $742 million dollars in FY94 to $17.9 billion in FY18. To further illustrate, only $13.7 billion of the total $48.4 billion in state expenditures was subject to the TABOR spending limits in FY18.

- While recent increases in vehicle and other fees have counted towards the TABOR cap, Proposition CC would allow future legislatures to raise revenue through certain fees without running into a spending limit.

III. WHERE HAVE RECENT REVENUE INCREASES BEEN SPENT?

- Over the past three budget cycles, FY17 through FY19, general fund appropriations have grown 4.8%, 6.9%, and an estimated 7.1%.

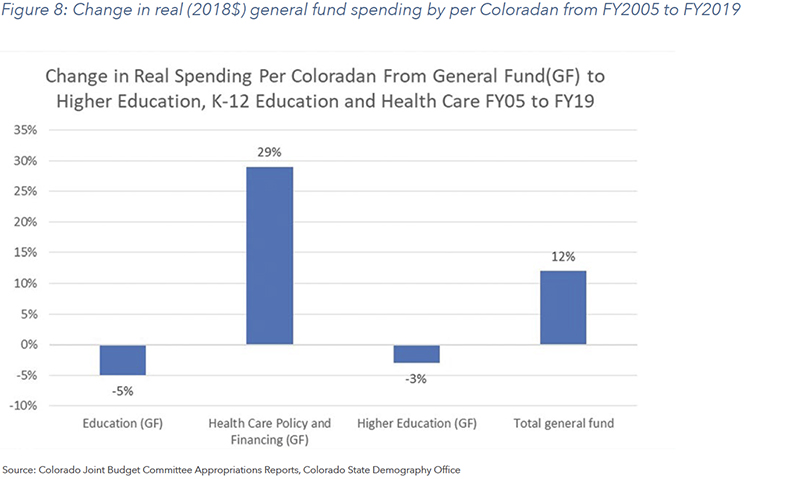

- The revenue retained under Referendum C, which was passed in 2005, is formulated to be spent on higher education, K-12 education and healthcare. Meanwhile, population and inflation adjusted general fund revenue has grown 12%, Health Care spending has grown 29%, whereas K-12 education and Higher Education have declined by -5% and -3% through FY19.

- The combined annual commitment of $425 million of two of the recent general fund expansions, a direct disbursement to PERA, and the state funding of full day kindergarten, is $160 million more than the projected TABOR surplus next year.

IV. HOW HAS THE TABOR SPENDING LIMIT IMPACTED TAXPAYERS IN COLORADO?

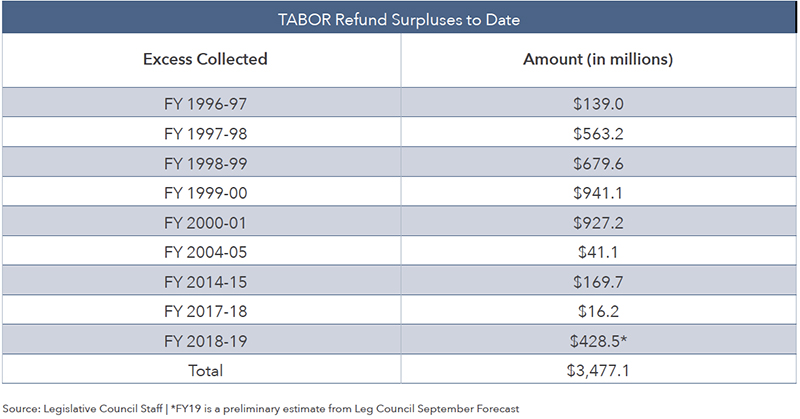

- During the 26-year history of TABOR, there have been 9 years of refunds to taxpayers, totaling $3.9 billion or 1.7% of all revenues subject to TABOR.

- Since the passage of Referendum C in 2005, the total amount of revenue subject to TABOR refunds, in excess of the TABOR limit has totaled $614 million, or 0.4% of all revenue subject to TABOR.

V. WHAT IS THE OUTLOOK FOR REVENUE SUBJECT TO TABOR?

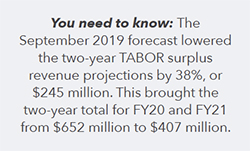

- The most recent forecast, released September 20th, revised the two-year estimated revenue in excess of the TABOR spending limits downwards by 38% from an estimated $652 million to $407 million.

