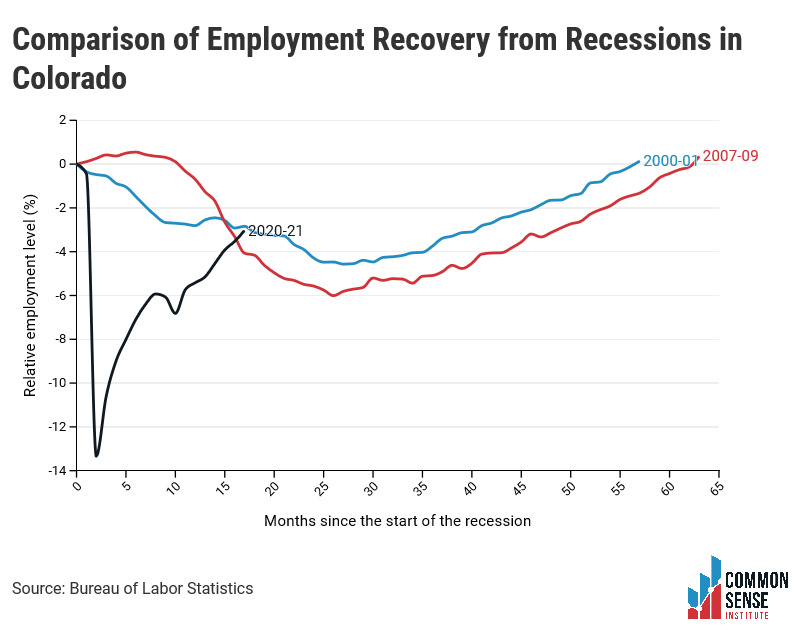

In April 2020, Colorado lost over 360,000 jobs, experienced the worst month of economic performance in its history, and launched into a deep and abiding recession. A little over a year later, the latest data from the Bureau of Labor Statistics (BLS) show that, though Colorado’s workforce has already endured the worst of the recession and is ahead of pace to recover fully by 2023, much progress remains to be made.

Key Findings—Colorado July 2021 Employment Data (BLS CES Survey[1])

- Colorado added 14,800 total nonfarm jobs in July.

- At this pace, the state would reach pre-pandemic employment levels in January 2022.

- To recover to pre-pandemic employment levels by January 2023—after adjusting for population growth—Colorado needs add 9,202 jobs each month on average.

- Total employment levels are down 3% or 85,900 jobs relative to pre-pandemic levels, ranking Colorado 16th in terms of July ‘21 job levels relative to Jan. ’20.

- New York ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 9% and 12%, respectively.

- Idaho and Utah are the only 2 states that have employment levels higher than they were before the pandemic—they’ve added 18,200 and 43,100 additional jobs, respectively.

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in July, while others lost

- The professional and business services industry added 5,000 jobs.

- The construction industry lost 1,600 jobs.

- Though the leisure and hospitality industry has led the recovery by adding 45,400 jobs between Jan. ‘21 and July ‘21, it is still down 36,900 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 12.7% (7,500 jobs).

- Accommodation and food services is down 10.2% (29,400 jobs).

Colorado Labor Force Update

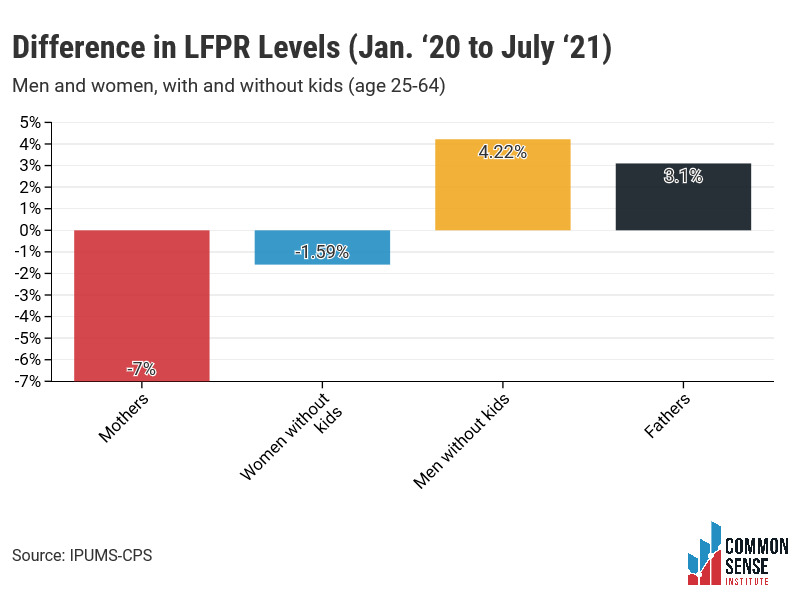

The overall Colorado labor force participation rate (LFPR) edges ever closer to full recovery, but the unemployment rate fell only minimally between June and July. Though the recovery from the pandemic is progressing, some demographic groups, especially mothers, are lagging.

Key Findings—Colorado July ‘21 Labor Force Data (BLS[2], FRED[3], and IPUMS-CPS[4])

- July’s LFPR decreased by .2 percentage points to 68.3%, which is .5 percentage points below Jan. ’20’s LFPR of 68.8%.

- July’s unemployment rate decreased by .1 percentage points to 6.1%, which is still 3.4 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- The monthly LFPR for Colorado women increased from 59.8% last month to 60% and remains 4.1 percentage points below its pre-pandemic level.

- The national female LFPR was, for the third consecutive month, 56.2%, which is 1.6% lower than its pre-pandemic level.

- If the pre-pandemic Colorado LFPR for women was the same as July’s, there would be 96,155 more women in the labor force today.

Women and Men, with and without Kids in the Labor Force

- The LFPR for mothers in Colorado was down 7 percentage points from 76.2% in Jan. ’20 to 69.2% in July ’21.

- The LFPR for women without kids fell 1.9 percentage points in July ’21 after spiking by 4 percentage points between May and June.

- LFPRs of fathers and men without kids continue to be higher now than they were in Jan. ’20.

Monthly trends may be volatile and should be interpreted cautiously.

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://www.bls.gov/

[3] https://fred.stlouisfed.org/

[4] https://cps.ipums.org/cps/