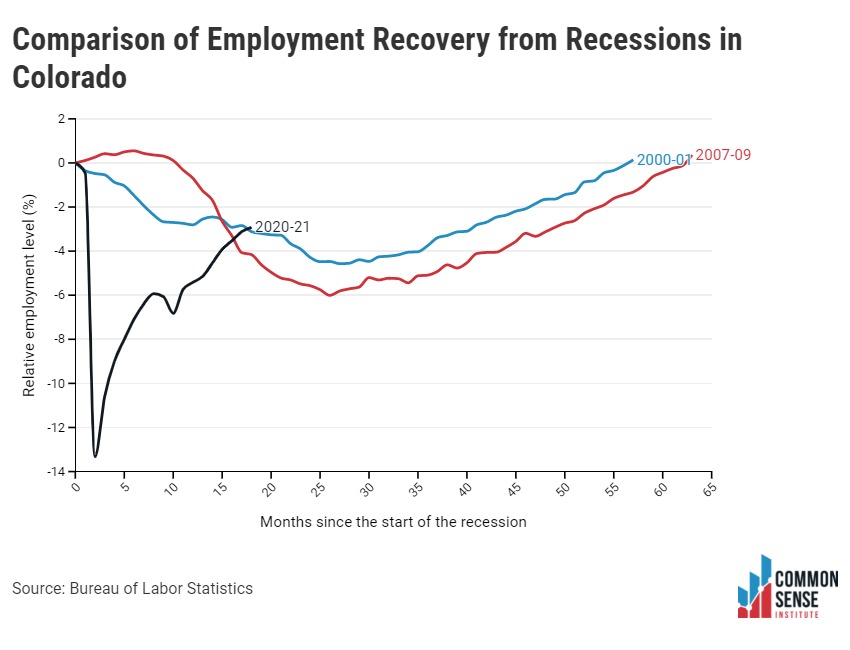

In April 2020, Colorado lost over 360,000 jobs, experienced the worst month of economic performance in its history, and launched into a deep and abiding recession. While the recovery has been swifter that during past recessions, full recovery is still months, if not years out.

In April 2020, Colorado lost over 360,000 jobs, experienced the worst month of economic performance in its history, and launched into a deep and abiding recession. While the recovery has been swifter that during past recessions, full recovery is still months, if not years out.

Key Findings—Colorado August 2021 Employment Data (BLS CES Survey[1])

- Colorado added 5,590 total nonfarm jobs in August.

- At this pace, the state would reach pre-pandemic employment levels in November 2022.

- To recover to pre-pandemic employment levels by January 2023 —after adjusting for population growth —Colorado needs add 9,567 jobs each month on average.

- Total employment levels are down 2.94% or 82,900 jobs relative to pre-pandemic levels, ranking Colorado 16th in terms of August ‘21 job levels relative to Jan. ’20.

- New York ranked 50th and Hawaii 51st in terms of current job levels relative to Jan. ’20 and are down 8.87% and 12.97%, respectively.

- Utah and Idaho are the only two states that have employment levels higher than they were before the pandemic—they’ve added 49,400 and 16,200 additional jobs, respectively.

A Deeper Dive into Colorado Industries

- Some sectors in Colorado added jobs in August, while others lost

- The accommodation and food services industry added 3,800 jobs.

- The retail trade industry lost 1,700 jobs.

- Though the hospitality and leisure industry has led the recovery by adding 49,200 jobs between Jan. ‘21 and August ‘21, it is still down 33,100 jobs relative to Jan. ‘20.

- Arts, entertainment, and recreation is down 14% (8,100 jobs).

- Accommodation and food services is down 9% (25,000 jobs).

Colorado Labor Force Update

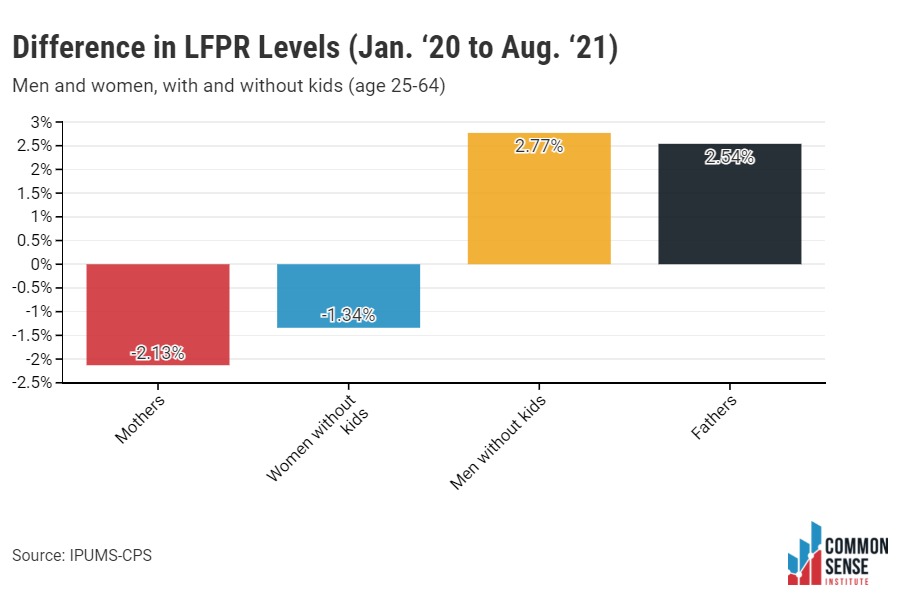

The overall Colorado labor force participation rate (LFPR) slightly decreased in August, allowing the unemployment rate to fall slightly despite the lower than recent month job growth. Though the recovery from the pandemic is progressing, some demographic groups, especially mothers, are lagging.

Key Findings—Colorado August ‘21 Labor Force Data (BLS[2], FRED[3], and IPUMS-CPS[4])

- August’s LFPR decreased by .1 percentage point to 68.3%, which is .5 percentage points below Jan. ’20’s LFPR of 68.8%.

- August’s unemployment rate decreased by .2 percentage points to 5.9%, which is still 3.2 percentage points above Jan. ’20’s unemployment rate of 2.7%.

- The LFPR for Colorado women increased from 59.3% last month to 62.2% and remains 1.95 percentage points below its pre-pandemic level.

-

- The national female LFPR was, for the fourth consecutive month, 56.2%, which is 1.6% lower than its pre-pandemic level.

- If the pre-pandemic Colorado LFPR for women was the same as August’s, there would be 45,754 more women in the labor force today.

Women and Men, with and without Kids in the Labor Force

- The LFPR for mothers in Colorado was down 2.13 percentage points from 76.2% in Jan. ’20 to 74.07% in August ’21.

- The LFPR for women without kids increased slightly yet remains 1.34 percentage points below the January ’20 level.

- LFPRs of fathers and men without kids continue to be higher now than they were in Jan. ’20.

Monthly trends may be volatile and should be interpreted cautiously.

[1] https://data.bls.gov/cgi-bin/dsrv?sm

[2] https://www.bls.gov/

[3] https://fred.stlouisfed.org/

[4] https://cps.ipums.org/cps/