- While not the official projections used by the General Assembly, the Governor’s Budget Office estimates a TABOR surplus of nearly $1.7 billion, amounting to a refund of $638 for joint filers, over next 3 years.

- The allowable growth rate in revenue subject to TABOR over the next two years is currently estimated to be 4.1% and 3.2%.

- Given the uncertainty of the annual growth of revenue, restrained state spending may be more useful to mitigate severe cuts during recessions, rather than funding new state programs.

VI. WHAT WILL YOUR VOTE MEAN?

- If Proposition CC fails, TABOR revenue retention or refunds will continue as they currently do under Ref C.

- If Proposition CC passes, the state would retain all revenue above the Ref C cap to be spent equally between K-12, higher ed and transportation.

- Prop CC does not require that existing expenditures continue as is, meaning that future retained revenue can go to education and transportation while existing revenue is repurposed for other programs.

I. SINCE TABOR PASSED, HOW MUCH HAS STATE SPENDING GROWN?

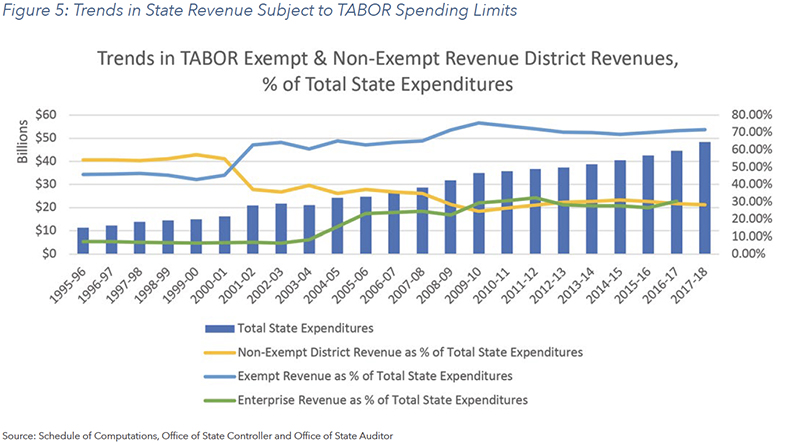

The spending limits under TABOR and Referendum C both use the formula of the population growth rate plus the inflation rate to establish the next year’s spending limit increase. Since FY96, which is the year the state audit reports begin, total state spending has grown from $11.3 billion to $48.4 billion in FY182.

The spending limits under TABOR and Referendum C both use the formula of the population growth rate plus the inflation rate to establish the next year’s spending limit increase. Since FY96, which is the year the state audit reports begin, total state spending has grown from $11.3 billion to $48.4 billion in FY182.

After adjusting for inflation and population, total state spending per person has increased 69% from 1996 to 2018, or from $5,249 (2018$) in FY96 to $8,863 (2018$) in FY18, which amounts to over $35,400 annually for a family of four.

In contrast, median household income in Colorado has grown by only 11.5% over those same 23 years.

