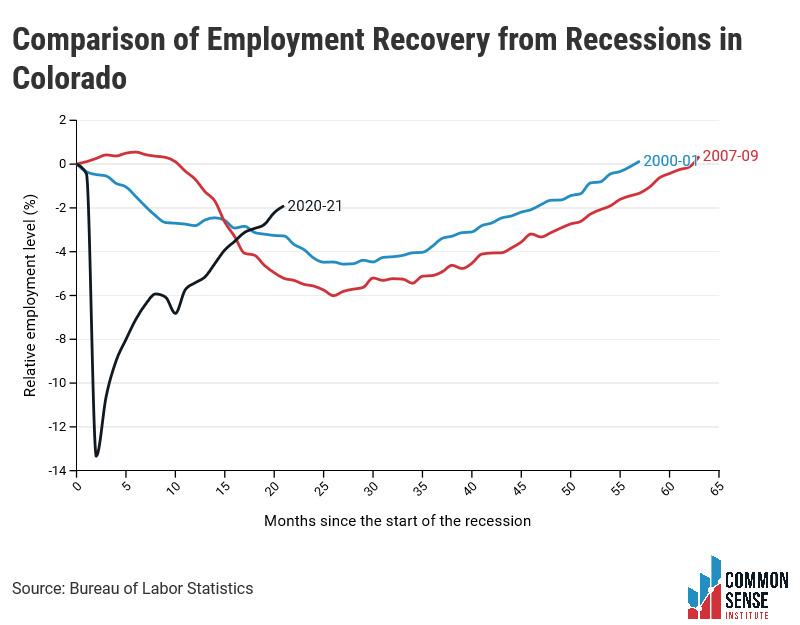

Despite concerns of rising inflation and a new COVID-19 variant, November job growth in Colorado remained relatively strong at 9,800 jobs. This is above the monthly average job growth needed to fully recover to a pre-pandemic employment-to-population ratio by 2023, ranking Colorado 17th in its November employment level relative to January 2020.

Key Findings—Colorado November 2021 Employment Data (BLS CES Survey[1])

- Colorado added 9,800 total nonfarm jobs in November.

- At this pace, the state would reach pre-pandemic employment levels in May 2022.

- To recover to pre-pandemic employment levels by January 2023—after adjusting for population growth—Colorado needs add 8,923 jobs each month, on average.

- Total employment levels are down 1.9% (54,100 jobs) relative to pre-pandemic levels, ranking Colorado 17th in terms of November ‘21 job levels relative to Jan. ’20.

- New York ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 8% and 12.8%, respectively.

- Utah, Idaho, Texas, and Arizona are the only states that have employment levels higher than they had before the pandemic. Utah has the highest differential (62,400 jobs).

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in November, and others lost

- The professional and business services industry added 3,900 jobs.

- The leisure and hospitality industry lost 1,700 jobs.

- Though the leisure and hospitality industry has led the recovery by adding 61,500 jobs between Jan. ‘21 and November ‘21, it is still down 20,800 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 9.1% (5,400 jobs).

- Accommodation and food services is down 5.3% (15,400 jobs).

Colorado Labor Force Update

Overall, the state’s labor force participation rate remained flat, contributing to a slight decrease in the unemployment rate given the stronger job growth. Despite this, the labor force participation rate of retirement-age workers remains exceptionally low.

Key Findings—Colorado November ‘21 Labor Force Data (FRED[2], and IPUMS-CPS[3])

- November’s LFPR remained at 68.2% for the third month in a row, which is .6 percentage points below Jan. ’20’s LFPR of 68.8%.

- November’s unemployment rate decreased by .2 percentage points to 5.4%, which is still 2.7 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- In November, the LFPR of Colorado women decreased from 64.9% to 64% and back below early 2020 levels. It is now .15 percentage points below its pre-pandemic level.

- The national female LFPR increased by .2 percentage points to 56.2%, which is 1.6% lower than its pre-pandemic level.

- If Colorado’s November LFPR of women was the same as it was before the pandemic, there would be 4,484 more women in the workforce today.

Prime-age, Older, and Retirement-age People in the Labor Force

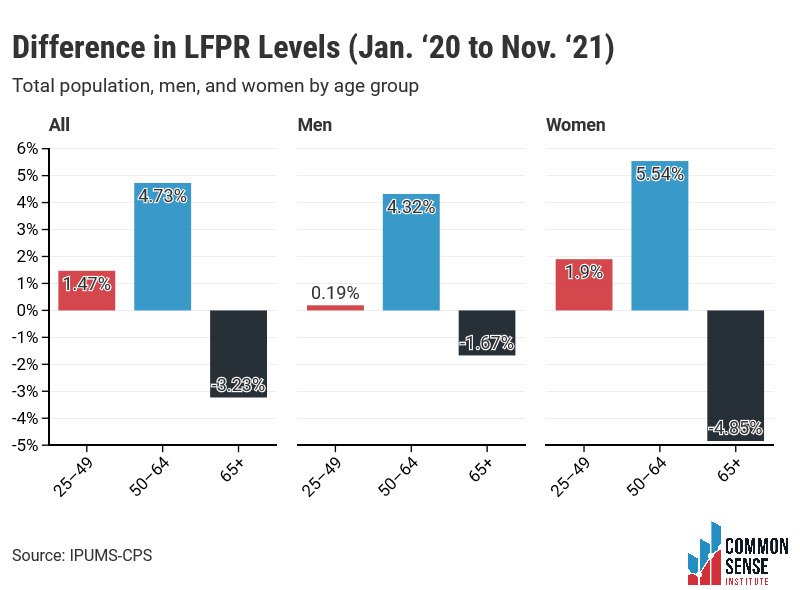

- Since Jan. ’20, labor force participation rates of all working-age people, regardless of sex, have increased.

- Retirement-age workers have been relatively unwilling to return to the labor force; this preference is especially pronounced among women and possibly attributable to the risk of severe COVID-19 infection. There are 15,667 fewer retirement-age workers in the labor force today than there would be at the pre-pandemic participation rate.

- Of the three age groups, that of people aged 50–64 exhibits the highest LFPR increase since before the pandemic. Prime-age workers, conversely, participate at rates only slightly higher than they were in Jan. ’20.

© 2021 Common Sense Institute.

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://fred.stlouisfed.org/

[3] https://cps.ipums.org/cps/