The March 2021 jobs and labor force data release for Colorado from the Bureau of Labor Statistics (BLS) marks a full year from the start of the more severe public policy reactions to COVID-19. The data show that, while the state has made significant progress from the April 2020 low points, achieving full recovery will take significantly more time.

Key Findings – Colorado March 2021 Employment Data (BLS Current Employment Statistics Survey)

- Colorado added 6,600 total nonfarm jobs in March, which is down from revised job growth in February of 9,100. Official state forecasts project total jobs to reach pre-pandemic levels by 2022; at the level of job growth in March, however, total jobs would not recover to pre-pandemic levels until January 2023.

- Total employment levels are down 5.2% relative to pre-pandemic levels, ranking Colorado 28th in terms of March job levels relative to Jan. ‘20.

- NY ranked 50th, and CA 51st, in terms of current job levels relative to Jan. ‘20 (down 10% and 8.4%, respectively).

- Idaho and Utah are the only two states that are above pre-pandemic job levels, having added 11,200 and 12,600 additional jobs, respectively.

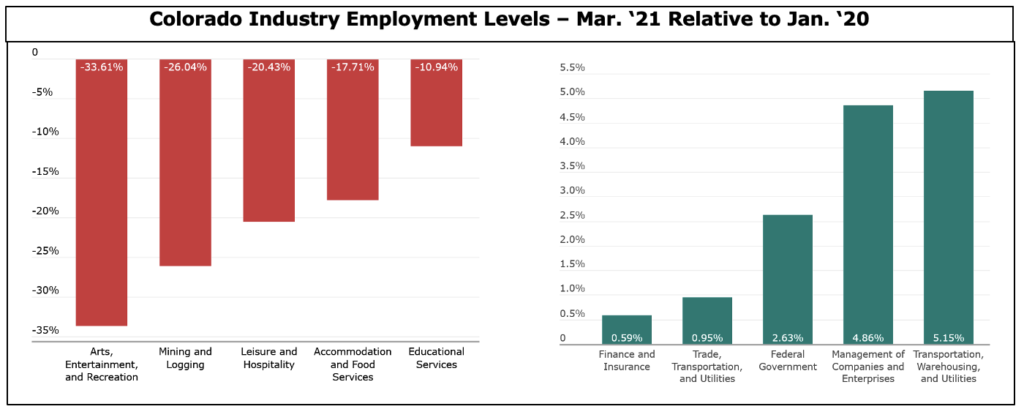

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in March, while others lost jobs.

- Leisure and hospitality lost 1,100 jobs.

- Professional and business services added 3,300 jobs.

- Though the accommodation and food services sector has led the recovery by adding 11,500 jobs between Jan. ‘21 and Mar. ‘21, it is still down 51,000 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 34% or 19,900 jobs.

- Leisure and hospitality is down 20% or 70,900 jobs.

Colorado Labor Force Update

Though the overall labor force participation rate (LFPR) has nearly fully recovered to pre-pandemic levels, those gains have not reached all groups equally.

Key Findings – Colorado March 2021 Labor Force Data (BLS Current Population Survey and IPUMS)

- The labor force participation rate remained flat at 68.5%. This puts the March 2021 rate .3 percentage points below what it was at the start of the pandemic in January 2020. That ties Colorado for the 8th-lowest decline among all states, after 6 states with LFPR equal to or above their January 2020 levels.

- The unemployment rate remained flat at 6.4%. While the LFPR stayed flat, the labor force grew by 5,800 people due to general population growth. Since this is a similar level to that of job growth, the rate remained flat.

- The LFPR for women dropped significantly from 63% to 59.7%. If the female LFPR in March 2021 were the same as it was before the pandemic, at 64.15% in January 2020, there would be 103,500 more women in the workforce. The large decline in March reflects some seasonality, but it is important to monitor the trend to see if it continues.

- The LFPR for women in Colorado has dropped significantly more than the national average. Nationally, the female LFPR dropped 1.7 percentage points from 57.8% to 56.1%. In Colorado it has dropped 4.44 percentage points from 64.15% to 59.71%.

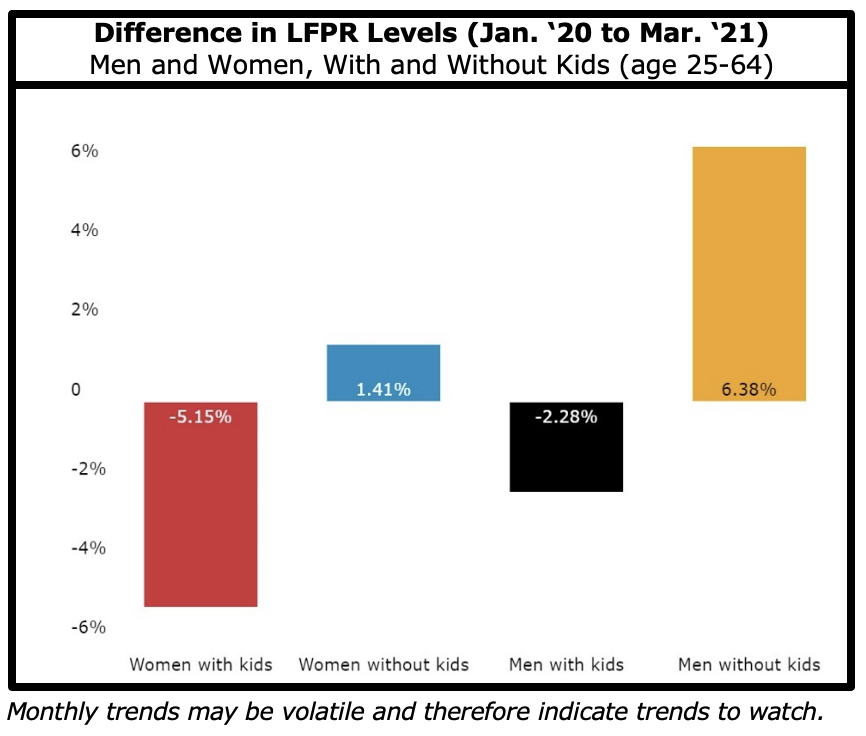

Women and Men, With and Without Kids in the Labor Force

- Whereas the LFPR for parents dropped in March and is below pre-pandemic levels, the rates for non-parents have surpassed pre-pandemic levels.

- Younger mothers seem to have been impacted even more. The LFPR for mothers between the ages of 25 and 39 is down 6.3 percentage points while the rate for mothers between the ages of 25-64 is down 5.1 percentage points.