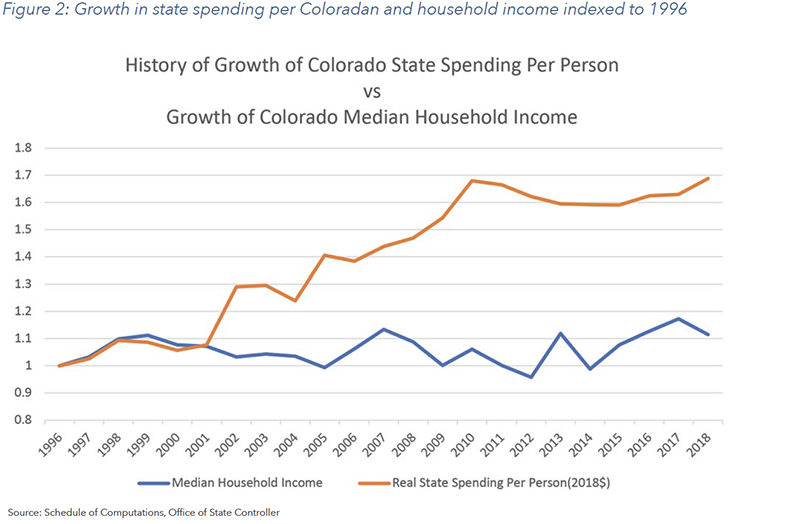

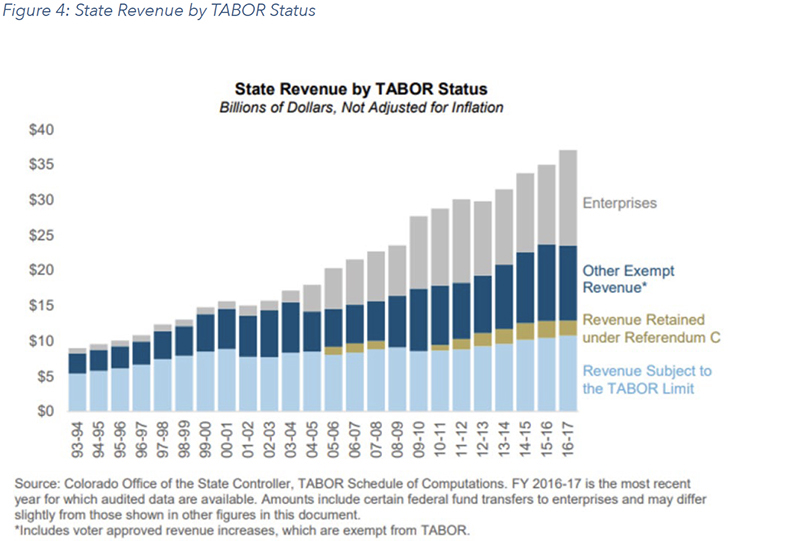

Since the inception of TABOR, the share of total state spending subject to the TABOR spending limit has dropped from 54% to 28.35% in FY18. This means that in FY95, $6.1 billion of revenue was subject to TABOR and $5.1 billion was exempt. Fast forward to FY18, $13.7 billion of the $48.4 billion in total state expenditures was subject to the TABOR spending limit and $34.7 billion or 62%, fell outside of the TABOR spending limits2.

This trend has occurred primarily due to the creation of new state enterprises. A state enterprise is a self-supporting, government-owned business that receives revenue in return for the provision of a good or service. When a program is granted enterprise status, its revenue is not counted toward the TABOR limit calculation. Because enterprise programs are primarily user-funded, they can grow revenue over time at rates deemed sufficient to fund expenses. Several of the largest enterprises include, institutions of higher education, the state lottery, and the state’s unemployment insurance program.

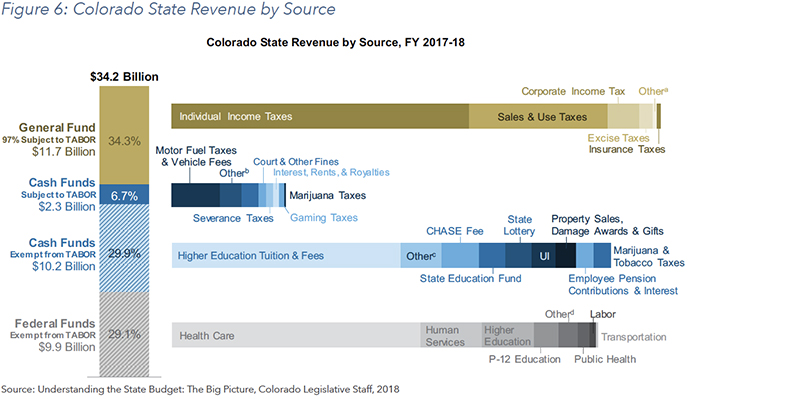

The revenue subject to TABOR includes most of the state’s general fund revenue, which was approximately 97% of general funds in FY18. Revenue exempt from TABOR includes some general fund revenue, federal revenue, and most cash funds. Cash funds include revenue collected as fees by state enterprises, and other fees such as motor vehicle fuel taxes which are subject to TABOR. More details on cash funds and enterprises can be found in Figures 5 and 6 in the following section.

The figure below shows the estimated total amount of spending per Coloradan from revenue subject to TABOR, revenue exempt from TABOR and total revenue. The inflation adjustment factors used in this figure are from the Denver Metro CPI. Given prices in the Denver may have risen faster than the entire state, the resulting growth in spending may be understated.

Several trends are important to note. While the total spending per person from revenue subject to TABOR has dropped below the original level, this is primarily due to fact that certain revenue sources have been removed and exempted from the TABOR limit. Following the 2009 recession it is important to highlight that while exempt revenue has just started to recover to a level seen before the recession, its growth is in no way impacted by the TABOR spending limit. And while revenue subject to TABOR also fell following the recession, it has consistently been above the FY10 level.

II. HOW MUCH HAS REVENUE SUBJECT TO THE TABOR LIMIT GROWN?

II. HOW MUCH HAS REVENUE SUBJECT TO THE TABOR LIMIT GROWN?

The figure below shows the year-over-year change in revenue subject to the TABOR spending limits, compared to the revenue that is exempt from the TABOR spending limits, which can grow as fast as the underlying revenue source dictates.

For deeper insights, Figure 5 shows the history of total state spending in Colorado, and the percentage of those expenditures that are either exempt, or not exempt from the TABOR spending limit, and the percent that is from state enterprises from FY96 to FY18.

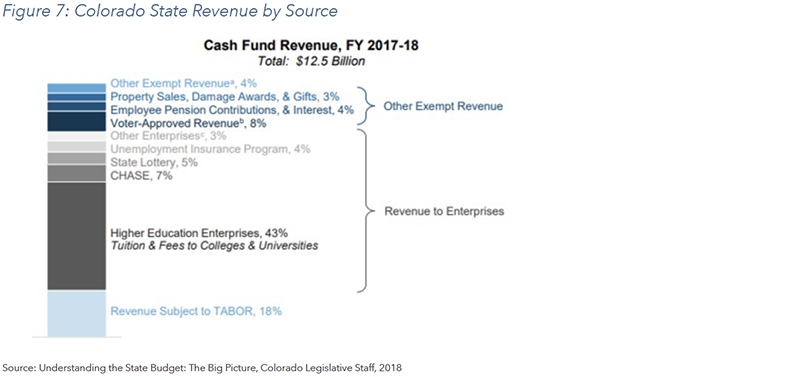

To better understand the types of revenue sources included within each broader category, the following figure shows the state revenue by specific source for FY18. Individual income taxes and sales taxes make up most of general fund revenue, while cash fund revenue exempt from TABOR primarily includes tuition and fees for higher education, the hospital provider fee, and sales taxes on lottery tickets.

Cash funds subject to TABOR are an important category to understand. While they are subject to the TABOR spending limit, in the event there is a surplus, only general fund revenue is used for the refund, leaving the cash funds untouched. The largest source of cash funds that are subject to TABOR include motor fuel taxes and vehicle fees.

Additionally, the second component to TABOR requires that new taxes and tax increases be voted on by the people. However, legislators have been allowed by courts to raise fees. Proposition CC would make it so that any new fees or increases in fees by the legislature would no longer take away revenue from the general fund given there would be no spending limit. This arguably makes it even easier for future legislatures to raise new revenue through fees.

Voter approved revenue increases are also not subject to the TABOR limit. In FY18, voter approved revenue increases, including cigarette and marijuana taxes, equaled 8% of all cash fund revenue as shown in Figure 7 3.

III. WHERE HAVE RECENT REVENUE INCREASES BEEN SPENT?

Since the passage of Referendum C, revenue subject to TABOR has grown from $9.2 billion in FY06 to $12.8 billion in FY18. General fund appropriations grew from $6.29 billion to $11.4 billion in FY18 4. After adjusting for population growth and inflation, that amounts to 12% real growth per Coloradan.

Since the passage of Referendum C, revenue subject to TABOR has grown from $9.2 billion in FY06 to $12.8 billion in FY18. General fund appropriations grew from $6.29 billion to $11.4 billion in FY18 4. After adjusting for population growth and inflation, that amounts to 12% real growth per Coloradan.

The additional revenue retained under Ref C was intended to add to spending for K-12 education, higher ed and health care. Because of sustained revenue growth, K-12 spending per student is at an all time high. Yet while overall spending and revenue have increased, spending adjusted for population and inflation for both K-12 education and higher education, have declined by 3% and 5% relative to 2005 levels. This difference in growth rates is a result of recent population growth being slightly higher than the growth in the number of K-12 students. This is in stark contrast to an increase of 29% of real per person spending to the state department of Health Care Policy & Financing as shown in Figure 8.

Over the previous two fiscal years, legislators entered the legislative session with significant budget surpluses. The March 2018 forecast, in the middle of the legislative session, suggested there would be nearly $1.29 billion, or 11.5% more to spend or save in the General Fund than what was currently budgeted. The March 2019 forecast again estimated the General Assembly would have an additional $1.18 billion, or 9.5%, more to spend or save.

These budget surpluses represent the starting point for changes in discretionary spending approved by the legislature and requested by the governor’s office. While a large portion of those increases went to existing programs, two legislative changes stand out as large increases in the long-term obligation of general fund revenue that could have been spent on existing obligations.

In 2018 the legislature committed an annual appropriation of $225 million to help pay off the PERA unfunded liability over the next 30 years. In 2019, the legislature chose to have the state fund 100% of full-day kindergarten where previously it funded 50%. Updated estimates suggest the program will cost over $200 million a year despite being passed with a projected cost of $177 million. Regardless of whether these items were sound policy decisions, they represent two new long-term obligations of state government spending. The combined annual total of $425 million would equal $950 million over the next budget years. This is almost twice as much the current projections for the TABOR excess during that time period. Given that money could have been spent on other budgetary items such as increasing per-pupil funding or allocating to higher education, this highlights how annual diversions from existing state priorities accumulate over time.

IV. HOW HAS THE TABOR SPENDING LIMIT IMPACTED TAXPAYERS IN COLORADO?

Below is the language from the original TABOR ballot question in 1992.

“Shall there be an amendment to the Colorado Constitution to require voter approval for certain state and local government tax revenue increases and debt; to restrict property, income, and other taxes; to limit the rate of increase in state and local government spending; to allow additional initiative and referendum elections; and to provide for the mailing of information to registered voters?”

The objective of TABOR was to give Coloradans a direct vote in approving tax increases, and to prevent large expansion in the growth rate of government spending. Granted that objective, Figure 9 graphs the history of the annual revenue that has been subject to TABOR and shows the years in which the revenue has been in excess of the spending limits and by how much.

During the 26-year history of TABOR, there have been 9 years of refunds to taxpayers, totaling $3.9 billion or 1.7% of all revenue subject to TABOR. Only three of those refunds were post-2005 due to the passage of the temporary De-Brucing measure known as Referendum C. This means that since 2006 the total amount of revenue subject to TABOR refunds, in excess of the TABOR limit has totaled $614 million, or 0.4% of all revenue subject to TABOR.

While state spending has not run into the TABOR cap in a significant way since 2006, partially due to Referendum C and partially due to the expansion of enterprises, the outlook for revenue is different. If Proposition CC were to pass, Coloradans would no longer have a constitutional check on the growth in government spending.

V. WHAT IS THE TABOR OUTLOOK?

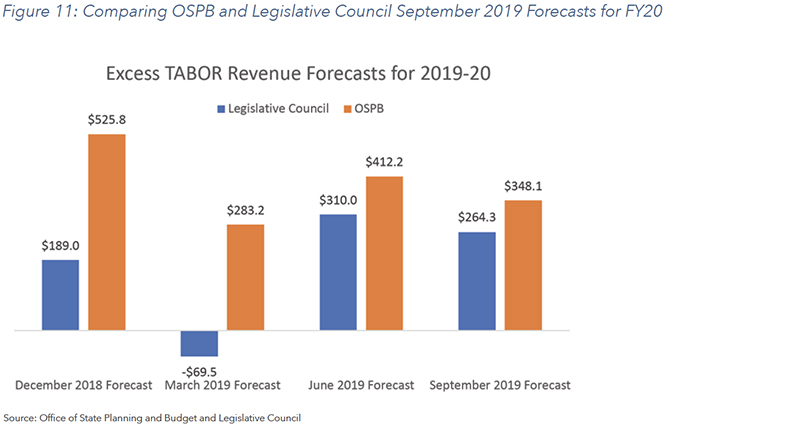

The Legislative Council staff along with The Governor’s Office of State Planning and Budget (OSPB), produce quarterly economic and revenue forecasts for the state 5. The official projections from the Colorado Legislative Council June 2019 forecast, which appear in the Ballot Information Booklet, “Blue Book”, estimate that over the next two budget cycles, there could be approximately $652 million in surplus revenue over the TABOR cap or spending limit that would be refunded back to Coloradans 6.

The Legislative Council staff along with The Governor’s Office of State Planning and Budget (OSPB), produce quarterly economic and revenue forecasts for the state 5. The official projections from the Colorado Legislative Council June 2019 forecast, which appear in the Ballot Information Booklet, “Blue Book”, estimate that over the next two budget cycles, there could be approximately $652 million in surplus revenue over the TABOR cap or spending limit that would be refunded back to Coloradans 6.

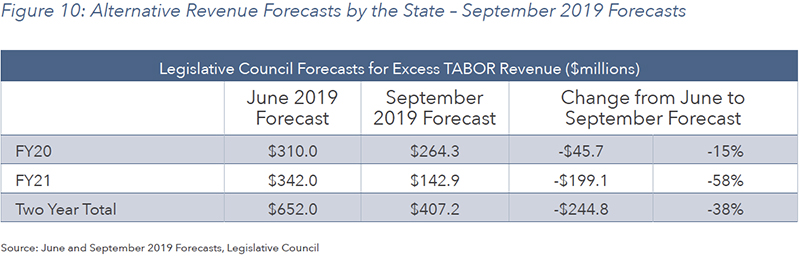

While not the officially adopted forecast, OSPB projects a nearly $1.7 billion TABOR surplus over the next 3 years, and $900 million over the next two.

The Colorado Legislative Council’s most recent forecast, which was released on September 20th, 2019 (after the release of the Blue Book), are depicted in the figures below 7. The two-year surplus was reduced by 38%, from an estimated $652 million to $407 million. The projected allowable growth rate in revenue subject to TABOR over the next two years is currently estimated to be 4.1% and 3.2%.

Relative to the total amount of revenue subject to TABOR in FY20, the latest projected TABOR refund of $264 million equals 2.06% of revenue subject to TABOR. While the TABOR refund would reduce the amount of money available for the state to spend, the same projections indicate General Fund Expenditures are set to increase by 2.7%. So, in the absence of the TABOR spending limit, state spending would grow by 4.76%, or 2.06% faster than the rate of population plus inflation.

However, projections are uncertain and economic forecasts increasingly indicate the economy is nearing a recession. If it were the case that the state experienced a recession, then more restrained spending would be useful to mitigate severe cuts. As shown in the figure below, over the last 4 Legislative Council quarterly forecasts, the projected FY20 TABOR surplus has ranged from -$69.5million to as much as $525.8 million.

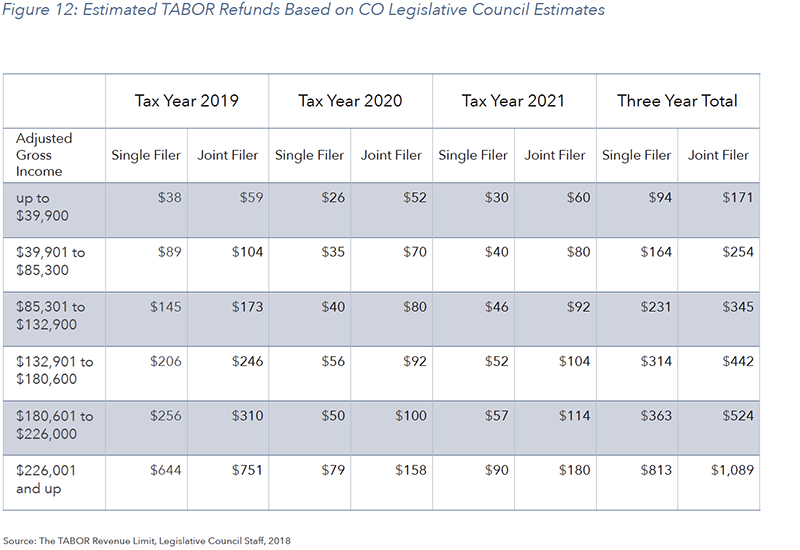

Based upon the projections from the Colorado Legislative Council, Figure 12 depicts how the combination of income tax cut and sales tax TABOR refunds would look by income level. Despite being called a sales tax refund, the refund appears on income tax forms as a means of returning sales tax revenue paid by individuals. The mechanism grants taxpayers a refund according to where their adjusted gross income falls among six adjusted gross income tiers. When the amount to be refunded via this mechanism is large enough to support at least $15 per taxpayer, the Department of Revenue is required to distribute the amount among the tiers as it was distributed for the sales tax refund in tax year 1999. If the amount to be refunded is less than $15 per taxpayer, an equal refund is provided to each taxpayer regardless of income. Under either scenario, taxpayers who file joint returns receive twice the refund amount as taxpayers who file single returns 8.

The tiers in Figure 12 are based on 2019 tax levels and based on the June 2019 excess TABOR revenue forecasts by the Legislative Council. Granted that the September 2019 forecast lowered the excess TABOR revenue estimate by 38%, the above single and joint filer refund numbers would be adjusted by a proportional amount.

VI. WHAT WILL YOUR VOTE MEAN?

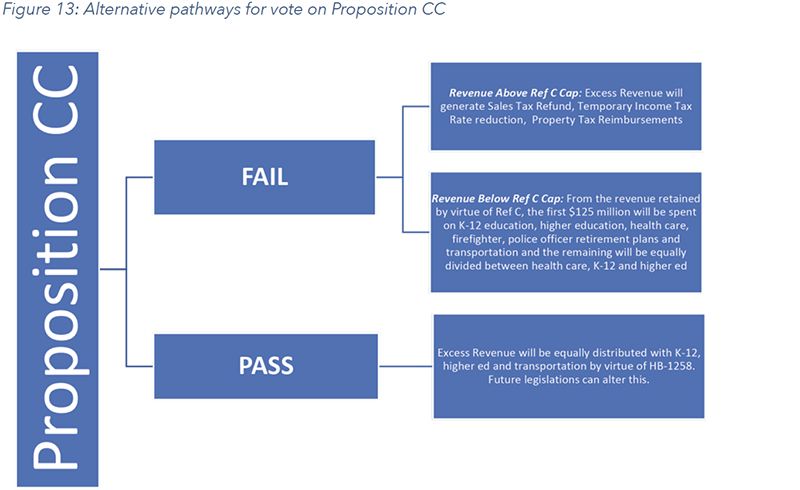

Whether Proposition CC passes or fails, Coloradans should consider three scenarios, depicted in the following chart:

Fail – Revenue Above Ref C Cap

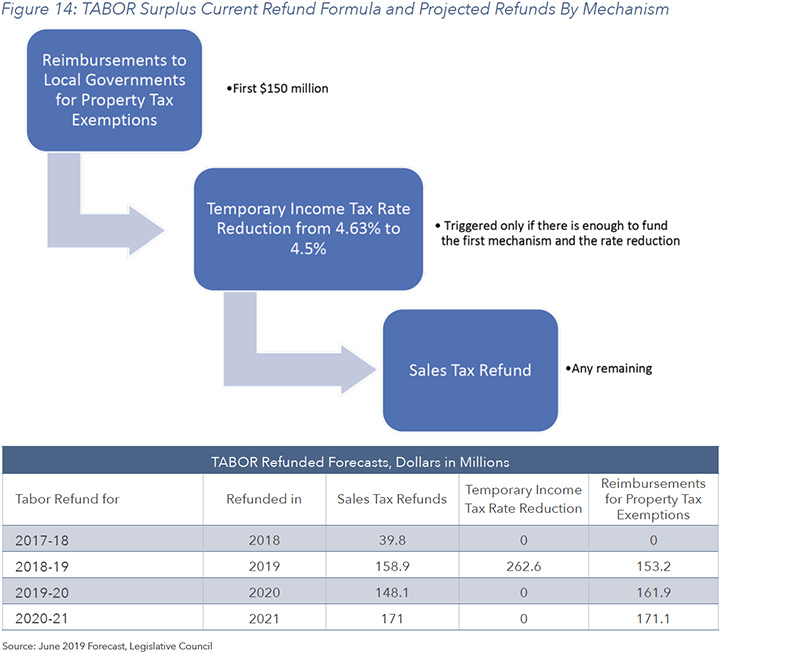

If Proposition CC fails, and there is excess revenue above Referendum C spending limit, the excess revenue will be refunded back to Coloradans. Historically, a number of refund mechanisms have been created to refund excess TABOR revenues. These alternative refund mechanisms have included things such as an earned income credit refund, capital gains refund, business personal property refund, and childcare credits, etc. which have all been repealed by the legislature as of 2017 8. The most recent formula for refunding revenue in excess of the Ref C cap includes sales tax refunds, temporary reduction in income tax rate, and reimbursements to local governments for the senior homestead and disabled veteran property tax exemptions, summarized in Figure 14 alongside refund forecasts from the Legislative Council.

Fail – Revenue Below Ref C Cap

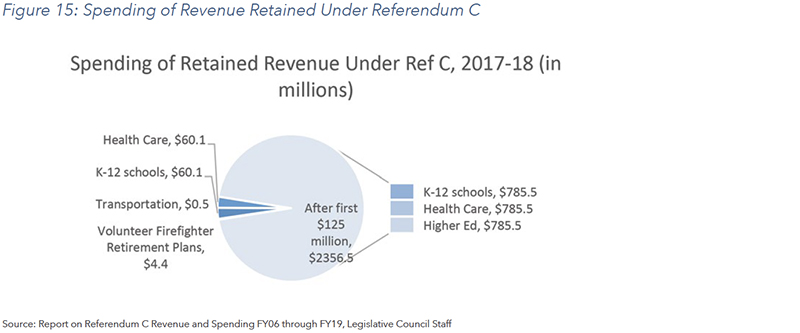

In the event that Proposition CC fails, and the revenue is below the Ref C cap, the state will be required to follow a set of guidelines to spend the revenue retained under Ref C, i.e., the difference between the original TABOR limit and the cap formulated under Ref C. Of this retained revenue, the state will spend the first $125 million on K-12 education, higher education, health care, firefighter, and police officer retirement plans and transportation. In recent years, the bulk of this has gone to K-12 education and health care, totaling $60.1 million each. The remaining revenue beyond the first $125 million must be equally distributed between healthcare, K-12 education and higher education 9.

Pass – State Retains All Collected Revenue

If Proposition CC passes, any future revenue in excess of the spending limit would be spent according to a formula established within the legislation. This formula would split the excess revenue equally by a third, and be distributed to K-12 education, higher education and transportation and only applied to excess revenues above the TABOR limit. To note, Proposition CC does not have a “maintenance of effort” clause, which would prevent future legislatures from allocating revenue retained under Proposition CC according to the new statute, while at the same time lowering spending to the same items and reallocating that money elsewhere. Therefore, similar to the change in relative growth of spending on education versus health care following Referendum C, the outcome of Proposition CC could be similar as retained revenue is used in place of existing revenue, rather than be used as additive.

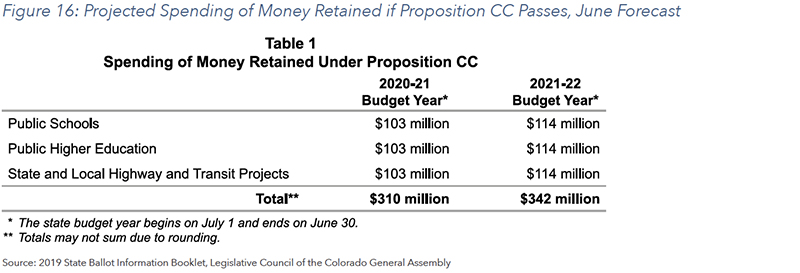

The following figure represents the projected spending allocation to the different budget items given the current forecast from Legislative Council.

Footnotes

1 References to real spending per person are expressed in 2018 dollars using the Denver CPI. This adjustment was made to put spending in terms of what the TABOR spending limit formula was intended to maintain.

2 State spending per K-12 student after adjusting for inflation is at an all-time high. The discrepancy in figures is due to population growth slightly outpacing growth in the number of students.

References

1 If “State Ballot Information Booklet,” Legislative Council of the Colorado General Assembly, Denver, 2019.

2 Schedule of Computations Required under article X, Section 20 of the State Constitution,” Office of State Controller, Denver, 1996-2017 .

3 Understanding the State Budget: The Big Picture,” Joint Budget Committee & Colorado Legislative Staff, Denver, 2018.

4 Appropriations History,” Joint Budget Committee, Colorado General Assembly , Denver, 2019.

5 September 2019 Colorado Economic and Fiscal Outlook,” Governor’s Office of State Planning and Budgeting, Denver, 2019.

6 June 2019 Economic & Revenue Forecast,” Colorado Legislative Staff, Denver, 2019.

7 2019 September Economic & Revenue Forecast,” Colorado Legislative Council Staff, Denver, 2019.

8 G. Sobetski, “History of TABOR Refund Mechanisms,” Legislative Council Staff, Denver, 2019.

9 Report on Referendum C Revenue and Spending FY 2005-06 through FY 2018-19,” Legislative Council Staff, Colorado General Assembly , Denver, 2018.